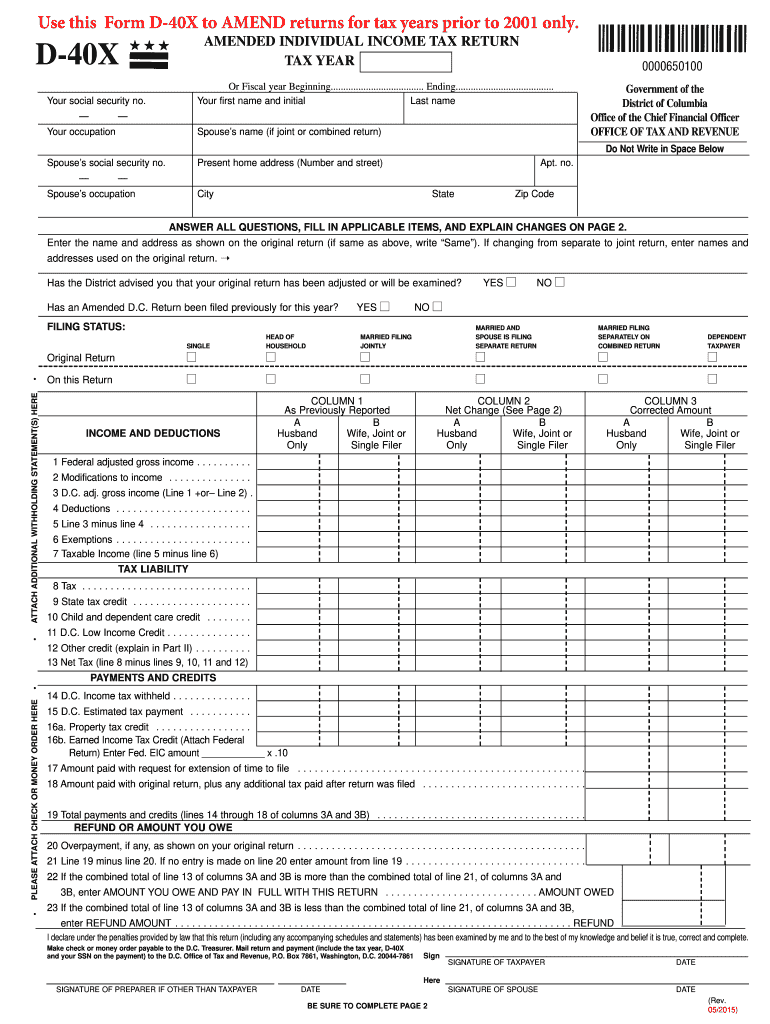

Dc Income Tax Form

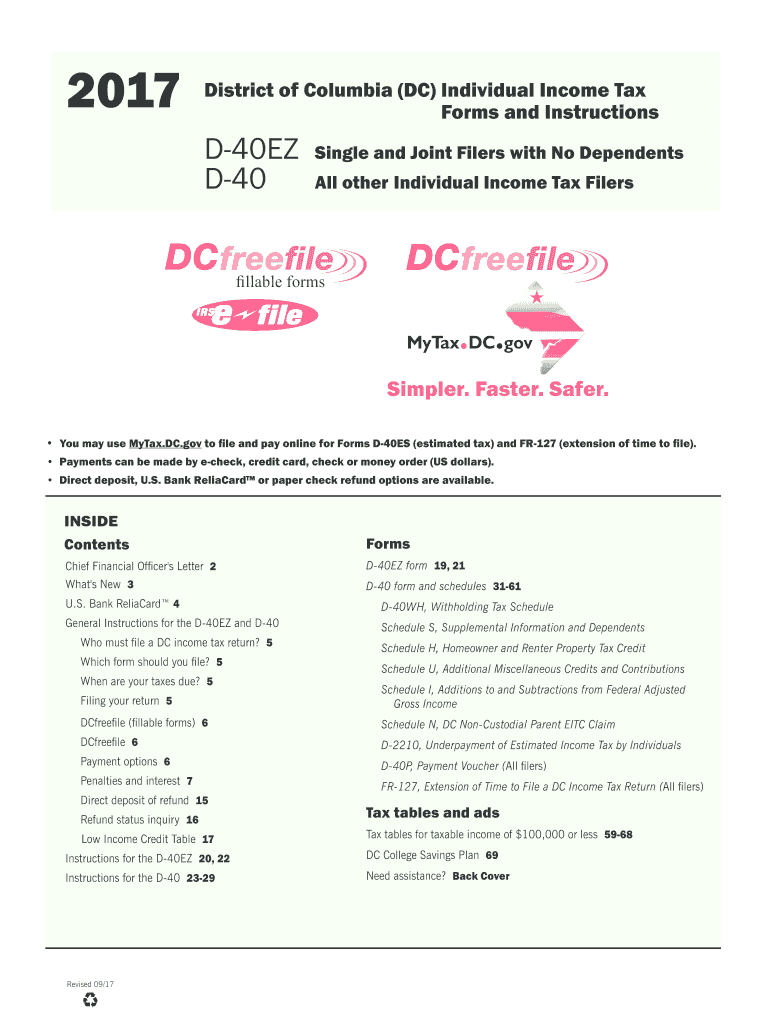

Dc Income Tax Form - Web your browser appears to have cookies disabled. In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler,. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Every new employee who resides in dc and is required to have dc income taxes withheld, must fi ll out form. Web district of columbia has a state income tax that ranges between 4% and 8.95% , which is administered by the district of columbia office of taxpayer revenue. Cookies are required to use this site. A district of columbia (dc) estate tax return (form d. Ad we can help you take on current and future income tax accounting issues with confidence. Sales and use tax forms. Web registration and exemption tax forms.

Details on how to only prepare and print a. Since2001, the virginia personal property tax relief varies by jurisdiction for qualifying vehicles. Web tax forms and publications. Web district of columbia has a state income tax that ranges between 4% and 8.95% , which is administered by the district of columbia office of taxpayer revenue. Premier income tax accounting services customized to your unique needs. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. On or before july 15, 2020. Complete, edit or print tax forms instantly. A district of columbia (dc) estate tax return (form d. Web your browser appears to have cookies disabled.

If the due date for filing a. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021. On or before april 18, 2023. In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler,. Web your browser appears to have cookies disabled. Premier income tax accounting services customized to your unique needs. Web tax forms and publications. Complete, edit or print tax forms instantly. Web the district of columbia tax rate is from 21 d.c. Ad we can help you take on current and future income tax accounting issues with confidence.

