Dave Ramsey Snowball Template

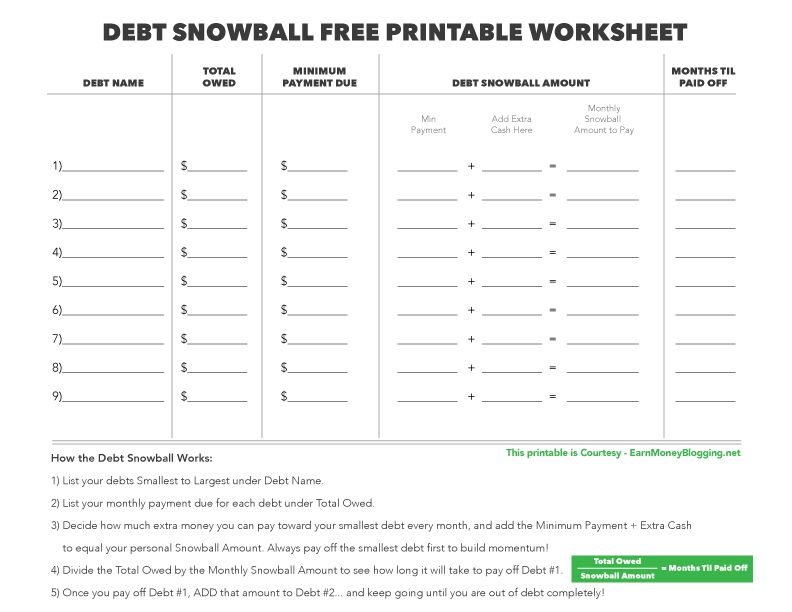

Dave Ramsey Snowball Template - The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. Not only does the debt snowball help you get rid of debt fast, it’s also designed to help you change your behavior with money—so you never go into debt again. With the debt snowball method, you pay off your debt from the smallest balance to the lowest balance. Web start fpu now what is the debt snowball? Web use a debt snowball worksheet printable 0 template to make your document workflow more streamlined. Getting rid of your student loans guide. The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates. Here are the basic steps if the debt snowball method. The debt snowball method is the best way to get out of debt. These worksheets ensure that it’s easy to clear off your debt promptly and visibly see the progress you’re making.

Knock out the smallest debt first. Not only does the debt snowball help you get rid of debt fast, it’s also designed to help you change your behavior with money—so you never go into debt again. To get things rolling, you can easily use dave ramsey’s debt snowball form to create and track your debt payoff progress. The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. Getting rid of your student loans guide. Download major components of a healthy financial plan Then, take what you were paying on that debt and add it to the payment of your next smallest debt. The debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. Dave ramsey debt snowball form. Show details how it works open the debt snowball worksheet pdf and follow the instructions easily sign the dave ramsey snowball pdf with your finger send filled & signed debt snowball spreadsheet pdf or save

These worksheets ensure that it’s easy to clear off your debt promptly and visibly see the progress you’re making. The debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. Getting rid of your student loans guide. Then, take what you were paying on that debt and add it to the payment of your next smallest debt. The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. Here are the basic steps if the debt snowball method. Knock out the smallest debt first. Web let’s discuss the different templates to use. Web use a debt snowball worksheet printable 0 template to make your document workflow more streamlined. Web what is the debt snowball?

Download Dave Ramsey Debt Snowball Gantt Chart Excel Template

Getting rid of your student loans guide. Web start fpu now what is the debt snowball? To get things rolling, you can easily use dave ramsey’s debt snowball form to create and track your debt payoff progress. Dave ramsey debt snowball form. These worksheets ensure that it’s easy to clear off your debt promptly and visibly see the progress you’re.

