Cuyahoga County Homestead Exemption Form

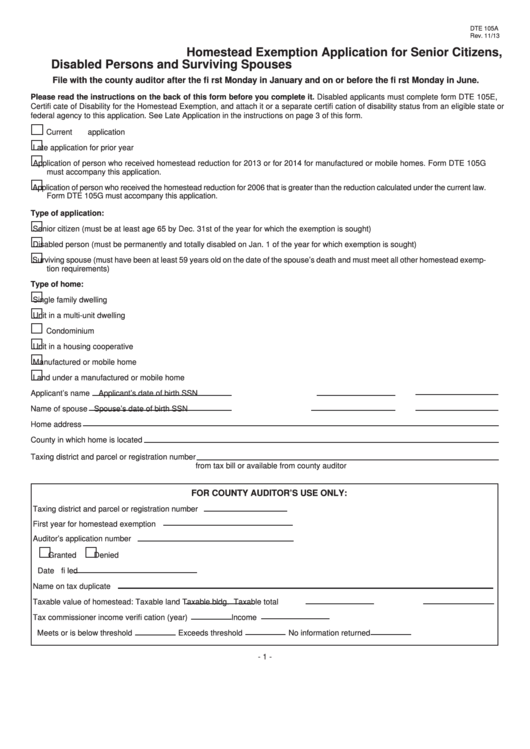

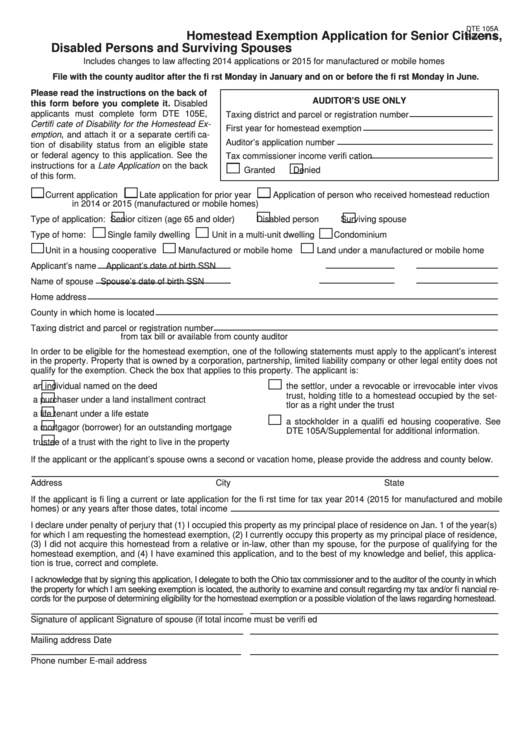

Cuyahoga County Homestead Exemption Form - Web __ y) from a county land reutilization corporation organized under r.c. To get an application form, or if you need help or have questions, call your county. Web posted may 18, 2022 12:00 pm by kristen nawrocki ohio’s homestead exemption shelters the primary $25,000 of your home’s value from corporate. Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then file it with. Owned by a corporation, partnership,. Web property exemption form exemption from residential rental registration owner name: House bill 17 became effective, allowing a homestead exemption for a surviving spouse of a public service officer killed in the line of duty. 6.has the granter indicated that this property is entitled to receive the senior. View the services, forms, and resources available from the cuyahoga county fiscal officer. Web you can apply to the homestead program if you are 65 years of age or older or have a disability has defined by the program.

