Certification Of Beneficial Ownership Form

Certification Of Beneficial Ownership Form - These regulations go into effect on january 1, 2024. Name and address of legal entity for which the account is being opened: Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). All persons opening an account on behalf of a legal entity must provide the following information: This form cannot be digitally signed. Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). All persons opening an account on behalf of a legal entity must provide the following information: Web certificate of status of beneficial owner for united states tax withholding and reporting (entities) department of the treasury internal revenue service do not use this form for: Web certification of beneficial owner(s) persons opening an account on behalf of a legal entity must provide the following information: Web beneficial ownership information reporting.

These regulations go into effect on january 1, 2024. Web certification of beneficial owner(s) persons opening an account on behalf of a legal entity must provide the following information: Name and title of natural person opening account: A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Name and address of legal entity for which the account is being opened: Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Web beneficial ownership information reporting. All persons opening an account on behalf of a legal entity must provide the following information: Web certificate of status of beneficial owner for united states tax withholding and reporting (entities) department of the treasury internal revenue service do not use this form for: Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230).

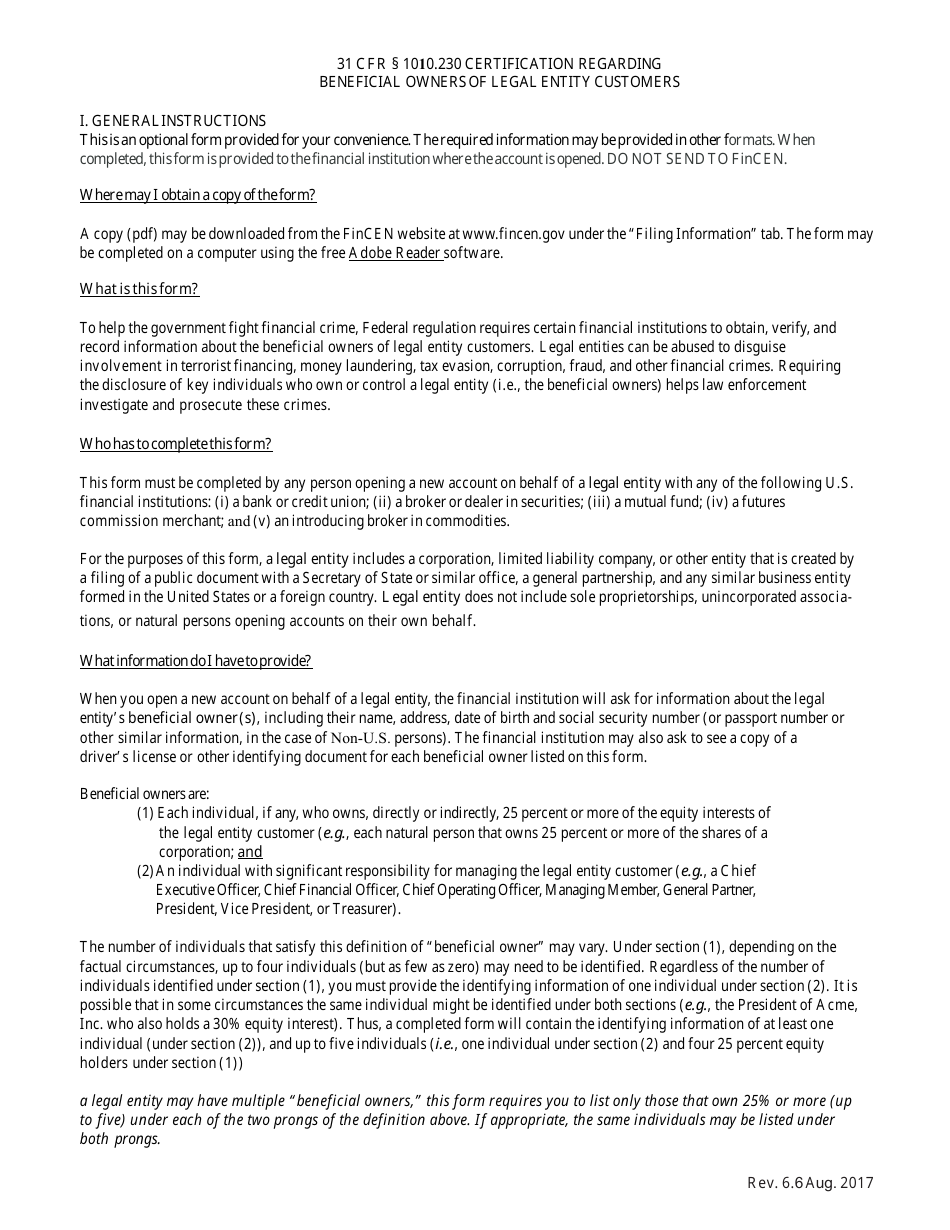

All persons opening an account on behalf of a legal entity must provide the following information: Web certificate of status of beneficial owner for united states tax withholding and reporting (entities) department of the treasury internal revenue service do not use this form for: Name and title of natural person opening account: Web beneficial ownership information reporting. These regulations go into effect on january 1, 2024. Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify and verify beneficial owner(s) of legal entity customers and to include such procedures. Web certification of beneficial owner(s) persons opening an account on behalf of a legal entity must provide the following information: Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. All persons opening an account on behalf of a legal entity must provide the following information:

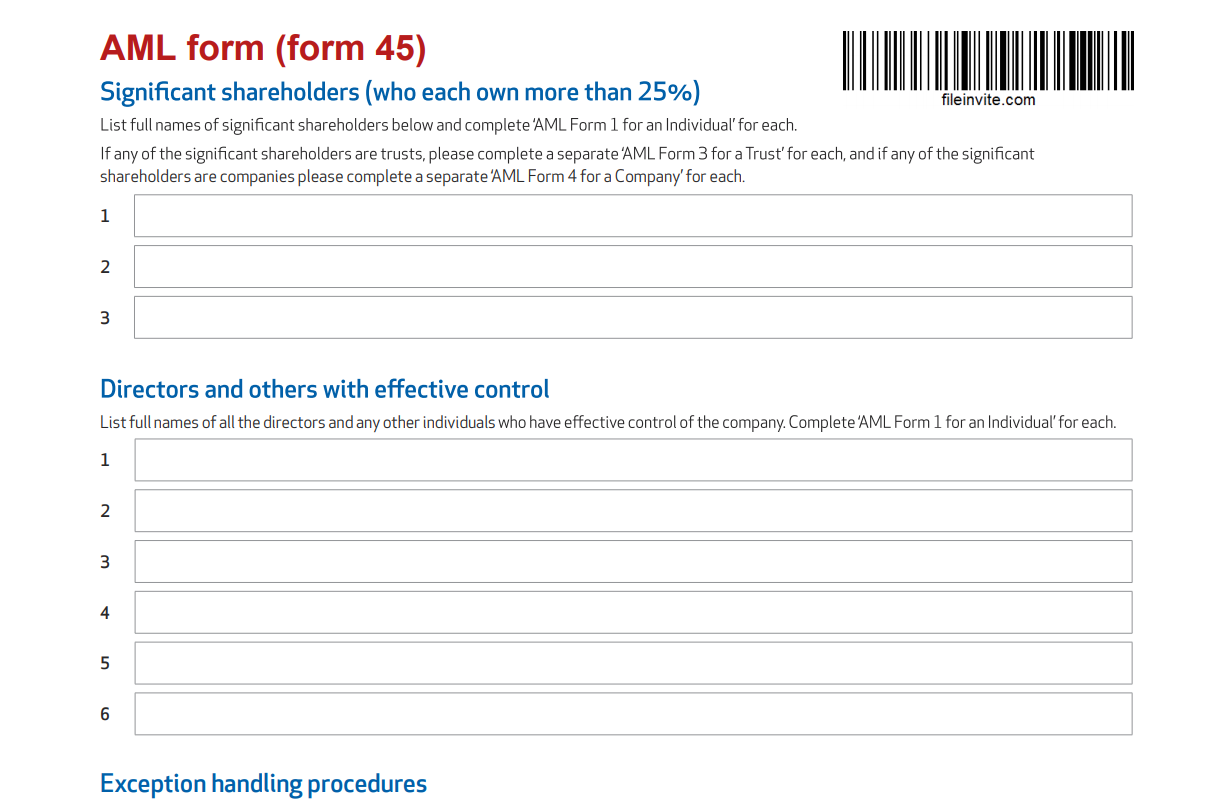

Create an online Beneficial Ownership Declaration Form with FileInvite

Web beneficial ownership information reporting. Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Completed forms require the signature of the individual providing the information. A final rule implementing the beneficial ownership information reporting requirements of the corporate.