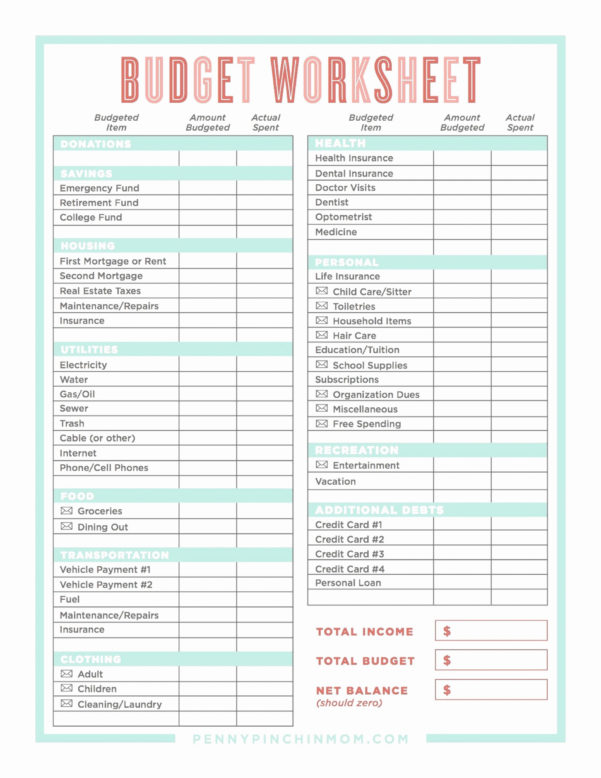

Ramsey Snowball Spreadsheet in Dave Ramsey Budget Form Pdf New

Web what is the debt snowball method? Getting rid of your student loans guide. Web this form outlines dave's recommended percentages for each category, making it easier to set up your budget. Web the debt snowball is a methodology to pay off debt developed by david ramsey. Web let’s discuss the different templates to use.

20 Luxury Dave Ramsey Snowball Excel Spreadsheet

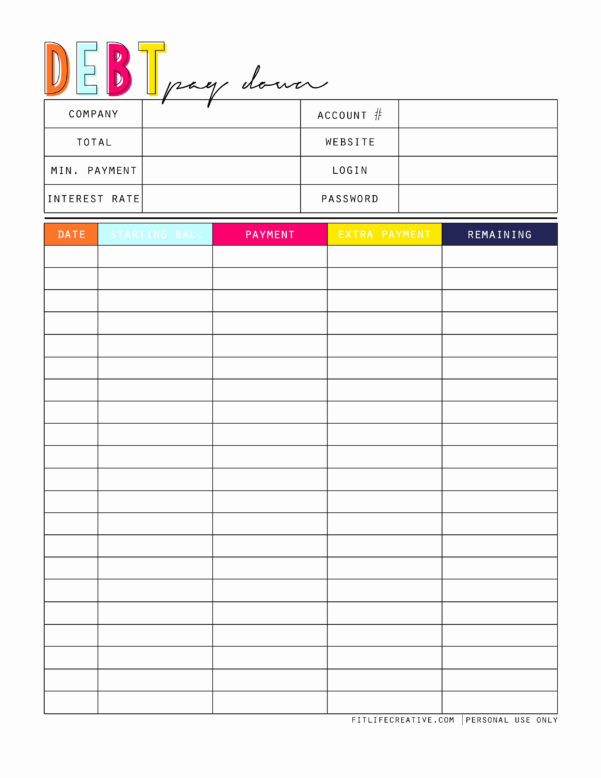

This is the exact debt snowball form that we used to get out debt in that short period of time. The debt snowball method is the best way to get out of debt. Web use a debt snowball worksheet printable 0 template to make your document workflow more streamlined. Document your debts and include their balances. The debt snowball is.

21 Awesome Dave Ramsey Snowball Worksheet Pdf

The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates. Web what is the debt snowball? Web what is the debt snowball method? Web start fpu now what is the debt snowball? To get things rolling, you can easily use dave ramsey’s debt snowball.

Dave Ramsey Debt Snowball Spreadsheet Spreadsheets

To get things rolling, you can easily use dave ramsey’s debt snowball form to create and track your debt payoff progress. Knock out the smallest debt first. Here are the basic steps if the debt snowball method. Web how to use the debt snowball method with free debt snowball worksheet. Show details how it works open the debt snowball worksheet.