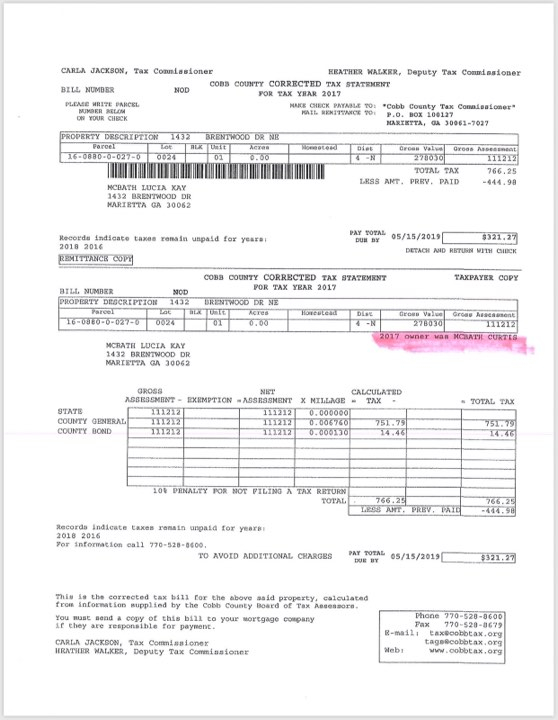

Web the exemption, which takes the form of a credit on property tax bills, allows qualifying homeowners to exempt $25,000 of the market value of their home from all. Maintains records of property ownership, valuation, and taxation. Web the real property department: You must own and live at the address where you. Web property exemption form exemption from residential rental registration owner name: This program offers you a property tax exemption to help you lower the amount of property tax you pay. Web posted may 18, 2022 12:00 pm by kristen nawrocki ohio’s homestead exemption shelters the primary $25,000 of your home’s value from corporate. Web fill out application form dte105a.you can get the form at your county auditor’s office or at your county auditor’s website. Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then file it with. House bill 17 became effective, allowing a homestead exemption for a surviving spouse of a public service officer killed in the line of duty.

