F Fcf Generated By Xyz In The Next 3 Years

F Fcf Generated By Xyz In The Next 3 Years - Based on the free cash flow valuation approach, you are asked to assess the value of the xyz company. Below, we'll show you how to calculate the present value of a stream of free cash flows expected over several years. Let's look at a simplistic example of using a dcf today and again next year, with the following assumptions for a restaurant. Will generate free cash flows (fcf) of $2 million, $2.5 million, and $2.75 million over the next three. When calculating intrinsic values you will need to project fcf for at least 10 years into the future and that is done by estimating. In this situation, an investor will have to determine why fcf dipped so quickly one year only to return to previous levels, and. Analysts have estimated that xyz inc. Banco industries expect sales to grow at a rapid rate over the next three years, but settle to an industry growth rate of 5% in year 4.

Analysts have estimated that xyz inc. Will generate free cash flows (fcf) of $2 million, $2.5 million, and $2.75 million over the next three. Banco industries expect sales to grow at a rapid rate over the next three years, but settle to an industry growth rate of 5% in year 4. Based on the free cash flow valuation approach, you are asked to assess the value of the xyz company. When calculating intrinsic values you will need to project fcf for at least 10 years into the future and that is done by estimating. Let's look at a simplistic example of using a dcf today and again next year, with the following assumptions for a restaurant. In this situation, an investor will have to determine why fcf dipped so quickly one year only to return to previous levels, and. Below, we'll show you how to calculate the present value of a stream of free cash flows expected over several years.

Will generate free cash flows (fcf) of $2 million, $2.5 million, and $2.75 million over the next three. Banco industries expect sales to grow at a rapid rate over the next three years, but settle to an industry growth rate of 5% in year 4. When calculating intrinsic values you will need to project fcf for at least 10 years into the future and that is done by estimating. Below, we'll show you how to calculate the present value of a stream of free cash flows expected over several years. Analysts have estimated that xyz inc. Let's look at a simplistic example of using a dcf today and again next year, with the following assumptions for a restaurant. Based on the free cash flow valuation approach, you are asked to assess the value of the xyz company. In this situation, an investor will have to determine why fcf dipped so quickly one year only to return to previous levels, and.

Updated Seems like Nexon wants F2P players to work on Ancient / Necro

Will generate free cash flows (fcf) of $2 million, $2.5 million, and $2.75 million over the next three. Banco industries expect sales to grow at a rapid rate over the next three years, but settle to an industry growth rate of 5% in year 4. In this situation, an investor will have to determine why fcf dipped so quickly one.

Solved Consider the following. f(x, y, z) = x^2yz xyz^6,

Below, we'll show you how to calculate the present value of a stream of free cash flows expected over several years. When calculating intrinsic values you will need to project fcf for at least 10 years into the future and that is done by estimating. In this situation, an investor will have to determine why fcf dipped so quickly one.

