Daily Compound Interest Calculator Excel Template

Daily Compound Interest Calculator Excel Template - P = the principal (starting) amount; Web by svetlana cheusheva, updated on march 22, 2023 the tutorial explains the compound interest formula for excel and provides examples of how to calculate the future value of the investment at annual, monthly or daily compounding interest rate. P = initial principal k = annual interest rate paid m = number of times per period (typically months) the interest is compounded n = number of periods (typically years) or term of the loan examples F = the future accumulated value; You can see how the future value changes as you give different values to the below factors. Web daily compound interest formula in excel. A = p (1 + r/n)nt. N is the number of times compounding occurs per year. P is the principal or the initial investment. Here, n = number of periods.

The rate argument is 5% divided by the 12 months in a year. T is the total time (in years) in. P' is the gross amount (after the interest is applied). Web =p+ (p*effect (effect (k,m)*n,n)) the general equation to calculate compound interest is as follows =p* (1+ (k/m))^ (m*n) where the following is true: Before we discuss the daily compound interest calculator in excel, we should know the basic compound interest formula. Web how to calculate daily compound interest in excel. We can use the following formula to find the ending value of some investment after a certain amount of time: Web by svetlana cheusheva, updated on march 22, 2023 the tutorial explains the compound interest formula for excel and provides examples of how to calculate the future value of the investment at annual, monthly or daily compounding interest rate. Current balance = present amount * (1 + interest rate)^n. Here, n = number of periods.

A = p (1 + r/n)nt. We can use the following formula to find the ending value of some investment after a certain amount of time: P is the principal or the initial investment. This example assumes that $1000 is invested for 10 years at an annual interest rate of 5%, compounded monthly. Current balance = present amount * (1 + interest rate)^n. P' is the gross amount (after the interest is applied). The interest rate the compounding period the time period of the investment value F = the future accumulated value; You will also find the detailed steps to create your own excel compound interest calculator. Web p ’ =p (1+r/n)^nt here:

