Federal Form 8995

Federal Form 8995 - Form 8995 and form 8995a. Tax form 8995 for 2022 is. Web form 8995 is the simplified form and is used if all of the following are true: Web what is form 8995? Ad register and subscribe now to work on your irs 8995 & more fillable forms. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web the federal form 8995, also known as the qualified business income deduction simplified computation, must be filed by us taxpayers eligible for the qbid. Web this deduction can be as much as 20% of the taxpayer's qualified business income, making it an essential aspect of tax planning for eligible taxpayers. Go digital and save time with signnow, the best solution for. This printable form 8995 allows eligible.

Web what is form 8995? If your income is over $170,050 for. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Web form 8995 is the simplified form and is used if all of the following are true: This printable form 8995 allows eligible. Web irs form 8995 is a crucial document for taxpayers in the united states as it pertains to the qualified business income (qbi) deduction. Web up to $40 cash back get, create, make and sign how to fill out irs form 8995. Web the federal form 8995, also known as the qualified business income deduction simplified computation, must be filed by us taxpayers eligible for the qbid. Ad register and subscribe now to work on your irs 8995 & more fillable forms. Web • if your total taxable income before the credit falls below $170,050 for single filers or $340,100 for joint filers, use form 8995.

Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web form 8995 is the simplified form and is used if all of the following are true: Go digital and save time with signnow, the best solution for. Form 8995 and form 8995a. Web the federal form 8995, also known as the qualified business income deduction simplified computation, must be filed by us taxpayers eligible for the qbid. Printing and scanning is no longer the best way to manage documents. Tax form 8995 for 2022 is. Web handy tips for filling out 2020 8995 online. Web up to $40 cash back get, create, make and sign how to fill out irs form 8995. Web irs form 8995 is a crucial document for taxpayers in the united states as it pertains to the qualified business income (qbi) deduction.

Qualified Business Deduction Worksheet Example Math Worksheets

Web what is form 8995? If your income is over $170,050 for. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Printing and scanning is no longer the best way to manage documents. Go digital and save time with signnow, the best solution for.

