Chapter 13 And Home Equity

Chapter 13 And Home Equity - Web can you file chapter 13 and keep your house? This means that, because you surrendered the home to the lender, you may not be responsible for paying the home equity line of credit. Discover the advantages of home equity. Find out how much you could save now! Web keeping your home depends on whether you meet all requirements in chapters 7 and 13. If the market value of your home is less than the balance on your first mortgage, you can strip off (remove) the heloc. If you have significant equity in your home and want to keep it, chapter 13 bankruptcy may be your best option. The example assume the following facts: If you have significant equity in your house that is not exempt in bankruptcy, it could increase your chapter 13 plan payment. Under this chapter, debtors propose a repayment.

Exempting equity in chapter 13. Web in a chapter 13 bankruptcy, there is never any liquidation or sale and seizure of assets, regardless of the amount of your home equity, but there is still a consequence that may affect the. Find out how much you could save now! Web keep your house with chapter 13 bankruptcy by stephen elias, attorney chapter 13 bankruptcy is a great tool for avoiding foreclosure. You will need to have kept your credit clean since the bankruptcy and have enough equity in your home. Foreclosure and acquisition of the property: Web chapter 13 provides two advantages in dealing with a heloc in certain situations. Find out how much you could save now! However, helocs are considered unsecured debt when the homes securing them lose too much value and are often eliminated during chapter 13. Web if you decide to return your home to the lender, your heloc may be wiped out in bankruptcy.

This means that, because you surrendered the home to the lender, you may not be responsible for paying the home equity line of credit. How a homestead exemption protects home equity what you'll need to do to keep a house in chapters 7 and 13. If you have significant equity in your house that is not exempt in bankruptcy, it could increase your chapter 13 plan payment. Web background a chapter 13 bankruptcy is also called a wage earner's plan. Here’s how this works in practice. Web if you decide to return your home to the lender, your heloc may be wiped out in bankruptcy. Web under a chapter 13 “adjustment of debts,” in contrast, you can keep and protect the home and its equity. In this article, you'll learn: Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Trump wasted little time using the mug shot for fundraising.

Can Federal Tax Return Be Garnished For Child Support TAXP

Web keep your house with chapter 13 bankruptcy by stephen elias, attorney chapter 13 bankruptcy is a great tool for avoiding foreclosure. Web keeping your home depends on whether you meet all requirements in chapters 7 and 13. Web if you decide to return your home to the lender, your heloc may be wiped out in bankruptcy. Web a person.

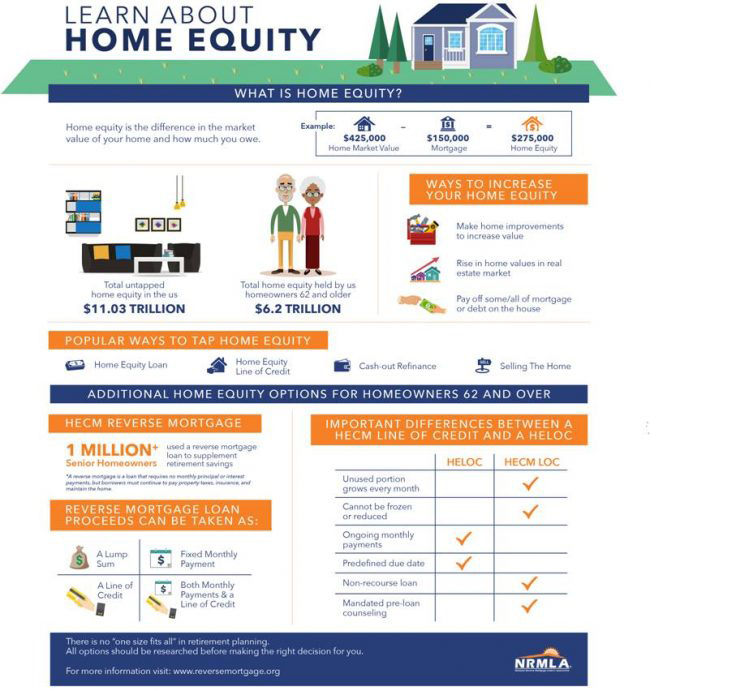

Infographic How Can You Use Home Equity?

Web a heloc is considered secured debt if a homeowner's home has retained or improved its value. However, helocs are considered unsecured debt when the homes securing them lose too much value and are often eliminated during chapter 13. Web in the photo, an unsmiling trump, 77, glares into the camera, his brow furrowed, his jaw clenched and his red.

chapter 13 international equity markets suggested answers

Discover the advantages of home equity. Stripping off helocs in chapter 13. Web chapter 13 bankruptcy has some advantages over chapter 7 bankruptcy if you want to keep your home. Web chapter 13 provides two advantages in dealing with a heloc in certain situations. Foreclosure and acquisition of the property:

Chapter 13 Equity Valuation

Web chapter 13 can be an extremely favorable way to keep a home with more equity than the homestead exemption amount. Each state decides the type of property filers can protect, including the amount of home equity… If you have significant equity in your house that is not exempt in bankruptcy, it could increase your chapter 13 plan payment. Property.

What Is Home Equity and What Can It Do For You? Credible

This means that, because you surrendered the home to the lender, you may not be responsible for paying the home equity line of credit. Web if you decide to return your home to the lender, your heloc may be wiped out in bankruptcy. Web in a chapter 13 bankruptcy, there is never any liquidation or sale and seizure of assets,.

What Home Equity Is & How to Use It Home Run Financing

Secured debtors in chapter 13 bankruptcy are entitled to repayment, however small, from their creditors. Trump wasted little time using the mug shot for fundraising. Find out how much you could save now! Discover the advantages of home equity. Ad the average american has gained $113,000 in equity in the last 3 years.

How is Your Home Equity Handled When You Convert Your Chapter 13 to a

Exempting equity in chapter 13. Web chapter 13 provides two advantages in dealing with a heloc in certain situations. Web under a chapter 13 “adjustment of debts,” in contrast, you can keep and protect the home and its equity. Web will having lots of home equity affect my chapter 13 bankruptcy? Web chapter 13 can be an extremely favorable way.

What Is Home Equity?

You don't lose property in chapter 13 if you can afford to keep it. Foreclosure and acquisition of the property: The good news is that most people who want to keep their homes can do so when they file under chapter 13. Find out how much you could save now! One of the main concerns people have when filing bankruptcy.

What is Equity and How Do I Cash Out?

Web chapter 13 can be an extremely favorable way to keep a home with more equity than the homestead exemption amount. Web in the photo, an unsmiling trump, 77, glares into the camera, his brow furrowed, his jaw clenched and his red tie knotted tightly. Recapture of section 235 assistance payments: Stripping off helocs in chapter 13. This means that,.

Let your equity work for you VisionBank

Here’s how this works in practice. Recapture of section 235 assistance payments: Ad the average american has gained $113,000 in equity in the last 3 years. Web background a chapter 13 bankruptcy is also called a wage earner's plan. You don't lose property in chapter 13 if you can afford to keep it.

Under This Chapter, Debtors Propose A Repayment.

Web keeping your home depends on whether you meet all requirements in chapters 7 and 13. This means that, because you surrendered the home to the lender, you may not be responsible for paying the home equity line of credit. In this article, you'll learn: Each state decides the type of property filers can protect, including the amount of home equity…

The Housing And Community Development Act Of 1987 Established A Federal Mortgage Insurance Program, Section 255 Of The National Housing Act, To Insure Home Equity Conversion Mortgages.

At worst, you’d pay the amount of equity in excess of the exemption. Web keep your house with chapter 13 bankruptcy by stephen elias, attorney chapter 13 bankruptcy is a great tool for avoiding foreclosure. You don't lose property in chapter 13 if you can afford to keep it. Web will having lots of home equity affect my chapter 13 bankruptcy?

If You Are Behind In Your Mortgage, Chapter 13.

Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Credit cards) in your chapter 13. Recapture of section 235 assistance payments: Exempting equity in chapter 13.

Web If You Decide To Return Your Home To The Lender, Your Heloc May Be Wiped Out In Bankruptcy.

If you are unable to get a home equity loan or refinance, you can use chapter 13 instead to achieve nearly identical goals. The heloc loan amount is treated like other unsecured debts (e.g. You will need to have kept your credit clean since the bankruptcy and have enough equity in your home. It enables individuals with regular income to develop a plan to repay all or part of their debts.