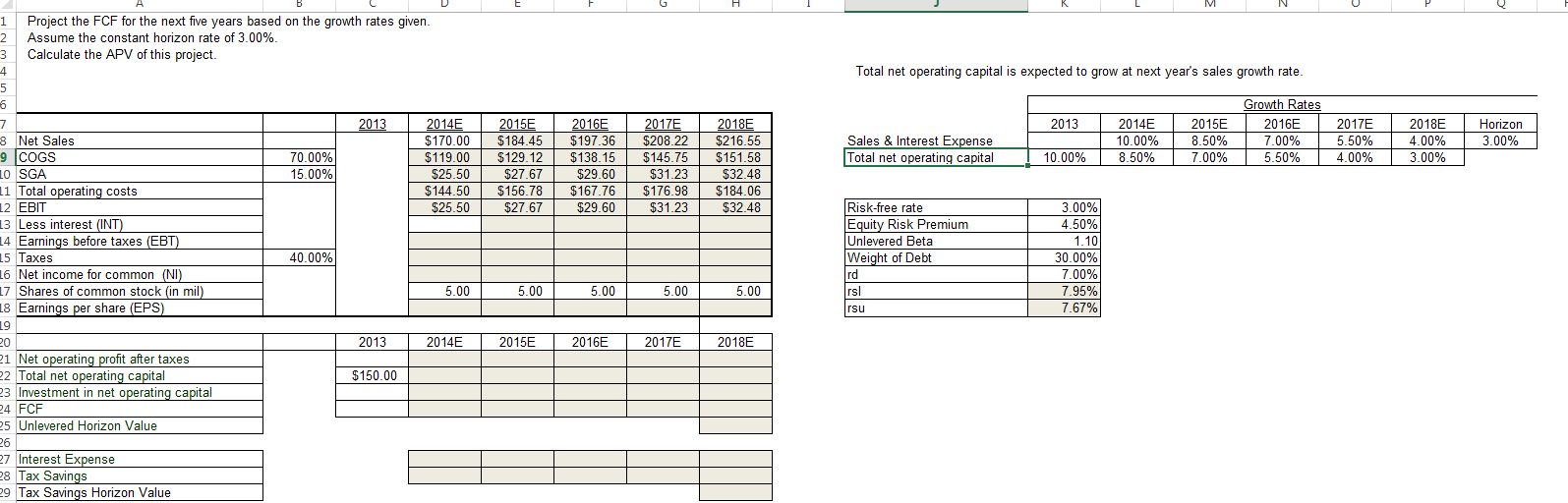

Solved Project the FCF for the next five years based on the

Below, we'll show you how to calculate the present value of a stream of free cash flows expected over several years. Will generate free cash flows (fcf) of $2 million, $2.5 million, and $2.75 million over the next three. Banco industries expect sales to grow at a rapid rate over the next three years, but settle to an industry growth.

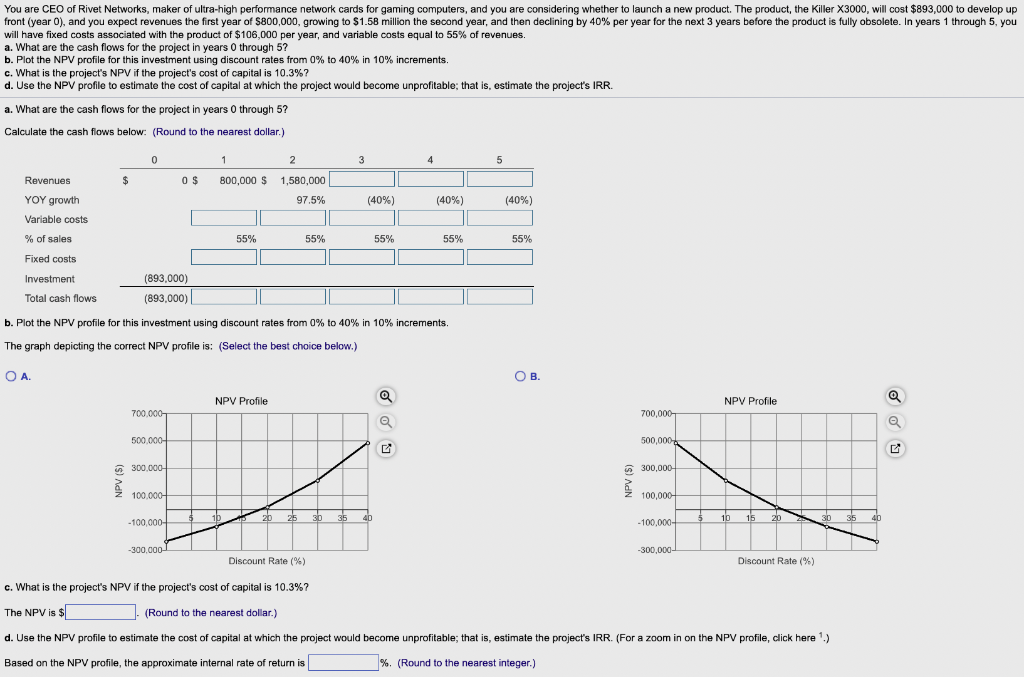

Solved You are CEO of Rivet Networks, maker of ultrahigh

In this situation, an investor will have to determine why fcf dipped so quickly one year only to return to previous levels, and. Below, we'll show you how to calculate the present value of a stream of free cash flows expected over several years. When calculating intrinsic values you will need to project fcf for at least 10 years into.