Bank Loan Interest Calculator Excel LOANCROT

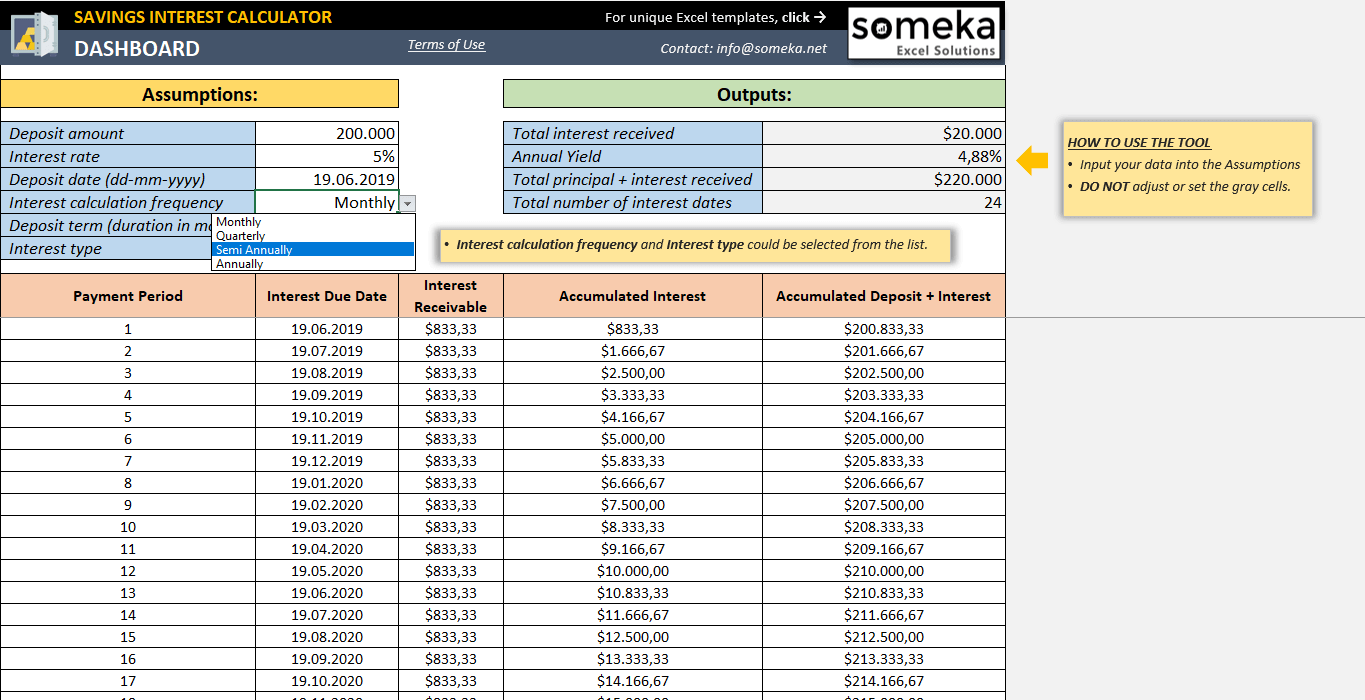

Here, n = number of periods. P = the principal (starting) amount; Additionally, the template also provides a schedule of payments and accumulated interests in each period. You can see how the future value changes as you give different values to the below factors. N is the number of times compounding occurs per year.

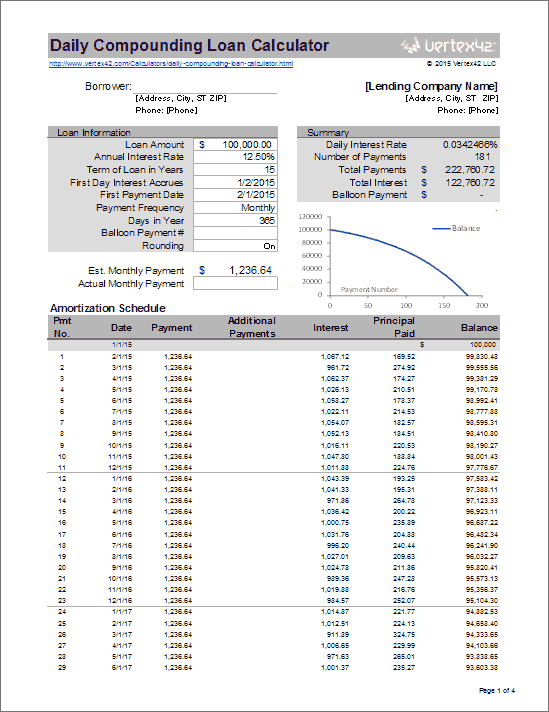

Daily Compounding Loan Calculator

Web =p+ (p*effect (effect (k,m)*n,n)) the general equation to calculate compound interest is as follows =p* (1+ (k/m))^ (m*n) where the following is true: Additionally, the template also provides a schedule of payments and accumulated interests in each period. Click here to download the compound interest calculator excel template. F = the future accumulated value; Web by svetlana cheusheva, updated.

