Do Banks File Form 8300

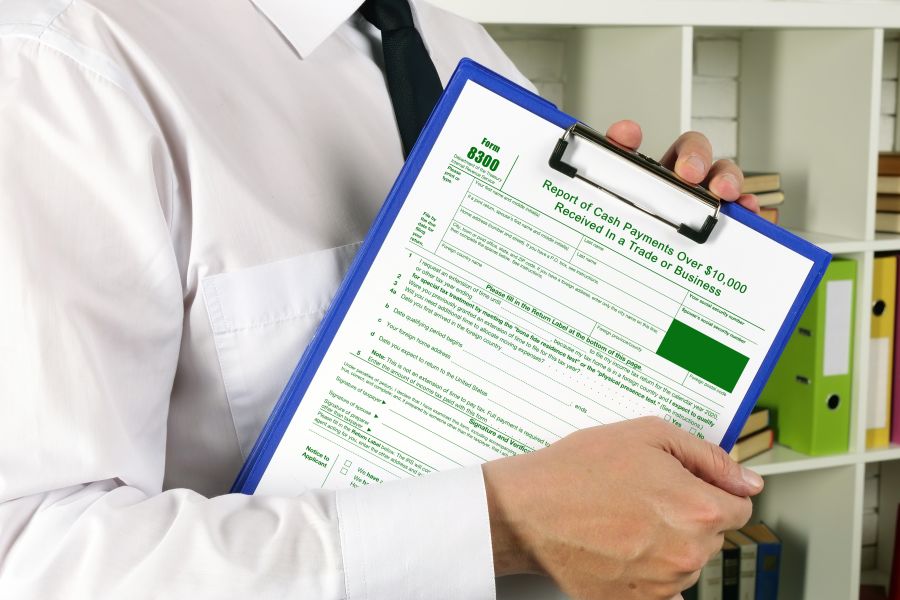

Do Banks File Form 8300 - Web (fincen) form 8300 provides the irs and fincen with a tangible record of large cash transactions. Web form 8300 may be filed voluntarily for any suspicious transaction (see definitions, later) for use by fincen and the irs, even if the total amount does not exceed $10,000. Web form 8300 is an important irs and fincen form for individual who own businesses, and receive payments of more than $10,000 (it does not need to be $10,000 at one specific. Fincen registration of money services business (fincen report 107) report of foreign bank. In two or more related payments within 24. Web failing to file form 8300 within 15 days after you receive the funds will lead to you or your business being penalized by the irs. For more information about penalties and reporting cash payments on form 8300, check out. Web and, in the comments section of the form, state how you tried to get the information. Web filing form 8300 absolves the bank from filing on behalf of the customer’s customer because form 8300 is filed on the true transactor and not the customer of the. A form 8300 must be filed with the irs within 15 days of receiving cash (or cash equivalent) exceeding $10,000.

Web there are two important exceptions to the requirement to file a form 8300. Additionally, failing to file on time. It is voluntary but highly encouraged. Web filing form 8300 absolves the bank from filing on behalf of the customer’s customer because form 8300 is filed on the true transactor and not the customer of the. Web when should we file the form 8300? Web for transactions under the reporting threshold, you can file form 8300, if the transaction appears suspicious. See when, where, and what to file, later. In two or more related payments within 24. Fincen registration of money services business (fincen report 107) report of foreign bank. A form 8300 must be filed with the irs within 15 days of receiving cash (or cash equivalent) exceeding $10,000.

In two or more related payments within 24. See when, where, and what to file, later. It is voluntary but highly encouraged. Report of cash payments over $10,000 received in a trade or business. Web when to file you must file form 8300 within 15 days after the date the cash transaction occurred. Web filing form 8300 absolves the bank from filing on behalf of the customer’s customer because form 8300 is filed on the true transactor and not the customer of the. Fincen registration of money services business (fincen report 107) report of foreign bank. Web businesses must file form 8300. Additionally, failing to file on time. Web form 8300 may be filed voluntarily for any suspicious transaction (see definitions, later) for use by fincen and the irs, even if the total amount does not exceed $10,000.

Form 8300 Do You Have Another IRS Issue? ACCCE

Web form 8300 is an important irs and fincen form for individual who own businesses, and receive payments of more than $10,000 (it does not need to be $10,000 at one specific. For more information about penalties and reporting cash payments on form 8300, check out. Besides filing form 8300, you also need to provide a written statement to. It.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Web businesses must file form 8300. Web when to file you must file form 8300 within 15 days after the date the cash transaction occurred. Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash. Web when should we file the form.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Web there are two important exceptions to the requirement to file a form 8300. Web failing to file form 8300 within 15 days after you receive the funds will lead to you or your business being penalized by the irs. Web filing form 8300 absolves the bank from filing on behalf of the customer’s customer because form 8300 is filed.

IRS Form 8300 Reporting Cash Sales Over 10,000

Web filing form 8300 absolves the bank from filing on behalf of the customer’s customer because form 8300 is filed on the true transactor and not the customer of the. Web when should we file the form 8300? Web when to file you must file form 8300 within 15 days after the date the cash transaction occurred. Web for transactions.

Form 8300 Do You Have Another IRS Issue? ACCCE

Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash. First, financial institutions are not required file a form 8300 because such entities are required to file a. It is voluntary but highly encouraged. For more information about penalties and reporting cash.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash. In two or more related payments within 24. Web when to file you must file form 8300 within 15 days after the date the cash transaction occurred. By law, individuals, businesses and.

Understanding How to Report Large Cash Transactions (Form 8300) Roger

Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash. Web form 8300 may be filed voluntarily for any suspicious transaction (see definitions, later) for use by fincen and the irs, even if the total amount does not exceed $10,000. See when,.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

In two or more related payments within 24. It is voluntary but highly encouraged. Web a person must file form 8300 if they receive cash of more than $10,000 from the same payer or agent: Web form 8300 may be filed voluntarily for any suspicious transaction (see definitions, later) for use by fincen and the irs, even if the total.

IRS eFile is Available for Form 8300 Mac's Tax & Bookkeeping

Fincen registration of money services business (fincen report 107) report of foreign bank. Additionally, failing to file on time. Web form 8300 may be filed voluntarily for any suspicious transaction (see definitions, later) for use by fincen and the irs, even if the total amount does not exceed $10,000. It is voluntary but highly encouraged. Web generally, any person in.

Who Needs to File Form 8300? Cannabis CPA, CFO, Bookkeeping

Web when to file you must file form 8300 within 15 days after the date the cash transaction occurred. Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash. First, financial institutions are not required file a form 8300 because such entities.

For More Information About Penalties And Reporting Cash Payments On Form 8300, Check Out.

Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash. Web a person must file form 8300 if they receive cash of more than $10,000 from the same payer or agent: Web failing to file form 8300 within 15 days after you receive the funds will lead to you or your business being penalized by the irs. Web businesses must file form 8300.

First, Financial Institutions Are Not Required File A Form 8300 Because Such Entities Are Required To File A.

See when, where, and what to file, later. It is voluntary but highly encouraged. Web generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or related transactions must complete a form 8300, report of cash. Web when should we file the form 8300?

Web When To File You Must File Form 8300 Within 15 Days After The Date The Cash Transaction Occurred.

Web and, in the comments section of the form, state how you tried to get the information. Web (fincen) form 8300 provides the irs and fincen with a tangible record of large cash transactions. Web for transactions under the reporting threshold, you can file form 8300, if the transaction appears suspicious. In two or more related payments within 24.

In Two Or More Related Payments Within 24.

Web a person must file form 8300 if they receive cash of more than $10,000 from the same payer or agent: A form 8300 must be filed with the irs within 15 days of receiving cash (or cash equivalent) exceeding $10,000. Additionally, failing to file on time. August 2014) department of the treasury internal revenue service.