Energy Credit Form 5695 Instructions

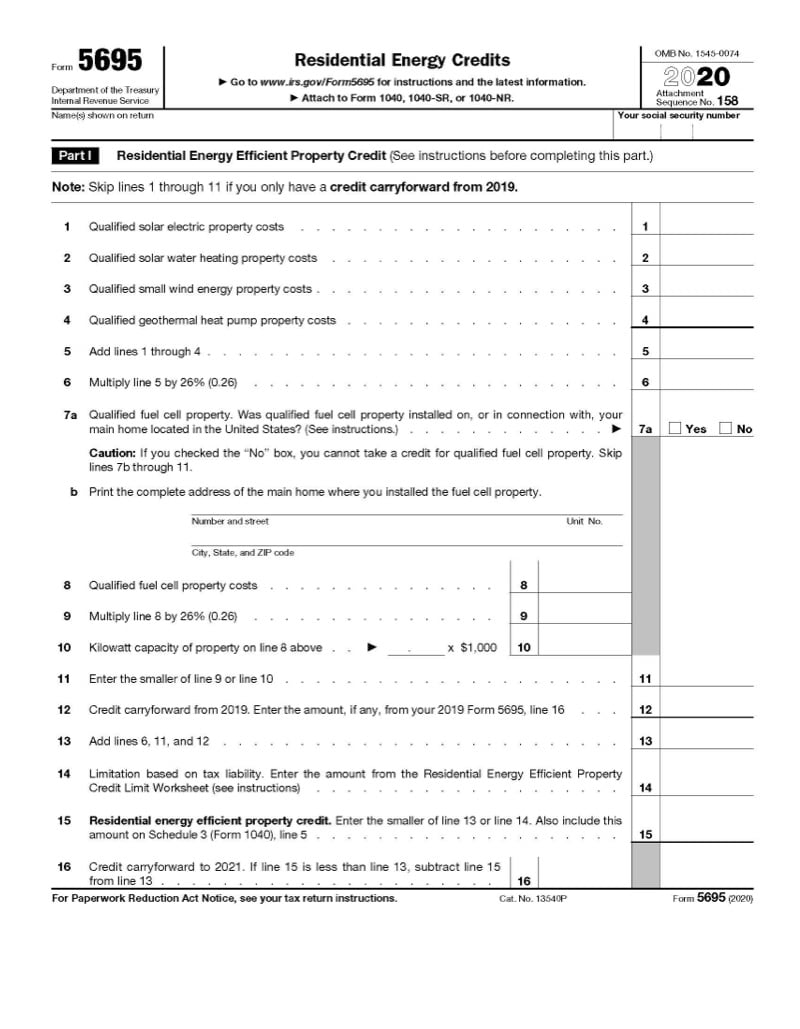

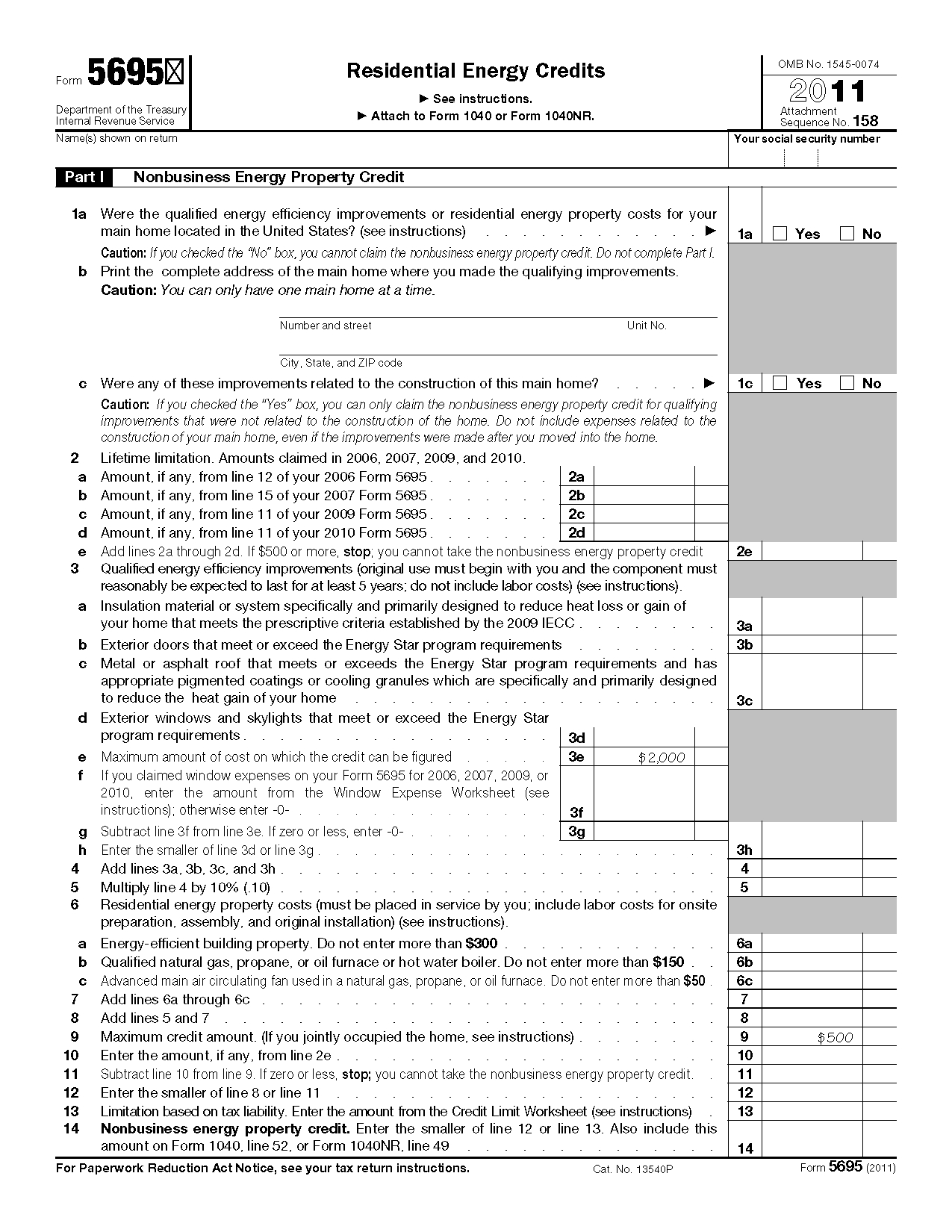

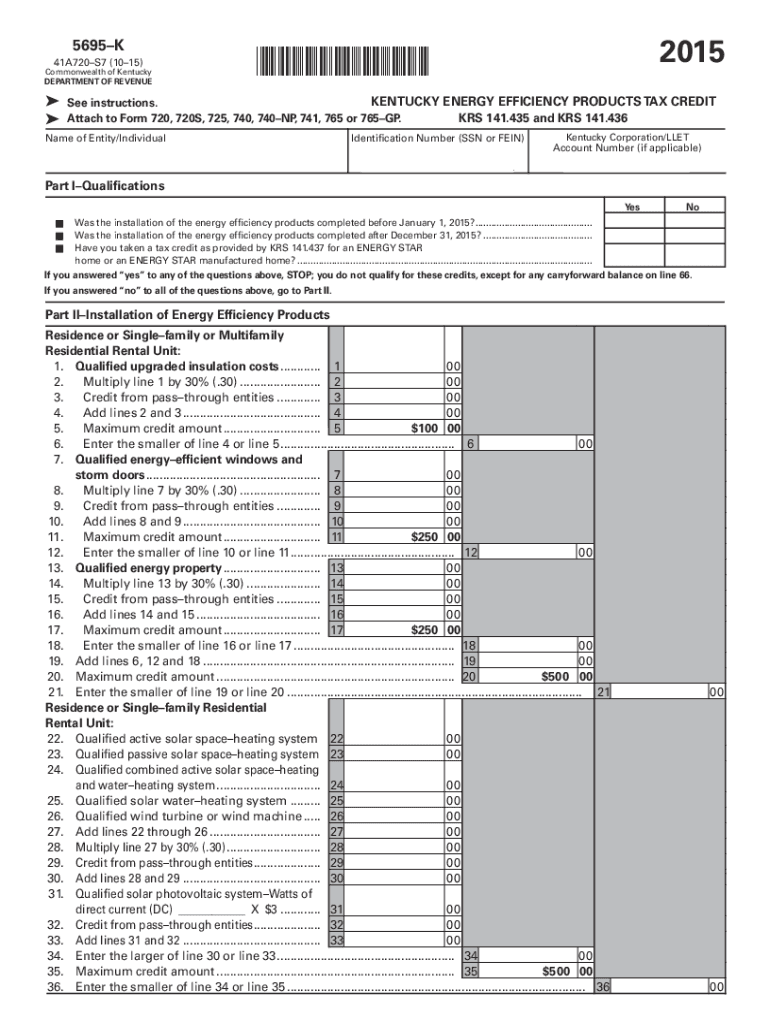

Energy Credit Form 5695 Instructions - The residential energy credits are: The residential energy credits are: • the residential clean energy credit, and • the energy. Use form 5695 to figure and take your residential energy credits. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:04 am overview. Also use form 5695 to take any. The residential energy credits are: Enter your energy efficiency property costs form 5695 calculates tax credits for a variety of qualified. Web per irs instructions for form 5695, page 1: • the residential energy efficient property credit, and • the nonbusiness energy property credit.

