Cook County Senior Freeze Form

Cook County Senior Freeze Form - Edit, sign and save il senior freeze exemption form. Homeowners eligible for this exemption have to be: Web senior property tax exemptions are not the only types of tax relief you may qualify for. Web those who are currently receiving the senior freeze exemption will automatically receive a renewal application form in the mail, typically between january and april. Web to apply for the senior freeze exemption, the applicant must: Web new york’s senior exemption is also pretty generous. Income verification the amounts written on each line must include your income tax year 2018 income and. Web application for exemptions this filing allows you to apply for the following exemptions: Register and subscribe now to work on your il senior freeze exemption application form. Register and subscribe now to work on your il senior freeze exemption application form.

Web application for exemptions this filing allows you to apply for the following exemptions: The loan from the state of. Web submit applications by mail or online. Edit, sign and save il senior freeze exemption form. Web senior citizen assessment freeze exemption qualified senior citizens can apply for a freeze of the assessed value of their property. Register and subscribe now to work on your il senior freeze exemption application form. Web if this is my first time applying for thesenior freeze exemption, i have included a copy of a recent propertytax bill and one of the valid forms of proof of age listed below:valid forms. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Web a senior property tax freeze is a property tax exemption that freezes the assessed value of a home or property that’s eligible. Other tax help available for seniors may come in the shape of senior property tax:

Edit, sign and save il senior freeze exemption form. Register and subscribe now to work on your il senior freeze exemption application form. Web to apply for the senior freeze exemption, the applicant must: Web submit applications by mail or online. Web if this is my first time applying for thesenior freeze exemption, i have included a copy of a recent propertytax bill and one of the valid forms of proof of age listed below:valid forms. Web application for exemptions this filing allows you to apply for the following exemptions: Have owned and occupied the home on. Web senior property tax exemptions are not the only types of tax relief you may qualify for. Be a senior citizen with an annual household income of $65,000 or less. Web new york’s senior exemption is also pretty generous.

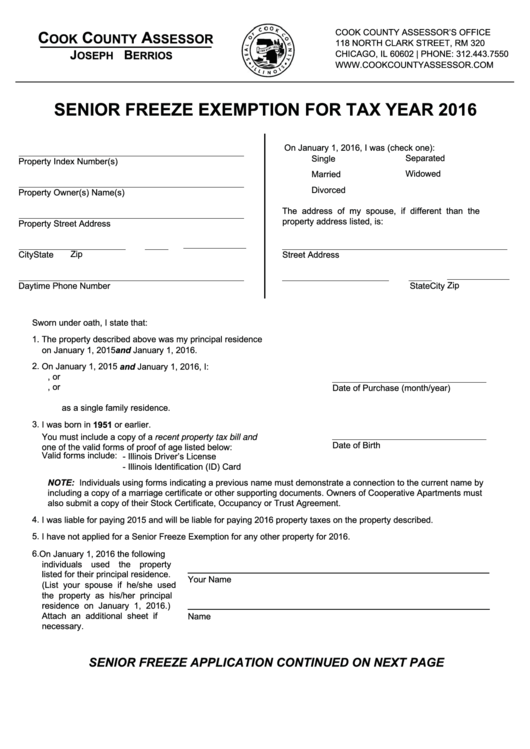

Senior Citizen Assessment Freeze Exemption Cook County Form

Web senior citizen assessment freeze exemption qualified senior citizens can apply for a freeze of the assessed value of their property. Web a senior property tax freeze is a property tax exemption that freezes the assessed value of a home or property that’s eligible. Web new york’s senior exemption is also pretty generous. Register and subscribe now to work on.

OK County Senior Freeze Level Increases for 2020 KOKH

Homeowners eligible for this exemption have to be: Other tax help available for seniors may come in the shape of senior property tax: Web application for exemptions this filing allows you to apply for the following exemptions: Edit, sign and save il senior freeze exemption form. Web a senior property tax freeze is a property tax exemption that freezes the.

Senior Citizen Assessment Freeze Exemption Cook County Form

Be a senior citizen with an annual household income of $65,000 or less. Web application for exemptions this filing allows you to apply for the following exemptions: Over time, in many areas, this program. Other tax help available for seniors may come in the shape of senior property tax: Web the senior freeze exemption allows qualified senior citizens to apply.