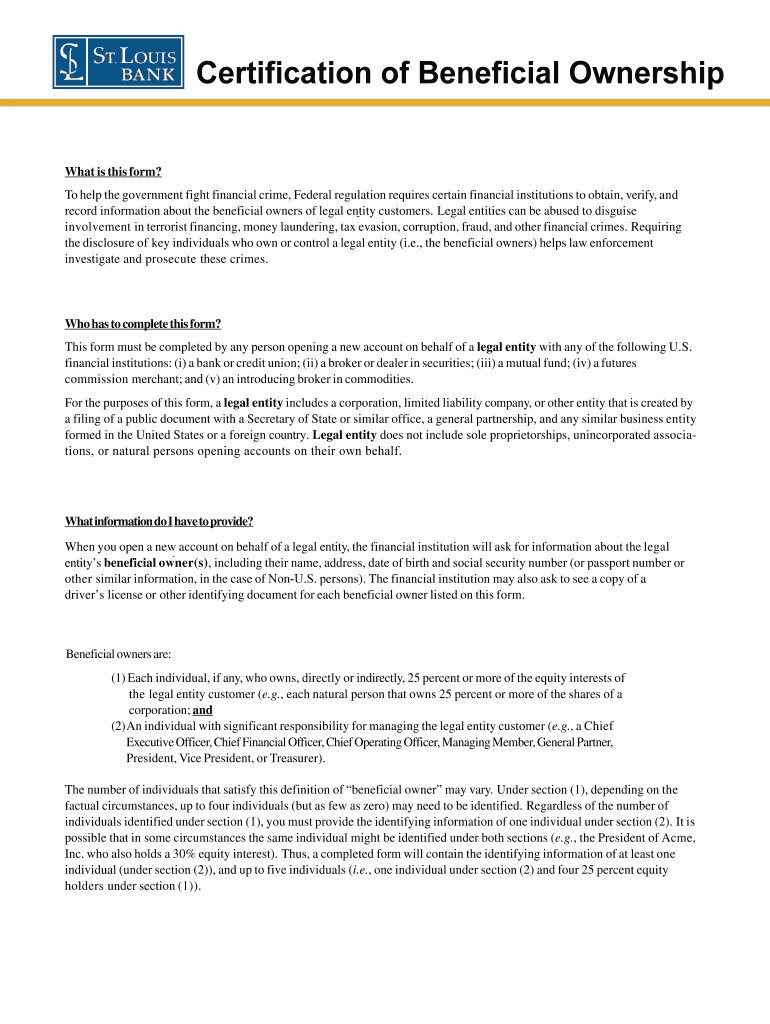

Beneficial Ownership Form Fill Out and Sign Printable PDF Template

Web beneficial ownership information reporting. Web certification of beneficial owner(s) persons opening an account on behalf of a legal entity must provide the following information: Web certificate of status of beneficial owner for united states tax withholding and reporting (entities) department of the treasury internal revenue service do not use this form for: These regulations go into effect on january.

Beneficial Ownership Certification Form Inspirational regarding

All persons opening an account on behalf of a legal entity must provide the following information: All persons opening an account on behalf of a legal entity must provide the following information: Completed forms require the signature of the individual providing the information. Web certification of beneficial owner(s) persons opening an account on behalf of a legal entity must provide.

Beneficial Ownership Form Blank Fill Online, Printable, Fillable

Name and address of legal entity for which the account is being opened: Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Web beneficial ownership information reporting. Web certificate of status of beneficial owner for united states tax.

Federal Register Customer Due Diligence Requirements for Financial

Web certification of beneficial owner(s) persons opening an account on behalf of a legal entity must provide the following information: These regulations go into effect on january 1, 2024. Name and title of natural person opening account: A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Web certificate.

Form W8BENE Certificate of Entities Status of Beneficial Owner for

Name and title of natural person opening account: Completed forms require the signature of the individual providing the information. Name and address of legal entity for which the account is being opened: Web certification of beneficial owner(s) persons opening an account on behalf of a legal entity must provide the following information: Web certification of beneficial owner(s) the information contained.

About Privacy Policy Copyright TOS Contact Sitemap

Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). These regulations go into effect on january 1, 2024. Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify.

Certification of Beneficial Owner Business Law Corporations

Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify and verify beneficial owner(s) of legal entity customers and to include such procedures. Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal.