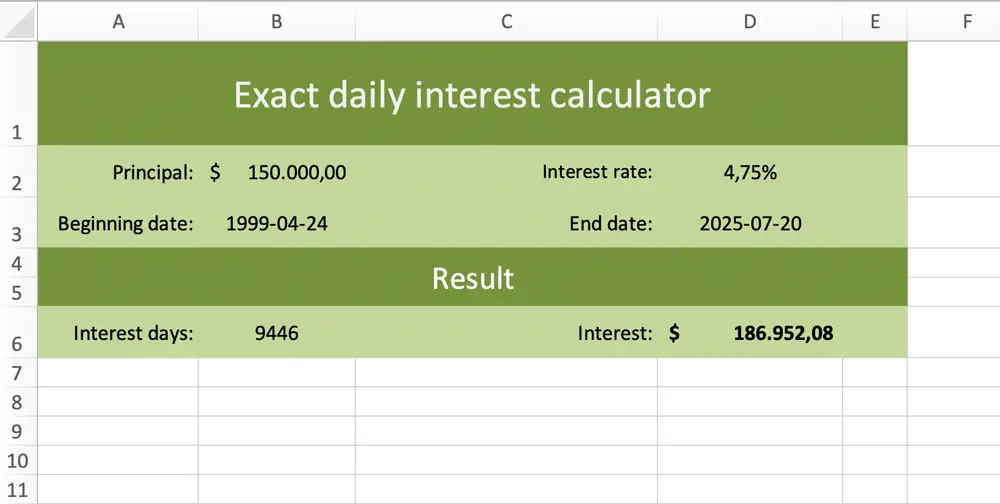

Exact interest calculator as a free Excel template

You will also find the detailed steps to create your own excel compound interest calculator. Using the function pmt(rate,nper,pv) =pmt(5%/12,30*12,180000) the result is a monthly payment (not including insurance and taxes) of $966.28. The interest rate the compounding period the time period of the investment value P = initial principal k = annual interest rate paid m = number of.

Daily Compounding Loan Calculator

Web p ’ =p (1+r/n)^nt here: We can use the following formula to find the ending value of some investment after a certain amount of time: P' is the gross amount (after the interest is applied). Web daily compound interest formula in excel. Web by svetlana cheusheva, updated on march 22, 2023 the tutorial explains the compound interest formula for.