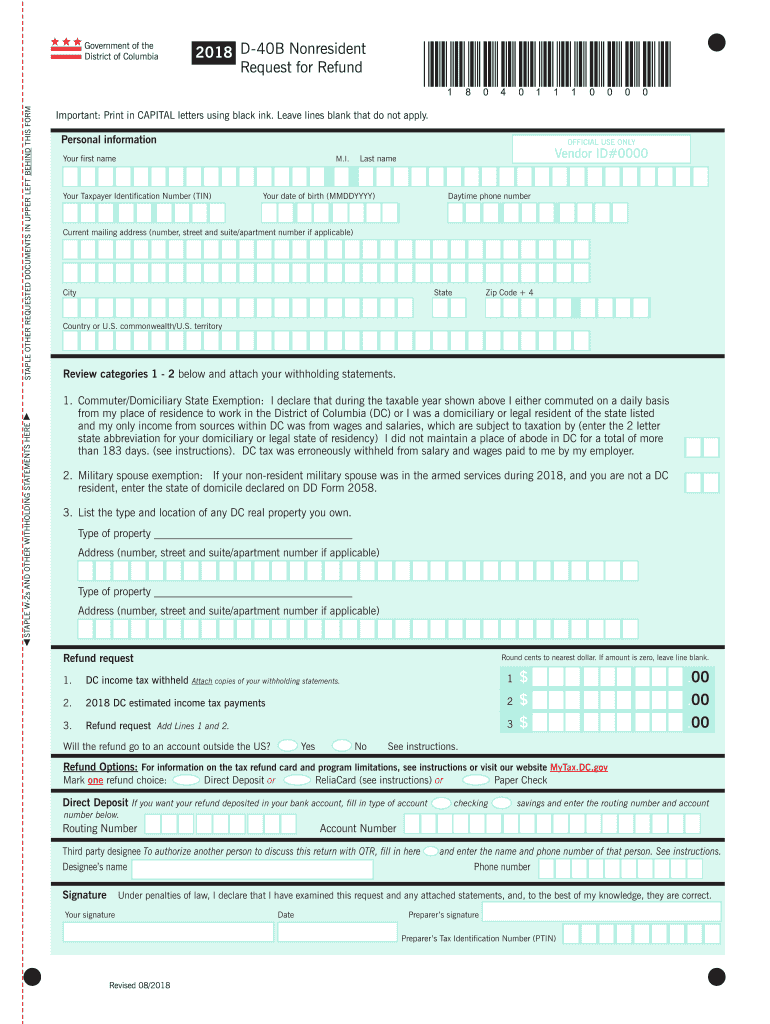

20182020 Form DC D40B Fill Online, Printable, Fillable, Blank pdfFiller

Every new employee who resides in dc and is required to have dc income taxes withheld, must fi ll out form. Web district of columbia has a state income tax that ranges between 4% and 8.95% , which is administered by the district of columbia office of taxpayer revenue. Web your browser appears to have cookies disabled. Premier income tax.

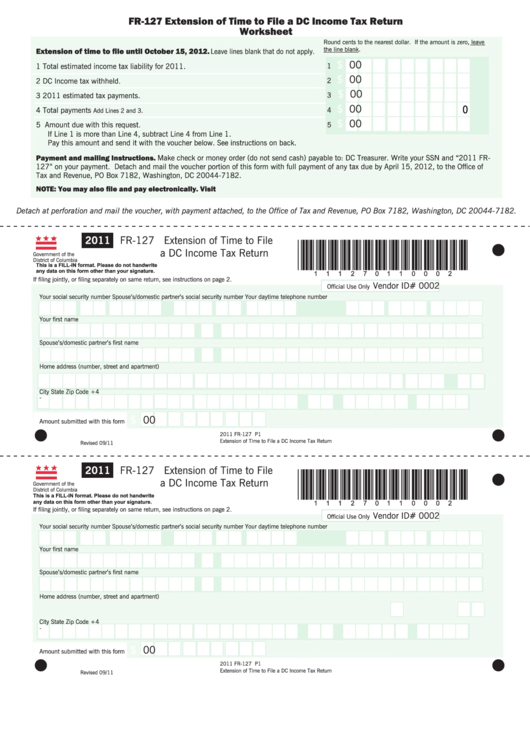

Fillable Form Fr127 Extension Of Time To File A Dc Tax Return

Web tax forms and publications. On or before april 18, 2023. Web if you are required to file a d.c. Sales and use tax forms. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers.

