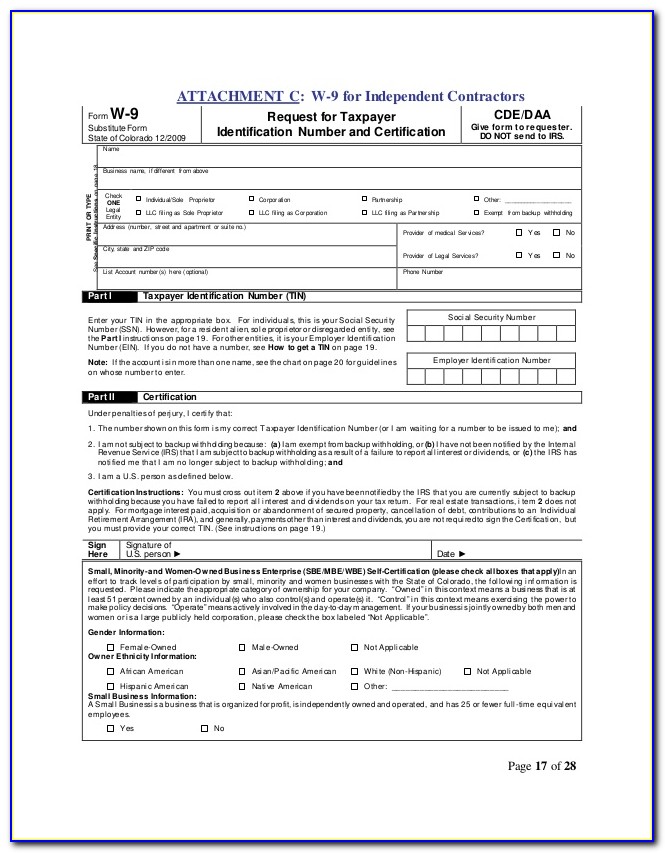

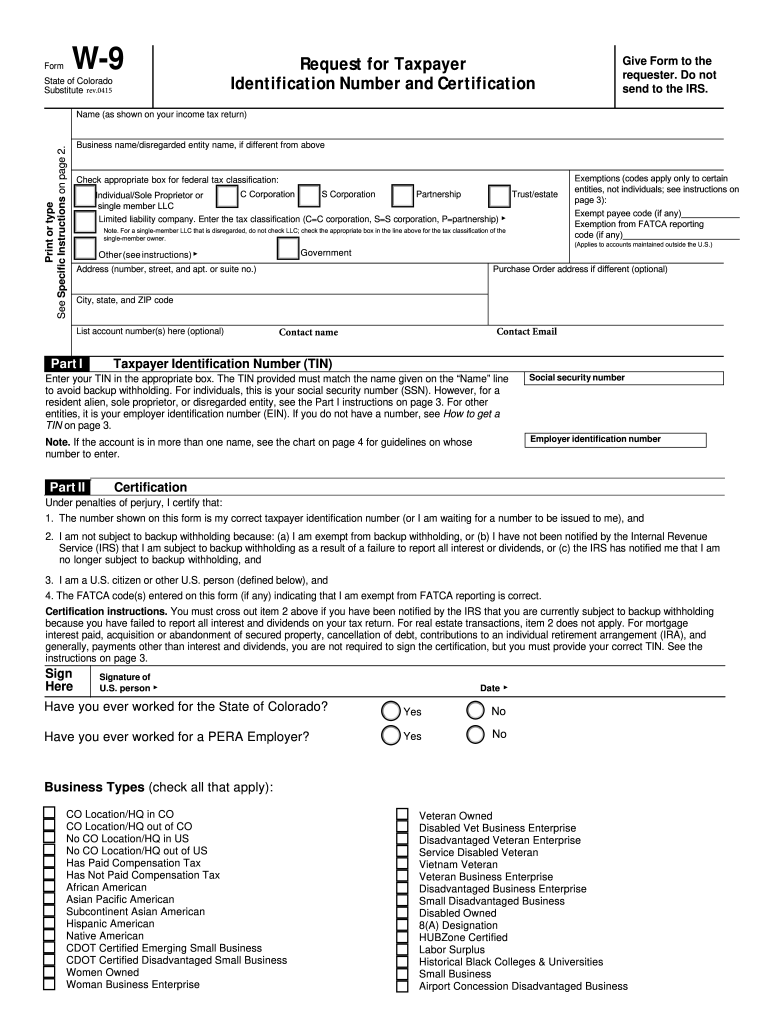

Colorado W 9 Form

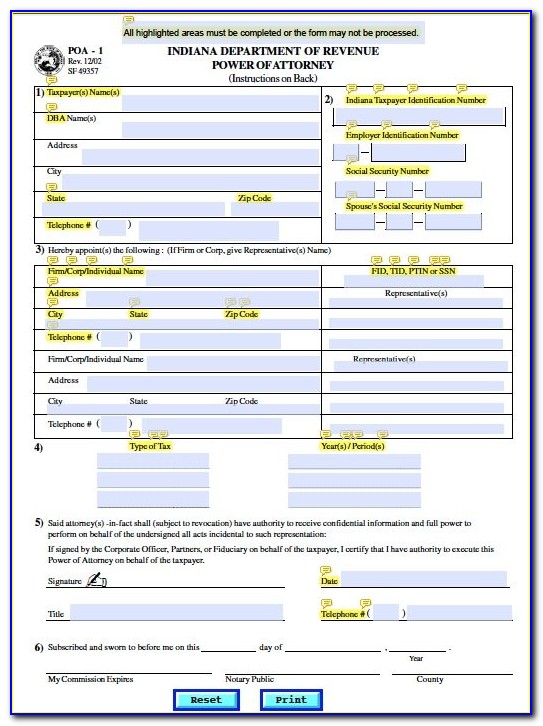

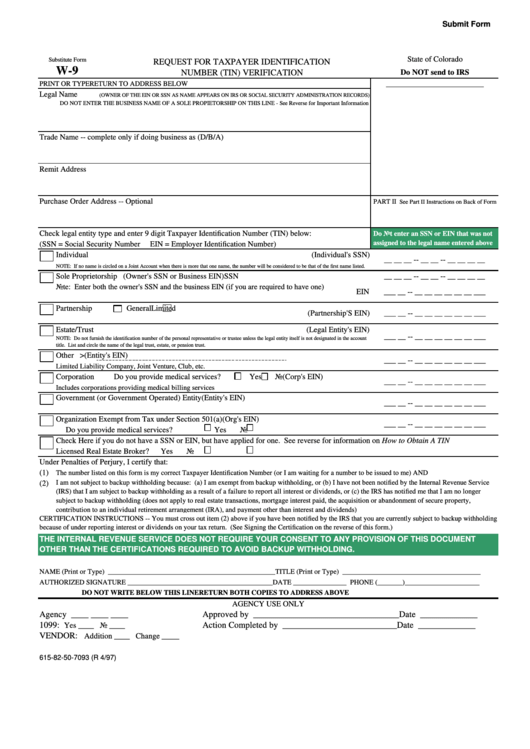

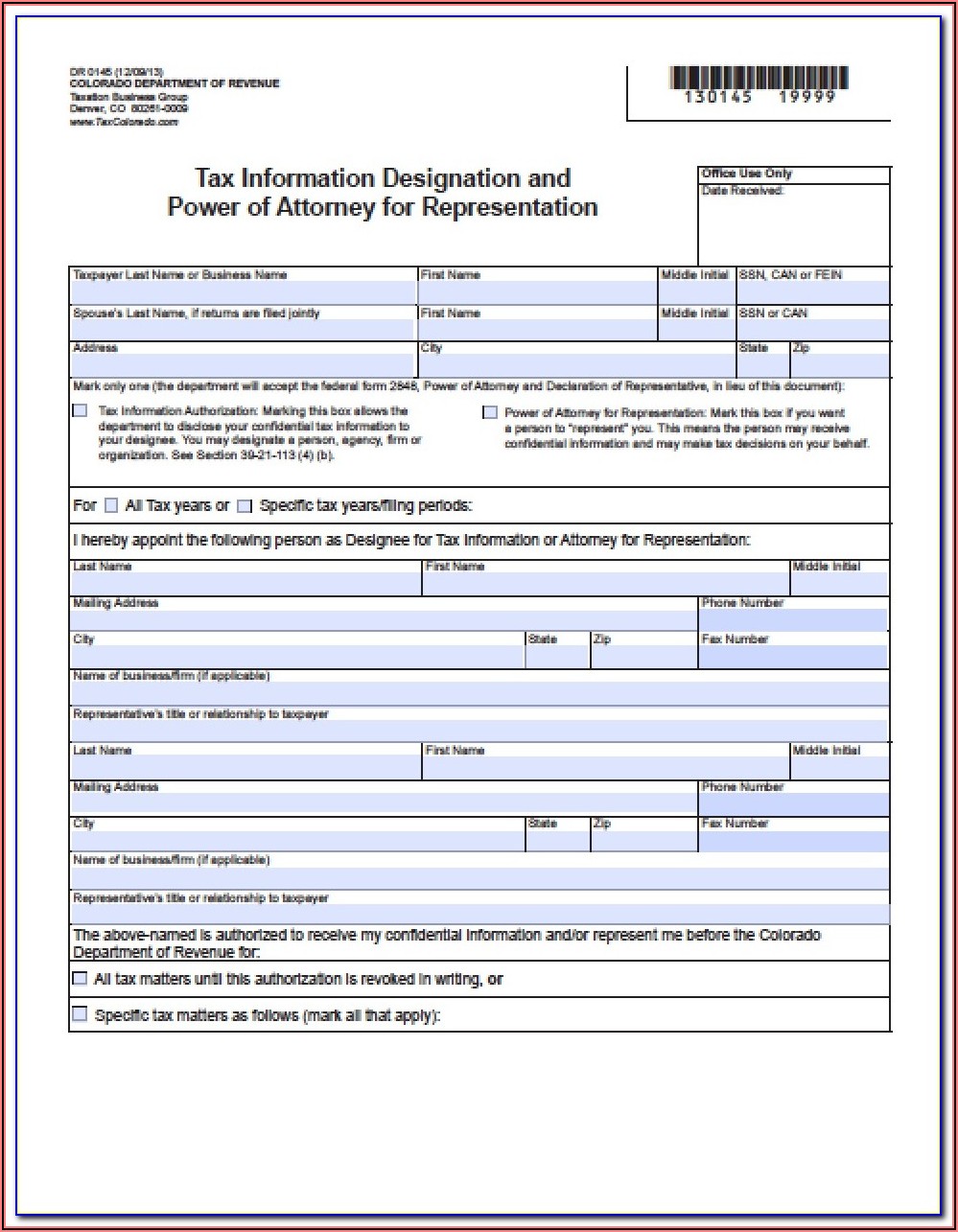

Colorado W 9 Form - Can i apply for payment for a tenant that no longer occupies the unit. Web what is the purpose of erap? Person (including a resident alien), to provide your correct tin. $10,500 if single or married filing separately; Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exemptions (codes apply only to certain. See instructions on exempt payee code (if any)____________ code (if any)________________________ under penalties of perjury, i certify that: Do not send to the irs. For examples of acceptable employment authorization. May 2019) state of colorado substitute request for taxpayer identification number and certification a go to www.irs.gov/formw9 for instructions and. Give form to the requester.

Person (including a resident alien), to provide your correct tin. Can i apply for payment for a tenant that no longer occupies the unit. May 2019) state of colorado substitute request for taxpayer identification number and certification a go to www.irs.gov/formw9 for instructions and. See instructions on exempt payee code (if any)____________ code (if any)________________________ under penalties of perjury, i certify that: The number shown on this form is my correct taxpayer identification number (or i am waiting for a number to be issued to. Person (including a resident alien), to provide your correct tin. For examples of acceptable employment authorization. Generally, this must be the same treaty under which you claimed. Web partnership trust/estate limited liability company. Do not send to the irs.

Can i apply for payment for a tenant that no longer occupies the unit. For examples of acceptable employment authorization. Does each adult on the lease need to fill out a separate tenant application? May 2019) state of colorado substitute request for taxpayer identification number and certification a go to www.irs.gov/formw9 for instructions and. Give form to the requester. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: Web partnership trust/estate limited liability company. See instructions on exempt payee code (if any)____________ code (if any)________________________ under penalties of perjury, i certify that: $10,500 if single or married filing separately; Person (including a resident alien), to.

Colorado 1099 Form Form Resume Examples edV1pPlBYq

The number shown on this form is my correct taxpayer identification number (or i am waiting for a number to be issued to. $10,500 if single or married filing separately; Can i apply for payment for a tenant that no longer occupies the unit. Generally, this must be the same treaty under which you claimed. Person (including a resident alien),.

Colorado Hoa Proxy Form Form Resume Examples aEDvlBKO1Y

Person (including a resident alien), to. For examples of acceptable employment authorization. Give form to the requester. $10,500 if single or married filing separately; Do not send to the irs.

Fillable State Of Colorado Substitute Form W9 Request For Taxpayer

Does each adult on the lease need to fill out a separate tenant application? $10,500 if single or married filing separately; Web what is the purpose of erap? See instructions on exempt payee code (if any)____________ code (if any)________________________ under penalties of perjury, i certify that: Person (including a resident alien), to provide your correct tin.

Colorado W 9 Form 2020 Form Resume Examples ko8LrgOeK9

Person (including a resident alien), to. May 2019) state of colorado substitute request for taxpayer identification number and certification a go to www.irs.gov/formw9 for instructions and. See instructions on exempt payee code (if any)____________ code (if any)________________________ under penalties of perjury, i certify that: Can i apply for payment for a tenant that no longer occupies the unit. Person (including.

Colorado W 9 Form Form Resume Examples wRYPwqPP94

May 2019) state of colorado substitute request for taxpayer identification number and certification a go to www.irs.gov/formw9 for instructions and. Can i apply for payment for a tenant that no longer occupies the unit. Generally, this must be the same treaty under which you claimed. Give form to the requester. Person (including a resident alien), to provide your correct tin.

Colorado Hoa Proxy Form Form Resume Examples aEDvlBKO1Y

Person (including a resident alien), to provide your correct tin. $10,500 if single or married filing separately; Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: For examples of acceptable employment authorization. Can i apply for payment for a tenant that no longer occupies the unit.

941 Quarterly Tax Return 2022

Person (including a resident alien), to provide your correct tin. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: May 2019) state of colorado substitute request for taxpayer identification number and certification a go to www.irs.gov/formw9 for instructions and. Does each adult on the lease need to fill.

20152022 Form CO DoR Substitute W9 Fill Online, Printable, Fillable

$10,500 if single or married filing separately; Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: Does each adult on the lease need to fill out a separate tenant application? Can i apply for payment for a tenant that no longer occupies the unit. For examples of acceptable.

Colorado W 9 Form 2020 Form Resume Examples ko8LrgOeK9

Does each adult on the lease need to fill out a separate tenant application? See instructions on exempt payee code (if any)____________ code (if any)________________________ under penalties of perjury, i certify that: Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: Generally, this must be the same treaty.

Colorado W 9 Form 2020 Form Resume Examples ko8LrgOeK9

$10,500 if single or married filing separately; Web partnership trust/estate limited liability company. Generally, this must be the same treaty under which you claimed. Give form to the requester. Does each adult on the lease need to fill out a separate tenant application?

Enter The Tax Classification (C=C Corporation, S=S Corporation, P=Partnership) Exemptions (Codes Apply Only To Certain.

Does each adult on the lease need to fill out a separate tenant application? Person (including a resident alien), to provide your correct tin. For examples of acceptable employment authorization. Person (including a resident alien), to.

Can I Apply For Payment For A Tenant That No Longer Occupies The Unit.

The number shown on this form is my correct taxpayer identification number (or i am waiting for a number to be issued to. Person (including a resident alien), to provide your correct tin. See instructions on exempt payee code (if any)____________ code (if any)________________________ under penalties of perjury, i certify that: Give form to the requester.

Web What Is The Purpose Of Erap?

Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: $10,500 if single or married filing separately; Generally, this must be the same treaty under which you claimed. Web partnership trust/estate limited liability company.

May 2019) State Of Colorado Substitute Request For Taxpayer Identification Number And Certification A Go To Www.irs.gov/Formw9 For Instructions And.

Do not send to the irs.