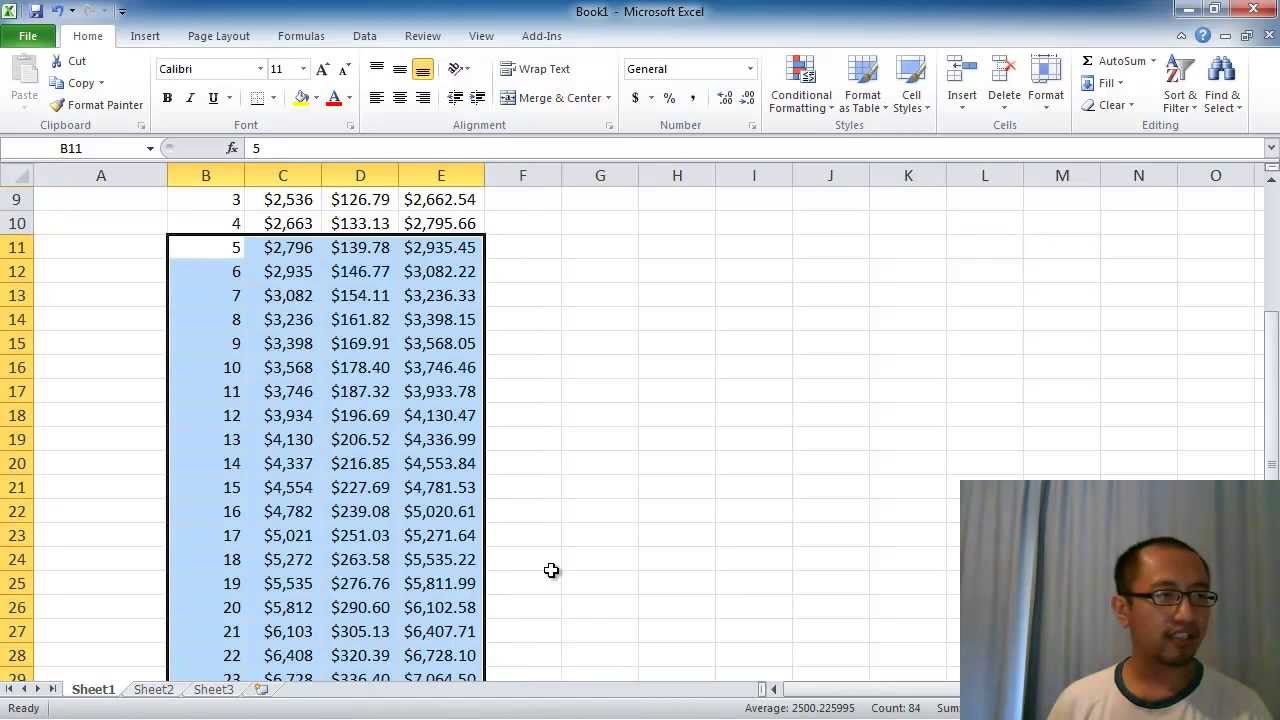

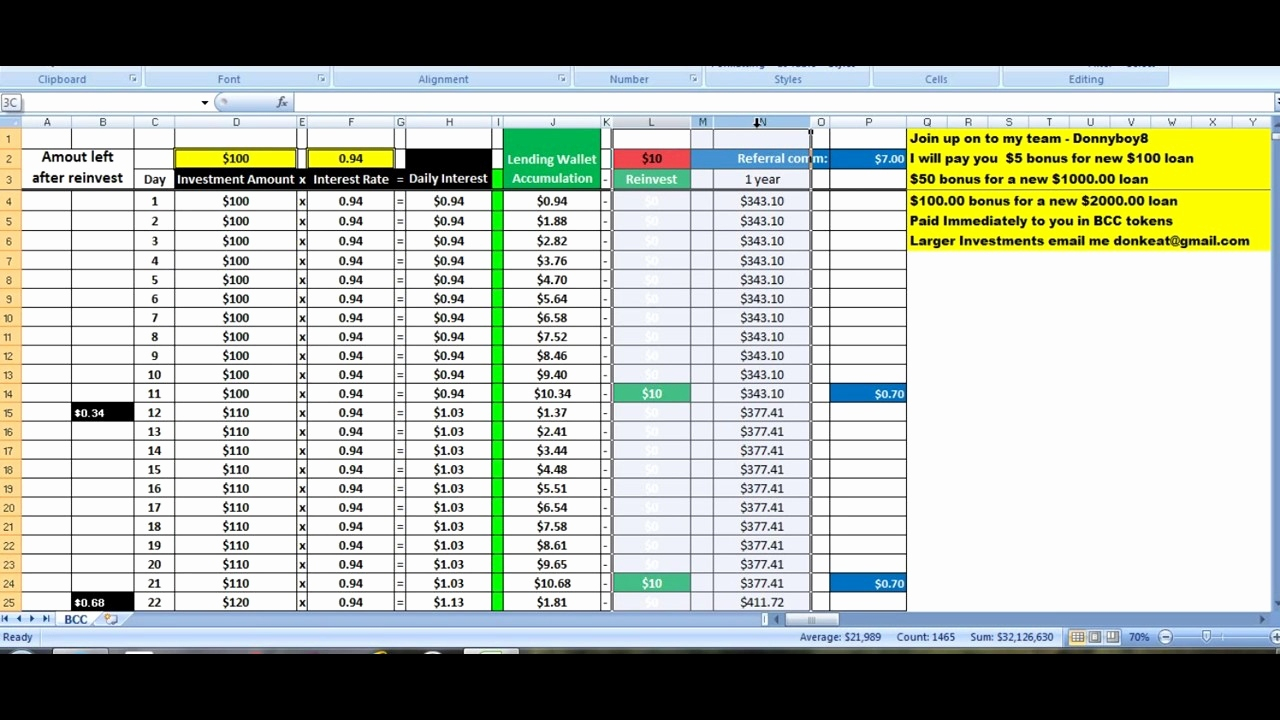

Forex Compound Interest Spreadsheet —

Web =p+ (p*effect (effect (k,m)*n,n)) the general equation to calculate compound interest is as follows =p* (1+ (k/m))^ (m*n) where the following is true: This example assumes that $1000 is invested for 10 years at an annual interest rate of 5%, compounded monthly. We can use the following formula to find the ending value of some investment after a certain.

