Due Date For Form 990

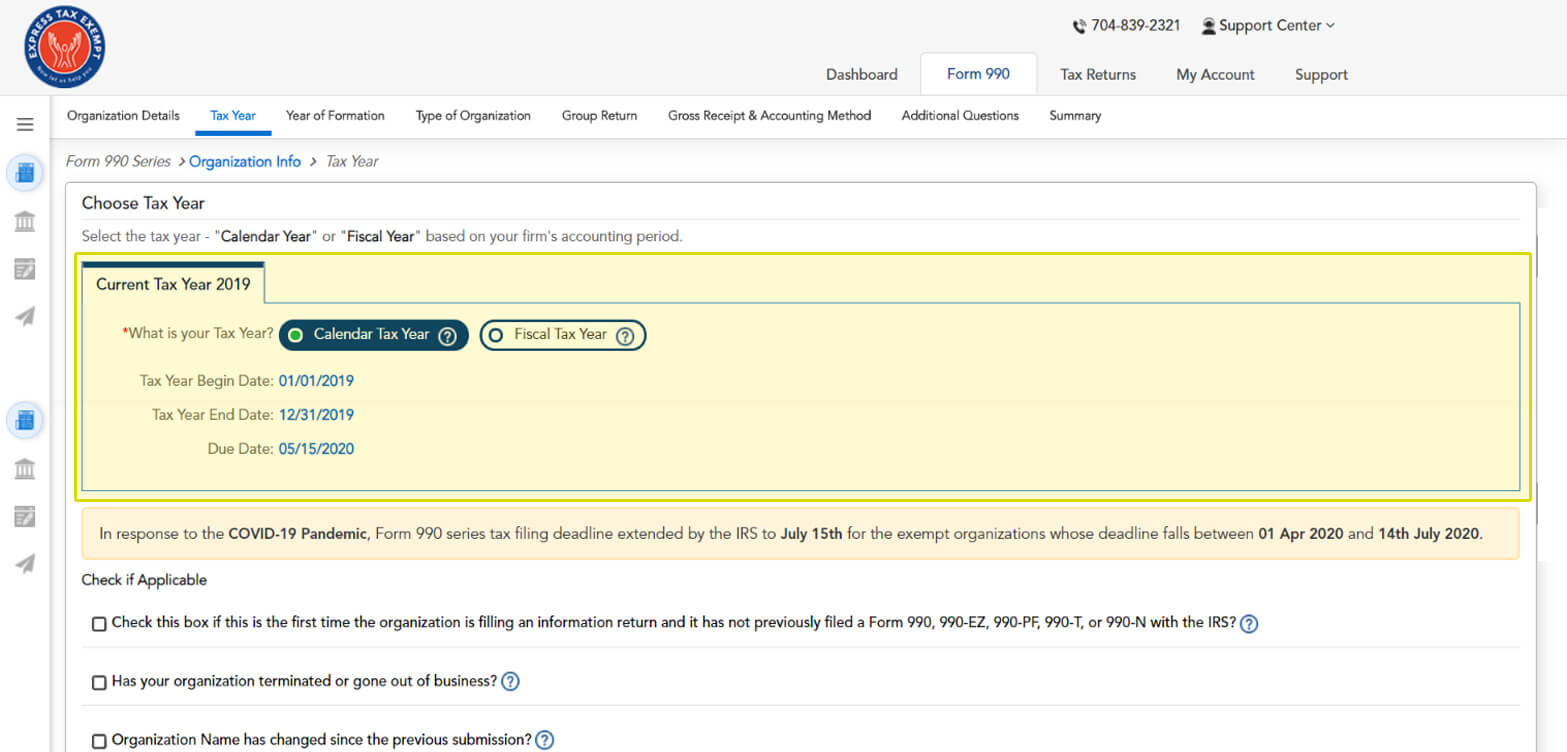

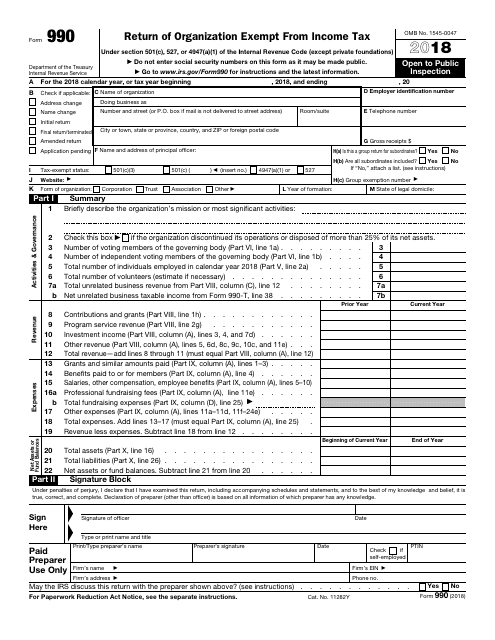

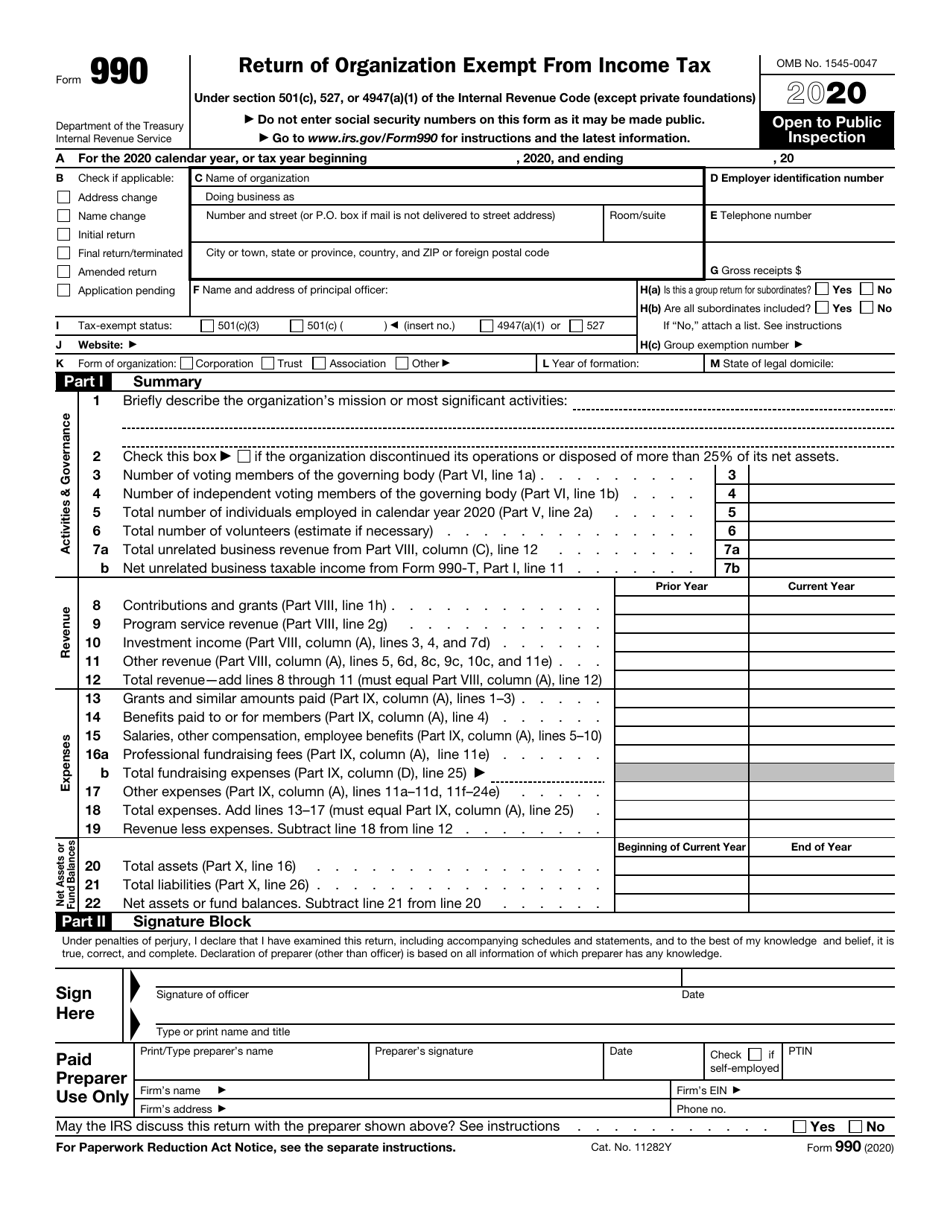

Due Date For Form 990 - Web the majority of nonprofits choose to operate on the calendar fiscal year, hence the short answer of may 15th for your tax form due dates. Web the form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Web nonprofit tax returns due date finder. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. Six month extension due date: Web upcoming form 990 deadline: Employees' trusts, defined in section 401(a), iras (including seps and simples), roth iras,. File an extension of time through november 15, 2020, on or before may 15, 2020. Web form 990 return due date:

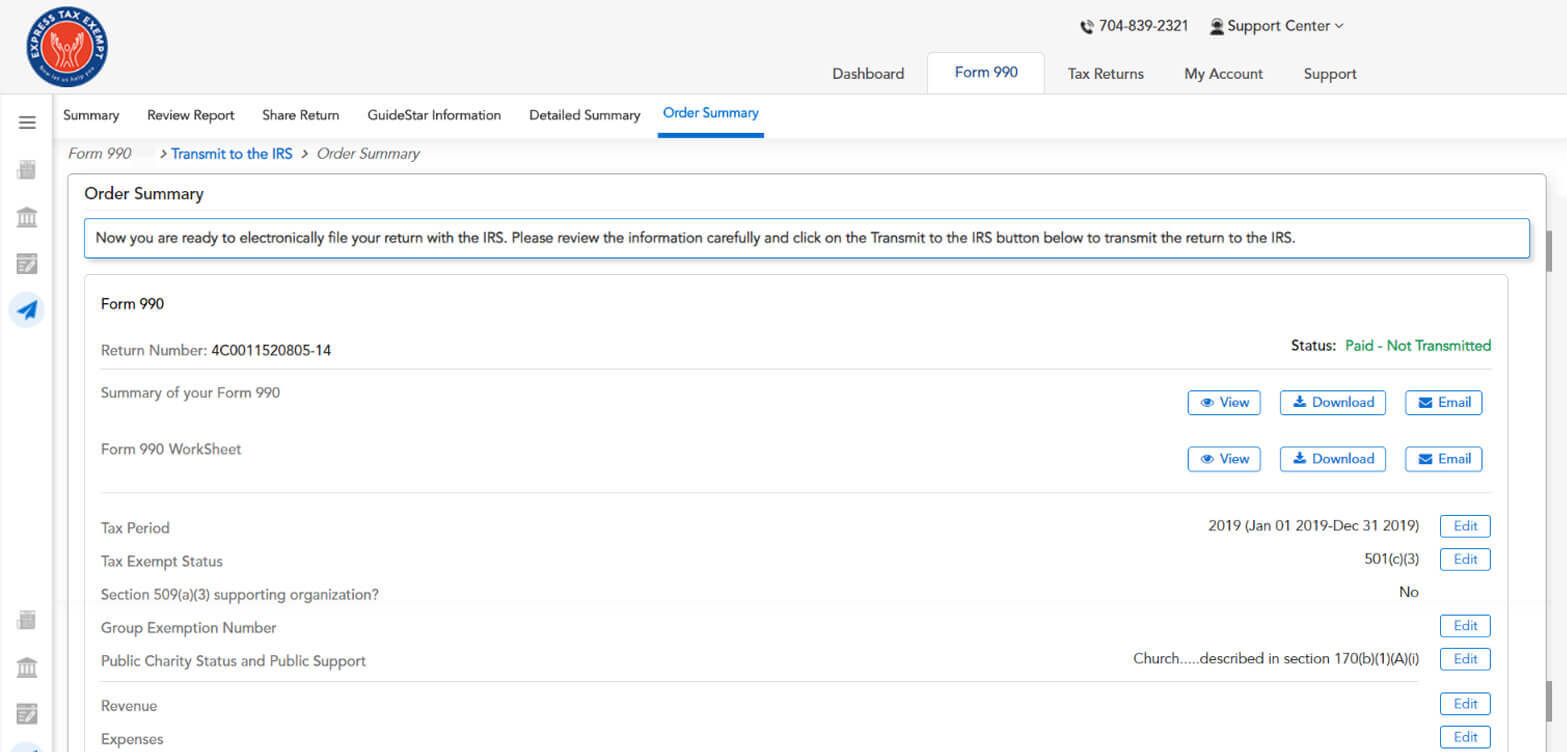

Web if the original due date of form 990 is may 15, 2020, the organization may either: Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. File an extension of time through november 15, 2020, on or before may 15, 2020. Six month extension due date: Employees' trusts, defined in section 401(a), iras (including seps and simples), roth iras,. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. This means that for any tax. Complete, edit or print tax forms instantly. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. 1 choose your appropriate form to find the.

If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Web upcoming 2023 form 990 deadline: Form 990 due date calculator. This means that for any tax. Web upcoming form 990 deadline: Web the form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period. Web due date for filing returns requried by irc 6033. That may seem complicated, but for organizations whose tax. Six month extension due date:

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

1 choose your appropriate form to find the. Web if the original due date of form 990 is may 15, 2020, the organization may either: Web upcoming 2023 form 990 deadline: File an extension of time through november 15, 2020, on or before may 15, 2020. Form 990 due date calculator.

what is the extended due date for form 990 Fill Online, Printable

Web upcoming 2023 form 990 deadline: If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. Web due date for filing returns requried by irc 6033. Form 990 due date calculator. Web nonprofit tax returns due date finder.

Fy2014 Form 990 Ccusa

Web form 990 return due date: Web if the original due date of form 990 is may 15, 2020, the organization may either: 1 choose your appropriate form to find the. Get ready for tax season deadlines by completing any required tax forms today. That may seem complicated, but for organizations whose tax.

Receptionist Self Evaluation Form Vincegray2014 / Various artists

Six month extension due date: For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web upcoming 2023 form 990 deadline: Form 990 due date calculator. Web the majority of nonprofits choose to operate on the calendar fiscal year, hence the short answer of.

File Form 990 Online Efile 990 990 Filing Deadline 2021

Web if the original due date of form 990 is may 15, 2020, the organization may either: Employees' trusts, defined in section 401(a), iras (including seps and simples), roth iras,. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Six month extension due.

