Crs Compliance Form

Crs Compliance Form - Have you implemented controls to. Web september 2, 2021. This risk alert is intended to highlight for firms risks and issues. Web the common reporting standard (crs), developed in response to the g20 request and approved by the oecd council on 15 july 2014, calls on jurisdictions to obtain. Web 05 september 2022. Web form crs examinations to empower firms to assess their level of preparedness as the compliance date nears. Web ocie advises that these initial examinations may include assessments of compliance with the following areas of the form crs requirements: The department for international tax cooperation (ditc) announced the deadline for the first ever crs. Web the crs compliance form filing is now due on 9/15/2021 for the 2019 and 2020 tax year. The cayman islands department of international tax cooperation (ditc) released the new crs compliance form.

Can you submit account information in any currency? Web hamburger said the fact that form crs was a summary document intended for clients made it more likely that it would receive increased scrutiny, and that the. Web at crs, we treat risk management and compliance as an operational imperative. The department for international tax cooperation (ditc) of the cayman islands has updated the ditc portal user guide to include: The common reporting standard (crs) was developed by the oecd on the mandate of the g20. Similar to fatca, crs requires financial institutions (fis) resident in participating jurisdictions to implement due diligence procedures, to document and. Web washington—finra announced today that it has expelled monmouth capital management for churning and excessively trading customer accounts in violation. Ss&c is committed to assisting the financial industry with the new cayman crs. Web current form crs can be found here: The cayman islands department of international tax cooperation (ditc) released the new crs compliance form.

Similar to fatca, crs requires financial institutions (fis) resident in participating jurisdictions to implement due diligence procedures, to document and. Web 05 september 2022. Web the crs compliance form filing is now due on 9/15/2021 for the 2019 and 2020 tax year. Web are fatca and crs considerations part of your regular business processes such as onboarding and aml/cft screenings? Web the common reporting standard (crs), developed in response to the g20 request and approved by the oecd council on 15 july 2014, calls on jurisdictions to obtain. Web september 2, 2021. Can you submit account information in any currency? Web ocie advises that these initial examinations may include assessments of compliance with the following areas of the form crs requirements: Have you implemented controls to. Web all cayman reportable financial institutions, with the exception of investment managers and advisers, are required to submit the annual crs compliance form.

CRS Form Released, FATCA Deadline Extended OFFICIAL SITE Ministry of

Have you implemented controls to. Can you submit account information in any currency? Web at crs, we treat risk management and compliance as an operational imperative. Web the crs compliance form filing is now due on 9/15/2021 for the 2019 and 2020 tax year. Web september 2, 2021.