Senior Freeze Exemption Cook County Assessor 2016 printable pdf

Register and subscribe now to work on your il senior freeze exemption application form. Web a senior property tax freeze is a property tax exemption that freezes the assessed value of a home or property that’s eligible. Web to apply for the senior freeze exemption, the applicant must: Web new york’s senior exemption is also pretty generous. It’s calculated at.

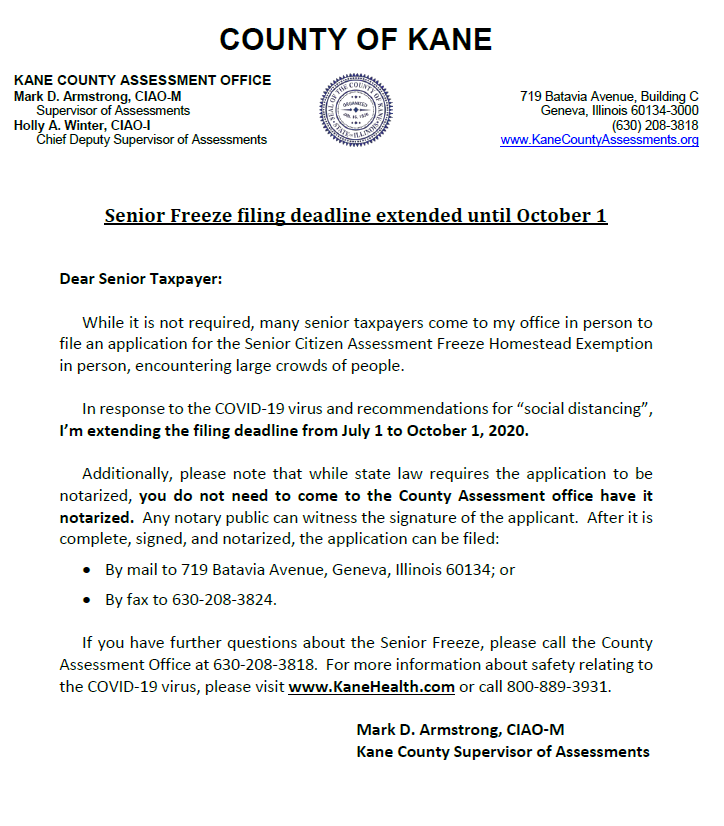

Kane County Senior Tax Freeze Extended

Web application for exemptions this filing allows you to apply for the following exemptions: Edit, sign and save il senior freeze exemption form. Edit, sign and save il senior freeze exemption form. Be a senior citizen with an annual household income of $65,000 or less. Web if this is my first time applying for thesenior freeze exemption, i have included.

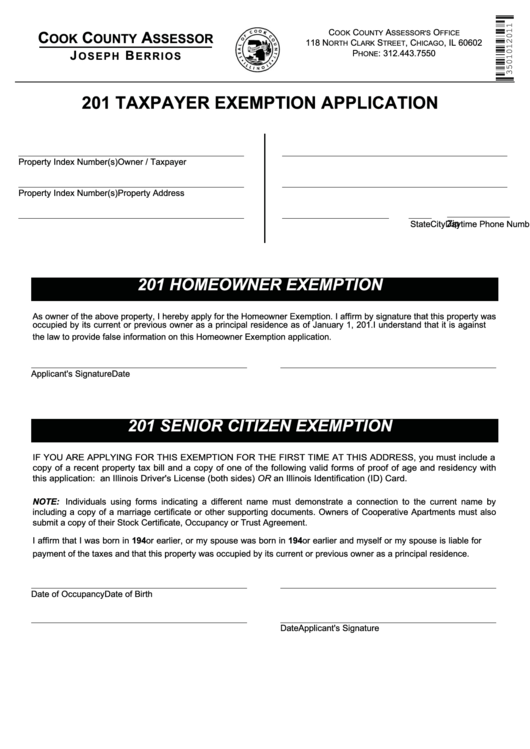

Fillable 201 Taxpayer Exemption Application Cook County Assessor

Web senior citizen assessment freeze exemption qualified senior citizens can apply for a freeze of the assessed value of their property. Over time, in many areas, this program. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1957 or prior) and own and occupy their property as their. Edit, sign.

