Fax Number For Form 2848

Fax Number For Form 2848 - In this post, we will discuss where to fax form 2848. One common way to submit the form is by fax. Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter. Faxaroo accepts payment via visa or mastercard. Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center where the related return was, or will be, filed. Web we have provided a list of irs fax numbers above on where to fax your form 2848, based on your residency. To find the service center address, see the related tax return instructions. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Web once the form is completed and signed, it must be submitted to the irs. An irs power of attorney stays in effect for seven years, or until you or your representative rescinds it.

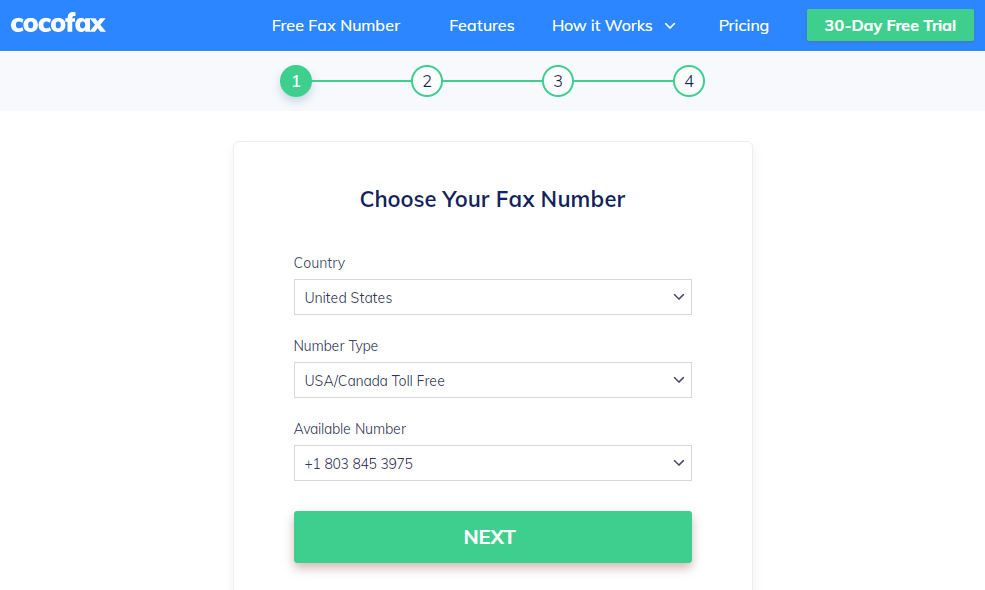

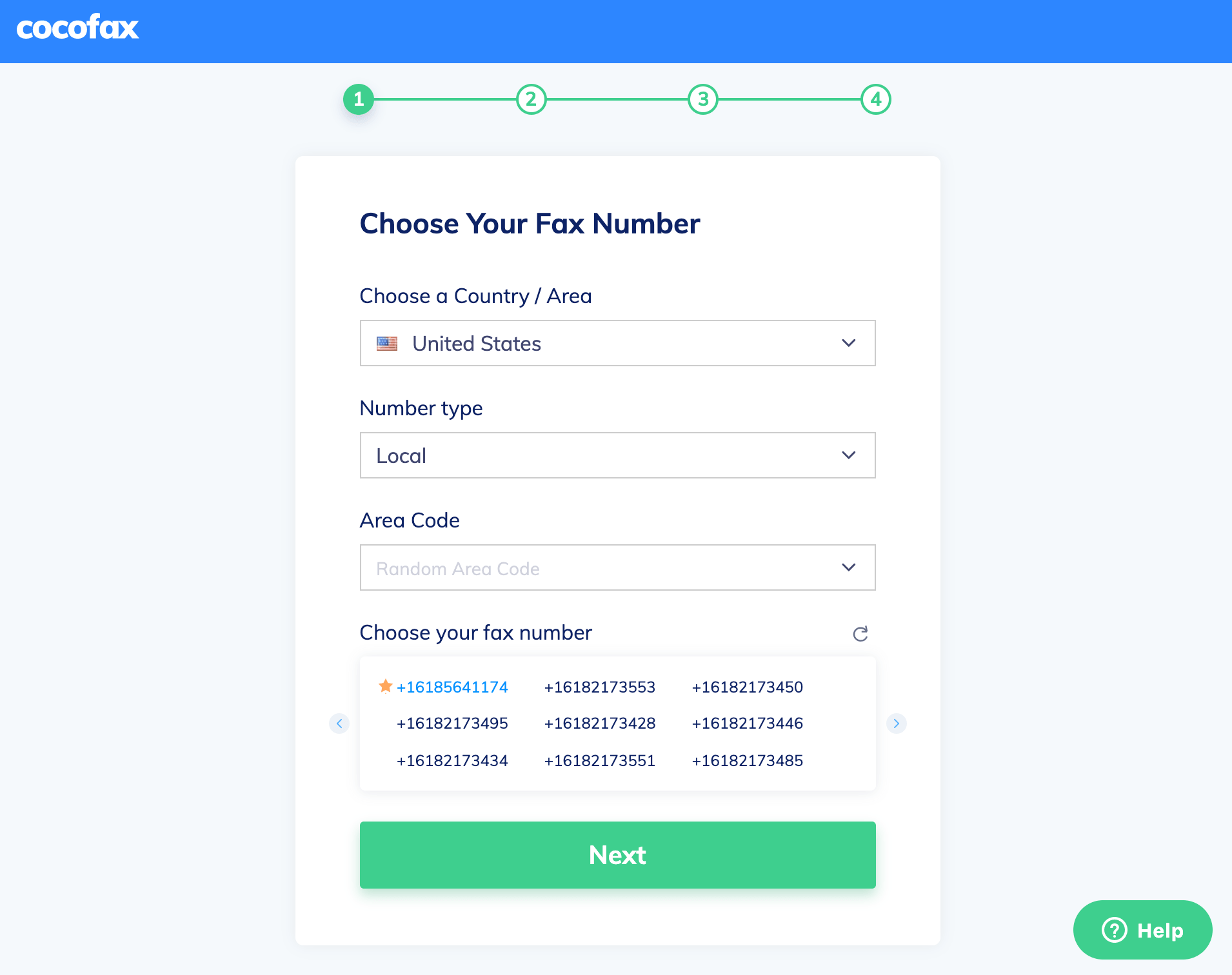

Mail your form 2848 directly to the irs address in the where to file chart. Web once the form is completed and signed, it must be submitted to the irs. Bottom line by filing form 2848, you’re essentially giving a third party the authority to act as. Web when you’re ready to submit form 2848, you can fax or mail it to one of the addresses listed on the form’s instructions. Once you’ve entered the correct irs fax number to send your form 2848, the final step is to confirm payment. Web that mailing address or fax number depends on the state in which you live. One common way to submit the form is by fax. Faxaroo accepts payment via visa or mastercard. Form 2848 is used to authorize an eligible individual to. Web we have provided a list of irs fax numbers above on where to fax your form 2848, based on your residency.

In this post, we will discuss where to fax form 2848. Web once the form is completed and signed, it must be submitted to the irs. Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter. Bottom line by filing form 2848, you’re essentially giving a third party the authority to act as. Form 2848 is used to authorize an eligible individual to. Where to file chart if you live in. Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center where the related return was, or will be, filed. Mail your form 2848 directly to the irs address in the where to file chart. One common way to submit the form is by fax. Web that mailing address or fax number depends on the state in which you live.

Breanna Form 2848 Fax Number Irs

Web when you’re ready to submit form 2848, you can fax or mail it to one of the addresses listed on the form’s instructions. Web even better than fax is to submit the form online. Web that mailing address or fax number depends on the state in which you live. Faxaroo accepts payment via visa or mastercard. Web we have.

Breanna Form 2848 Fax Number Irs

Fax number* alabama, arkansas, connecticut, delaware, district of In this post, we will discuss where to fax form 2848. Form 8821, tax information authorization pdf. Where to file chart if you live in. You can find the address and fax number for your state in the 'where to file chart' included with the irs instructions for form 2848.

Easy Methods to Send and Receive Faxes from Gmail Technogog

You can find the address and fax number for your state in the 'where to file chart' included with the irs instructions for form 2848. Web when you’re ready to submit form 2848, you can fax or mail it to one of the addresses listed on the form’s instructions. Web that mailing address or fax number depends on the state.

Breanna Form 2848 Fax Number Irs

Form 8821, tax information authorization pdf. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart. The irs provides a dedicated fax number for taxpayers to submit form 2848. You can find the address and fax number for your state in the 'where to file chart' included with the irs instructions for.