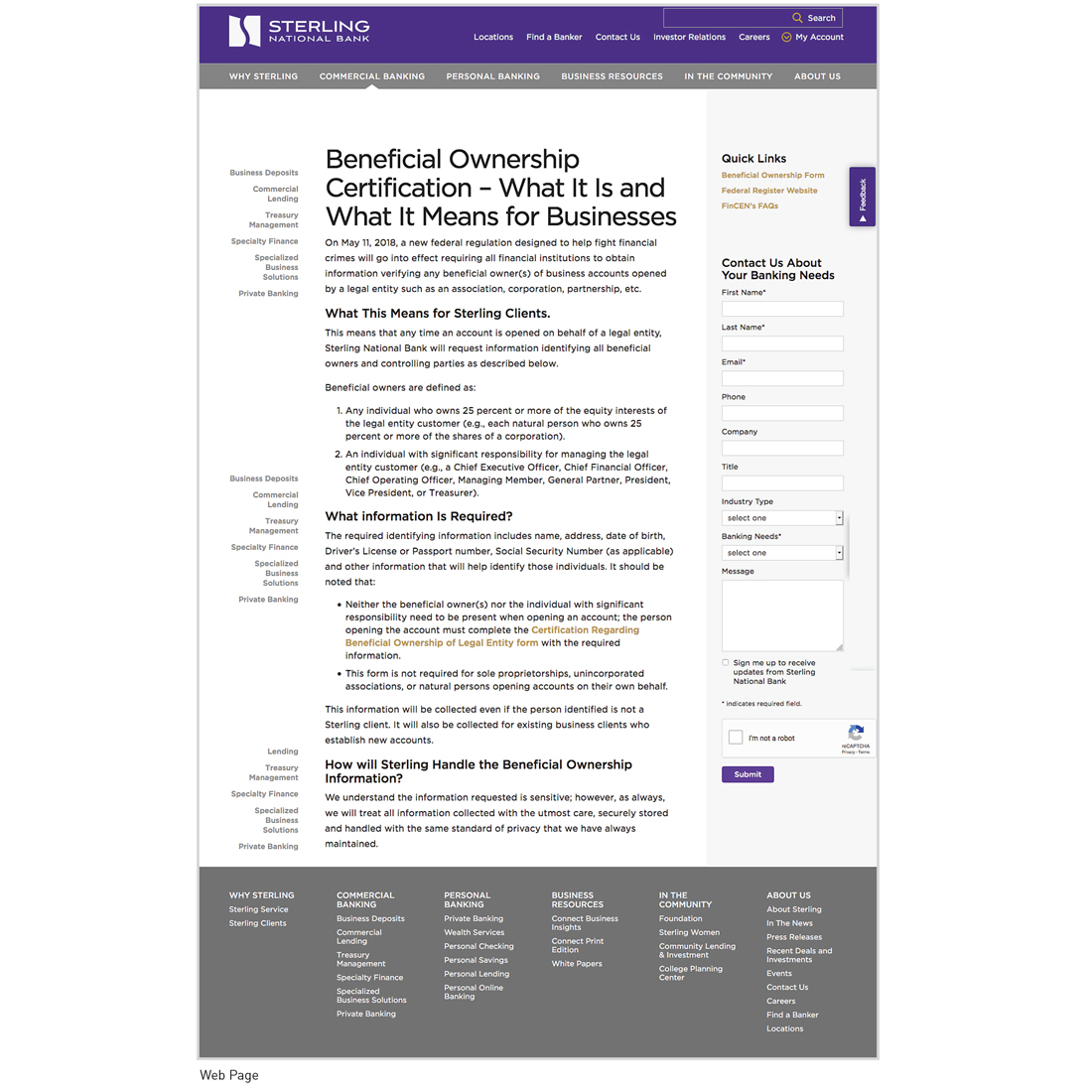

Sterling Beneficial Ownership Certification MKP Team

Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Web certificate of status of beneficial owner for united states tax withholding and reporting (entities) department of the treasury internal revenue service do not use this form for: All.

Certification of Beneficial Owner(S) Download Fillable PDF Templateroller

All persons opening an account on behalf of a legal entity must provide the following information: Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Web certification of beneficial owner(s) the information contained in this certification is sought.

This Form Cannot Be Digitally Signed.

Web beneficial ownership information reporting. Name and title of natural person opening account: All persons opening an account on behalf of a legal entity must provide the following information: All persons opening an account on behalf of a legal entity must provide the following information:

Web Certification Of Beneficial Owner(S) Persons Opening An Account On Behalf Of A Legal Entity Must Provide The Following Information:

Name and address of legal entity for which the account is being opened: Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Web certificate of status of beneficial owner for united states tax withholding and reporting (entities) department of the treasury internal revenue service do not use this form for: Completed forms require the signature of the individual providing the information.

A Final Rule Implementing The Beneficial Ownership Information Reporting Requirements Of The Corporate Transparency Act (Cta) Was Issued In September 2022.

Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify and verify beneficial owner(s) of legal entity customers and to include such procedures. Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). These regulations go into effect on january 1, 2024.