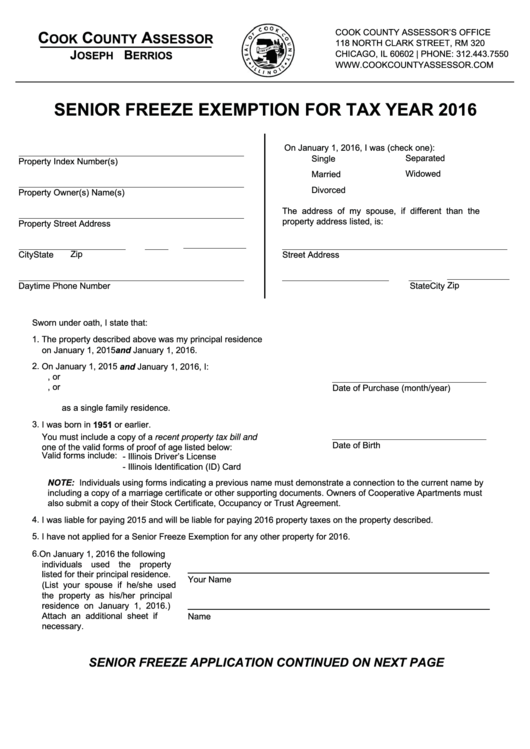

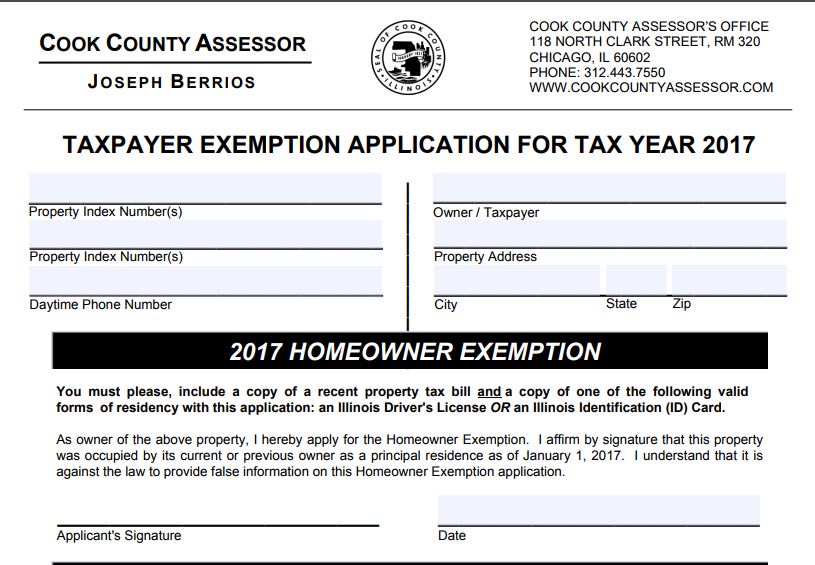

Cook County Senior Freeze 2022 Form

Cook County Senior Freeze 2022 Form - Web to apply for the senior freeze exemption, the applicant must: The amounts written on each line. Www.cookcountyassessor.com senior citizen homestead exemption seniors can save,. Have owned and occupied the home on. Web the senior citizens assessment freeze homestead exemption qualifications for the 2022 tax year (for the property taxes you will pay in 2023), are listed below. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Web information application for exemptions this filing allows you to apply for the following exemptions: Web exemption applications for the 2022 tax year are due by friday, august 4, 2023. Beginning april 1, 2023, the family support division will be required to restart annual renewals for mo healthnet. Please note, exemptions are only reflected on your second installment property tax bill.