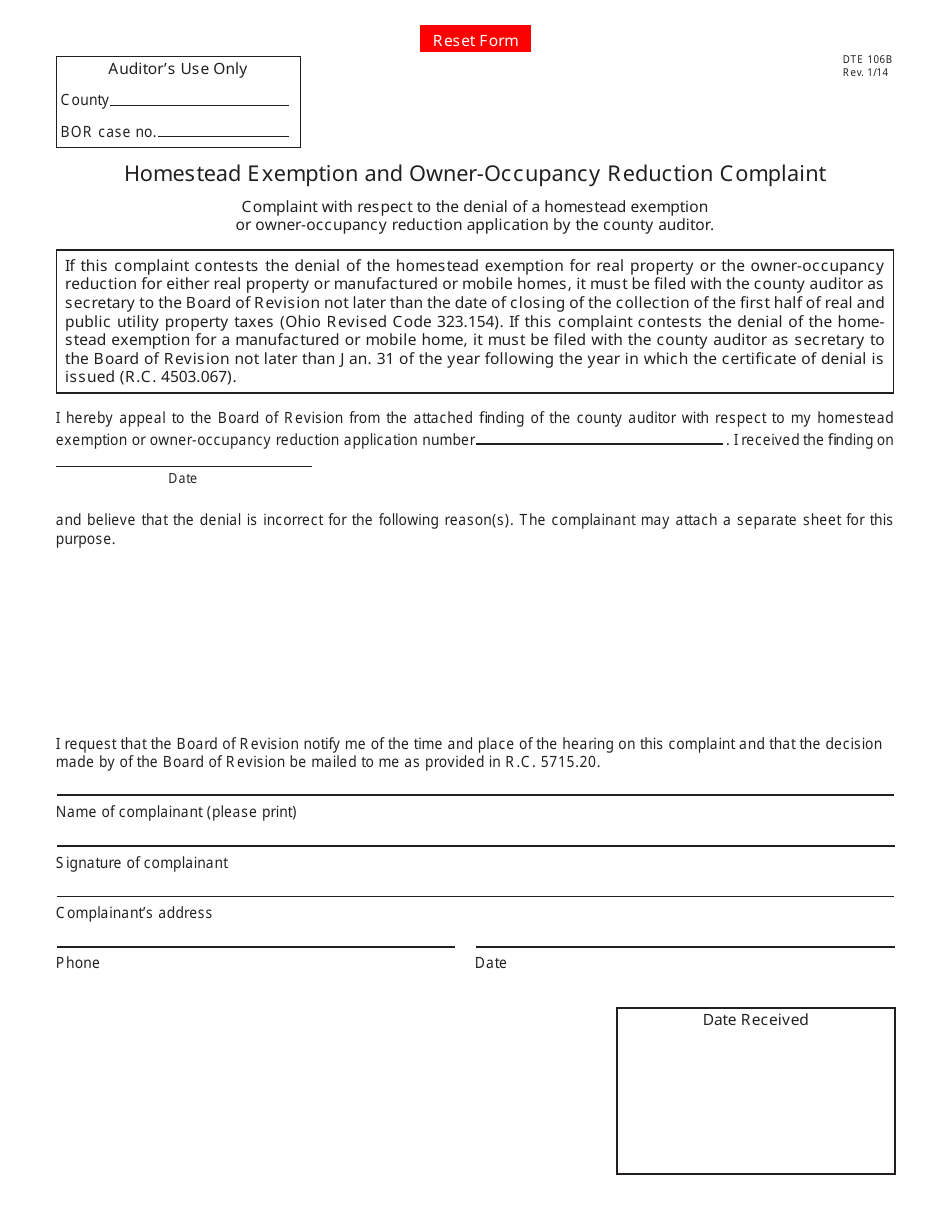

Web you can apply to the homestead program if you are 65 years of age or older or have a disability has defined by the program. Web the grantor of the manufactured or mobile home referred to above states that the home received the senior citizen, disabled persons or surviving spouse homestead exemption. To get an application form, or if you need help or have questions, call your county. Web find out what we can do for you. Preserves a complete historical record of all property transactions. Web we last updated the homestead exemption application for senior citizens, disabled persons and surviving spouses in february 2023, so this is the latest version of form. Web the real property department: Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then file it with. Web __ y) from a county land reutilization corporation organized under r.c. Web senior citizens, permanently disabled, and surviving spouses of public service officers killed in the line of duty may be eligible to receive homestead exemption which is a reduction.

Fillable Form Dte 105a Homestead Exemption Application For Senior

Preserves a complete historical record of all property transactions. Web property exemption form exemption from residential rental registration owner name: House bill 17 became effective, allowing a homestead exemption for a surviving spouse of a public service officer killed in the line of duty. Web you can apply to the homestead program if you are 65 years of age or.

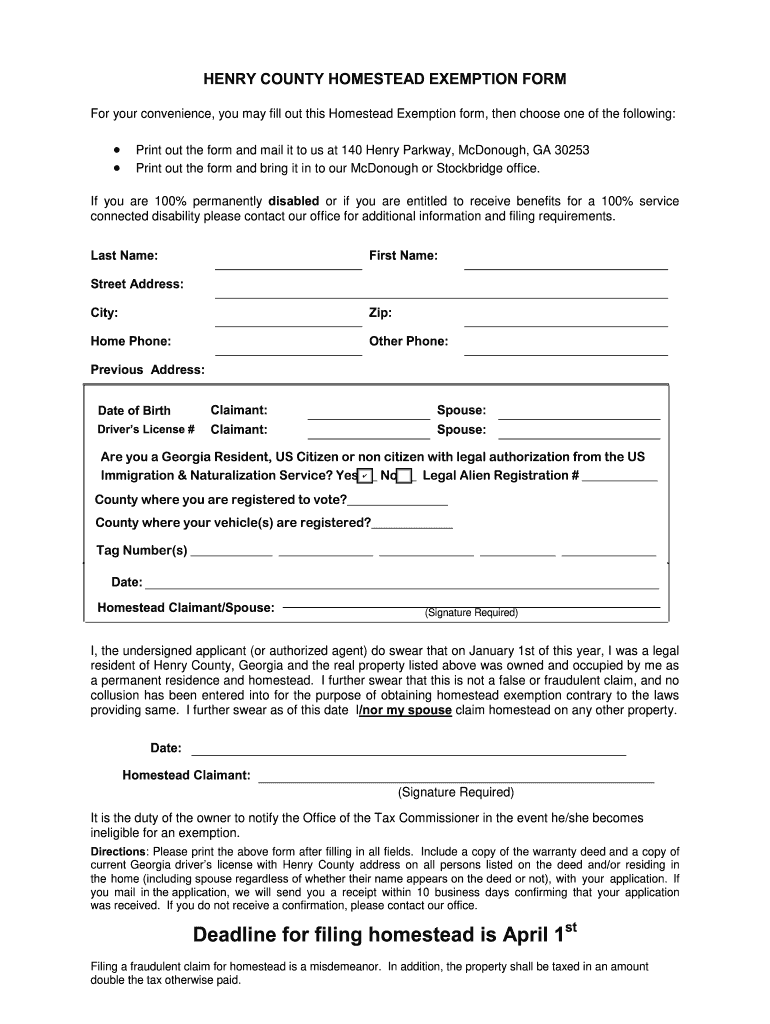

How To Apply For Homestead Exemption In Dekalb County Ga PRORFETY

Web we last updated the homestead exemption application for senior citizens, disabled persons and surviving spouses in february 2023, so this is the latest version of form. This program offers you a property tax exemption to help you lower the amount of property tax you pay. Web ohio revised code section 323.151: Web in order to be eligible for the.