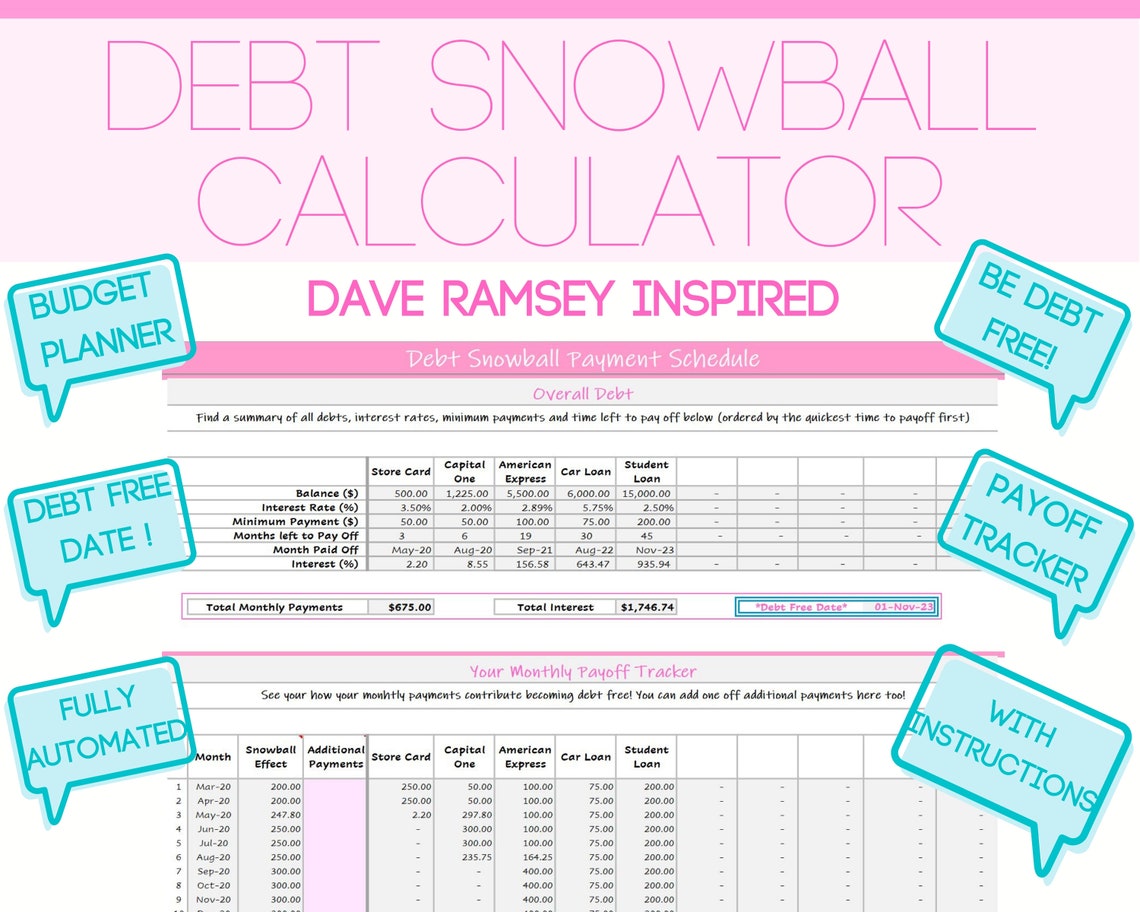

Dave Ramsey Debt Snowball Calculator Excel Budget Planner Etsy

Download major components of a healthy financial plan Web the debt snowball is a methodology to pay off debt developed by david ramsey. The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates. Show details how it works open the debt snowball worksheet pdf.