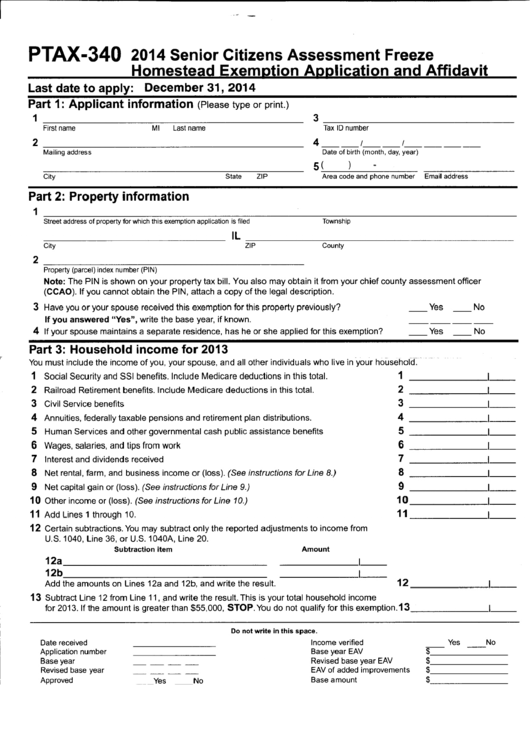

The application filing period for the tax year 2022 is now open. Application instructions (senior citizens assessment freeze homestead exemption) section 2: The benefits of applying online are that homeowners can track their application, upload additional. Please note, exemptions are only reflected on your second installment property tax bill. Web initial application in 2022. Web the senior citizens assessment freeze homestead exemption qualifications for the 2022 tax year (for the property taxes you will pay in 2023), are listed below. Please note, exemptions are only reflected on your second installment property tax bill. Www.cookcountyassessor.com senior citizen homestead exemption seniors can save,. Beginning april 1, 2023, the family support division will be required to restart annual renewals for mo healthnet. • you will be 65 or.

The application filing period for the tax year 2022 is now open. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Web exemption applications for the 2022 tax year are due by friday, august 4, 2023. Exemptions are only reflected on your second installment property tax bill. Please note, exemptions are only reflected on your second installment property tax bill. Web exemption applications for the 2022 tax year are now available. Web exemption applications for the 2022 tax year are due by friday, august 4, 2023. Please note, exemptions are only reflected on your second installment property tax bill. The amounts written on each line. Web the senior freeze exemption (senior citizens assessment freeze homestead exemption) allows a qualified senior citizen to apply for a freeze of the equalized.

Cook County Assessor Property Data Download brownend

Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. The application filing period for the tax year 2022 is now open. Web the senior freeze exemption (senior citizens assessment freeze homestead exemption) allows a qualified senior citizen to.

2023 Senior Citizen Exemption Application Form Cook County

Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Web exemption applications for the 2022 tax year are now available. Web exemption applications for the 2022 tax year are due by friday, august 4, 2023. Web initial application.

Mom’s Senior Freeze form got lost in the mail. What can we do?

Web exemption applications for the 2022 tax year are due by friday, august 4, 2023. Web to apply for the senior freeze exemption, the applicant must: Exemptions are only reflected on your second installment property tax bill. • you will be 65 or. Web initial application in 2022.

Online fillable certificate of error for homeowners exemption pdf Fill

Web to apply for the senior freeze exemption, the applicant must: Exemptions are only reflected on your second installment property tax bill. • you will be 65 or. Missouri lawmakers debated a resolution monday that, upon voter approval, would exempt certain senior citizens from. Please note, exemptions are only reflected on your second installment property tax bill.

