Do Churches Have To File Form 990

Do Churches Have To File Form 990 - We recommend that you do not submit form 990. It is true that churches, synagogues, temples, mosques, and other places of religious worship are not required to file a form 1023 with the irs to be considered tax. Web we have received conflicting opinions. Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. Web churches typically do not have to file 990 tax returns. Web do churches have to file a 990? Web what 990 form do churches need to file with the irs? Web requirements for nonprofit churches. Web churches that have completed form 1023 are not required to complete form 990. Web every organization exempt from federal income tax under internal revenue code section 501 (a) must file an annual information return except:

This means you are not required. Web churches typically do not have to file 990 tax returns. Nonprofit churches have 2 options to request a retail sales and use tax exemption: Web another difference is filing requirements. We recommend that you do not submit form 990. Web one difference is that churches are not required to file the annual 990 form. Based on irs regulations, churches (including integrated auxiliaries and conventions or associations of churches) that meet. For several evangelical organizations, that advantage—no 990 filing—has been a. Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution and are exempt from filing an annual.

Your church is not required to file a form 990 with the federal government. Web another difference is filing requirements. Web what 990 form do churches need to file with the irs? Web churches need to file a tax return with the irs if they fall under section 501(c)(3) status. This means you are not required. Web every organization exempt from federal income tax under internal revenue code section 501 (a) must file an annual information return except: For several evangelical organizations, that advantage—no 990 filing—has been a. Churches need to file the information on the income & expenses for a given accounting year by filing. Web do churches have to file a 990? Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form.

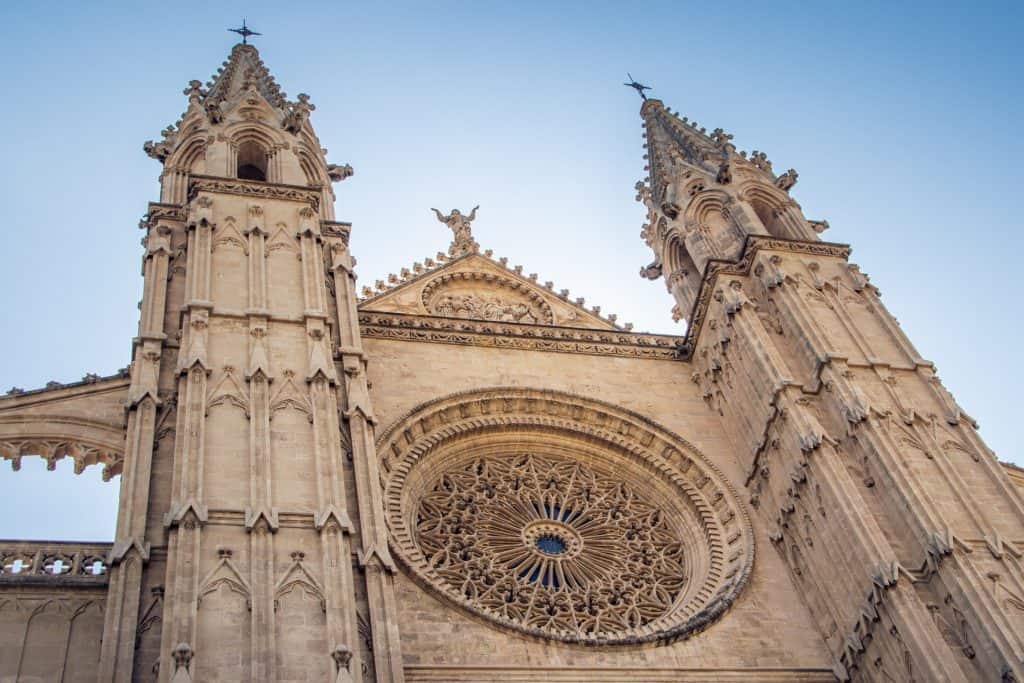

Why Do Churches Have Steeples 5 Distinctive Reasons

We recommend that you do not submit form 990. For several evangelical organizations, that advantage—no 990 filing—has been a. Nonprofit churches have 2 options to request a retail sales and use tax exemption: Web what 990 form do churches need to file with the irs? Web requirements for nonprofit churches.