The residential energy credits are: Web irs instructions for form 5695. The residential energy credits are: Use form 5695 to figure and take. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:04 am overview. For any new energy efficient property complete the residential clean energy credit smart. Web instructions for filling out irs form 5695 for 2022 1. Enter your energy efficiency property costs form 5695 calculates tax credits for a variety of qualified. For instructions and the latest. Also use form 5695 to take.

The residential energy credits are: Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:04 am overview. Web per irs instructions for form 5695, page 1: Web the bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for form 5695. To use this feature, place your. Use form 5695 to figure and take your residential energy credits. Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. Web instructions for filling out irs form 5695 for 2022 1. Purpose of form use form 5695 to figure and take your residential energy credits. The residential energy credits are:

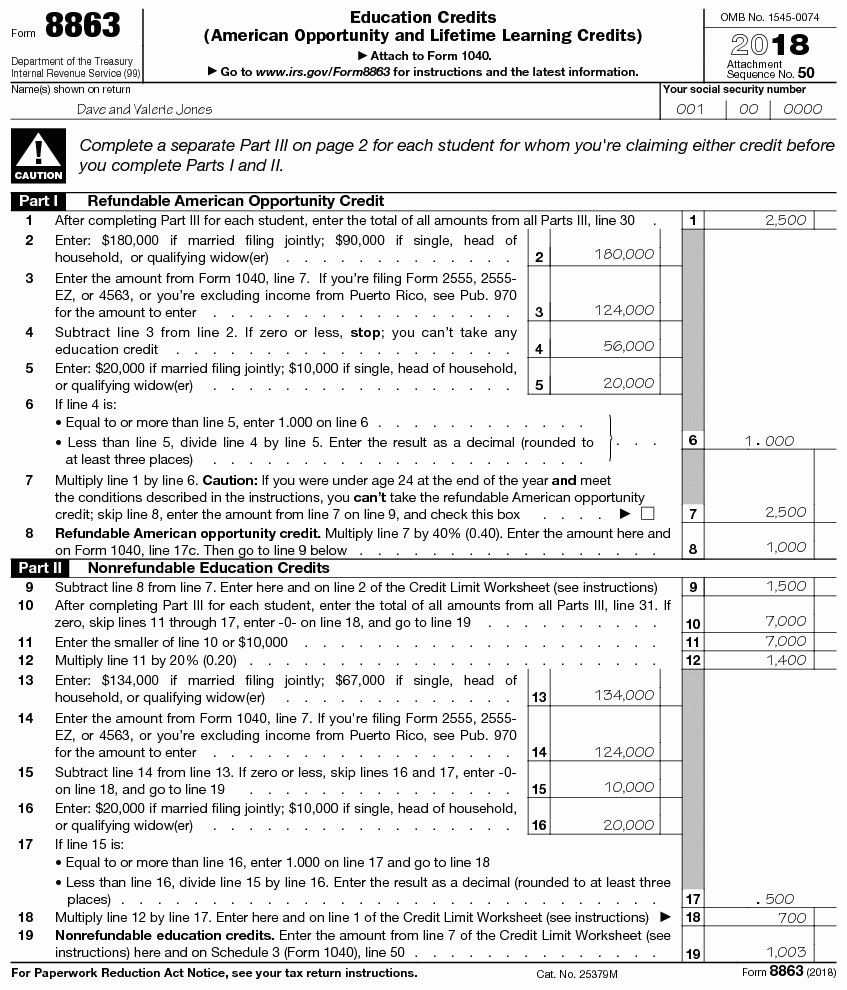

Form Instructions Is Available For How To File 5695 2018 —

Also use form 5695 to take. Web the bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for form 5695. Purpose of form use form 5695 to figure and take your residential energy credits. Use form 5695 to figure and take your residential energy credits..

Form 5695 Claiming Residential Energy Credits Jackson Hewitt

Also use form 5695 to take. The residential energy credits are: Also use form 5695 to take any. Web type 5695 to highlight the form 5695 and click ok to open the form. Also use form 5695 to take any.

