Coinbase 1099 Form

Coinbase 1099 Form - Web coinbase taxes will help you understand what coinbase.com activity is taxable, your gains or losses, earned income on coinbase, and the information and reports (including irs. One goes to the eligible user with more than $600 from crypto rewards or staking, and the. You're a coinbase customer and you're a. These forms detail your taxable income from. If so, you may owe taxes if you’re a us taxpayer. You are a us person for tax purposes and; Web currently, coinbase may issue 1099 forms to both you (the account owner) and the irs if you meet certain qualifying factors. Did you stake any crypto or earn crypto rewards this year using coinbase? This layer of reporting helps the. Select custom reports and choose the type of report you want to generate.

These forms detail your taxable income from. If you earned $600 or more in crypto, we’re required to report your. Go to “taxes” and then “tax forms.” you. Web as a user, you need to know what form 1099 is, where you can get it, and how you should organize your records of crypto transactions to stay on top of your taxes. Web sign in to your coinbase account. Here’s a look at what that could mean, the steps you may have to take, forms you’ll. You are a coinbase customer and; Select custom reports and choose the type of report you want to generate. Web currently, coinbase may issue 1099 forms to both you (the account owner) and the irs if you meet certain qualifying factors. Web if you earn $600 or more in a year paid by an exchange, including coinbase, the exchange is required to report these payments to the irs as “other income” via irs form 1099.

These forms detail your taxable income from. One goes to the eligible user with more than $600 from crypto rewards or staking, and the. Web did you buy, sell, use, or trade crypto? You're a coinbase customer and you're a. You are a coinbase customer and; You are a us person for tax purposes and; Here’s a look at what that could mean, the steps you may have to take, forms you’ll. Select custom reports and choose the type of report you want to generate. If so, you may owe taxes if you’re a us taxpayer. This coinbase tax form may be issued by coinbase to.

Do Legal Firms Get A 1099 Darrin Kenney's Templates

Web coinbase taxes will help you understand what coinbase.com activity is taxable, your gains or losses, earned income on coinbase, and the information and reports (including irs. If you earned $600 or more in crypto, we’re required to report your. You're a coinbase customer and you're a. Web how to find coinbase tax forms? Web if you earn $600 or.