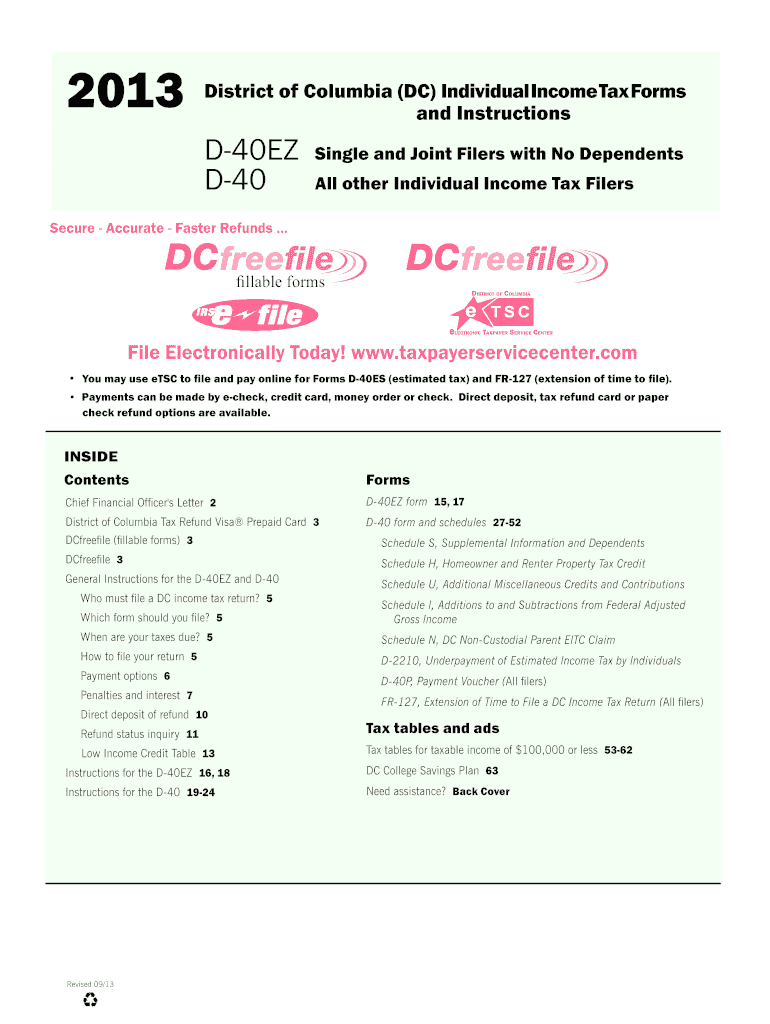

2013 Form DC D40EZ & D40 Fill Online, Printable, Fillable, Blank

A district of columbia (dc) estate tax return (form d. Since2001, the virginia personal property tax relief varies by jurisdiction for qualifying vehicles. Borrowers would need to supply their tax return or other income documentation covering the period. Complete, edit or print tax forms instantly. Web district of columbia has a state income tax that ranges between 4% and 8.95%.

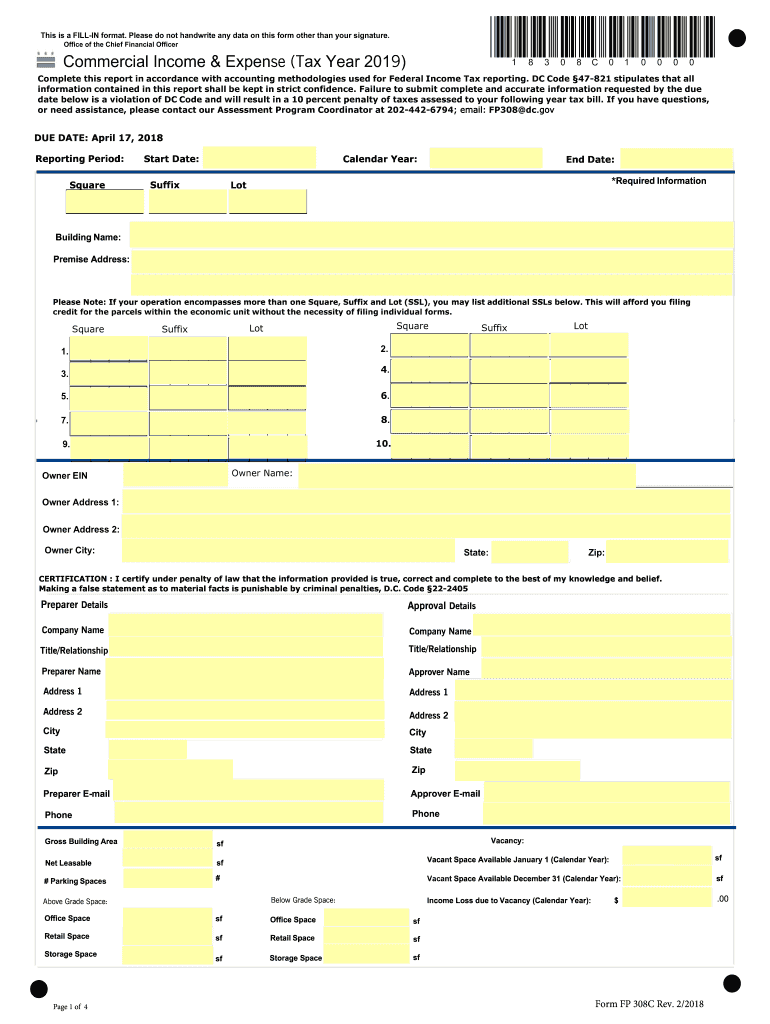

Dc And Expense Report Fill Out and Sign Printable PDF Template

Web registration and exemption tax forms. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021. Individual income tax forms and instructions for single and joint filers.

Washington DC Tax Form 2010 Teach for America

In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler,. Premier income tax accounting services customized to your unique needs. Since2001, the virginia personal property tax relief varies by jurisdiction for qualifying vehicles. Web district of columbia has a state income tax that ranges between 4% and 8.95%.

District of Columbia Taxes Taxed Right

Borrowers would need to supply their tax return or other income documentation covering the period. Ad we can help you take on current and future income tax accounting issues with confidence. Details on how to only prepare and print a. Sales and use tax forms. Web dc tax withholding form.

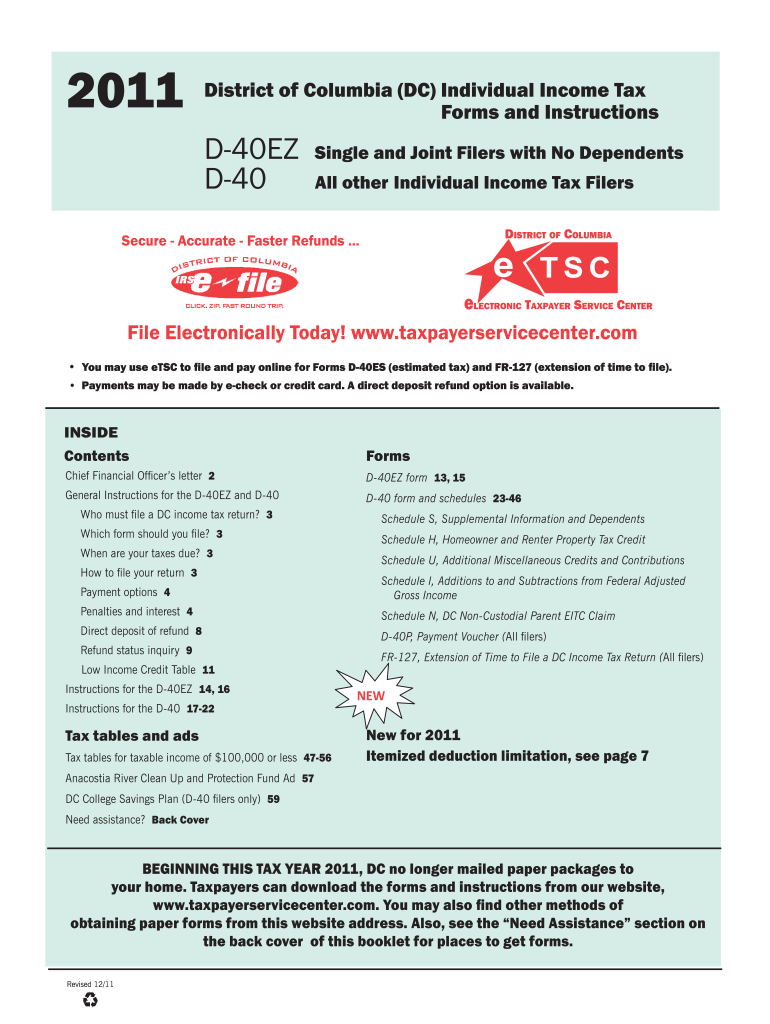

2011 Form DC D40EZ & D40 Fill Online, Printable, Fillable, Blank

Web tax forms and publications. Complete, edit or print tax forms instantly. If the due date for filing a. On or before april 18, 2023. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers.