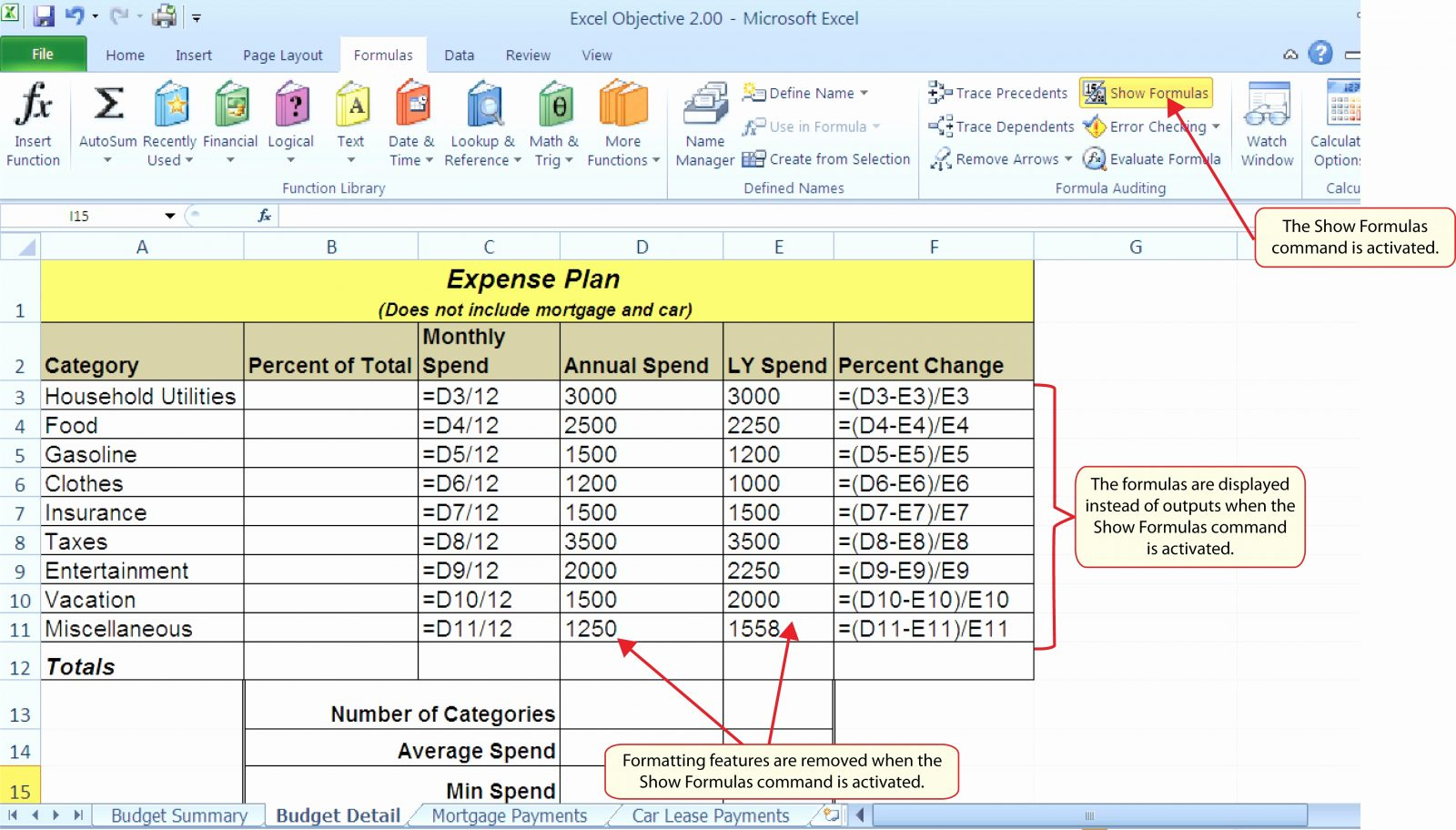

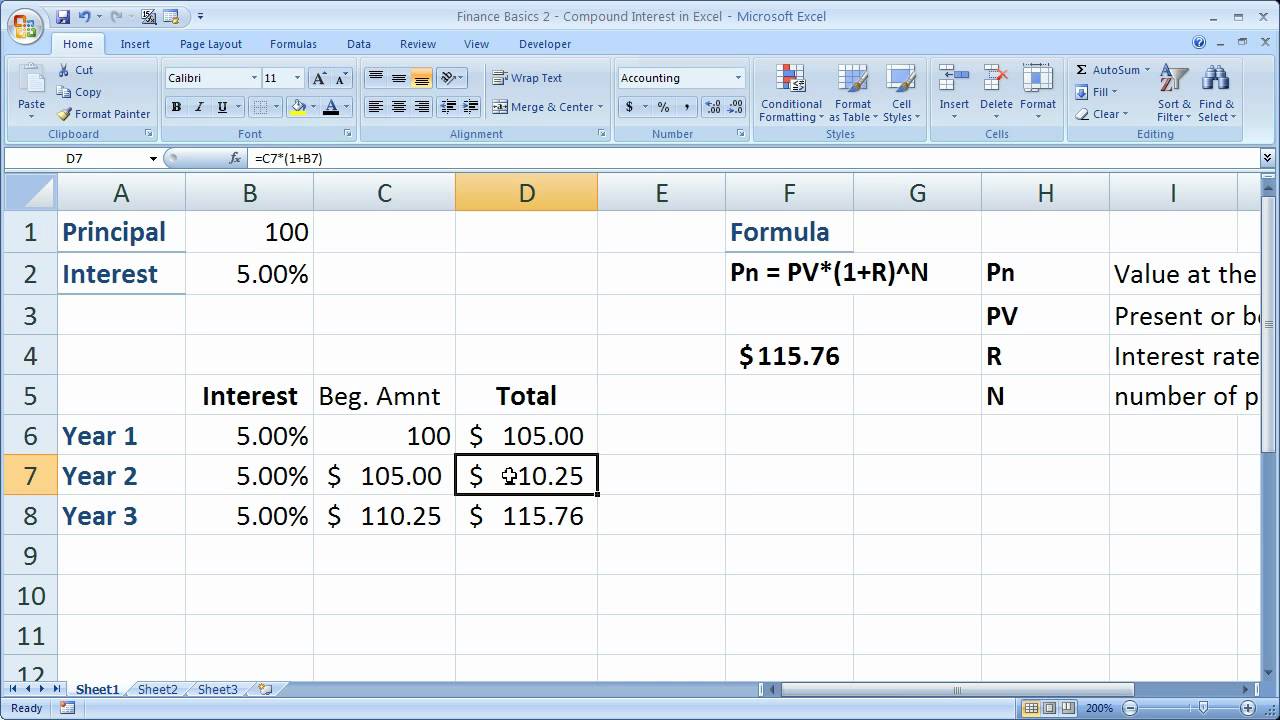

Microsoft Excel lesson 2 compound interest calculator (absolute

This example assumes that $1000 is invested for 10 years at an annual interest rate of 5%, compounded monthly. Web you can use the excel template provided above as your compound interest calculator. Web how to calculate daily compound interest in excel. Here, n = number of periods. Click here to download the compound interest calculator excel template.

Compound Interest Spreadsheet Google Spreadshee compound interest

Rate = the interest rate per compounding period Web you can use the excel template provided above as your compound interest calculator. P = initial principal k = annual interest rate paid m = number of times per period (typically months) the interest is compounded n = number of periods (typically years) or term of the loan examples This example.