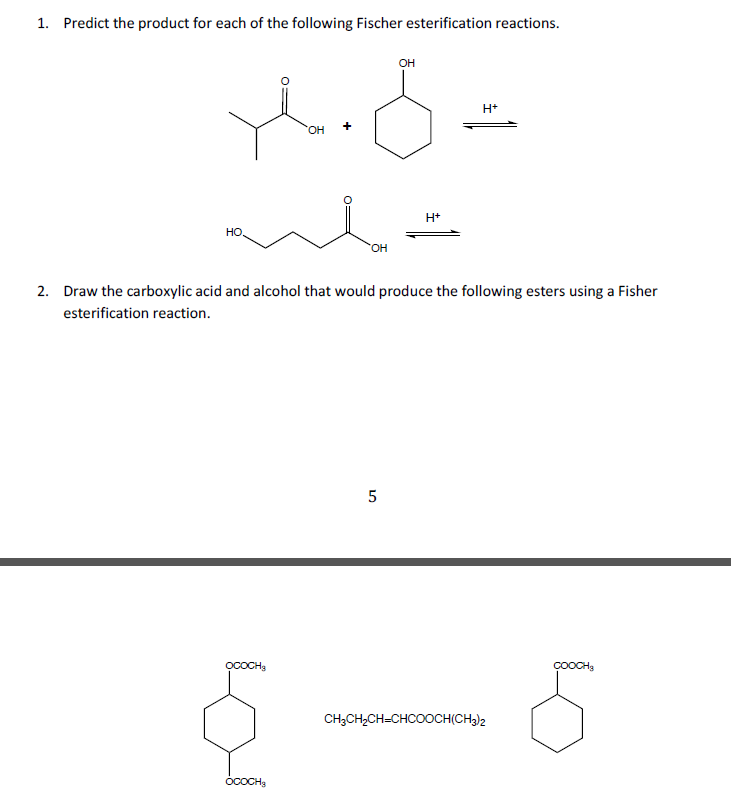

Solved 1. Predict the product for each of the following

Web to apply for the senior freeze exemption, the applicant must: Have owned and occupied the home on. Exemptions are only reflected on your second installment property tax bill. Www.cookcountyassessor.com senior citizen homestead exemption seniors can save,. The benefits of applying online are that homeowners can track their application, upload additional.

