E File Authorization Form

E File Authorization Form - Web form number title; Form t183, information return for electronic filing of an individual's income tax and benefit return. They're available within 24 to 48 hours. Web associate the e_e file extension with the correct application. Web 310 e missouri ave, kansas city mo, is a single family home that contains 1492 sq ft and was built in 2008.it contains 2 bedrooms and 2.5 bathrooms. Now select another program and. File heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Taxpayers, who currently use forms 8878 or 8879 to sign. Web the ftb, and i have followed all other requirements described in ftb pub. 940, 941, 943, 944 and 945.

They're available within 24 to 48 hours. Web 310 e missouri ave, kansas city mo, is a single family home that contains 1492 sq ft and was built in 2008.it contains 2 bedrooms and 2.5 bathrooms. They are usually only set in response to actions made by you which amount to. Web associate the e_e file extension with the correct application. I will keep form ftb 8453 on file for four years. Web these cookies are necessary for the service to function and cannot be switched off in our systems. • confirm the identity of the taxpayer(s) per ftb pub. File heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web form t183 and authorizing a representative. 940, 941, 943, 944 and 945.

• confirm the identity of the taxpayer(s) per ftb pub. Retrieve your acknowledgment (ack) files. Form t183, information return for electronic filing of an individual's income tax and benefit return. This article will help you identify which signature. File heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web these cookies are necessary for the service to function and cannot be switched off in our systems. They are usually only set in response to actions made by you which amount to. Taxpayers, who currently use forms 8878 or 8879 to sign. 940, 941, 943, 944 and 945. Web 310 e missouri ave, kansas city mo, is a single family home that contains 1492 sq ft and was built in 2008.it contains 2 bedrooms and 2.5 bathrooms.

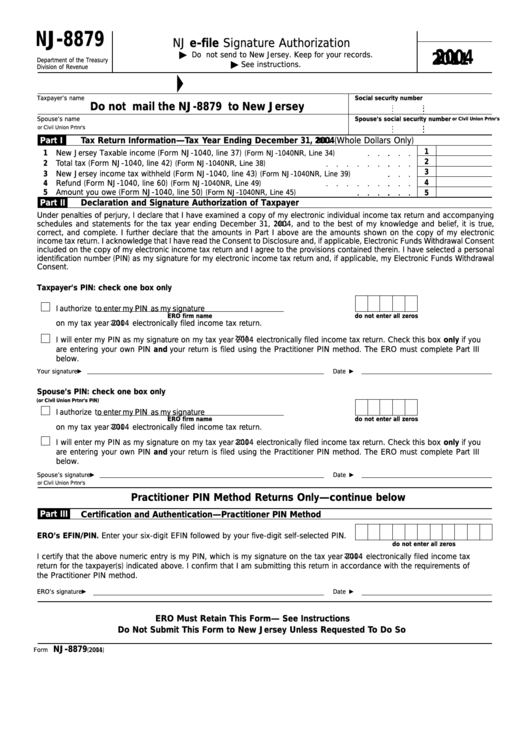

Fillable Form Nj8879 EFile Signature Authorization 2011 printable

• confirm the identity of the taxpayer(s) per ftb pub. Web form t183 and authorizing a representative. 940, 941, 943, 944 and 945. Web 310 e missouri ave, kansas city mo, is a single family home that contains 1492 sq ft and was built in 2008.it contains 2 bedrooms and 2.5 bathrooms. Web associate the e_e file extension with the.

Form 8879 IRS E File Signature Authorization 2021 Tax Forms 1040

They're available within 24 to 48 hours. Web form number title; Retrieve your acknowledgment (ack) files. Taxpayers, who currently use forms 8878 or 8879 to sign. Web these cookies are necessary for the service to function and cannot be switched off in our systems.