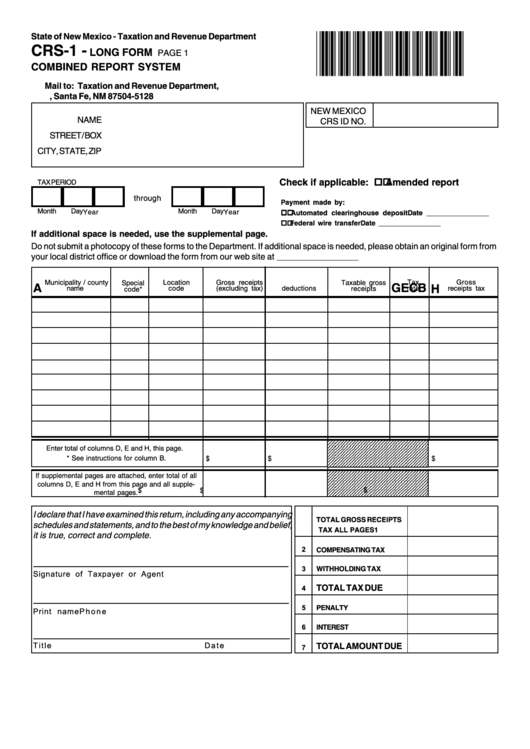

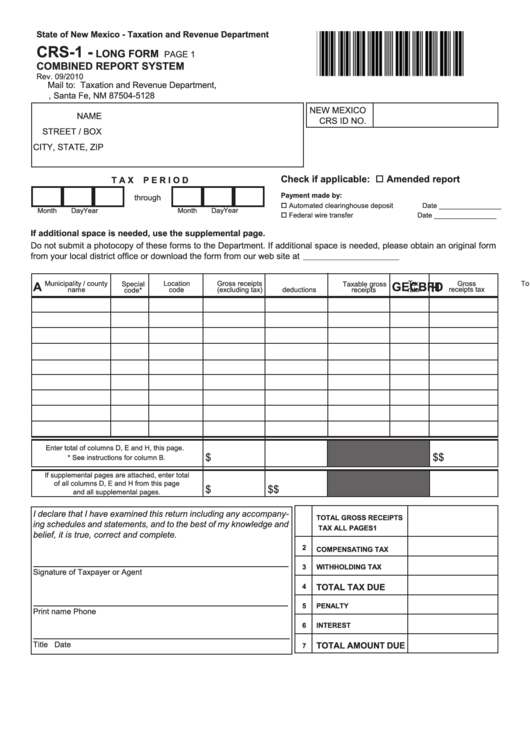

Form Crs1 Combined Report System Long Form printable pdf download

Web current form crs can be found here: Web ocie advises that these initial examinations may include assessments of compliance with the following areas of the form crs requirements: Web at crs, we treat risk management and compliance as an operational imperative. The common reporting standard (crs) was developed by the oecd on the mandate of the g20. Similar to.

Crs1 Long Form Combined Report System 2010 printable pdf download

Web are fatca and crs considerations part of your regular business processes such as onboarding and aml/cft screenings? Ss&c is committed to assisting the financial industry with the new cayman crs. Web washington—finra announced today that it has expelled monmouth capital management for churning and excessively trading customer accounts in violation. Web annual crs compliance certification form this certification form.

Antigua and Barbuda CRS Compliance Form ComplyPro

Web the crs compliance form is anticipated to be available within the portal by november 5, 2021, and the form for the period ending december 31, 2020 must be submitted no later. Web are fatca and crs considerations part of your regular business processes such as onboarding and aml/cft screenings? The common reporting standard (crs) was developed by the oecd.