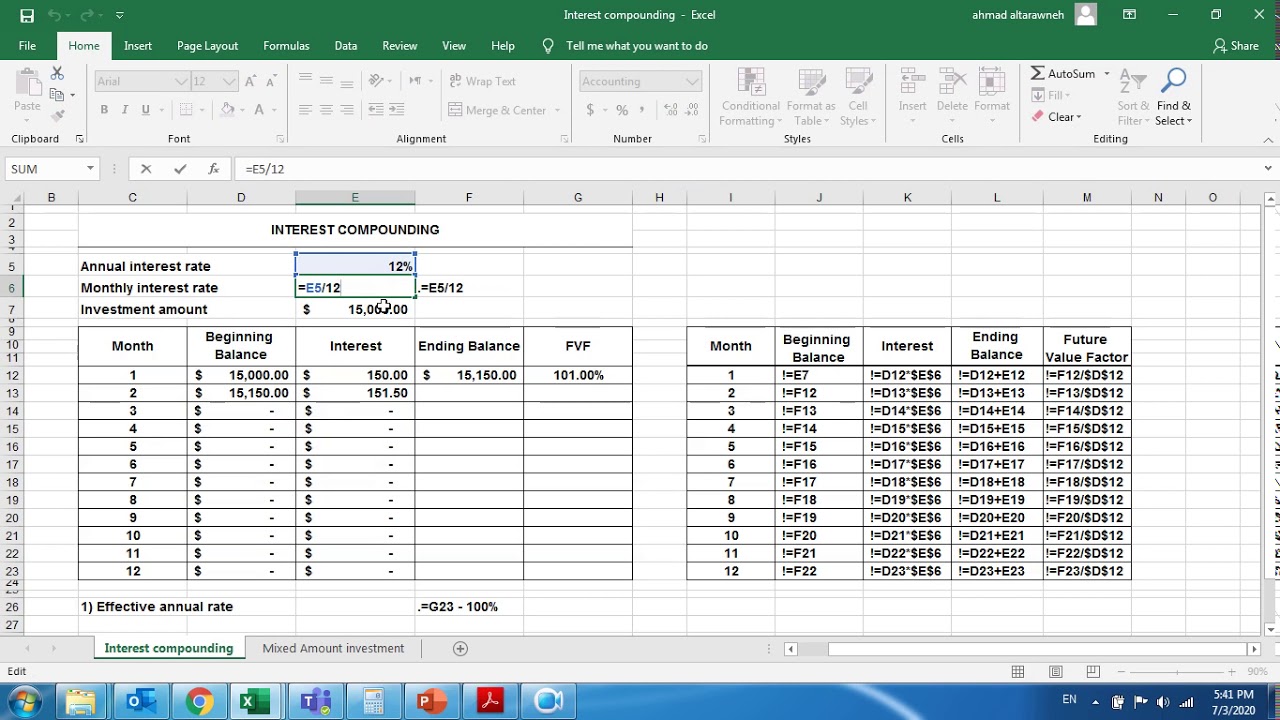

Interest compounding By using Microsoft Excel YouTube

Web just enter a few data and the template will calculate the compound interest for a particular investment. N is the number of times compounding occurs per year. In the example shown, the formula in c10 is: You will also find the detailed steps to create your own excel compound interest calculator. Web how to calculate daily compound interest in.

Top Annual Interest Rate Formula Excel Tips Formulas

Web to calculate compound interest in excel, you can use the fv function. Web you can use the excel template provided above as your compound interest calculator. P' is the gross amount (after the interest is applied). F = the future accumulated value; The interest rate the compounding period the time period of the investment value

Savings Calculator Excel Template Savings Account Interest Calculation

Web to calculate compound interest in excel, you can use the fv function. Web p ’ =p (1+r/n)^nt here: The interest rate the compounding period the time period of the investment value Here, n = number of periods. Web daily compound interest formula in excel.

Web =P+ (P*Effect (Effect (K,M)*N,N)) The General Equation To Calculate Compound Interest Is As Follows =P* (1+ (K/M))^ (M*N) Where The Following Is True:

P' is the gross amount (after the interest is applied). Before we discuss the daily compound interest calculator in excel, we should know the basic compound interest formula. You can see how the future value changes as you give different values to the below factors. T is the total time (in years) in.

The Rate Argument Is 5% Divided By The 12 Months In A Year.

This example assumes that $1000 is invested for 10 years at an annual interest rate of 5%, compounded monthly. Web you can use the excel template provided above as your compound interest calculator. N is the number of times compounding occurs per year. P is the principal or the initial investment.

The Interest Rate The Compounding Period The Time Period Of The Investment Value

The basic compound interest formula for calculating a future value is f = p*(1+rate)^nper where. The basic compound interest formula is shown below: P = initial principal k = annual interest rate paid m = number of times per period (typically months) the interest is compounded n = number of periods (typically years) or term of the loan examples P = the principal (starting) amount;

Web By Svetlana Cheusheva, Updated On March 22, 2023 The Tutorial Explains The Compound Interest Formula For Excel And Provides Examples Of How To Calculate The Future Value Of The Investment At Annual, Monthly Or Daily Compounding Interest Rate.

Web just enter a few data and the template will calculate the compound interest for a particular investment. Current balance = present amount * (1 + interest rate)^n. In the example shown, the formula in c10 is: Using the function pmt(rate,nper,pv) =pmt(5%/12,30*12,180000) the result is a monthly payment (not including insurance and taxes) of $966.28.