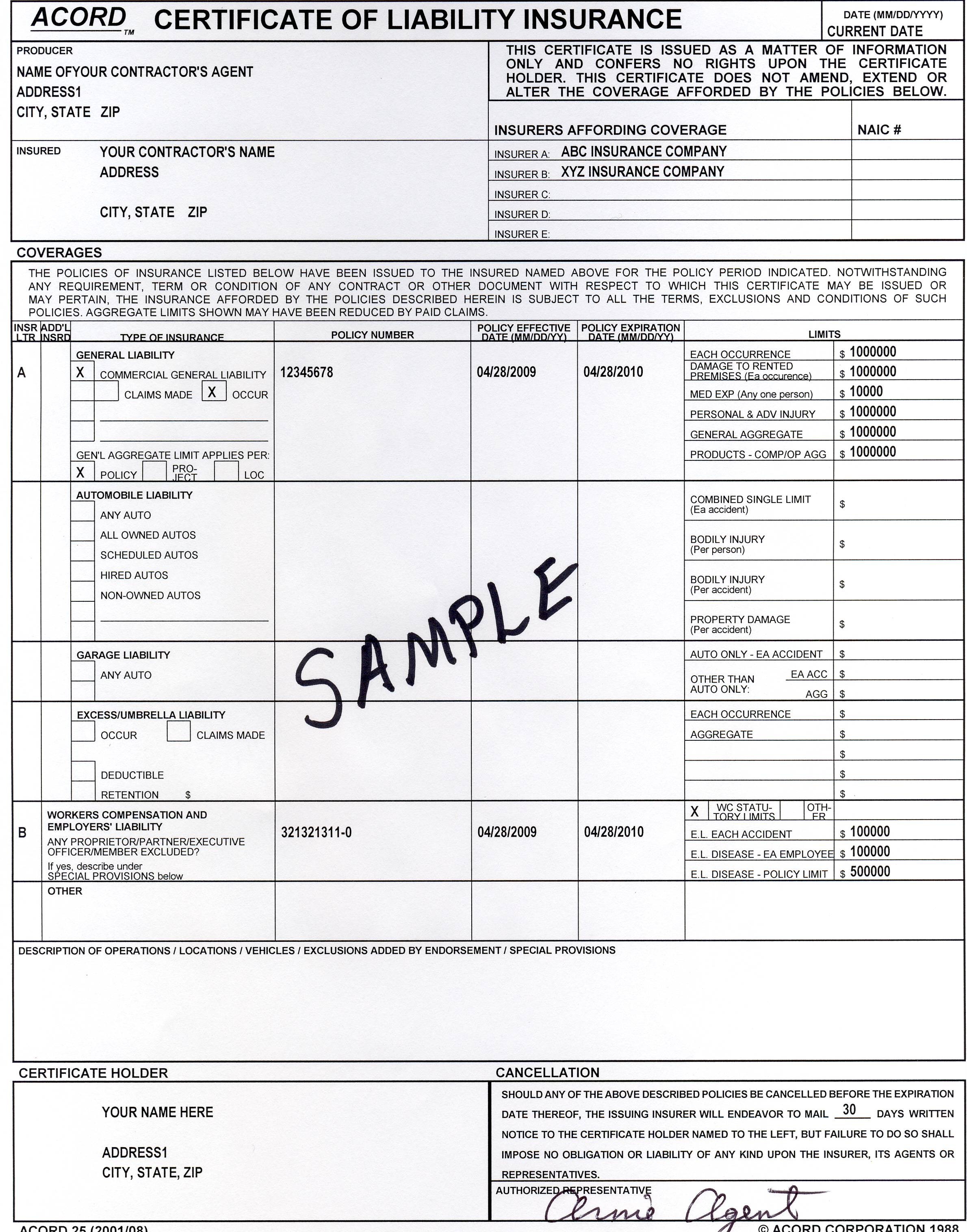

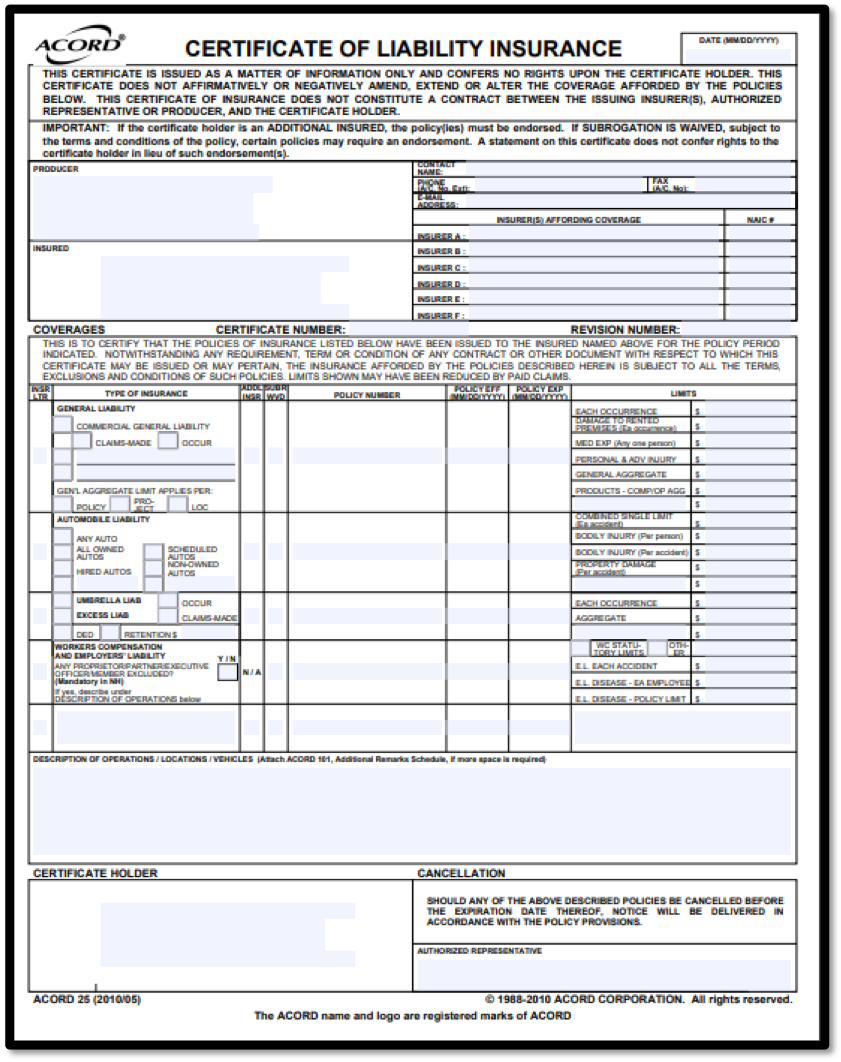

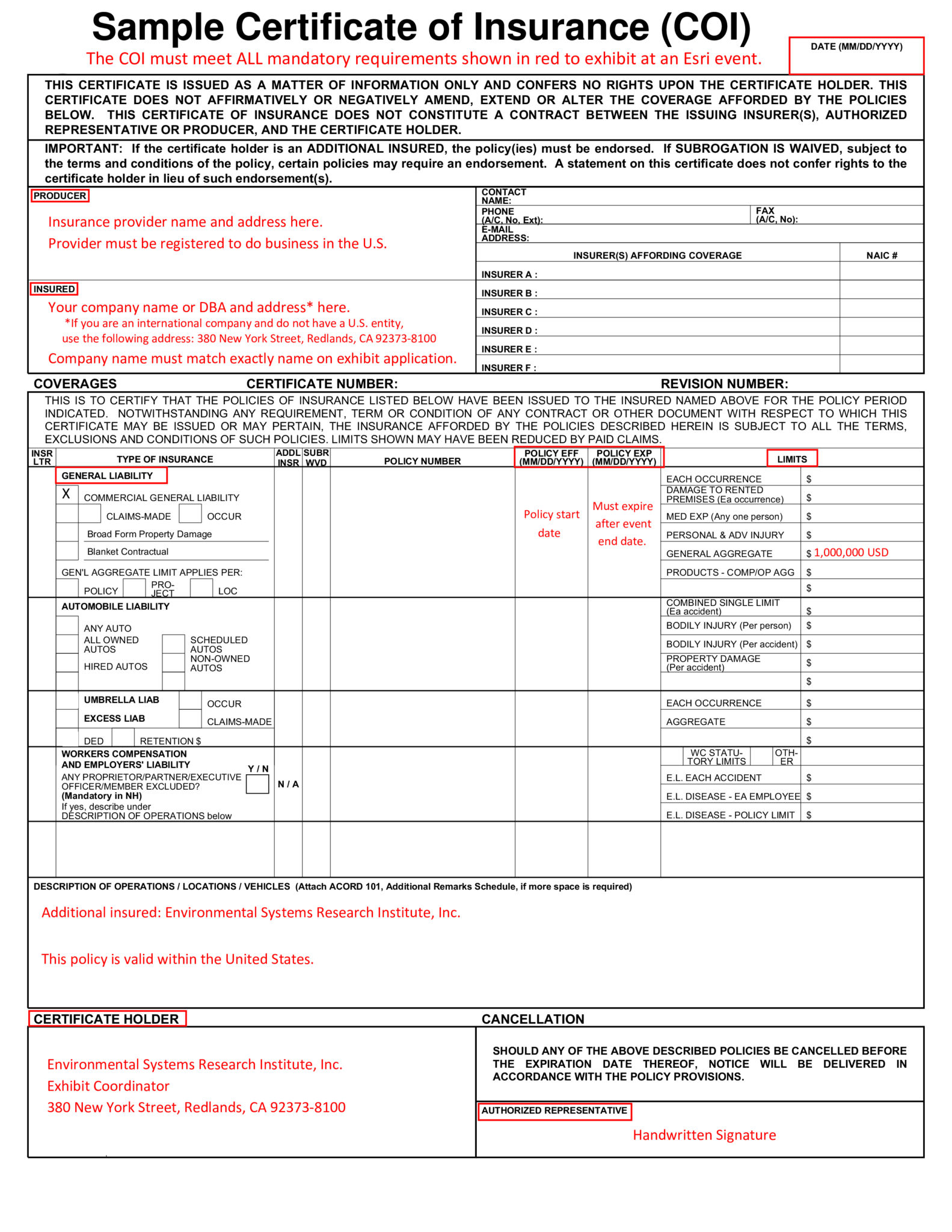

Coi Insurance Form

Coi Insurance Form - It is also known as an acord 25 certificate of insurance, certificate of insurance (coi) or a. It includes policy details like your specific coverage, limits, and effective dates, but it isn’t an insurance contract. $ $ $ property damage $ bodily injury (per accident) bodily injury (per person) combined single limit autos only autos only. To acquire a coi, you must first buy a small business liability insurance policy. They’re also known as certificates of liability insurance or proof of insurance. Limits shown may have been reduced by paid claims. A coi for most insurance policies is no longer than one page. In some cases you may need to fill out an online form or send an email to your insurance company to get a copy of your coi. This certificate of insurance does not constitute a contract between the issuing insurer(s), authorized representative or producer, and the certificate holder. After the policy has been issued, most certificates of insurance are available online.