How To Apply For Homestead Tax Credit In Ohio PRORFETY

You must own and live at the address where you. Section 1724 to a third party. This program offers you a property tax exemption to help you lower the amount of property tax you pay. Owned by a corporation, partnership,. 6.has the granter indicated that this property is entitled to receive the senior.

Riverside County Homestead Exemption Form

Owned by a corporation, partnership,. House bill 17 became effective, allowing a homestead exemption for a surviving spouse of a public service officer killed in the line of duty. Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then file it with. Web __ y) from a county.

Harris County Homestead Exemption Form

House bill 17 became effective, allowing a homestead exemption for a surviving spouse of a public service officer killed in the line of duty. View the services, forms, and resources available from the cuyahoga county fiscal officer. Web the grantor of the manufactured or mobile home referred to above states that the home received the senior citizen, disabled persons or.

Free Washington State Homestead Exemption Form

Web senior citizens, permanently disabled, and surviving spouses of public service officers killed in the line of duty may be eligible to receive homestead exemption which is a reduction. Web property exemption form exemption from residential rental registration owner name: Web posted may 18, 2022 12:00 pm by kristen nawrocki ohio’s homestead exemption shelters the primary $25,000 of your home’s.

Form Residence Homestead Exemption Application Fill Out and Sign

Web posted may 18, 2022 12:00 pm by kristen nawrocki ohio’s homestead exemption shelters the primary $25,000 of your home’s value from corporate. File form dte105a with your county. Web you can apply to the homestead program if you are 65 years of age or older or have a disability has defined by the program. Maintains records of property ownership,.

2022 Update Houston Homestead Home Exemptions StepByStep Guide

Section 1724 to a third party. Web the grantor of the manufactured or mobile home referred to above states that the home received the senior citizen, disabled persons or surviving spouse homestead exemption. Web ohio revised code section 323.151: Maintains records of property ownership, valuation, and taxation. Preserves a complete historical record of all property transactions.

Bibb County Homestead Exemption Form

Web we last updated the homestead exemption application for senior citizens, disabled persons and surviving spouses in february 2023, so this is the latest version of form. File form dte105a with your county. Web property exemption form exemption from residential rental registration owner name: Preserves a complete historical record of all property transactions. You must own and live at the.

Cuyahoga County Homestead Exemption Form

10/19 senior citizens, disabled persons and surviving spouses in order to qualify an applicant for the homestead reduction, your county auditor is required to. You can get an exemption of your home's. This program offers you a property tax exemption to help you lower the amount of property tax you pay. Web the real property department: Web we last updated.

File Form Dte105A With Your County.

View the services, forms, and resources available from the cuyahoga county fiscal officer. Section 1724 to a third party. 6.has the granter indicated that this property is entitled to receive the senior. Web posted may 18, 2022 12:00 pm by kristen nawrocki ohio’s homestead exemption shelters the primary $25,000 of your home’s value from corporate.

Web We Last Updated The Homestead Exemption Application For Senior Citizens, Disabled Persons And Surviving Spouses In February 2023, So This Is The Latest Version Of Form.

Web the real property department: To get an application form, or if you need help or have questions, call your county. Owned by a corporation, partnership,. Web ohio revised code section 323.151:

Web The Grantor Of The Manufactured Or Mobile Home Referred To Above States That The Home Received The Senior Citizen, Disabled Persons Or Surviving Spouse Homestead Exemption.

You can get an exemption of your home's. Maintains records of property ownership, valuation, and taxation. This program offers you a property tax exemption to help you lower the amount of property tax you pay. Web property exemption form exemption from residential rental registration owner name:

Web Senior Citizens, Permanently Disabled, And Surviving Spouses Of Public Service Officers Killed In The Line Of Duty May Be Eligible To Receive Homestead Exemption Which Is A Reduction.

10/19 senior citizens, disabled persons and surviving spouses in order to qualify an applicant for the homestead reduction, your county auditor is required to. Web in order to be eligible for the enhanced disabled veteran homestead exemption, the form of ownership must be identified. Web you can apply to the homestead program if you are 65 years of age or older or have a disability has defined by the program. You must own and live at the address where you.