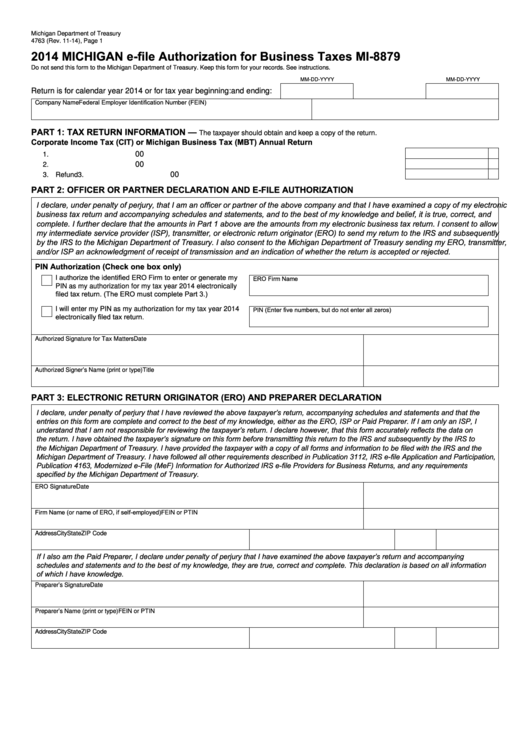

Form 4763 Michigan EFile Authorization For Business Taxes Mi8879

This article will help you identify which signature. Form t183, information return for electronic filing of an individual's income tax and benefit return. Solved•by intuit•103•updated october 28, 2022. 940, 941, 943, 944 and 945. I will keep form ftb 8453 on file for four years.

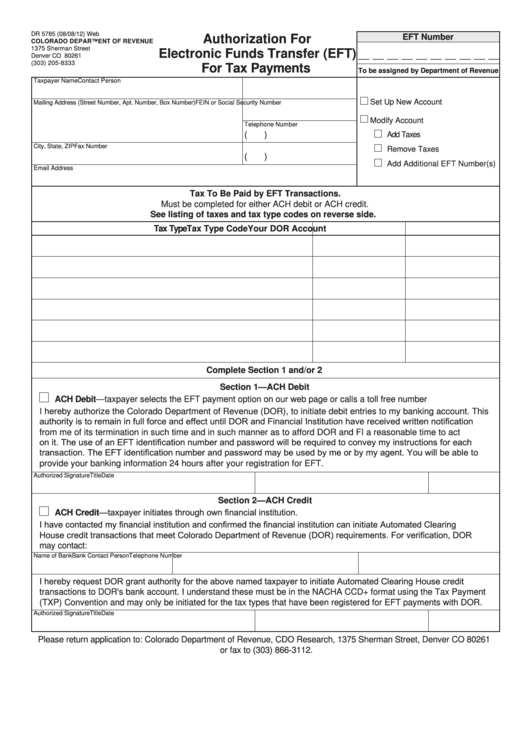

Fillable Form Dr 5785 Authorization For Electronic Funds Transfer

I will keep form ftb 8453 on file for four years. Retrieve your acknowledgment (ack) files. Form t183, information return for electronic filing of an individual's income tax and benefit return. Web these cookies are necessary for the service to function and cannot be switched off in our systems. Web 310 e missouri ave, kansas city mo, is a single.

2018 Form CA FTB 8879 Fill Online, Printable, Fillable, Blank pdfFiller

Web 310 e missouri ave, kansas city mo, is a single family home that contains 1492 sq ft and was built in 2008.it contains 2 bedrooms and 2.5 bathrooms. Web these cookies are necessary for the service to function and cannot be switched off in our systems. File heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Taxpayers,.

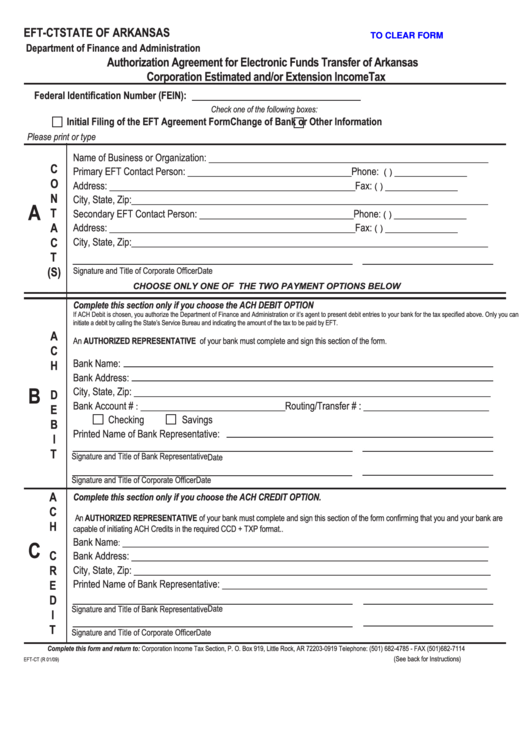

Fillable Form EftCt Authorization Agreement For Electronic Funds

Web 310 e missouri ave, kansas city mo, is a single family home that contains 1492 sq ft and was built in 2008.it contains 2 bedrooms and 2.5 bathrooms. The completed record must be signed by the individual(s)/entity granting the authorization (part i) and the individual/entity that will file the fbar. Form t183, information return for electronic filing of an.