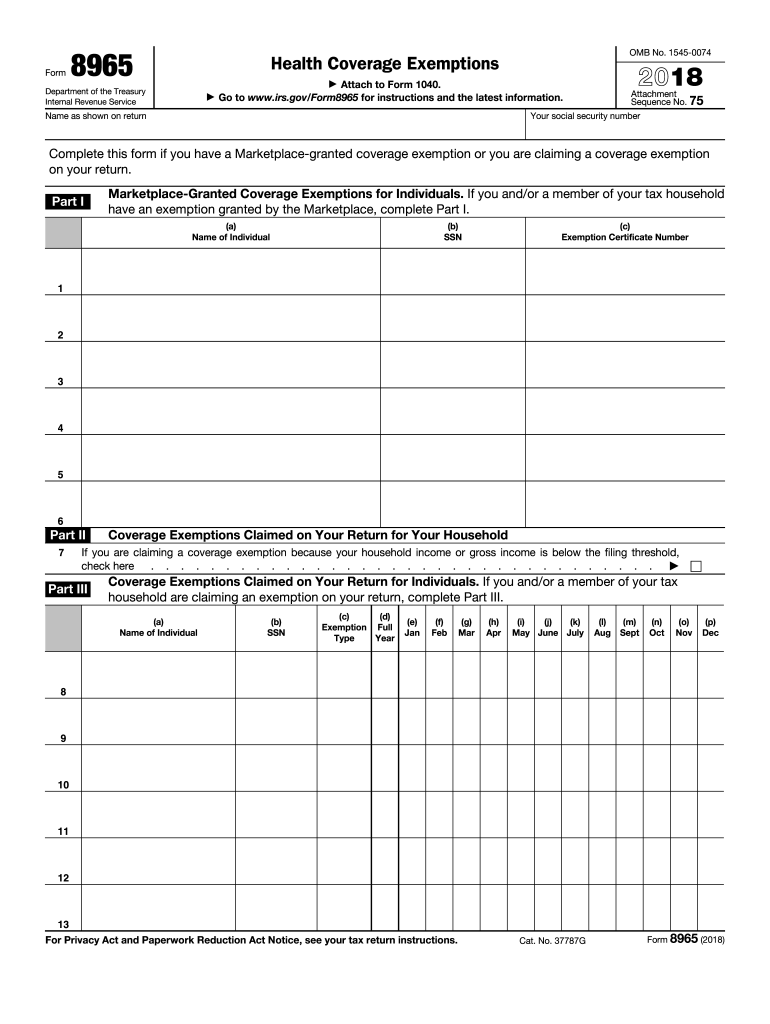

20182023 Form IRS 8965 Fill Online, Printable, Fillable, Blank pdfFiller

Go digital and save time with signnow, the best solution for. Type text, complete fillable fields, insert images, highlight or blackout. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). This form is for income earned in tax year 2022, with tax returns due in april 2023. When attached to the.

Online Advertising; Do Your 2019 Tax Return Right with IRS VITA

This printable form 8995 allows eligible. Web handy tips for filling out 2020 8995 online. Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041. Ad register and subscribe now to work on your irs 8995 & more fillable forms. Web up to.