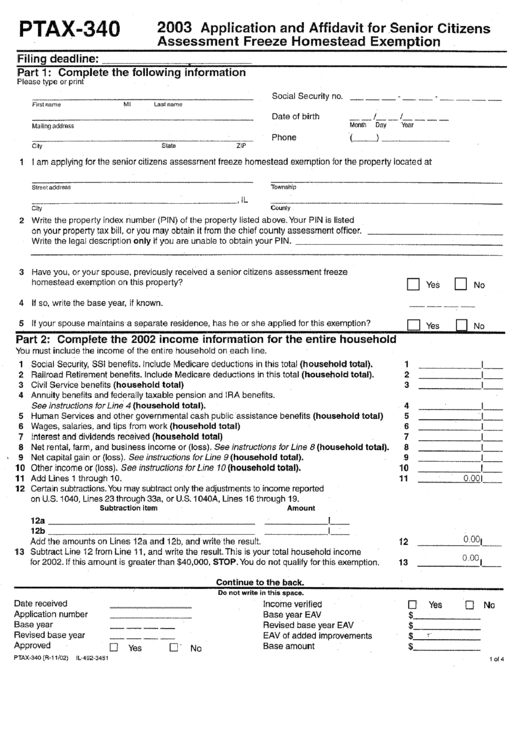

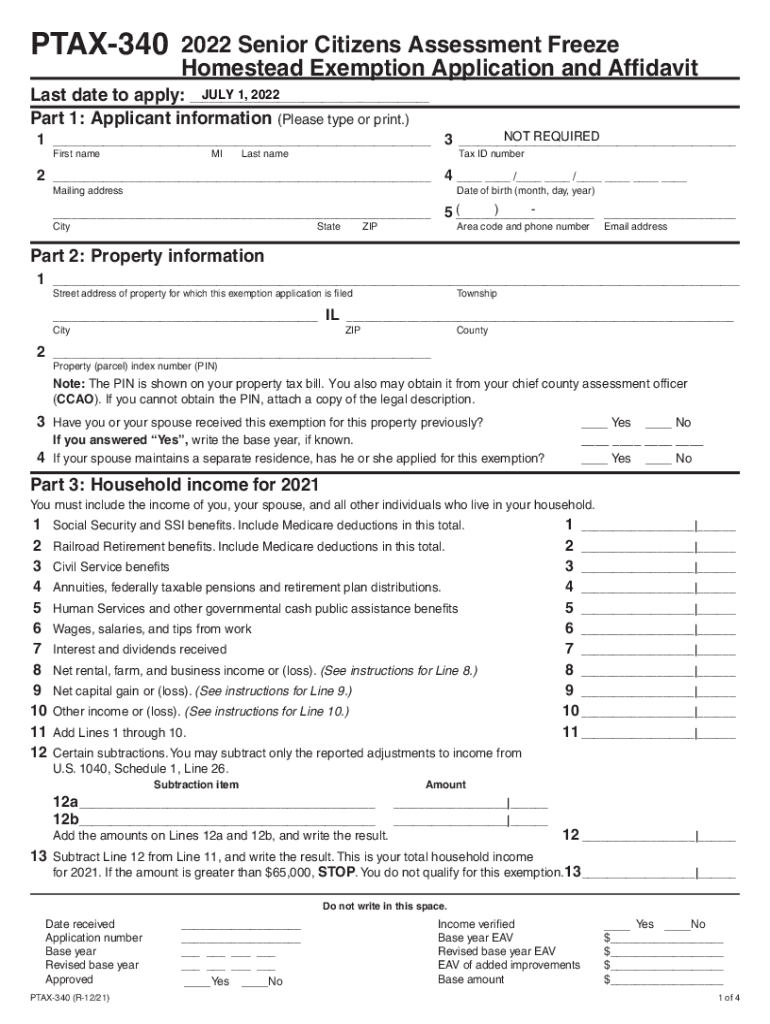

IL PTAX340 2022 Fill and Sign Printable Template Online US Legal Forms

Www.cookcountyassessor.com senior citizen homestead exemption seniors can save,. Web the senior citizens assessment freeze homestead exemption qualifications for the 2022 tax year (for the property taxes you will pay in 2023), are listed below. The amounts written on each line. Web cook county board president toni preckwinkle announced wednesday that second installment property tax bills for the 2022 tax year.

Cook County Property Tax Search By Address Property Walls

Seniors who did not receive applications in the mail but believe they are entitled to an. Be a senior citizen with an annual household income of $65,000 or less. Web chicago, il 60602 312.443.7550 you may find applications and additional information at: Web exemption applications for the 2022 tax year are due by friday, august 4, 2023. Web cook county.