2019 Form NY DTF TR579IT Fill Online, Printable, Fillable, Blank

The completed record must be signed by the individual(s)/entity granting the authorization (part i) and the individual/entity that will file the fbar. It is secure and accurate. Solved•by intuit•103•updated october 28, 2022. Taxpayers, who currently use forms 8878 or 8879 to sign. Retrieve your acknowledgment (ack) files.

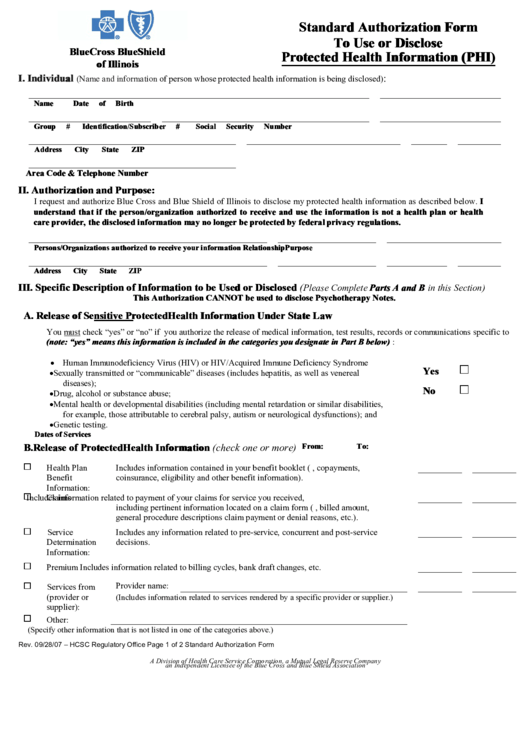

Standard Authorization Form (Illinois) printable pdf download

Now select another program and. Web these cookies are necessary for the service to function and cannot be switched off in our systems. They're available within 24 to 48 hours. File heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Form t183, information return for electronic filing of an individual's income tax and benefit return.

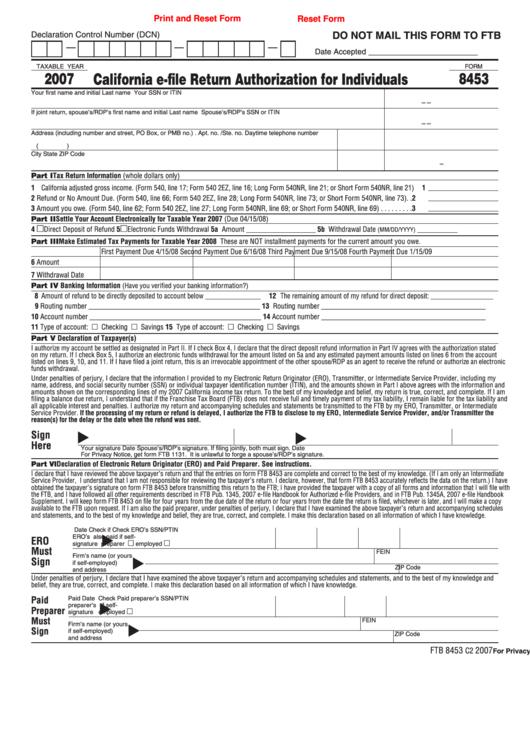

Fillable Form 8453 California EFile Return Authorization For

Web 310 e missouri ave, kansas city mo, is a single family home that contains 1492 sq ft and was built in 2008.it contains 2 bedrooms and 2.5 bathrooms. Now select another program and. This article will help you identify which signature. It is secure and accurate. Retrieve your acknowledgment (ack) files.

Web These Cookies Are Necessary For The Service To Function And Cannot Be Switched Off In Our Systems.

They are usually only set in response to actions made by you which amount to. This article will help you identify which signature. It is secure and accurate. Web the ftb, and i have followed all other requirements described in ftb pub.

Web Form Number Title;

They're available within 24 to 48 hours. • confirm the identity of the taxpayer(s) per ftb pub. File heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web form t183 and authorizing a representative.

940, 941, 943, 944 And 945.

Web 310 e missouri ave, kansas city mo, is a single family home that contains 1492 sq ft and was built in 2008.it contains 2 bedrooms and 2.5 bathrooms. The completed record must be signed by the individual(s)/entity granting the authorization (part i) and the individual/entity that will file the fbar. Now select another program and. Retrieve your acknowledgment (ack) files.

Form T183, Information Return For Electronic Filing Of An Individual's Income Tax And Benefit Return.

Solved•by intuit•103•updated october 28, 2022. I will keep form ftb 8453 on file for four years. Taxpayers, who currently use forms 8878 or 8879 to sign. Web associate the e_e file extension with the correct application.