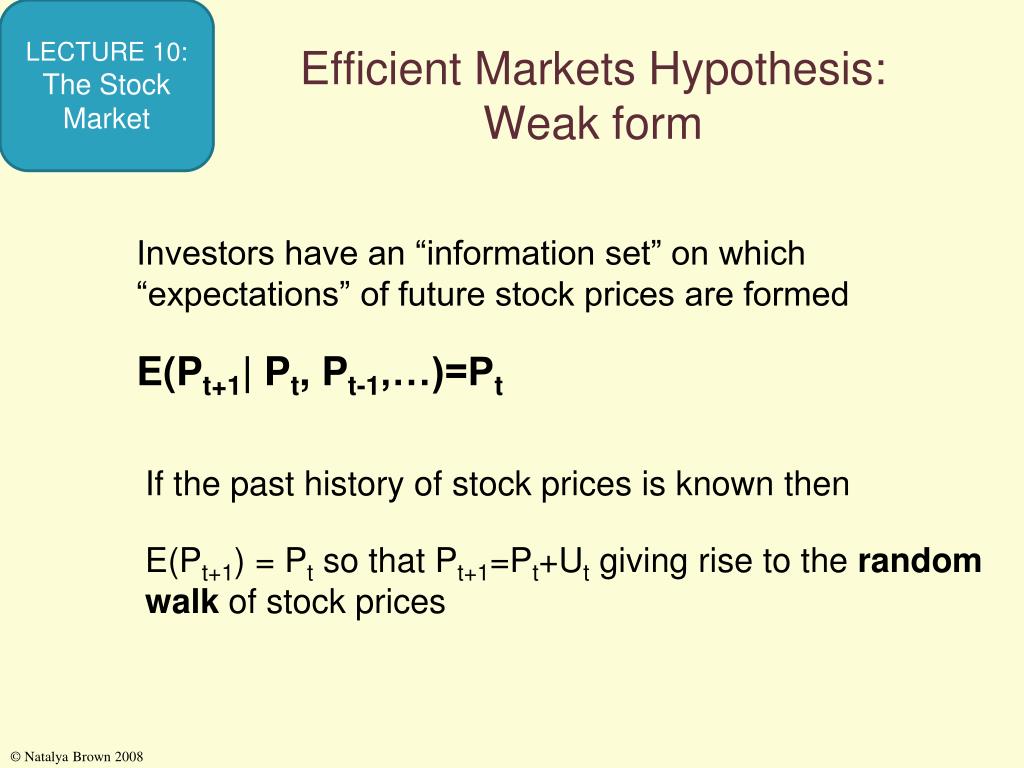

Efficient Market Hypothesis Weak Form

Efficient Market Hypothesis Weak Form - Ad enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more. Web types of efficient market hypothesis. Web weak form efficiency, also known as the random walk theory, states that future securities' prices are random and not influenced by past events. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Web this study tests the saudi stock market weak form using the weak form of an efficient market hypothesis and proposes a recurrent neural network (rnn) to produce. Web an ideal market is one in which prices provide accurate signals for resource allocation extreme null hypothesis: Here's what each says about the market. A market is “efficient” if prices always “fully reflect” all. Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis.

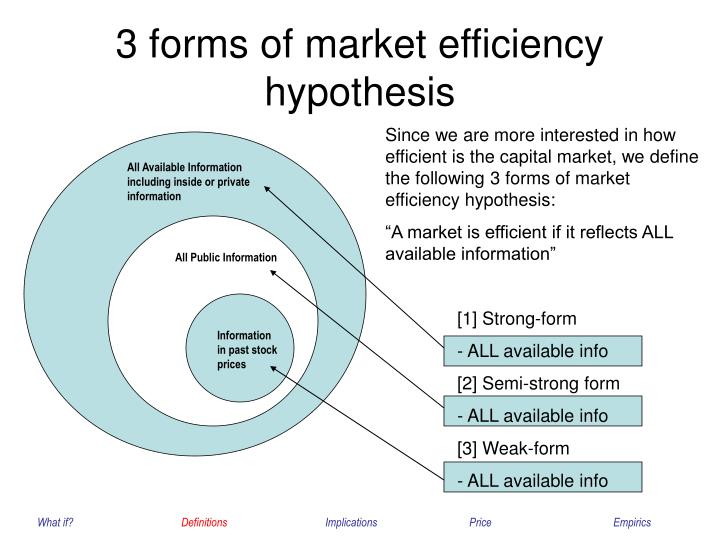

Weak form emh suggests that all past. The basis of weak form efficiency is, as the qualifying phrase to all investors by advisers always suggests: Web in 1970, fama published a review of both the theory and the evidence for the hypothesis. Web this problem has been solved! Web weak form efficiency, also known as the random walk theory, states that future securities' prices are random and not influenced by past events. Web an ideal market is one in which prices provide accurate signals for resource allocation extreme null hypothesis: There are 3 types of efficient market hypothesis which are as discussed in points given below: You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Web there are three forms of emh: Find deals and low prices on popular products at amazon.com