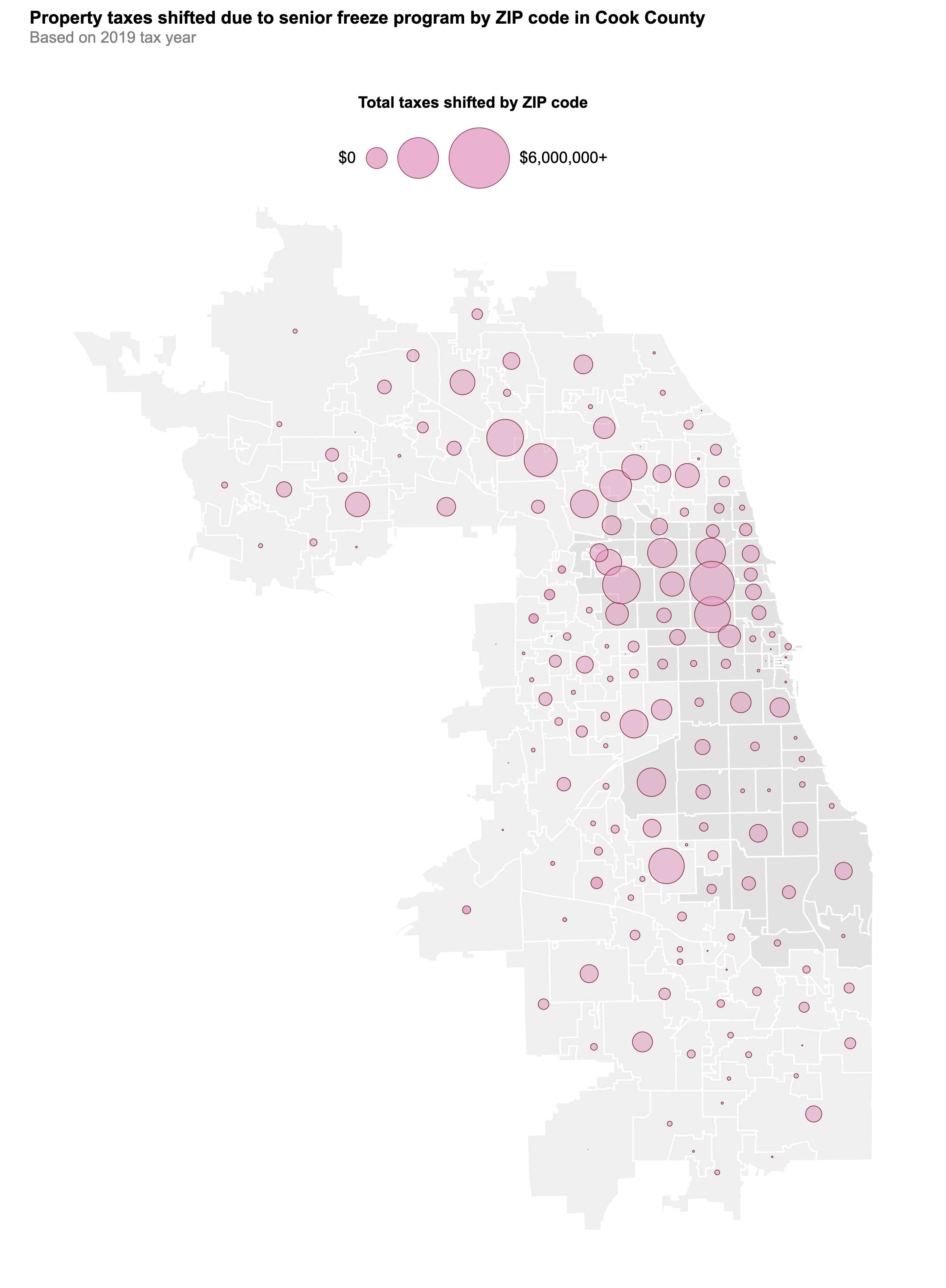

‘Senior freeze’ property tax breaks in Cook County riddled with errors

Missouri lawmakers debated a resolution monday that, upon voter approval, would exempt certain senior citizens from. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Application instructions (senior citizens assessment freeze homestead exemption) section 2: Web the senior.

Fillable Form Ptax 340 2014 Senior Citizens Assessment Freeze

Web initial application in 2022. Seniors who did not receive applications in the mail but believe they are entitled to an. Application instructions (senior citizens assessment freeze homestead exemption) section 2: Have owned and occupied the home on. Beginning april 1, 2023, the family support division will be required to restart annual renewals for mo healthnet.

What Is The Senior Exemption In Cook County PROFRTY

Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Www.cookcountyassessor.com senior citizen homestead exemption seniors can save,. • you will be 65 or. Exemptions are only reflected on your second installment property tax bill. Be a senior citizen.

Please Note, Exemptions Are Only Reflected On Your Second Installment Property Tax Bill.

Seniors who did not receive applications in the mail but believe they are entitled to an. The application filing period for the tax year 2022 is now open. Beginning april 1, 2023, the family support division will be required to restart annual renewals for mo healthnet. Web to apply for the senior freeze exemption, the applicant must:

Web Cook County Board President Toni Preckwinkle Announced Wednesday That Second Installment Property Tax Bills For The 2022 Tax Year Are Expected To Be Ready Nov.

Please note, exemptions are only reflected on your second installment property tax bill. Exemptions are only reflected on your second installment property tax bill. Web the senior citizens assessment freeze homestead exemption qualifications for the 2022 tax year (for the property taxes you will pay in 2023), are listed below. Web exemption applications for the 2022 tax year are due by friday, august 4, 2023.

Www.cookcountyassessor.com Senior Citizen Homestead Exemption Seniors Can Save,.

Have owned and occupied the home on. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Web chicago, il 60602 312.443.7550 you may find applications and additional information at: Web initial application in 2022.

Be A Senior Citizen With An Annual Household Income Of $65,000 Or Less.

The amounts written on each line. Missouri lawmakers debated a resolution monday that, upon voter approval, would exempt certain senior citizens from. The benefits of applying online are that homeowners can track their application, upload additional. Application instructions (senior citizens assessment freeze homestead exemption) section 2: