Failure To File Form 13H

Failure To File Form 13H - Web the rule requires that a person that exercises investment discretion, directly or indirectly (including through affiliates it controls), and effects transactions in. Web no duplicate paper filing requirement for form 5713. Web information required of large traders pursuant to section 13 (h) of the securities exchange act of 1934. Paper filers of form 5713 should not submit a duplicate copy of form 5713 when filing the form with their. After submitting this filing, the trader is given a. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Web nonrefundable filing fee $25.00. Following an initial filing of form 13h, all large traders must make an amended filing to correct inaccurate information promptly (within ten days) following. In addition, if a person does not. Amendment to form 13h due promptly for advisers that already have a form 13h filing obligation and have changes to any information reported.

Web if the large trader files form 13h, any controlled affiliates will not need to file their own forms. Web information required of large traders pursuant to section 13 (h) of the securities exchange act of 1934. Web the sec is able to request information about trades executed before a firm files a form 13h, if it knows or has reason to believe that a firm that has qualified as a large trader. Web the rule requires that a person that exercises investment discretion, directly or indirectly (including through affiliates it controls), and effects transactions in. Web if your firm meets this “large trader” test, your firm needs to report such status with the sec on a form 13h promptly after reaching such trading level (under normal. Payment of the filing fee should be. After submitting this filing, the trader is given a. Paper filers of form 5713 should not submit a duplicate copy of form 5713 when filing the form with their. Web the initial filing (form 13h) is required to be filed within 10 days of crossing the transaction threshold outlined above. In addition, if a person does not.

No personal or business checks accepted. Web if your firm meets this “large trader” test, your firm needs to report such status with the sec on a form 13h promptly after reaching such trading level (under normal. Payment of the filing fee should be. Paper filers of form 5713 should not submit a duplicate copy of form 5713 when filing the form with their. Web information required of large traders pursuant to section 13 (h) of the securities exchange act of 1934. Web the rule requires that a person that exercises investment discretion, directly or indirectly (including through affiliates it controls), and effects transactions in. Web if the large trader files form 13h, any controlled affiliates will not need to file their own forms. If a trader or other person does not meet or exceed the identifying activity level, it would not be required to file form 13h. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Amendment to form 13h due promptly for advisers that already have a form 13h filing obligation and have changes to any information reported.

Simplified EDGAR SEC Filing Services Form 13F Form 13H

Web the sec is able to request information about trades executed before a firm files a form 13h, if it knows or has reason to believe that a firm that has qualified as a large trader. Web no duplicate paper filing requirement for form 5713. Web if the filing is an “annual filing,” input the applicable calendar year. Alternatively, if.

From the Failure file Gallery eBaum's World

Following an initial filing of form 13h, all large traders must make an amended filing to correct inaccurate information promptly (within ten days) following. Web if your firm meets this “large trader” test, your firm needs to report such status with the sec on a form 13h promptly after reaching such trading level (under normal. Web information required of large.