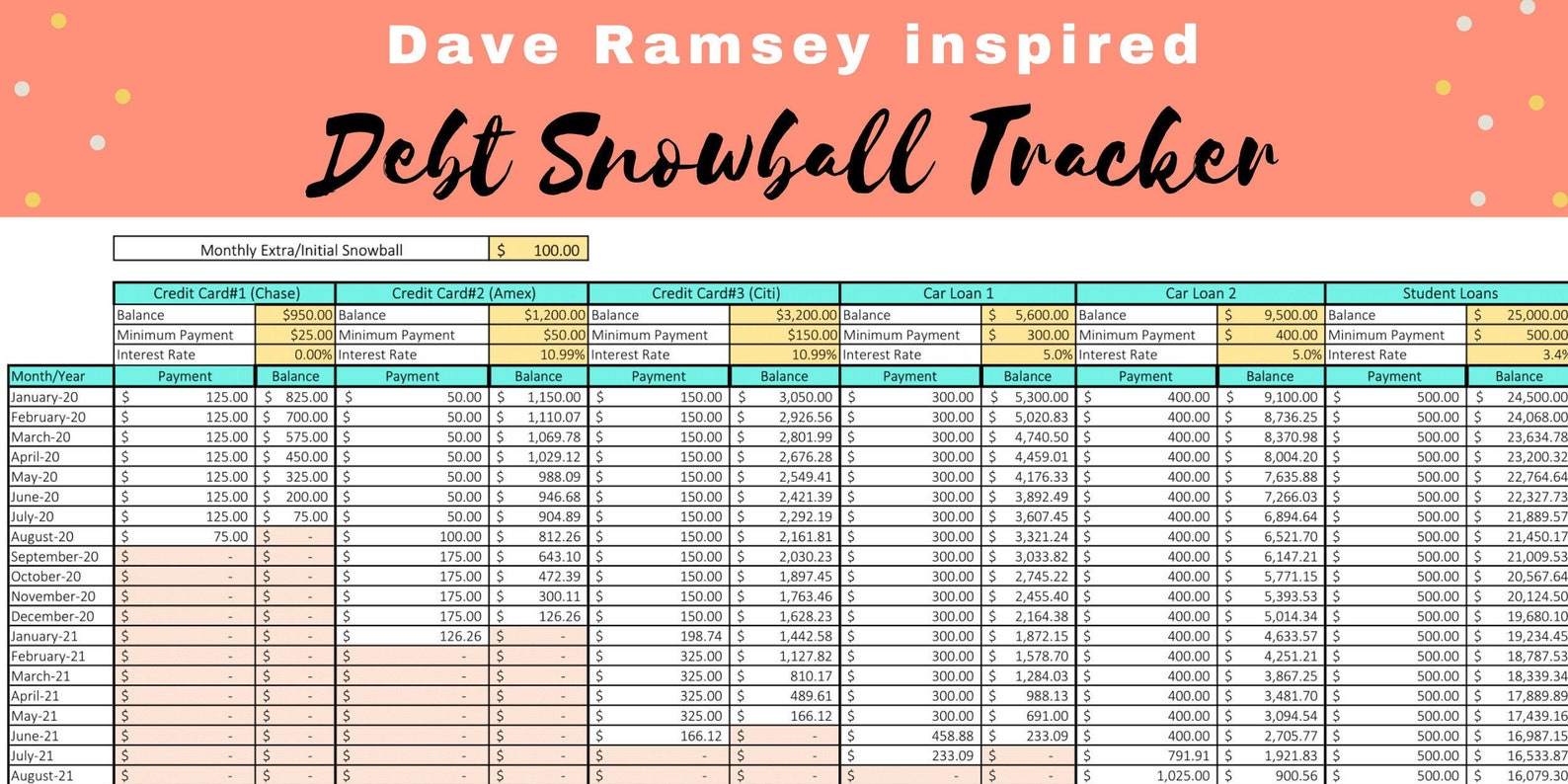

Ramsey Snowball Spreadsheet Spreadsheet Downloa dave ramsey snowball

The debt snowball method is the best way to get out of debt. The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates. Web how to use the debt snowball method with free debt snowball worksheet. Web what is the debt snowball? Web start.

Dave Ramsey Inspired Debt Snowball Spreadsheet Excel Etsy

Document your debts and include their balances. Web use a debt snowball worksheet printable 0 template to make your document workflow more streamlined. The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates. To get things rolling, you can easily use dave ramsey’s debt.

Dave Ramsey Snowball Worksheet Pdf Qualads

Document your debts and include their balances. Web start fpu now what is the debt snowball? Web use a debt snowball worksheet printable 0 template to make your document workflow more streamlined. This is the exact debt snowball form that we used to get out debt in that short period of time. These worksheets ensure that it’s easy to clear.

Dave Ramsey Snowball Sheet Printable room

Show details how it works open the debt snowball worksheet pdf and follow the instructions easily sign the dave ramsey snowball pdf with your finger send filled & signed debt snowball spreadsheet pdf or save Web what is the debt snowball method? Document your debts and include their balances. To get things rolling, you can easily use dave ramsey’s debt.

Getting Rid Of Your Student Loans Guide.

With the debt snowball method, you pay off your debt from the smallest balance to the lowest balance. This is the exact debt snowball form that we used to get out debt in that short period of time. Web how to use the debt snowball method with free debt snowball worksheet. Web let’s discuss the different templates to use.

Web Use A Debt Snowball Worksheet Printable 0 Template To Make Your Document Workflow More Streamlined.

Web what is the debt snowball method? Here are the basic steps if the debt snowball method. These worksheets ensure that it’s easy to clear off your debt promptly and visibly see the progress you’re making. Web what is the debt snowball?

Web The Debt Snowball Is A Methodology To Pay Off Debt Developed By David Ramsey.

The debt snowball method is the best way to get out of debt. Web start fpu now what is the debt snowball? The debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. Dave ramsey debt snowball form.

The Debt Snowball Is A Debt Payoff Method Where You Pay Your Debts From Smallest To Largest, Regardless Of Interest Rate.

Download major components of a healthy financial plan The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates. Then, take what you were paying on that debt and add it to the payment of your next smallest debt. Web this form outlines dave's recommended percentages for each category, making it easier to set up your budget.