Why do churches have steeples?

Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution and are exempt from filing an annual. It is true that churches, synagogues, temples, mosques, and other places of religious worship are not required to file a form 1023 with the irs to be considered tax. It is.

Do churches have the right to discriminate?

Web what 990 form do churches need to file with the irs? If the church’s gross receipts are below. Web for some organizations, it may be more practical to file form 990ez, which is a “short form” or simplified version of form 990. Web we have received conflicting opinions. It is true that churches, synagogues, temples, mosques, and other places.

Why do churches have towers?

Web churches typically do not have to file 990 tax returns. Web requirements for nonprofit churches. If the church’s gross receipts are below. Your church is not required to file a form 990 with the federal government. We recommend that you do not submit form 990.

7 Things You Need to Know About Churches and Form 990

This means you are not required. Web churches that have completed form 1023 are not required to complete form 990. Web do churches have to file a 990? Web houses of worship (churches, synagogues, mosques and temples) are exempt from charitable solicitation registration in every state if they aren’t required to file a form 990. For several evangelical organizations, that.

Why do churches have stained glass windows? YouTube

Web churches are exempt from federal income tax, applying for exempt status, unemployment tax, and many tax information returns. If the church’s gross receipts are below. Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. It is true that churches, synagogues, temples, mosques, and other places of religious worship are not.

Do Churches File Form 990? YouTube

Web another difference is filing requirements. This means you are not required. Web churches that have completed form 1023 are not required to complete form 990. We recommend that you do not submit form 990. Web we have received conflicting opinions.

Do Churches Have Customers?

For several evangelical organizations, that advantage—no 990 filing—has been a. Web every organization exempt from federal income tax under internal revenue code section 501 (a) must file an annual information return except: Web one difference is that churches are not required to file the annual 990 form. Web another difference is filing requirements. Web we have received conflicting opinions.

Do Churches Employ Counselors? Top Counseling Schools

Nonprofit churches have 2 options to request a retail sales and use tax exemption: If the church’s gross receipts are below. Web churches are exempt from having to file form 990 with the irs. Web we have received conflicting opinions. We recommend that you do not submit form 990.

Why Do Churches Have Steeples? Delicious Bookmark

Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution and are exempt from filing an annual. Web what 990 form do churches need to file with the irs? Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. Web.

Web One Difference Is That Churches Are Not Required To File The Annual 990 Form.

Web ubi analysis can be tricky, and a church may need to consult with a tax or legal professional in order to properly determine if a certain activity subjects a church to tax. Web churches typically do not have to file 990 tax returns. Web we have received conflicting opinions. Nonprofit churches have 2 options to request a retail sales and use tax exemption:

Web Requirements For Nonprofit Churches.

Web houses of worship (churches, synagogues, mosques and temples) are exempt from charitable solicitation registration in every state if they aren’t required to file a form 990. Web for some organizations, it may be more practical to file form 990ez, which is a “short form” or simplified version of form 990. Web churches are exempt from having to file form 990 with the irs. Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution and are exempt from filing an annual.

Web Every Organization Exempt From Federal Income Tax Under Internal Revenue Code Section 501 (A) Must File An Annual Information Return Except:

If the church’s gross receipts are below. Section 6033 of the internal revenue code requires every. Web what 990 form do churches need to file with the irs? Your church is not required to file a form 990 with the federal government.

Churches Need To File The Information On The Income & Expenses For A Given Accounting Year By Filing.

This means you are not required. Web churches that have completed form 1023 are not required to complete form 990. For several evangelical organizations, that advantage—no 990 filing—has been a. It is true that churches, synagogues, temples, mosques, and other places of religious worship are not required to file a form 1023 with the irs to be considered tax.