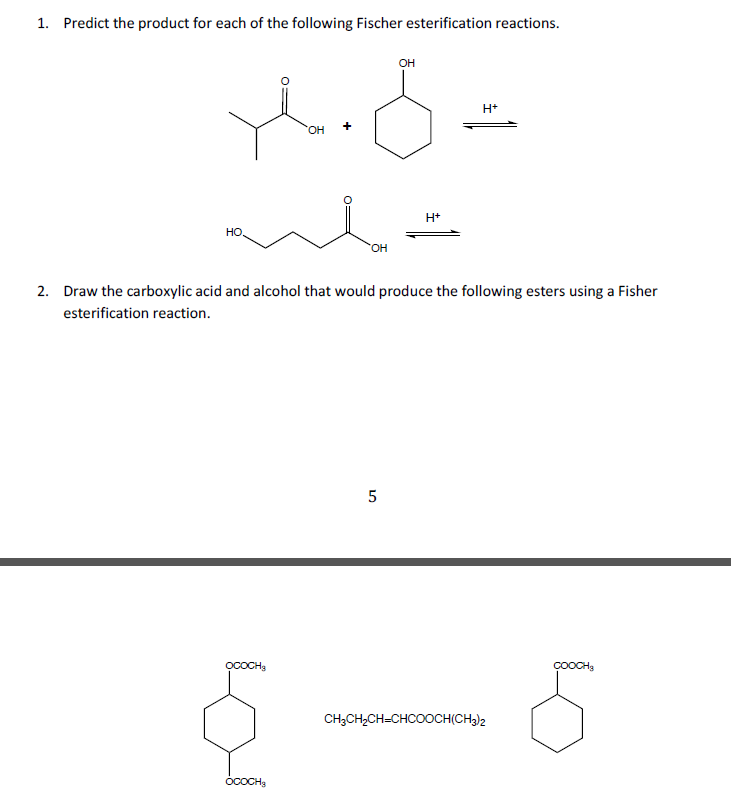

Solved 1. Predict the product for each of the following

Over time, in many areas, this program. Web the senior freeze exemption allows qualified senior citizens to apply for a freeze of the equalized assessed value (eav) of their properties for the year preceding. Web if this is my first time applying for thesenior freeze exemption, i have included a copy of a recent propertytax bill and one of the.