Business Line Of Credit Stated 2022 Cuanmologi

The residential energy credits are: Recent legislation has made the nonbusiness energy. • the residential energy efficient property credit, and • the nonbusiness energy property credit. Limitation and credit amount details are also available for each field using the feature in lacerte. The residential energy credits are:

How to Claim the Federal Solar Investment Tax Credit Solar Sam

Web per irs instructions for form 5695, page 1: Web use form 5695 to figure and take your residential energy credits. • the residential energy efficient property credit, and • the nonbusiness energy property credit. Web the bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the.

Form 5695 Residential Energy Credits —

• the residential energy efficient property credit, and • the nonbusiness energy property credit. Web purpose of form use form 5695 to figure and take your residential energy credits. Department of the treasury internal revenue service. For any new energy efficient property complete the residential clean energy credit smart. The residential energy credits are:

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Recent legislation has made the nonbusiness energy. • the residential energy efficient property credit, and • the nonbusiness energy property credit. Also use form 5695 to take any. Use form 5695 to figure and take your residential energy credits. Web irs instructions for form 5695.

2020 Form 5695 Instructions Fill Out and Sign Printable PDF Template

Web instructions for filling out irs form 5695 for 2022 1. The residential energy credits are: Web use form 5695 to figure and take your residential energy credits. Limitation and credit amount details are also available for each field using the feature in lacerte. Nonbusiness energy property credit is available for 2018 and 2019.

Form 5695 Instructions Information On Form 5695 —

Web per irs instructions for form 5695, page 1: The residential energy credits are: Also use form 5695 to take any. To use this feature, place your. The residential energy credits are:

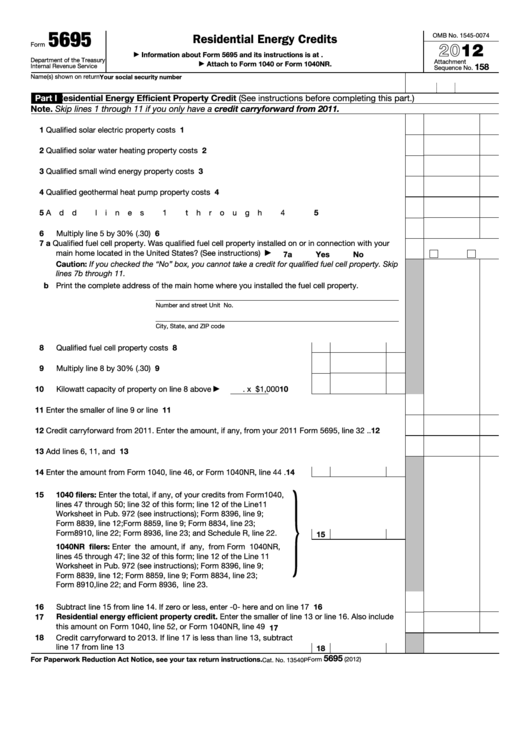

Fillable Form 5695 Residential Energy Credits 2012 printable pdf

Web purpose of form use form 5695 to figure and take your residential energy credits. Web the bipartisan budget act of 2018 extended the credits in part i of form 5695 residential energy credits until 2021 as told in the instructions for form 5695. For instructions and the latest. Recent legislation has made the nonbusiness energy. The residential energy credits.

Ev Federal Tax Credit Form

Purpose of form use form 5695 to figure and take your residential energy credits. Also use form 5695 to take. Recent legislation has made the nonbusiness energy. Web instructions for filling out irs form 5695 for 2022 1. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file.

Web The Bipartisan Budget Act Of 2018 Extended The Credits In Part I Of Form 5695 Residential Energy Credits Until 2021 As Told In The Instructions For Form 5695.

Web per irs instructions for form 5695, on page 1: Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. The residential energy credits are: Web use form 5695 to figure and take your residential energy credits.

The Residential Energy Credits Are:

Also use form 5695 to take. • the residential energy efficient property credit, and • the nonbusiness energy property credit. Web per irs instructions for form 5695, page 1: Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file.

Nonbusiness Energy Property Credit Is Available For 2018 And 2019.

Also use form 5695 to take any. Web instructions for filling out irs form 5695 for 2022 1. Web per irs instructions for form 5695, page 1: The residential energy credits are:

Department Of The Treasury Internal Revenue Service.

Also use form 5695 to take any. Web what is the irs form 5695? Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:04 am overview. Web purpose of form use form 5695 to figure and take your residential energy credits.