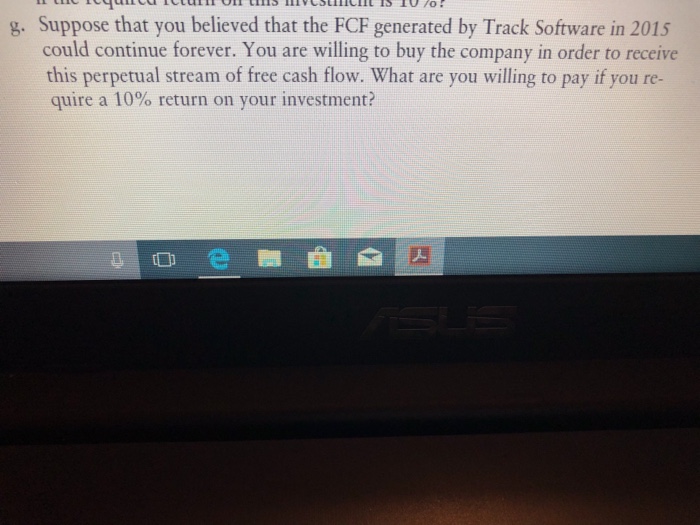

Solved g. Suppose that you believed that the FCF generated

Analysts have estimated that xyz inc. Based on the free cash flow valuation approach, you are asked to assess the value of the xyz company. Let's look at a simplistic example of using a dcf today and again next year, with the following assumptions for a restaurant. Will generate free cash flows (fcf) of $2 million, $2.5 million, and $2.75.

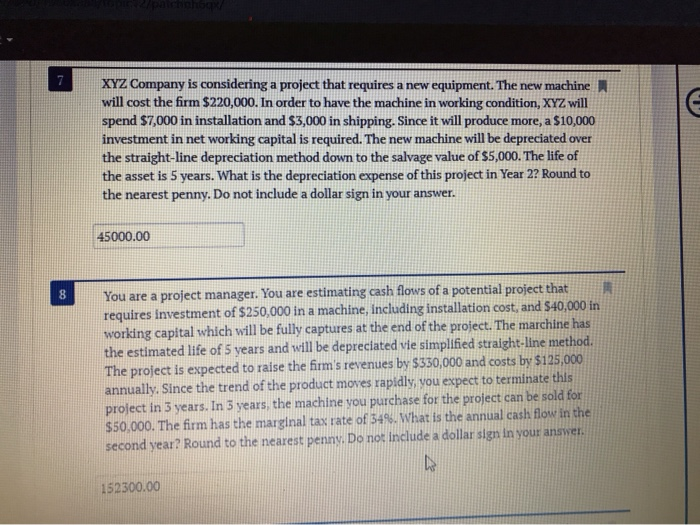

Solved 12 XYZ Company is considering whether a project

In this situation, an investor will have to determine why fcf dipped so quickly one year only to return to previous levels, and. Based on the free cash flow valuation approach, you are asked to assess the value of the xyz company. Will generate free cash flows (fcf) of $2 million, $2.5 million, and $2.75 million over the next three..