File Form 990 Online Efile 990 990 Filing Deadline 2021

If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. Get ready for tax season deadlines by completing any required tax forms today. This means that for any tax. For organizations with an accounting tax period starting on april 1, 2022, and ending on march.

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Web the majority of nonprofits choose to operate on the calendar fiscal year, hence the short answer of may 15th for your tax form due dates. Web upcoming 2023 form 990 deadline: Web the form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period. Complete, edit or print tax forms instantly..

Printable Irs Form 990 Master of Documents

Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. That may seem complicated, but for organizations whose.

IRS Form 990 Download Fillable PDF or Fill Online Return of

Web upcoming 2023 form 990 deadline: For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web the form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period. Six month extension due date: Get ready.

2017 IRS Form 990 or 990EZ Schedule L Editable Online Blank in PDF

If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. Web the form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period. Employees' trusts, defined in section 401(a), iras (including seps and simples), roth iras,. Web.

If Your Organization’s Accounting Tax Period Starts On March 01, 2022, And Ends In February 2023, Your Form 990 Is Due By July 17, 2023.

Form 990 due date calculator. Employees' trusts, defined in section 401(a), iras (including seps and simples), roth iras,. Exempt organizations with a filing obligation. To use the table, you must know.

That May Seem Complicated, But For Organizations Whose Tax.

For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Get ready for tax season deadlines by completing any required tax forms today. This means that for any tax.

Web Due Date For Filing Returns Requried By Irc 6033.

Web nonprofit tax returns due date finder. Complete, edit or print tax forms instantly. Web upcoming form 990 deadline: 1 choose your appropriate form to find the.

File An Extension Of Time Through November 15, 2020, On Or Before May 15, 2020.

Six month extension due date: Web upcoming 2023 form 990 deadline: Web if the original due date of form 990 is may 15, 2020, the organization may either: Web the majority of nonprofits choose to operate on the calendar fiscal year, hence the short answer of may 15th for your tax form due dates.