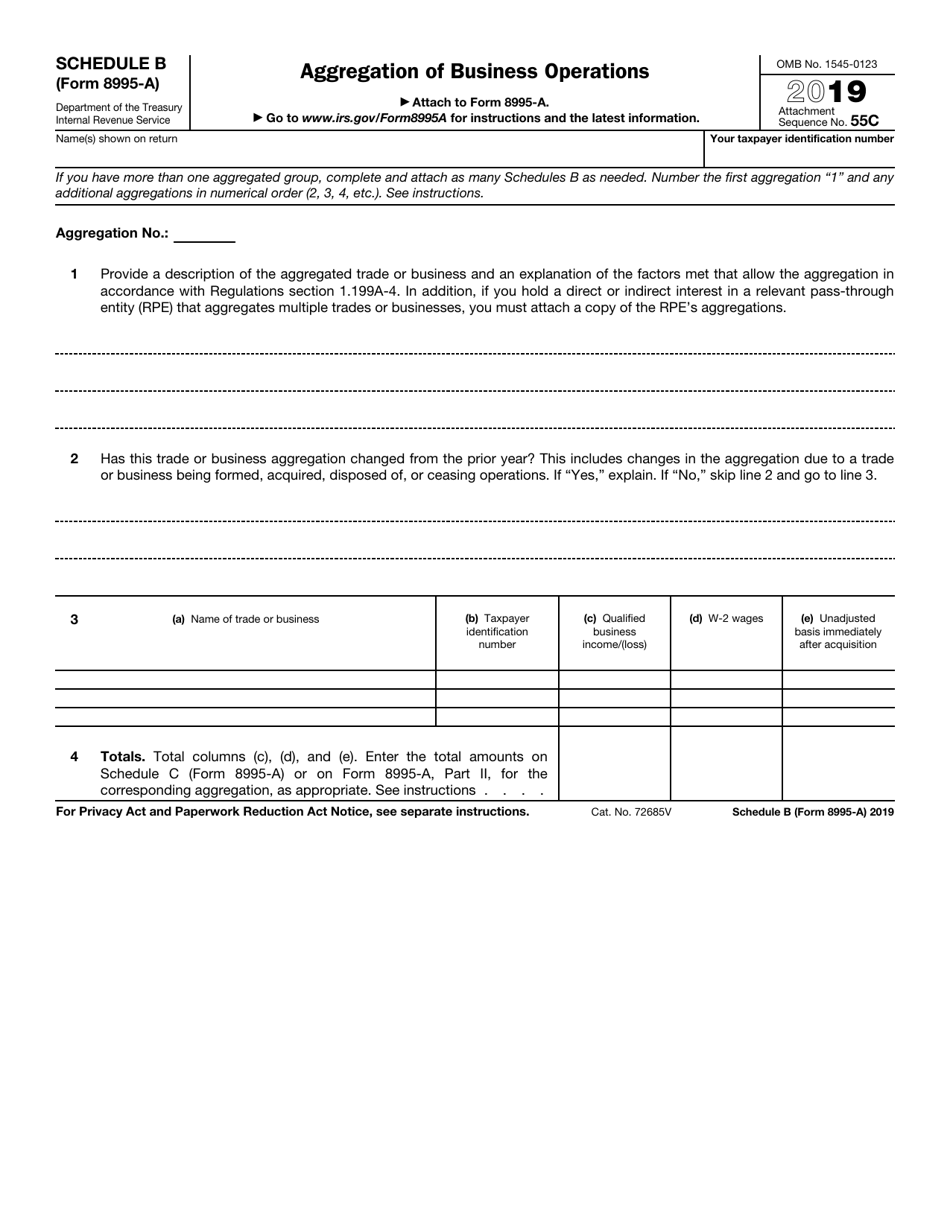

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web form 8995 is the simplified form and is used if all of the following are true: Web 8995 qualified business income deduction form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to. Type text,.