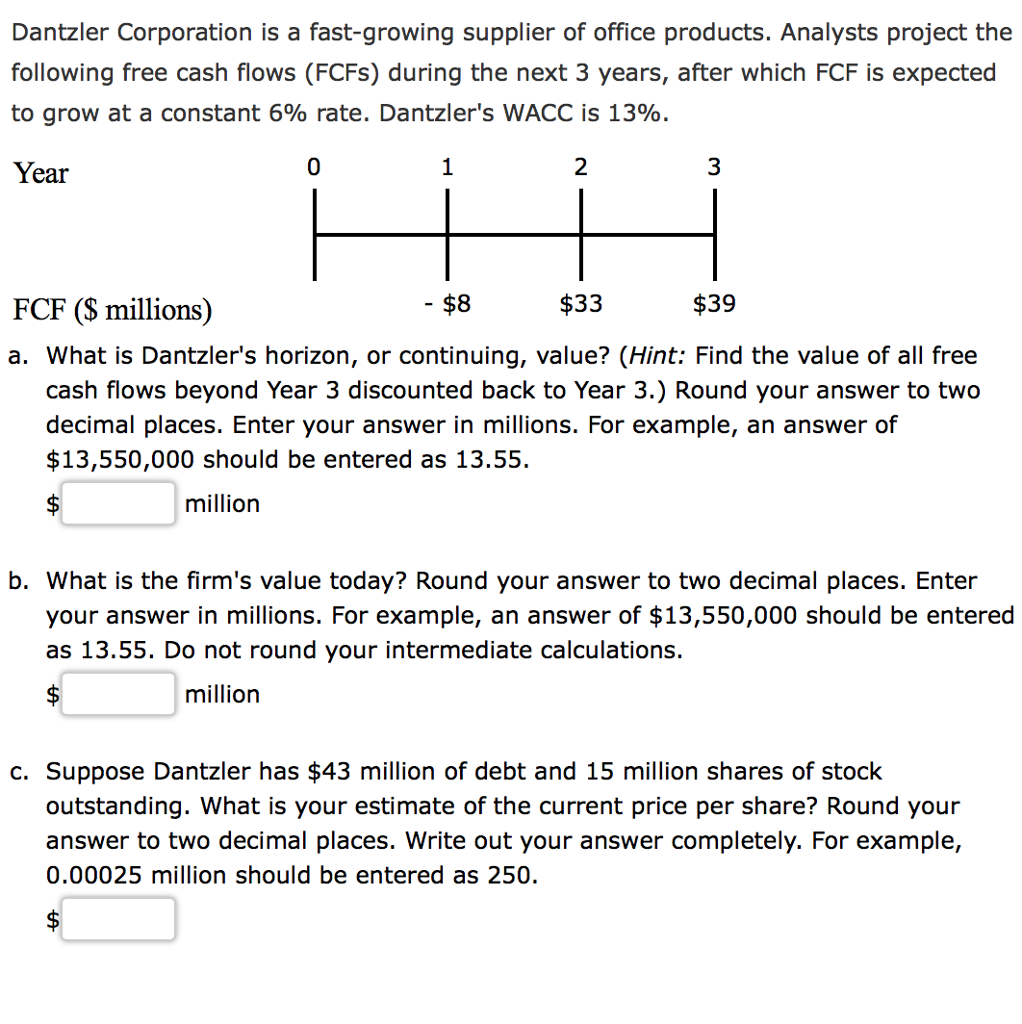

Solved Dantzler Corporation is a fastgrowing supplier of

When calculating intrinsic values you will need to project fcf for at least 10 years into the future and that is done by estimating. Will generate free cash flows (fcf) of $2 million, $2.5 million, and $2.75 million over the next three. Below, we'll show you how to calculate the present value of a stream of free cash flows expected.

