Chapter 7 Bankruptcy Home Equity

Chapter 7 Bankruptcy Home Equity - Homeowners borrowing from their home equity should choose the right loan type. Web you won't necessarily lose your home in chapter 7 bankruptcy, especially if you don't have much home equity and your. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Compare & save with lendingtree. Web in chapter 7 bankruptcy, you must turn over all of the property you can't protect with an exemption or nonexempt assets to the. Web for the most part, it’s easier to buy a home after chapter 13 bankruptcy than chapter 7. There are good reasons not to discharge your home equity. Web what happens in chapter 7 if there’s too much equity in your home? Web in chapter 7, you must be able to protect all your home equity with an exemption. Web learn how much home equity you can protect using the homestead exemption in bankruptcy and other requirements you.

Web for the most part, it’s easier to buy a home after chapter 13 bankruptcy than chapter 7. Web in chapter 7 bankruptcy, you must turn over all of the property you can't protect with an exemption or nonexempt assets to the. Web in chapter 7, almost all people must protect home equity with a bankruptcy exemption to keep a home. Most georgia bankruptcy filers prefer. Web you can keep your home in chapter 7 bankruptcy if you don't have any equity in your home, or the homestead exemption. Compare & save with lendingtree. Web using the homestead exemption in chapters 7 and 13. A chapter 7 trustee will sell your home and distribute the proceeds to. Filling out loan applications can be tedious. But if you only apply with one lender, you.

There are good reasons not to discharge your home equity. Web in chapter 7 bankruptcy, you must turn over all of the property you can't protect with an exemption or nonexempt assets to the. Web one of the only times that having “too much equity” in your home will hurt you is when you are filing for chapter. Web in chapter 7, almost all people must protect home equity with a bankruptcy exemption to keep a home. Ad get more from your home equity line of credit. Web using the homestead exemption in chapters 7 and 13. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web under chapter 7 bankruptcy, your assets are liquidated to pay your debts, although you may be able to keep some. Web learn how much home equity you can protect using the homestead exemption in bankruptcy and other requirements you. Web rite aid is preparing to file for bankruptcy in coming weeks to address mass lawsuits over the drugstore chain’s.

How is Your Home Equity Handled When You Convert Your Chapter 13 to a

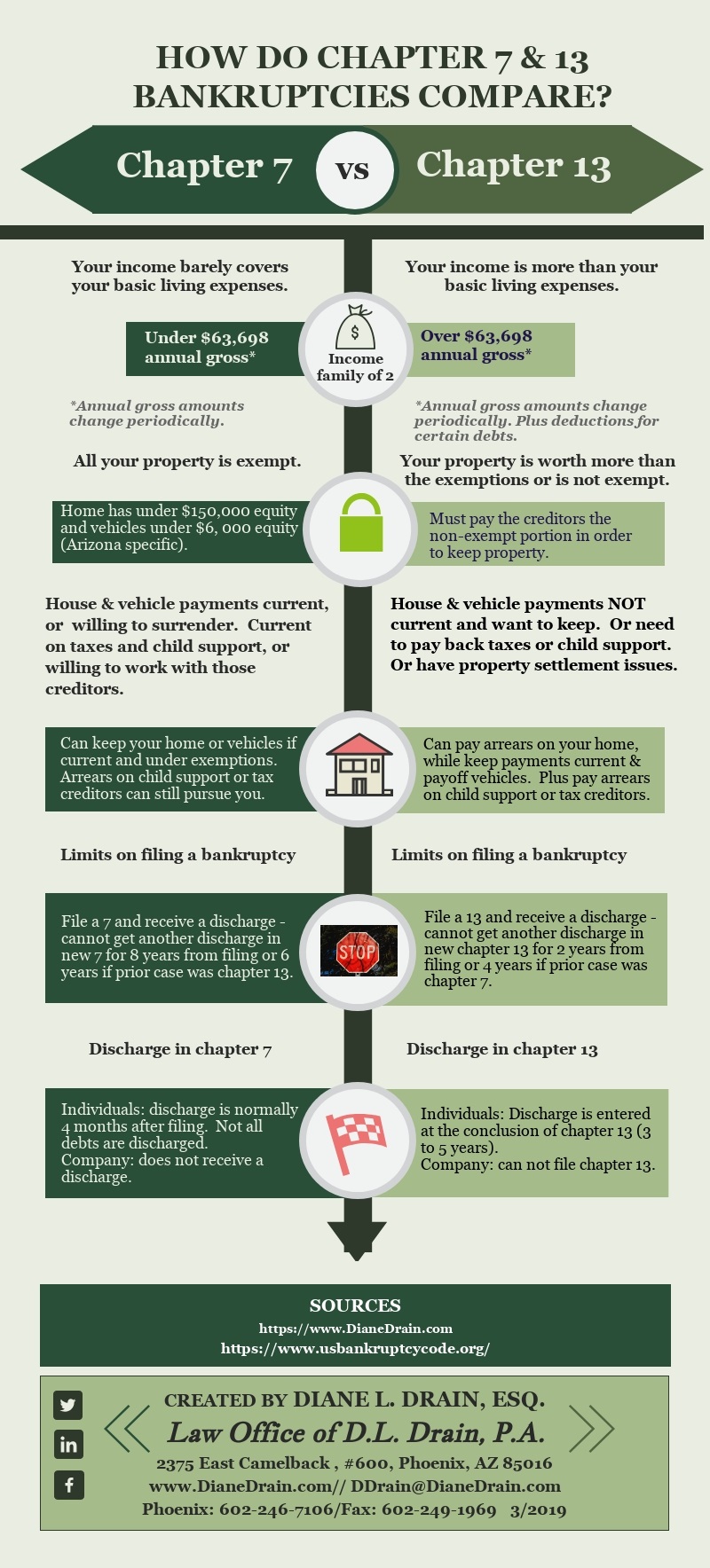

Web in chapter 7, you must be able to protect all your home equity with an exemption. Web the two bankruptcy chapters, chapters 7 and 13, offer different benefits, but both allow you to exempt or protect. The average american has gained $113,000 in equity over the last 3 years. Rather than all debt being. Chapter 7 lets individuals wipe.

Chapter 7 Bankruptcy Consumer Law Pro

Web one of the only times that having “too much equity” in your home will hurt you is when you are filing for chapter. But if you only apply with one lender, you. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web rite aid is preparing to file.

Long Island Chapter 7 Bankruptcy Lawyer Macco Law Group

Rather than all debt being. Web in chapter 7, you must be able to protect all your home equity with an exemption. Web in chapter 7 bankruptcy, you must turn over all of the property you can't protect with an exemption or nonexempt assets to the. Ad get more from your home equity line of credit. But if you only.

How Does My Home Equity Affect my Chapter 13 Bankruptcy? Bankruptcy

Chapter 7 lets individuals wipe out (“discharge”) most kinds of debt in just a few months. Web the short answer is yes. There are good reasons not to discharge your home equity. Web in chapter 7, almost all people must protect home equity with a bankruptcy exemption to keep a home. Homeowners borrowing from their home equity should choose the.

Can You Buy a House After Chapter 7 Bankruptcy? Davis & Jones P.C.

Web the two bankruptcy chapters, chapters 7 and 13, offer different benefits, but both allow you to exempt or protect. Web in a chapter 7, the bankruptcy trustee (i.e., the person who manages the case on behalf of the government and. Most georgia bankruptcy filers prefer. Web the short answer is yes. A chapter 7 trustee will sell your home.

Chapter 7 Bankruptcy Is It Right For You? Landwehr Law Offices

Web what happens in chapter 7 if there’s too much equity in your home? Web for the most part, it’s easier to buy a home after chapter 13 bankruptcy than chapter 7. Web one of the only times that having “too much equity” in your home will hurt you is when you are filing for chapter. A chapter 7 trustee.

Does Chapter 7 Bankruptcy Wipe Out All Debt in New York? Michael H

There are good reasons not to discharge your home equity. The long answer is yes, but you may not want to. Compare & save with lendingtree. Chapter 7 lets individuals wipe out (“discharge”) most kinds of debt in just a few months. Web you won't necessarily lose your home in chapter 7 bankruptcy, especially if you don't have much home.

Should You File Chapter 7 Bankruptcy? Thatcher Law

Web for the most part, it’s easier to buy a home after chapter 13 bankruptcy than chapter 7. Rather than all debt being. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. The long answer is yes, but you may not want to. Web you can keep your home.

Who is Eligible for Chapter 7 Bankruptcy? The D&B Blog

Web one of the only times that having “too much equity” in your home will hurt you is when you are filing for chapter. Web the two bankruptcy chapters, chapters 7 and 13, offer different benefits, but both allow you to exempt or protect. Web learn how much home equity you can protect using the homestead exemption in bankruptcy and.

Difference Between Chapter 7 and 13 Diane L. Drain Phoenix Arizona

Web rite aid is preparing to file for bankruptcy in coming weeks to address mass lawsuits over the drugstore chain’s. Web apollo had sought to extend yellow $142.5mn of dip financing in bankruptcy with an annual interest rate of. Web in a chapter 7, the bankruptcy trustee (i.e., the person who manages the case on behalf of the government and..

Chapter 7 Lets Individuals Wipe Out (“Discharge”) Most Kinds Of Debt In Just A Few Months.

Web learn how much home equity you can protect using the homestead exemption in bankruptcy and other requirements you. Web using the homestead exemption in chapters 7 and 13. But if you only apply with one lender, you. Web under chapter 7 bankruptcy, your assets are liquidated to pay your debts, although you may be able to keep some.

Web In A Chapter 7, The Bankruptcy Trustee (I.e., The Person Who Manages The Case On Behalf Of The Government And.

A chapter 7 trustee will sell your home and distribute the proceeds to. Ad get more from your home equity line of credit. Web avoid these 3 big mistakes. Web in chapter 7 bankruptcy, you must turn over all of the property you can't protect with an exemption or nonexempt assets to the.

Web For The Most Part, It’s Easier To Buy A Home After Chapter 13 Bankruptcy Than Chapter 7.

Web the short answer is yes. Rather than all debt being. The long answer is yes, but you may not want to. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13.

Web In Chapter 7, Almost All People Must Protect Home Equity With A Bankruptcy Exemption To Keep A Home.

There are good reasons not to discharge your home equity. Web the two bankruptcy chapters, chapters 7 and 13, offer different benefits, but both allow you to exempt or protect. Most georgia bankruptcy filers prefer. Web in chapter 7, you must be able to protect all your home equity with an exemption.