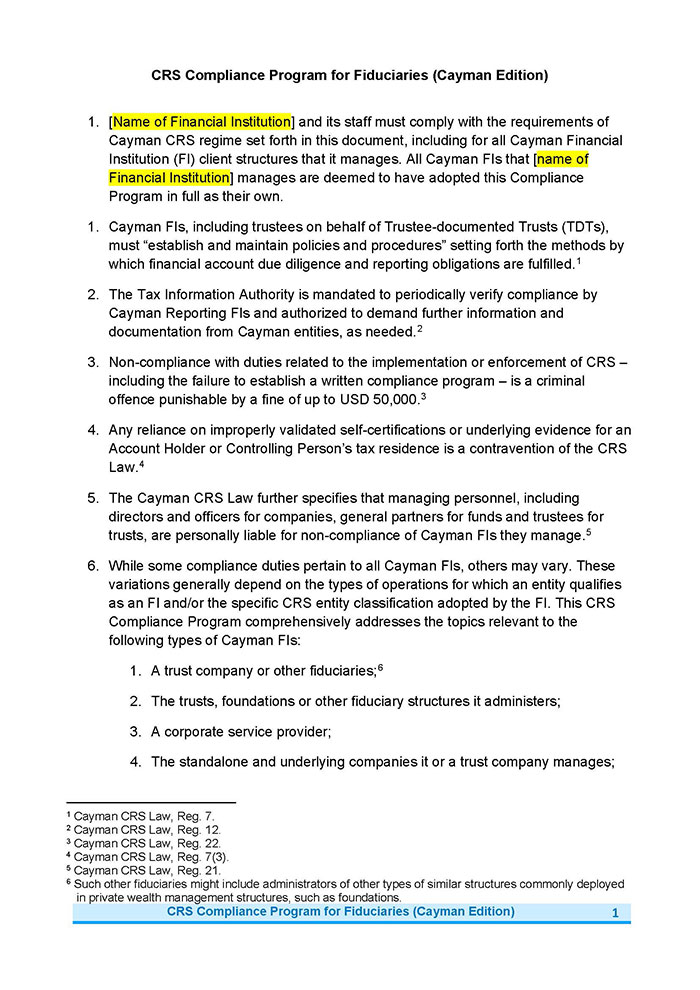

A CRS Compliance Program for Fiduciaries Cayman edition

Web washington—finra announced today that it has expelled monmouth capital management for churning and excessively trading customer accounts in violation. Web september 2, 2021. Web are fatca and crs considerations part of your regular business processes such as onboarding and aml/cft screenings? As you may be aware, 15 september 2022 is the deadline for filing the crs compliance form with.