Web a certificate of insurance (coi) form provides proof of insurance coverage. Web a certificate of insurance (coi) is a document from an insurer to show you have business insurance. Small business owners and contractors typically require a coi. Web request a copy of your coi through your insurer if necessary. They’re also known as certificates of liability insurance or proof of insurance. If the certificate holder is an additional insured, the policy(ies) must be endorsed. After the policy has been issued, most certificates of insurance are available online. It summarizes the benefits and limits of your general liability insurance policy. Web a certificate of insurance (coi), also known as a certificate of liability insurance, is proof of an active, valid insurance policy and serves as verification to your vendors, customers, or landlords that your business is indeed insured. Web a certificate of liability insurance (coi) is a form that provides proof of professional liability insurance for your business.

Web a certificate of insurance (coi), also known as a certificate of liability insurance, is proof of an active, valid insurance policy and serves as verification to your vendors, customers, or landlords that your business is indeed insured. Web a certificate of liability insurance (coi) is a form that provides proof of professional liability insurance for your business. If the certificate holder is an additional insured, the policy(ies) must be endorsed. $ $ $ property damage $ bodily injury (per accident) bodily injury (per person) combined single limit autos only autos only. A coi for most insurance policies is no longer than one page. In some cases you may need to fill out an online form or send an email to your insurance company to get a copy of your coi. With a coi, your clients can make sure you have the right insurance before they start working with you. It includes policy details like your specific coverage, limits, and effective dates, but it isn’t an insurance contract. Web request a copy of your coi through your insurer if necessary. It summarizes the benefits and limits of your general liability insurance policy.

FREE 9+ Liability Insurance Forms in PDF MS Word

It includes policy details like your specific coverage, limits, and effective dates, but it isn’t an insurance contract. Web a certificate of insurance (coi), also known as a certificate of liability insurance, is proof of an active, valid insurance policy and serves as verification to your vendors, customers, or landlords that your business is indeed insured. It summarizes the benefits.

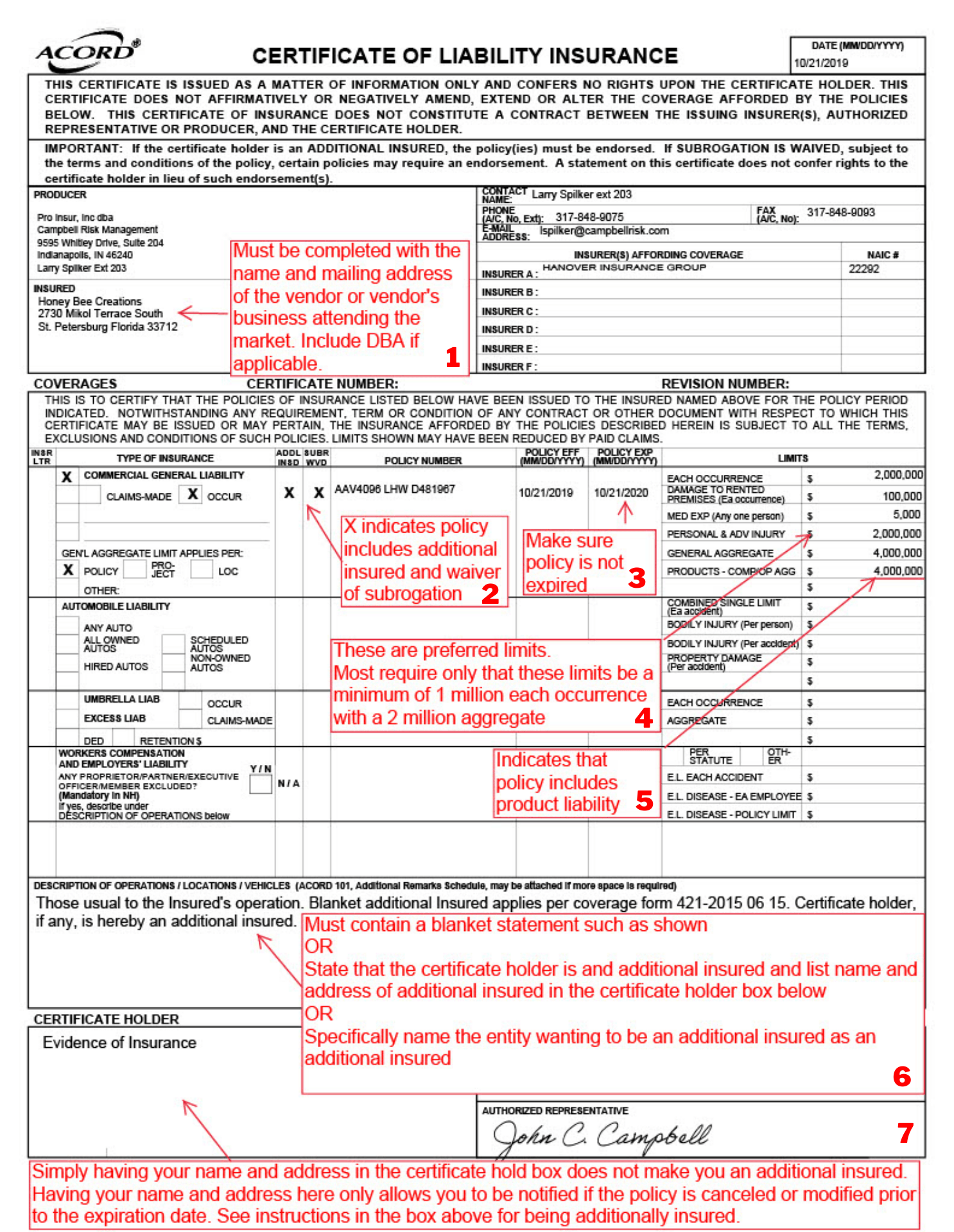

How to Read Your Certificate of Liability Insurance Campbell Risk

This certificate of insurance does not constitute a contract between the issuing insurer(s), authorized representative or producer, and the certificate holder. To acquire a coi, you must first buy a small business liability insurance policy. In some cases you may need to fill out an online form or send an email to your insurance company to get a copy of.