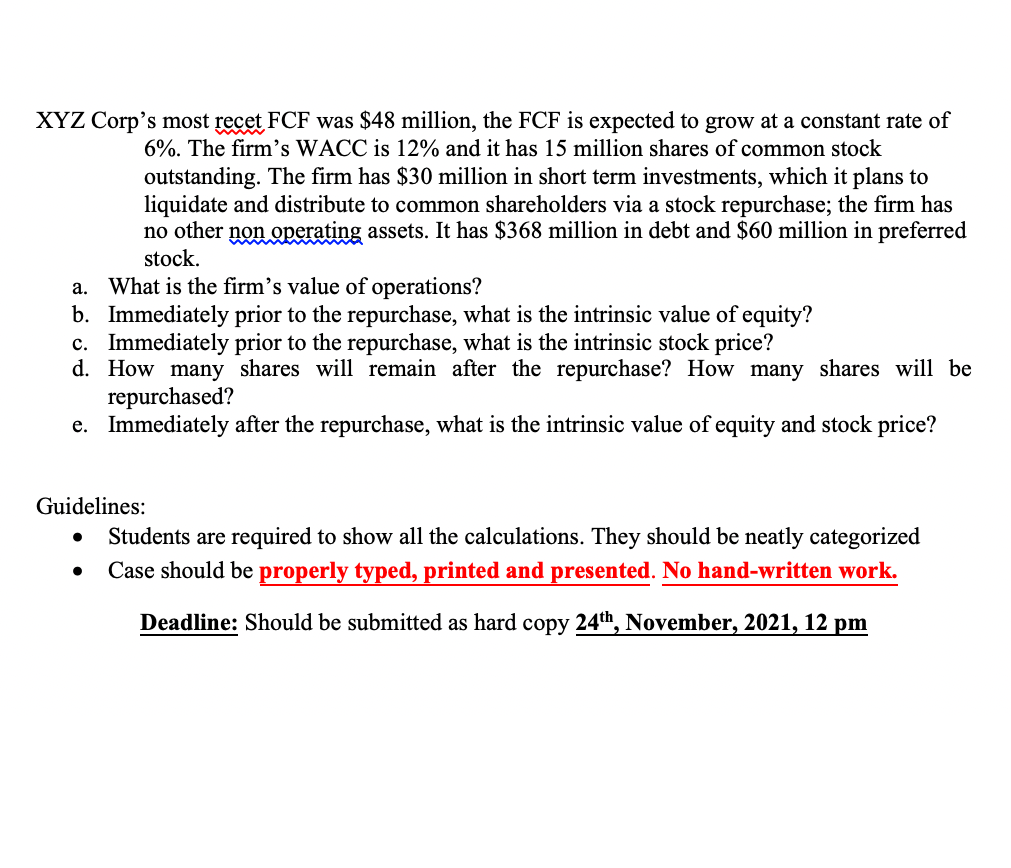

Solved XYZ Corp's most recet FCF was 48 million, the FCF is

Let's look at a simplistic example of using a dcf today and again next year, with the following assumptions for a restaurant. When calculating intrinsic values you will need to project fcf for at least 10 years into the future and that is done by estimating. Based on the free cash flow valuation approach, you are asked to assess the.

Answered What is the NPV of a project that costs… bartleby

Let's look at a simplistic example of using a dcf today and again next year, with the following assumptions for a restaurant. Will generate free cash flows (fcf) of $2 million, $2.5 million, and $2.75 million over the next three. Below, we'll show you how to calculate the present value of a stream of free cash flows expected over several.

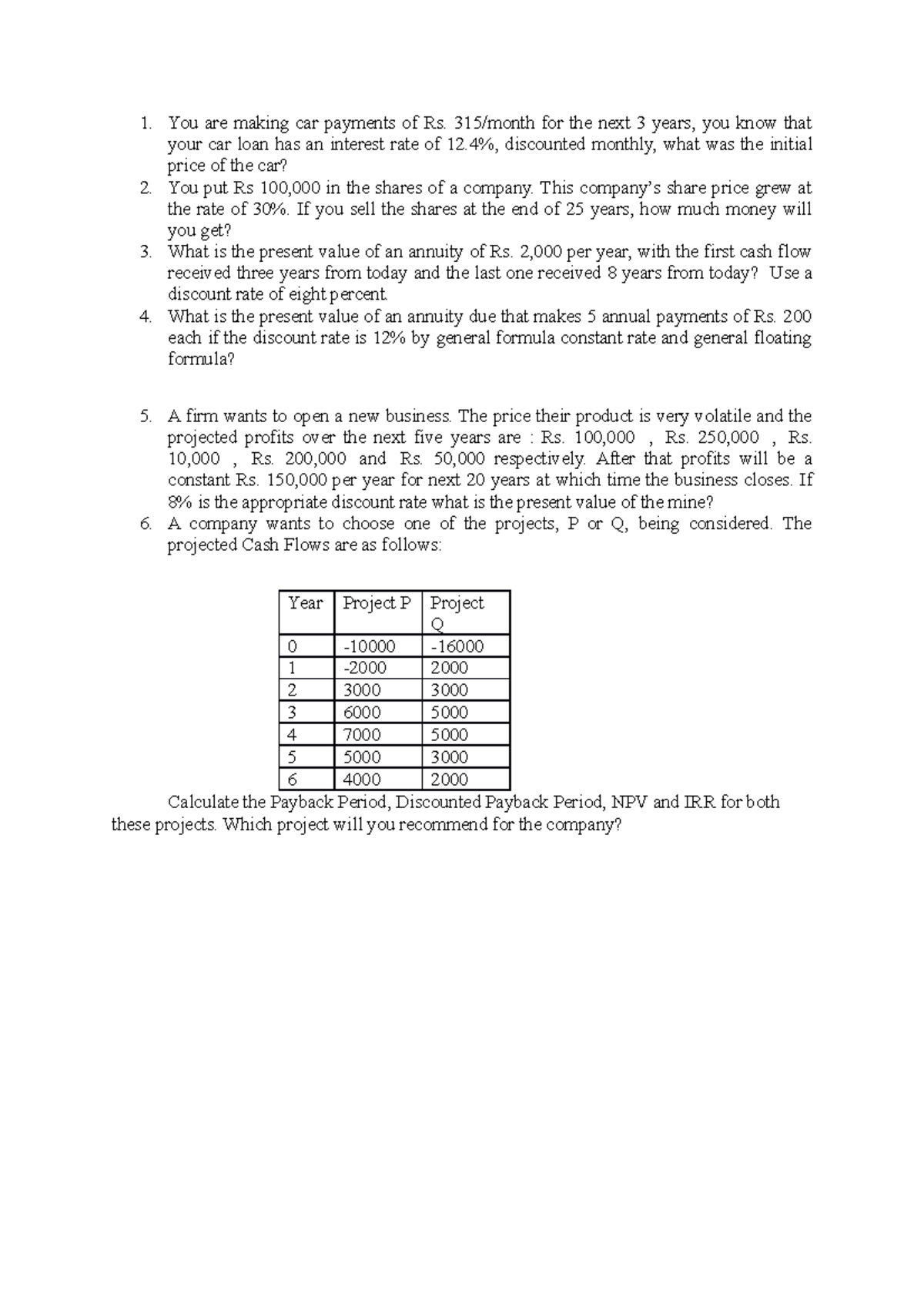

3a Capl Budgeting assignment You are making car payments of Rs. 315

Below, we'll show you how to calculate the present value of a stream of free cash flows expected over several years. In this situation, an investor will have to determine why fcf dipped so quickly one year only to return to previous levels, and. Analysts have estimated that xyz inc. Let's look at a simplistic example of using a dcf.

Below, We'll Show You How To Calculate The Present Value Of A Stream Of Free Cash Flows Expected Over Several Years.

Will generate free cash flows (fcf) of $2 million, $2.5 million, and $2.75 million over the next three. When calculating intrinsic values you will need to project fcf for at least 10 years into the future and that is done by estimating. Analysts have estimated that xyz inc. Banco industries expect sales to grow at a rapid rate over the next three years, but settle to an industry growth rate of 5% in year 4.

Let's Look At A Simplistic Example Of Using A Dcf Today And Again Next Year, With The Following Assumptions For A Restaurant.

Based on the free cash flow valuation approach, you are asked to assess the value of the xyz company. In this situation, an investor will have to determine why fcf dipped so quickly one year only to return to previous levels, and.