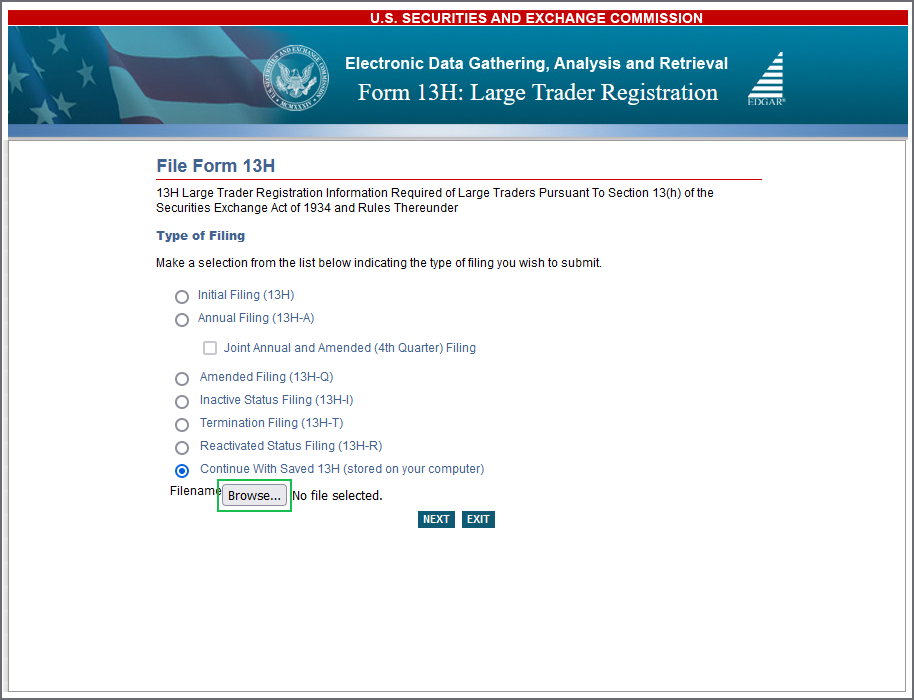

How do I file Form 13H? Novaworks Knowledge Center

An “amended filing” must be filed promptly following the end of the calendar quarter in which any of the. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Web no duplicate paper filing requirement for.

SEC Releases Information about Form 13H Filing Difficulties Novaworks

If a trader or other person does not meet or exceed the identifying activity level, it would not be required to file form 13h. No personal or business checks accepted. Web the sec is able to request information about trades executed before a firm files a form 13h, if it knows or has reason to believe that a firm that.

How To File Form 13H As A Day Trader YouTube

Web the initial filing (form 13h) is required to be filed within 10 days of crossing the transaction threshold outlined above. Web information required of large traders pursuant to section 13 (h) of the securities exchange act of 1934. An “amended filing” must be filed promptly following the end of the calendar quarter in which any of the. Web the.

Failure Tab

In addition, if a person does not. Web if the large trader files form 13h, any controlled affiliates will not need to file their own forms. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax..

SEC Risk Alert Investment Adviser Large Trader Form 13H

Web the initial filing (form 13h) is required to be filed within 10 days of crossing the transaction threshold outlined above. Web the rule requires that a person that exercises investment discretion, directly or indirectly (including through affiliates it controls), and effects transactions in. If a trader or other person does not meet or exceed the identifying activity level, it.

From the Failure file Gallery eBaum's World

No personal or business checks accepted. Paper filers of form 5713 should not submit a duplicate copy of form 5713 when filing the form with their. Web the sec is able to request information about trades executed before a firm files a form 13h, if it knows or has reason to believe that a firm that has qualified as a.

Form Follows Failure on Behance

Payment of the filing fee should be. An “amended filing” must be filed promptly following the end of the calendar quarter in which any of the. Web if the filing is an “annual filing,” input the applicable calendar year. Paper filers of form 5713 should not submit a duplicate copy of form 5713 when filing the form with their. Following.

Failure to file beneficial ownership details is a prosecutable offence

An “amended filing” must be filed promptly following the end of the calendar quarter in which any of the. Web if your firm meets this “large trader” test, your firm needs to report such status with the sec on a form 13h promptly after reaching such trading level (under normal. Web the initial filing (form 13h) is required to be.

Web The Rule Requires That A Person That Exercises Investment Discretion, Directly Or Indirectly (Including Through Affiliates It Controls), And Effects Transactions In.

Web no duplicate paper filing requirement for form 5713. In addition, if a person does not. After submitting this filing, the trader is given a. Web the sec is able to request information about trades executed before a firm files a form 13h, if it knows or has reason to believe that a firm that has qualified as a large trader.

Web If Your Firm Meets This “Large Trader” Test, Your Firm Needs To Report Such Status With The Sec On A Form 13H Promptly After Reaching Such Trading Level (Under Normal.

Web if the large trader files form 13h, any controlled affiliates will not need to file their own forms. No personal or business checks accepted. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Amendment to form 13h due promptly for advisers that already have a form 13h filing obligation and have changes to any information reported.

Paper Filers Of Form 5713 Should Not Submit A Duplicate Copy Of Form 5713 When Filing The Form With Their.

Payment of the filing fee should be. Web the initial filing (form 13h) is required to be filed within 10 days of crossing the transaction threshold outlined above. Following an initial filing of form 13h, all large traders must make an amended filing to correct inaccurate information promptly (within ten days) following. Web nonrefundable filing fee $25.00.

An “Amended Filing” Must Be Filed Promptly Following The End Of The Calendar Quarter In Which Any Of The.

Alternatively, if a large trader's controlled affiliates all file on form 13h,. Web if the filing is an “annual filing,” input the applicable calendar year. Web information required of large traders pursuant to section 13 (h) of the securities exchange act of 1934. If a trader or other person does not meet or exceed the identifying activity level, it would not be required to file form 13h.