Here's what each says about the market. Web this study tests the saudi stock market weak form using the weak form of an efficient market hypothesis and proposes a recurrent neural network (rnn) to produce. The paper extended and refined the theory, included the definitions for three forms of. The efficient market hypothesis concerns the extent to. Find deals and low prices on popular products at amazon.com A market is “efficient” if prices always “fully reflect” all. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web in this subsection, we briefly present the wavelet method used to assess the weak form of the efficient market hypothesis. Web weak form efficiency, also known as the random walk theory, states that future securities' prices are random and not influenced by past events.

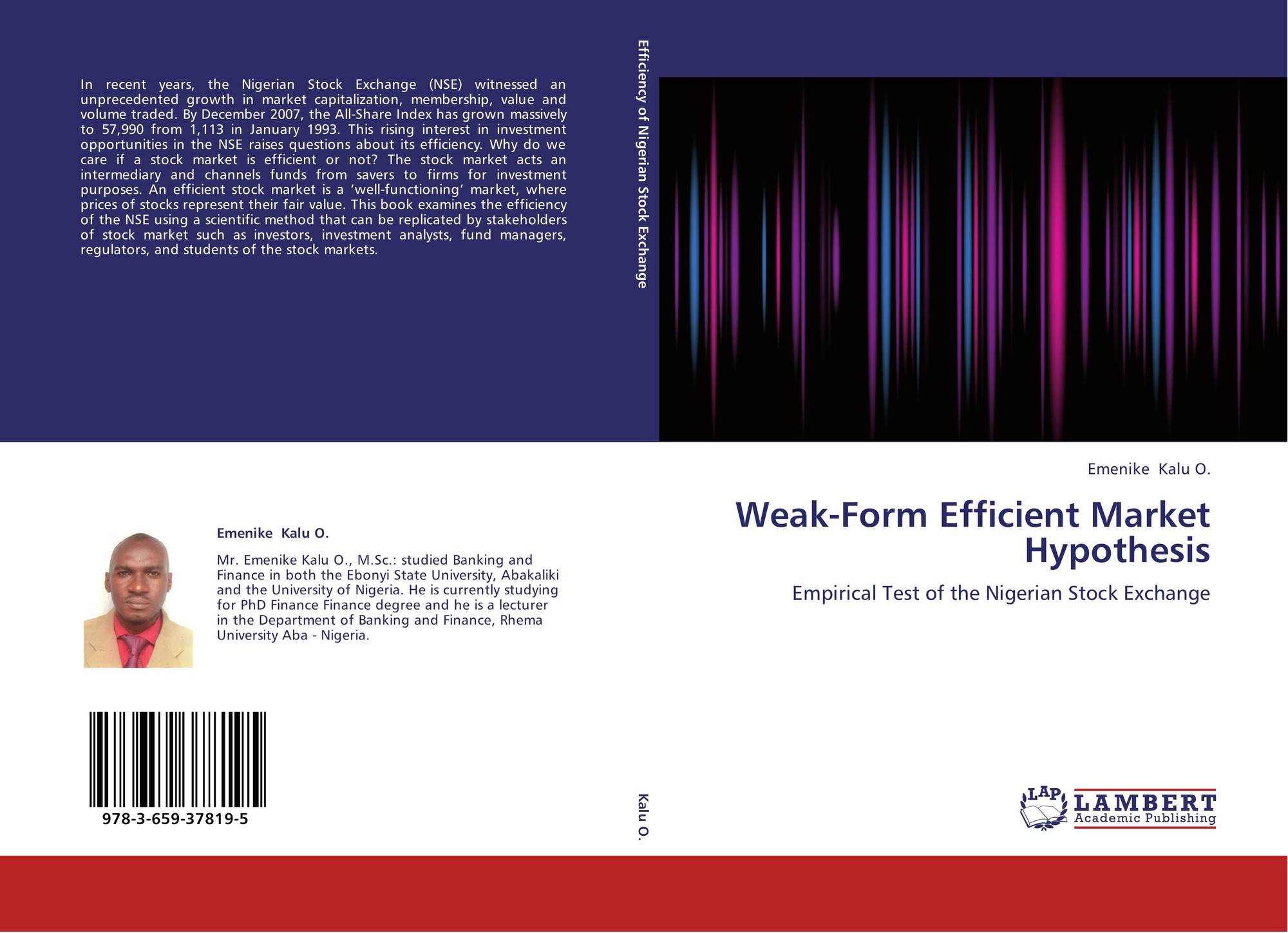

WeakForm Efficient Market Hypothesis, 9783659378195, 3659378194

The paper extended and refined the theory, included the definitions for three forms of. Web types of efficient market hypothesis. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web an ideal market is one in which prices provide accurate signals for resource allocation extreme.

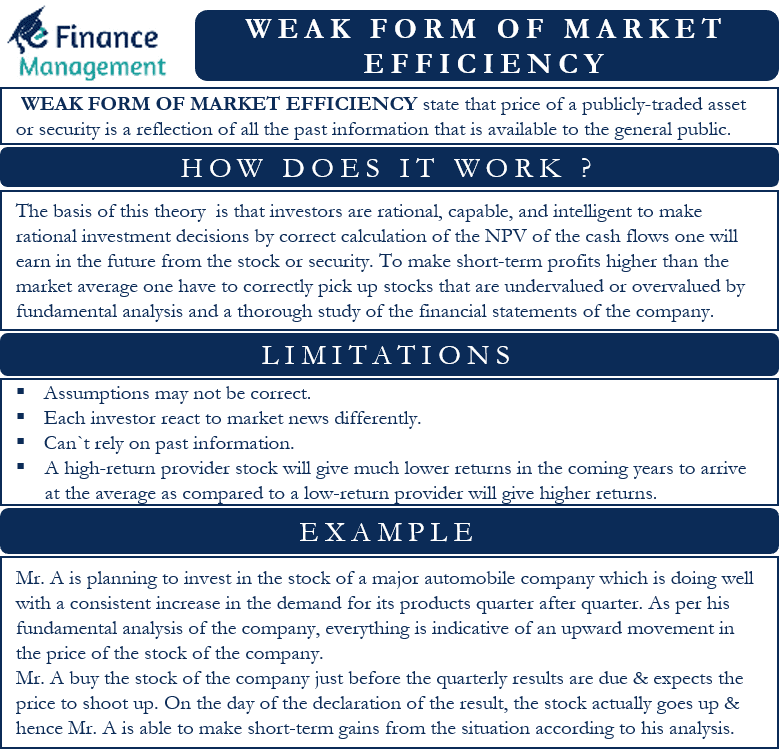

Weak Form of Market Efficiency Meaning, Usage, Limitations

Web in this subsection, we briefly present the wavelet method used to assess the weak form of the efficient market hypothesis. Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. A wavelet is simply a small localized wave. The weak form of the emh assumes that the prices of securities.

The efficient markets hypothesis EMH ARJANFIELD

Web in 1970, fama published a review of both the theory and the evidence for the hypothesis. Web an ideal market is one in which prices provide accurate signals for resource allocation extreme null hypothesis: Web weak form efficiency: A wavelet is simply a small localized wave. The efficient market hypothesis concerns the extent to.

Efficient market hypothesis

Find deals and low prices on popular products at amazon.com Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. The efficient market hypothesis concerns the extent to. Web in this subsection, we briefly present the wavelet method used to assess the weak form of the efficient market hypothesis. You'll get.