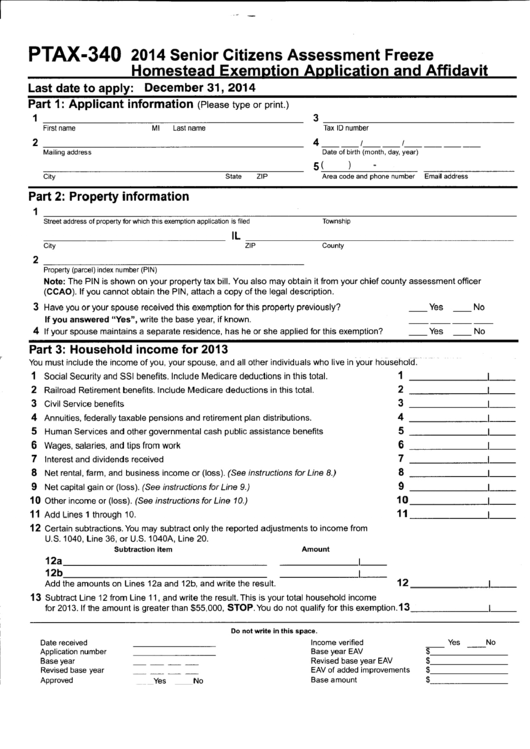

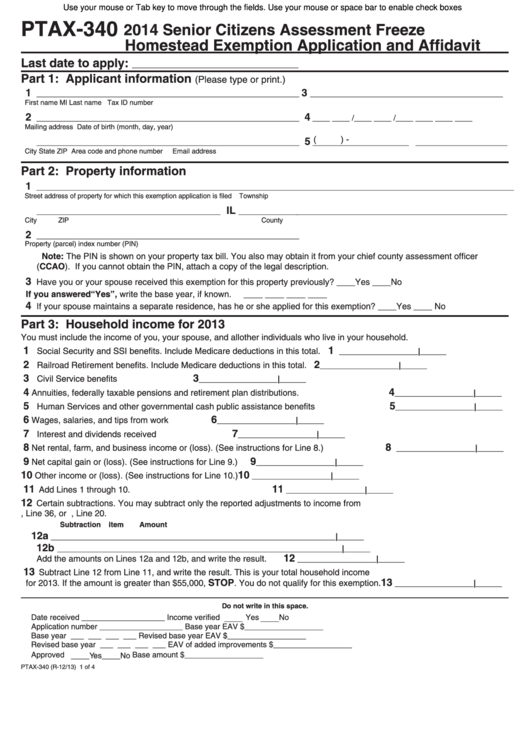

Fillable Form Ptax340 Senior Citizens Assessment Freeze Homestead

Web if this is my first time applying for thesenior freeze exemption, i have included a copy of a recent propertytax bill and one of the valid forms of proof of age listed below:valid forms. Web those who are currently receiving the senior freeze exemption will automatically receive a renewal application form in the mail, typically between january and april..

senior ze application ptr 2 Fill out & sign online DocHub

Web a senior property tax freeze is a property tax exemption that freezes the assessed value of a home or property that’s eligible. Register and subscribe now to work on your il senior freeze exemption application form. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1957 or prior) and.