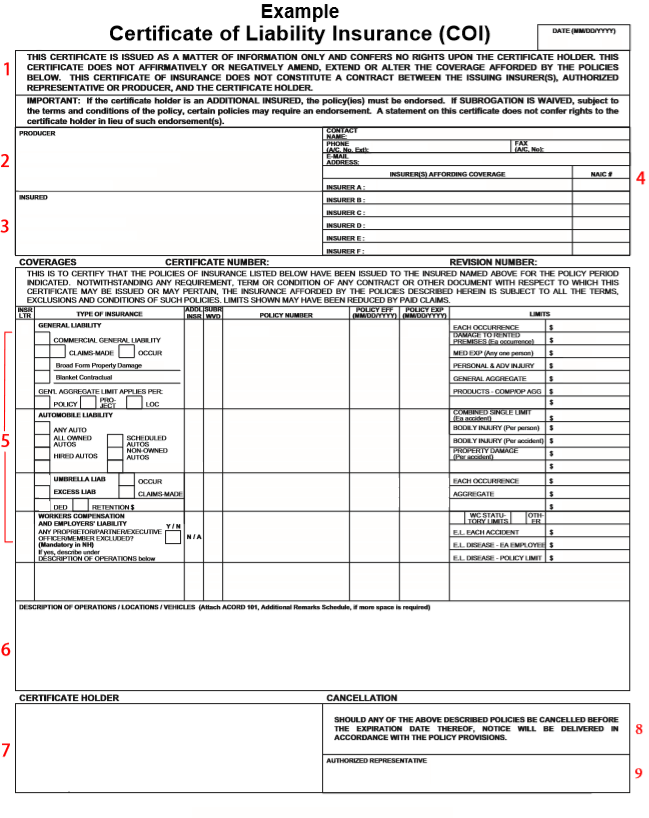

Certificate of Liability Insurance How to Request + Sample

$ $ $ property damage $ bodily injury (per accident) bodily injury (per person) combined single limit autos only autos only. Web a certificate of insurance (coi) is a document from an insurer to show you have business insurance. This certificate of insurance does not constitute a contract between the issuing insurer(s), authorized representative or producer, and the certificate holder..

Apply for a Booth

Web a certificate of insurance (coi) form provides proof of insurance coverage. After the policy has been issued, most certificates of insurance are available online. To acquire a coi, you must first buy a small business liability insurance policy. Web a certificate of liability insurance (coi) is a form that provides proof of professional liability insurance for your business. It.