Send your Form 2848 to the IRS securely via fax Faxaroo

To find the service center address, see the related tax return instructions. If form 2848 is for a specific use, mail or fax it to the Form 8821, tax information authorization pdf. An irs power of attorney stays in effect for seven years, or until you or your representative rescinds it. Bottom line by filing form 2848, you’re essentially giving.

Form 2848 Example

One common way to submit the form is by fax. Form 2848 is used to authorize an eligible individual to. Web when you’re ready to submit form 2848, you can fax or mail it to one of the addresses listed on the form’s instructions. Bottom line by filing form 2848, you’re essentially giving a third party the authority to act.

5 Best Free Fax Software for Windows 10/8/7/XP

If form 2848 is for a specific use, mail or fax it to the An irs power of attorney stays in effect for seven years, or until you or your representative rescinds it. Web that mailing address or fax number depends on the state in which you live. Form 2848 is used to authorize an eligible individual to. Web even.

How to Get Fax Number From Computer or Email

In this post, we will discuss where to fax form 2848. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Web submit forms 2848 and 8821 online. The irs provides a dedicated fax number for taxpayers to submit form 2848. Bottom line by filing form 2848,.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Bottom line by filing form 2848, you’re essentially giving a third party the authority to act as. One common way to submit the form is by fax. Web once the form is completed and signed, it must be submitted to the irs. The irs provides a dedicated fax number for taxpayers to submit form 2848. Web submit forms 2848 and.

Fax and Business Tips Faxburner Blog

Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter. Faxaroo accepts payment via visa or mastercard. If form 2848 is for a specific use, mail or fax it to the Web submit forms 2848 and 8821 online. Web information about form 2848, power of attorney and declaration.

In This Post, We Will Discuss Where To Fax Form 2848.

Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center where the related return was, or will be, filed. Web even better than fax is to submit the form online. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file.

Web Once The Form Is Completed And Signed, It Must Be Submitted To The Irs.

The irs provides a dedicated fax number for taxpayers to submit form 2848. Web that mailing address or fax number depends on the state in which you live. Once you’ve entered the correct irs fax number to send your form 2848, the final step is to confirm payment. To find the service center address, see the related tax return instructions.

If Form 2848 Is For A Specific Use, Mail Or Fax It To The

Form 8821, tax information authorization pdf. Where to file chart if you live in. Faxaroo accepts payment via visa or mastercard. Web when you’re ready to submit form 2848, you can fax or mail it to one of the addresses listed on the form’s instructions.

Form 2848 Is Used To Authorize An Eligible Individual To.

Bottom line by filing form 2848, you’re essentially giving a third party the authority to act as. Web submit forms 2848 and 8821 online. An irs power of attorney stays in effect for seven years, or until you or your representative rescinds it. You can find the address and fax number for your state in the 'where to file chart' included with the irs instructions for form 2848.