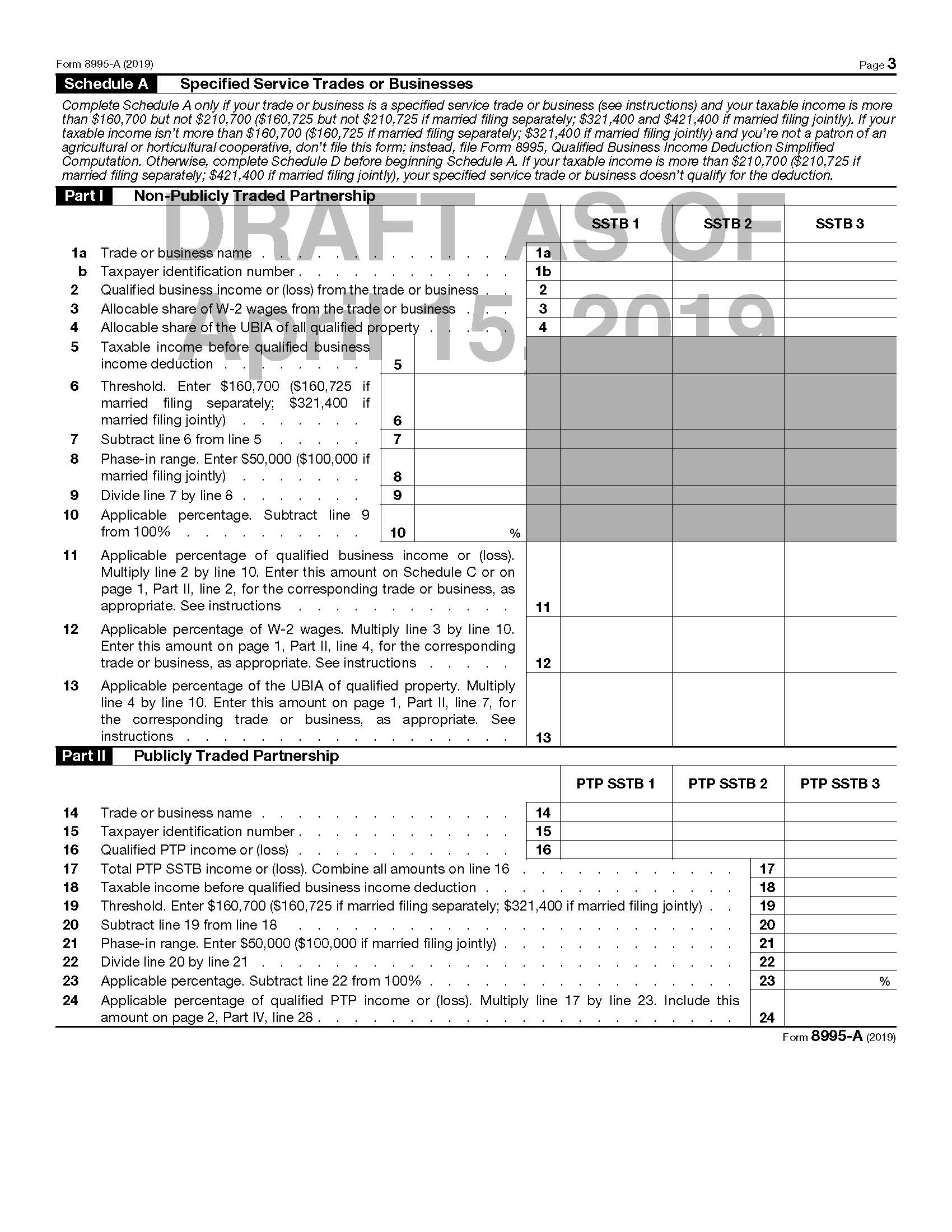

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

This printable form 8995 allows eligible. Printing and scanning is no longer the best way to manage documents. Edit your 2018 form 8995 form online. Web the federal form 8995, also known as the qualified business income deduction simplified computation, must be filed by us taxpayers eligible for the qbid. The individual has qualified business income (qbi), qualified reit dividends,.

Form 8995 Basics & Beyond

Printing and scanning is no longer the best way to manage documents. Web the federal form 8995, also known as the qualified business income deduction simplified computation, must be filed by us taxpayers eligible for the qbid. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully.

Instructions for Form 8995 (2019) Internal Revenue Service Small

Ad register and subscribe now to work on your irs 8995 & more fillable forms. Form 8995 and form 8995a. Web we last updated federal 8995 in january 2023 from the federal internal revenue service. Complete, edit or print tax forms instantly. Web 8995 qualified business income deduction form 8995 department of the treasury internal revenue service qualified business income.

Online Advertising; Do Your 2020 Tax Return Right with IRS VITA

Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Web irs form 8995 is a crucial document for taxpayers in the united states as it pertains to the qualified business income (qbi) deduction. Web the form 8995 used to compute the.

Mason + Rich Blog NH’s CPA Blog

Web handy tips for filling out 2020 8995 online. Go digital and save time with signnow, the best solution for. Web 8995 qualified business income deduction form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to. When attached to the esbt tax. Web we last updated the qualified business income deduction simplified computation.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

Web handy tips for filling out 2020 8995 online. Edit your 2018 form 8995 form online. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Type text, complete fillable fields, insert images, highlight or blackout. Web irs form 8995 is a.

Printing And Scanning Is No Longer The Best Way To Manage Documents.

Edit your 2018 form 8995 form online. Ad register and subscribe now to work on your irs 8995 & more fillable forms. Web 8995 qualified business income deduction form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to. Web irs form 8995 is a crucial document for taxpayers in the united states as it pertains to the qualified business income (qbi) deduction.

Go Digital And Save Time With Signnow, The Best Solution For.

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web up to $40 cash back get, create, make and sign how to fill out irs form 8995. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web handy tips for filling out 2020 8995 online.

If Your Income Is Over $170,050 For.

Web this deduction can be as much as 20% of the taxpayer's qualified business income, making it an essential aspect of tax planning for eligible taxpayers. Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041. When attached to the esbt tax. Type text, complete fillable fields, insert images, highlight or blackout.

Tax Form 8995 For 2022 Is.

Web what is form 8995? Web form 8995 is the simplified form and is used if all of the following are true: Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Web • if your total taxable income before the credit falls below $170,050 for single filers or $340,100 for joint filers, use form 8995.