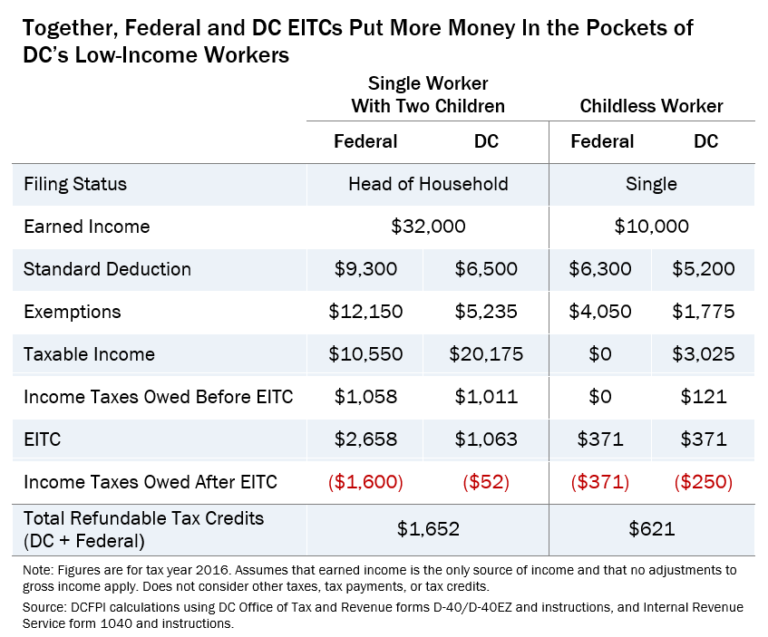

DC’s Earned Tax Credit

Ad we can help you take on current and future income tax accounting issues with confidence. Sales and use tax forms. If the due date for filing a. In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler,. Borrowers would need to supply their tax return or other.

D40Ez Fill Out and Sign Printable PDF Template signNow

Every new employee who resides in dc and is required to have dc income taxes withheld, must fi ll out form. On or before july 15, 2020. Web district of columbia has a state income tax that ranges between 4% and 8.95% , which is administered by the district of columbia office of taxpayer revenue. If the due date for.

Dc d 40 2019 online fill in form Fill out & sign online DocHub

A district of columbia (dc) estate tax return (form d. Web the district of columbia tax rate is from 21 d.c. In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler,. On or before april 18, 2023. Individual income tax forms and instructions for single and joint filers.

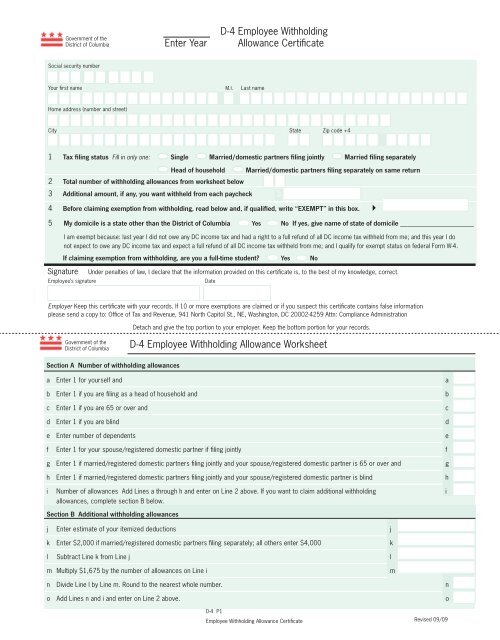

Every New Employee Who Resides In Dc And Is Required To Have Dc Income Taxes Withheld, Must Fi Ll Out Form.

Web district of columbia has a state income tax that ranges between 4% and 8.95% , which is administered by the district of columbia office of taxpayer revenue. Ad we can help you take on current and future income tax accounting issues with confidence. Web your browser appears to have cookies disabled. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers.

Complete, Edit Or Print Tax Forms Instantly.

Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web registration and exemption tax forms. Sales and use tax forms. Web if you are required to file a d.c.

Cookies Are Required To Use This Site.

A district of columbia (dc) estate tax return (form d. Web dc tax withholding form. If the due date for filing a. On or before april 18, 2023.

In Addition To The Forms Available Below, The District Of Columbia Offers Several Electronic Filing Services To Make Filing Your Taxes Simpler,.

Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021. Details on how to only prepare and print a. Web tax forms and publications. Borrowers would need to supply their tax return or other income documentation covering the period.