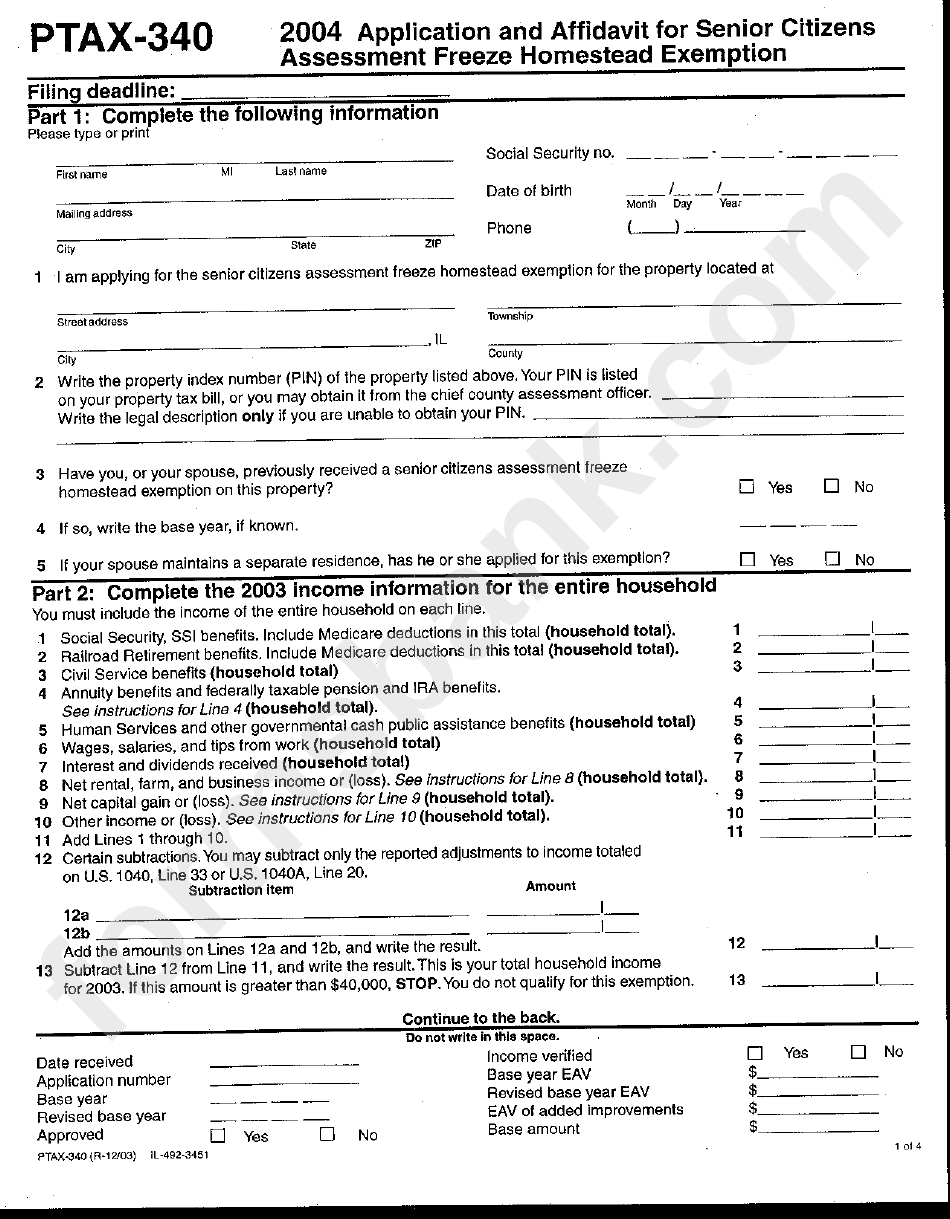

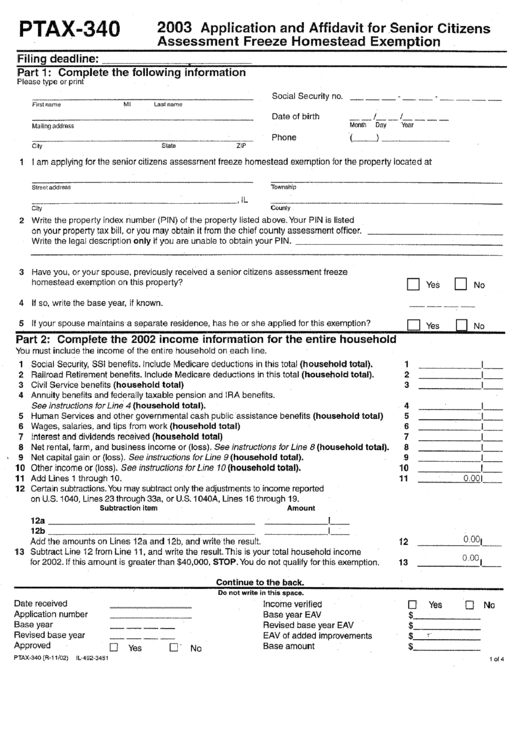

Form Ptax 340 Application And Affidavit For Senior Citizens

Edit, sign and save il senior freeze exemption form. Web a senior property tax freeze is a property tax exemption that freezes the assessed value of a home or property that’s eligible. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent.

Web New York’s Senior Exemption Is Also Pretty Generous.

Other tax help available for seniors may come in the shape of senior property tax: Web senior property tax exemptions are not the only types of tax relief you may qualify for. Have owned and occupied the home on. Web to apply for the senior freeze exemption, the applicant must:

Homeowners Eligible For This Exemption Have To Be:

Web it allows qualified seniors to defer a maximum of $7,500 per tax year (this includes 1st and 2nd installments) on their primary home. Web senior citizen assessment freeze exemption qualified senior citizens can apply for a freeze of the assessed value of their property. Web application for exemptions this filing allows you to apply for the following exemptions: Edit, sign and save il senior freeze exemption form.

Web A Senior Property Tax Freeze Is A Property Tax Exemption That Freezes The Assessed Value Of A Home Or Property That’s Eligible.

Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Register and subscribe now to work on your il senior freeze exemption application form. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1957 or prior) and own and occupy their property as their. Web submit applications by mail or online.

It’s Calculated At 50 Percent Of Your Home’s Appraised Value, Meaning You’re Only Paying Half The Usual Taxes.

Register and subscribe now to work on your il senior freeze exemption application form. Income verification the amounts written on each line must include your income tax year 2018 income and. Web the senior freeze exemption allows qualified senior citizens to apply for a freeze of the equalized assessed value (eav) of their properties for the year preceding. Web those who are currently receiving the senior freeze exemption will automatically receive a renewal application form in the mail, typically between january and april.