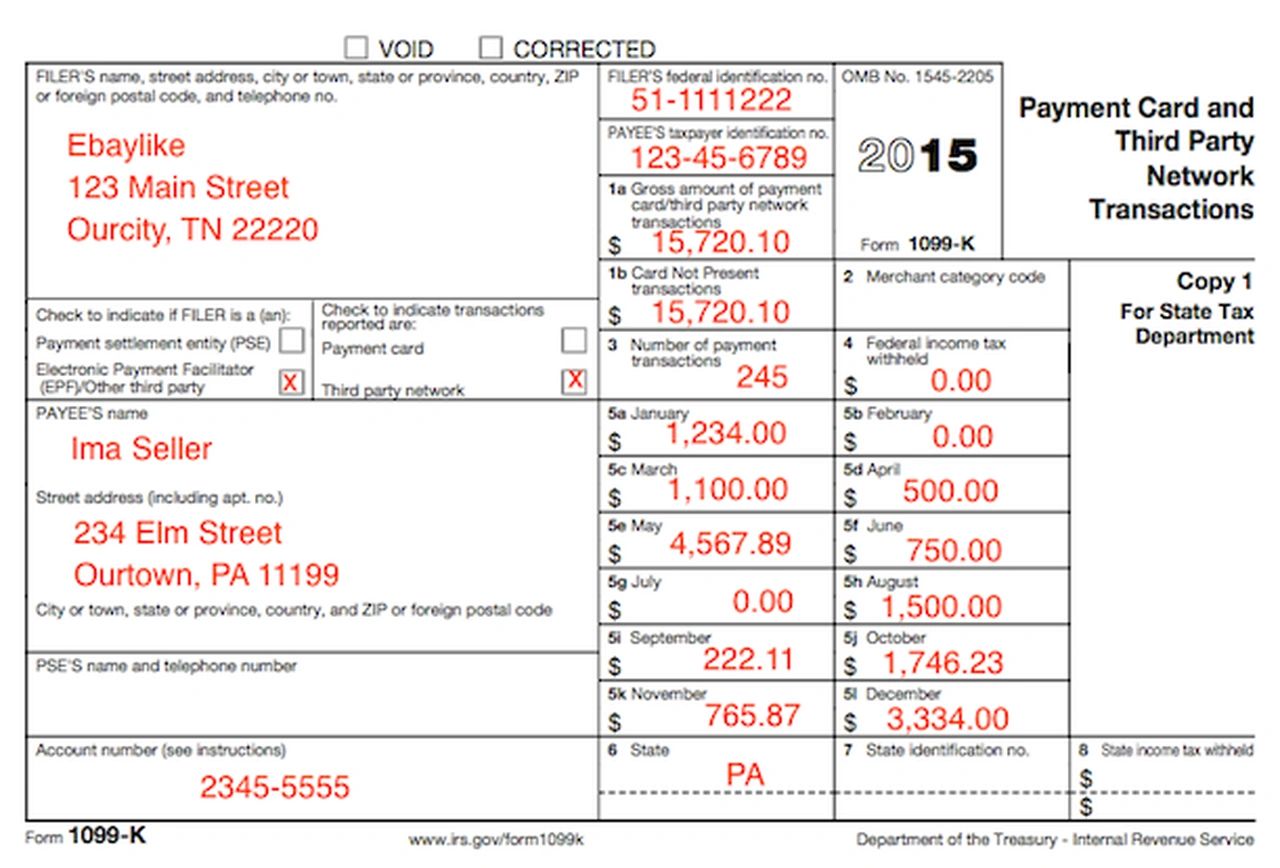

Coinbase Pro Issues Tax Form 1099K What Does This Mean for Crypto

Here’s a look at what that could mean, the steps you may have to take, forms you’ll. Web currently, coinbase may issue 1099 forms to both you (the account owner) and the irs if you meet certain qualifying factors. If so, you may owe taxes if you’re a us taxpayer. Web coinbase taxes will help you understand what coinbase.com activity.

Coinbase 1099 What to Do with Your Coinbase Tax Documents Gordon Law

This layer of reporting helps the. Here’s a look at what that could mean, the steps you may have to take, forms you’ll. Web sign in to your coinbase account. Web if you earn $600 or more in a year paid by an exchange, including coinbase, the exchange is required to report these payments to the irs as “other income”.

How To Get 1099 K From Coinbase Ethel Hernandez's Templates

If so, you may owe taxes if you’re a us taxpayer. Here’s a look at what that could mean, the steps you may have to take, forms you’ll. Web currently, coinbase may issue 1099 forms to both you (the account owner) and the irs if you meet certain qualifying factors. These forms detail your taxable income from. You are a.

Coinbase 1099 K / What To Do With Your 1099 K For Cryptotaxes Each

One goes to the eligible user with more than $600 from crypto rewards or staking, and the. Web as a user, you need to know what form 1099 is, where you can get it, and how you should organize your records of crypto transactions to stay on top of your taxes. Web sign in to your coinbase account. You are.

Coinbase 1099 Issues New Form 1099B & 8300 for Crypto

This coinbase tax form may be issued by coinbase to. If so, you may owe taxes if you’re a us taxpayer. These forms detail your taxable income from. If you earned $600 or more in crypto, we’re required to report your. Web sign in to your coinbase account.

What Is A Cryptocurrency 1099K? Coinbase 1099K TokenTax

Select custom reports and choose the type of report you want to generate. Web did you buy, sell, use, or trade crypto? Web how to find coinbase tax forms? Web as a user, you need to know what form 1099 is, where you can get it, and how you should organize your records of crypto transactions to stay on top.

"1099K from Coinbase, Inc." Email? CoinBase

Select custom reports and choose the type of report you want to generate. Web as a user, you need to know what form 1099 is, where you can get it, and how you should organize your records of crypto transactions to stay on top of your taxes. If you earned $600 or more in crypto, we’re required to report your..

Coinbase 1099 Guide to Coinbase Tax Documents Gordon Law Group

You are a us person for tax purposes and; These forms detail your taxable income from. Select custom reports and choose the type of report you want to generate. Go to “taxes” and then “tax forms.” you. If you earned $600 or more in crypto, we’re required to report your.

BTC News Coinbase Sends American Clients IRS Tax Form 1099K YouTube

One goes to the eligible user with more than $600 from crypto rewards or staking, and the. Web did you buy, sell, use, or trade crypto? You're a coinbase customer and you're a. Web sign in to your coinbase account. If you earned $600 or more in crypto, we’re required to report your.

Web If You Earn $600 Or More In A Year Paid By An Exchange, Including Coinbase, The Exchange Is Required To Report These Payments To The Irs As “Other Income” Via Irs Form 1099.

One goes to the eligible user with more than $600 from crypto rewards or staking, and the. This layer of reporting helps the. Web did you buy, sell, use, or trade crypto? You're a coinbase customer and you're a.

Web How To Find Coinbase Tax Forms?

Web coinbase taxes will help you understand what coinbase.com activity is taxable, your gains or losses, earned income on coinbase, and the information and reports (including irs. Select custom reports and choose the type of report you want to generate. You are a coinbase customer and; Did you stake any crypto or earn crypto rewards this year using coinbase?

If You Earned $600 Or More In Crypto, We’re Required To Report Your.

Web currently, coinbase may issue 1099 forms to both you (the account owner) and the irs if you meet certain qualifying factors. Web as a user, you need to know what form 1099 is, where you can get it, and how you should organize your records of crypto transactions to stay on top of your taxes. You are a us person for tax purposes and; These forms detail your taxable income from.

Here’s A Look At What That Could Mean, The Steps You May Have To Take, Forms You’ll.

Go to “taxes” and then “tax forms.” you. If so, you may owe taxes if you’re a us taxpayer. Web sign in to your coinbase account. This coinbase tax form may be issued by coinbase to.