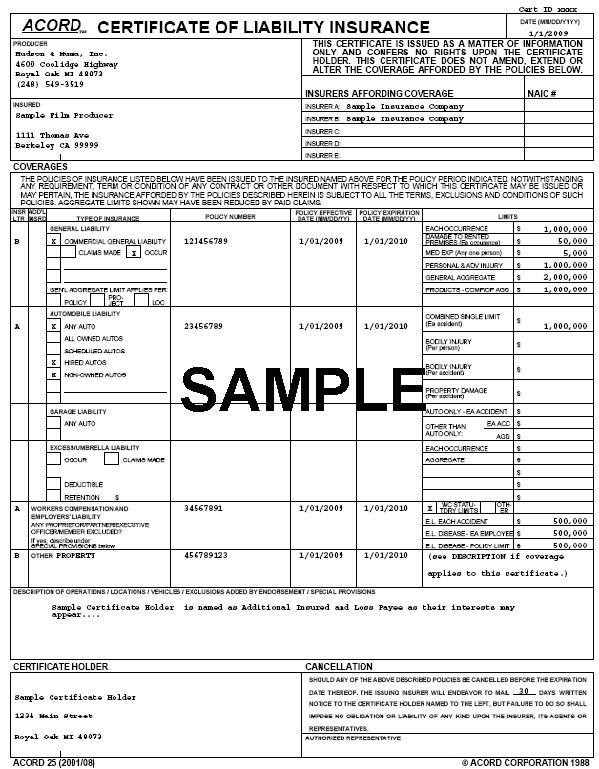

Certificate of Insurance Form Fill Out and Sign Printable PDF

To acquire a coi, you must first buy a small business liability insurance policy. It includes policy details like your specific coverage, limits, and effective dates, but it isn’t an insurance contract. After the policy has been issued, most certificates of insurance are available online. $ $ $ property damage $ bodily injury (per accident) bodily injury (per person) combined.

Certificate of Insurance Bounce About

It summarizes the benefits and limits of your general liability insurance policy. Web a certificate of insurance (coi) is a document from an insurer to show you have business insurance. Web certificate may be issued or may pertain, the insurance afforded by the policies described herein is subject to all the terms, exclusions and conditions of such policies. Web a.

Workers Compensation Insurance Workers Compensation Insurance Certificate

Learn more from the hartford. This certificate of insurance does not constitute a contract between the issuing insurer(s), authorized representative or producer, and the certificate holder. Small business owners and contractors typically require a coi. To acquire a coi, you must first buy a small business liability insurance policy. Limits shown may have been reduced by paid claims.

How to Read a Certificate of Insurance — Centurion Insurance

If the certificate holder is an additional insured, the policy(ies) must be endorsed. It summarizes the benefits and limits of your general liability insurance policy. Web a certificate of insurance (coi), also known as a certificate of liability insurance, is proof of an active, valid insurance policy and serves as verification to your vendors, customers, or landlords that your business.

Sample Certificate Of Insurance (Coi) Templates At throughout

Web a certificate of insurance (coi) is a document from an insurer to show you have business insurance. It is also known as an acord 25 certificate of insurance, certificate of insurance (coi) or a. Web a certificate of insurance (coi) is issued by an insurance company or broker and verifies the existence of an insurance policy. Learn more from.

HOW TO INSPECT AN EXHIBITOR'S COI EVENT HUB

Limits shown may have been reduced by paid claims. Web request a copy of your coi through your insurer if necessary. They’re also known as certificates of liability insurance or proof of insurance. To acquire a coi, you must first buy a small business liability insurance policy. This certificate of insurance does not constitute a contract between the issuing insurer(s),.

Web Request A Copy Of Your Coi Through Your Insurer If Necessary.

It summarizes the benefits and limits of your general liability insurance policy. Web a certificate of insurance (coi), also known as a certificate of liability insurance, is proof of an active, valid insurance policy and serves as verification to your vendors, customers, or landlords that your business is indeed insured. $ $ $ property damage $ bodily injury (per accident) bodily injury (per person) combined single limit autos only autos only. Web a certificate of insurance (coi) is issued by an insurance company or broker and verifies the existence of an insurance policy.

This Certificate Of Insurance Does Not Constitute A Contract Between The Issuing Insurer(S), Authorized Representative Or Producer, And The Certificate Holder.

Learn more from the hartford. Web a certificate of insurance (coi) form provides proof of insurance coverage. It includes policy details like your specific coverage, limits, and effective dates, but it isn’t an insurance contract. Web a certificate of insurance (coi) is a document from an insurer to show you have business insurance.

Web A Certificate Of Liability Insurance (Coi) Is A Form That Provides Proof Of Professional Liability Insurance For Your Business.

Small business owners and contractors typically require a coi. Limits shown may have been reduced by paid claims. To acquire a coi, you must first buy a small business liability insurance policy. If the certificate holder is an additional insured, the policy(ies) must be endorsed.

A Coi For Most Insurance Policies Is No Longer Than One Page.

In some cases you may need to fill out an online form or send an email to your insurance company to get a copy of your coi. After the policy has been issued, most certificates of insurance are available online. They’re also known as certificates of liability insurance or proof of insurance. It is also known as an acord 25 certificate of insurance, certificate of insurance (coi) or a.