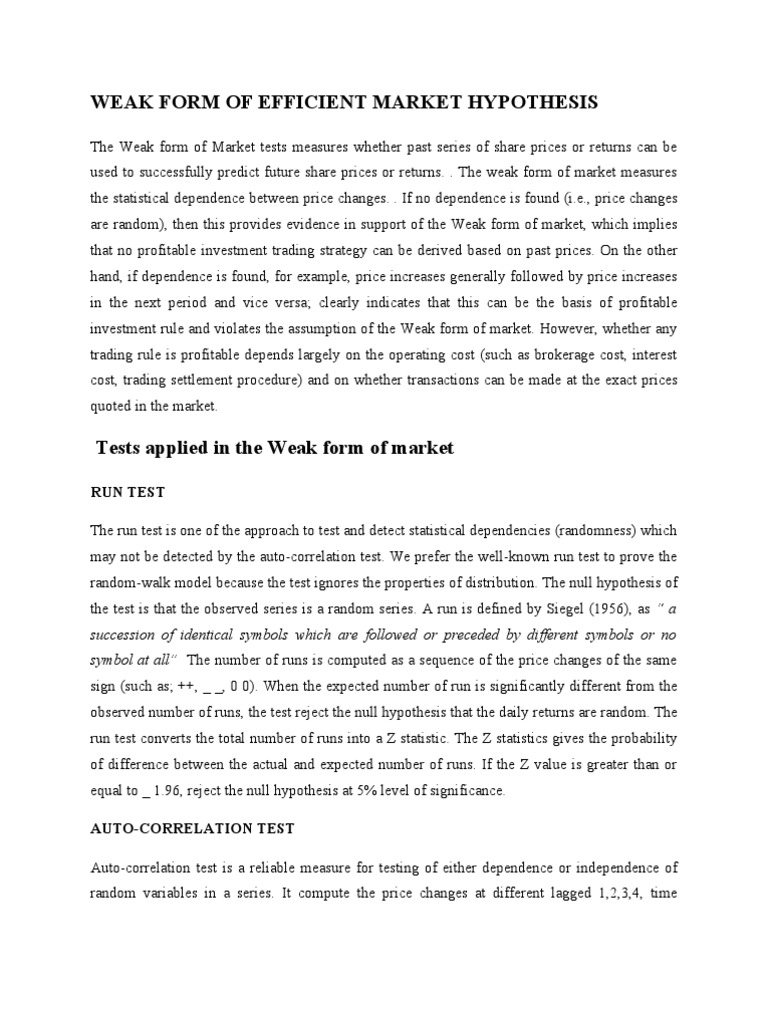

Weak Form of Efficient Market Hypothesis Correlation And Dependence

Web an ideal market is one in which prices provide accurate signals for resource allocation extreme null hypothesis: Ad enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more. Here's what each says about the market. Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web.

Download Investment Efficiency Theory Gif invenstmen

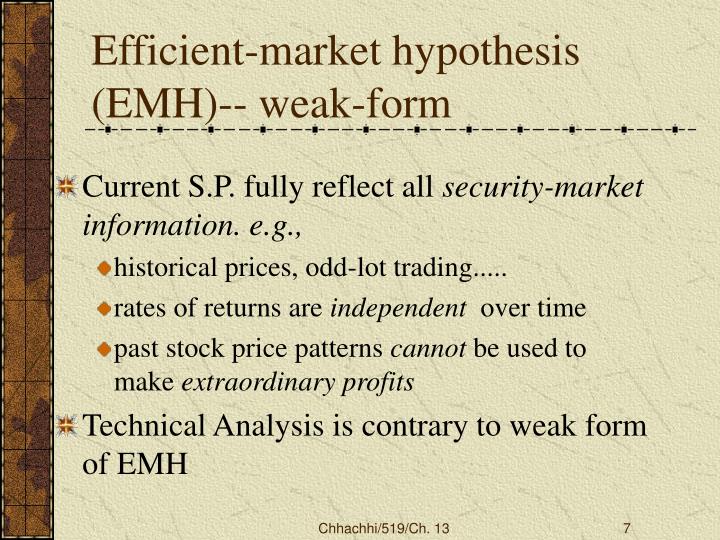

Web there are three forms of emh: The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new. Web types of efficient market hypothesis. Web an ideal market is one in which prices provide accurate signals for resource allocation extreme null hypothesis: A market is “efficient” if prices.

Weak form efficiency indian stock markets make money with meghan system

Web in this subsection, we briefly present the wavelet method used to assess the weak form of the efficient market hypothesis. Web there are three forms of emh: Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Here's what each says about the market. A.

PPT The Stock Market and Stock Prices PowerPoint Presentation, free

Weak form emh suggests that all past. The efficient market hypothesis concerns the extent to. Web types of efficient market hypothesis. Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. The paper extended and refined the theory, included the definitions for three forms of.

PPT Capital Market Efficiency The concepts PowerPoint Presentation

Web types of efficient market hypothesis. Here's what each says about the market. The efficient market hypothesis concerns the extent to. Ad enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more. Web types of efficient market hypothesis emh has three variations which constitute different market efficiency levels.

Efficient Market Theory/Hypothesis EMH Forms, Concepts BBAmantra

Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web there are three forms of emh: The paper extended and refined the theory, included the definitions for three forms of. Web types of efficient market hypothesis. Web in 1970, fama published a review of both.

Web This Problem Has Been Solved!

There are 3 types of efficient market hypothesis which are as discussed in points given below: Web types of efficient market hypothesis. The efficient market hypothesis concerns the extent to. Web this study tests the saudi stock market weak form using the weak form of an efficient market hypothesis and proposes a recurrent neural network (rnn) to produce.

Find Deals And Low Prices On Popular Products At Amazon.com

Web weak form efficiency, also known as the random walk theory, states that future securities' prices are random and not influenced by past events. Web in this subsection, we briefly present the wavelet method used to assess the weak form of the efficient market hypothesis. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new. Ad enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more.

The Basis Of Weak Form Efficiency Is, As The Qualifying Phrase To All Investors By Advisers Always Suggests:

Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web an ideal market is one in which prices provide accurate signals for resource allocation extreme null hypothesis: Weak form emh suggests that all past. A market is “efficient” if prices always “fully reflect” all.

Here's What Each Says About The Market.

You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Web types of efficient market hypothesis emh has three variations which constitute different market efficiency levels. The paper extended and refined the theory, included the definitions for three forms of. A wavelet is simply a small localized wave.