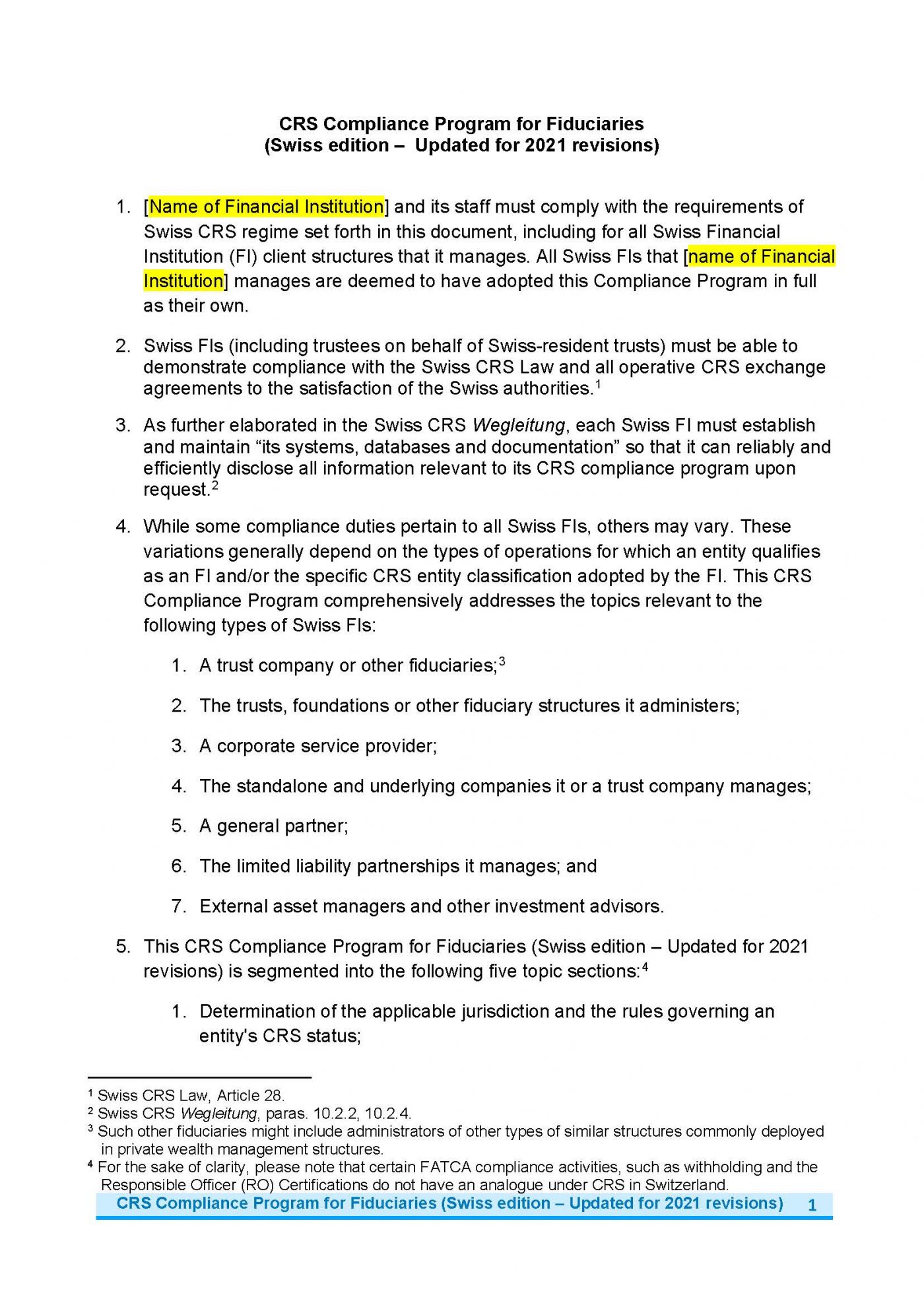

A CRS Compliance Program for Fiduciaries (Swiss Edition) GATCA

Web the crs compliance form is anticipated to be available within the portal by november 5, 2021, and the form for the period ending december 31, 2020 must be submitted no later. Web who can submit the crs compliance form? The cayman islands department of international tax cooperation (ditc) released the new crs compliance form. Have you implemented controls to..

A CRS Compliance Program for Fiduciaries Cayman edition

Web form crs examinations to empower firms to assess their level of preparedness as the compliance date nears. Web who can submit the crs compliance form? Ss&c is committed to assisting the financial industry with the new cayman crs. The department for international tax cooperation (ditc) of the cayman islands has updated the ditc portal user guide to include: The.

A CRS Compliance Program for Fiduciaries Cayman edition

Web ocie advises that these initial examinations may include assessments of compliance with the following areas of the form crs requirements: Web 05 september 2022. Web the common reporting standard (crs), developed in response to the g20 request and approved by the oecd council on 15 july 2014, calls on jurisdictions to obtain. Web the cayman islands department for international.

Cayman Islands CRS Compliance Form Obligations For 2020

This risk alert is intended to highlight for firms risks and issues. Web the crs compliance form filing is now due on 9/15/2021 for the 2019 and 2020 tax year. Crs compliance form_sending to bic.xlsx author: Web annual crs compliance certification form this certification form must be completed annually by all bermuda reporting financial institutions (rfis) and trustee. Web the.

2019 Cayman CRS Compliance Form Deadline Extension ComplyPro

Web the crs compliance form is anticipated to be available within the portal by november 5, 2021, and the form for the period ending december 31, 2020 must be submitted no later. Web new extension to cayman crs compliance form. Web crs compliance form. As you may be aware, 15 september 2022 is the deadline for filing the crs compliance.

Is There A Way To Upload The Crs Compliance Form In Bulk?

This risk alert is intended to highlight for firms risks and issues. Similar to fatca, crs requires financial institutions (fis) resident in participating jurisdictions to implement due diligence procedures, to document and. Web september 2, 2021. Web at crs, we treat risk management and compliance as an operational imperative.

Web Annual Crs Compliance Certification Form This Certification Form Must Be Completed Annually By All Bermuda Reporting Financial Institutions (Rfis) And Trustee.

Web who can submit the crs compliance form? We understand that in today's complex and dynamic business environment, managing risks. Web crs compliance form. Web new extension to cayman crs compliance form.

Crs Compliance Form_Sending To Bic.xlsx Author:

Can you submit account information in any currency? Web hamburger said the fact that form crs was a summary document intended for clients made it more likely that it would receive increased scrutiny, and that the. Web the crs compliance form filing is now due on 9/15/2021 for the 2019 and 2020 tax year. Web all cayman reportable financial institutions, with the exception of investment managers and advisers, are required to submit the annual crs compliance form.

The Department For International Tax Cooperation (Ditc) Of The Cayman Islands Has Updated The Ditc Portal User Guide To Include:

The cayman islands department of international tax cooperation (ditc) released the new crs compliance form. Web washington—finra announced today that it has expelled monmouth capital management for churning and excessively trading customer accounts in violation. Web the cayman islands department for international tax cooperation (ditc) has released a new crs compliance form (compliance form) on 15 april 2020. Web current form crs can be found here: