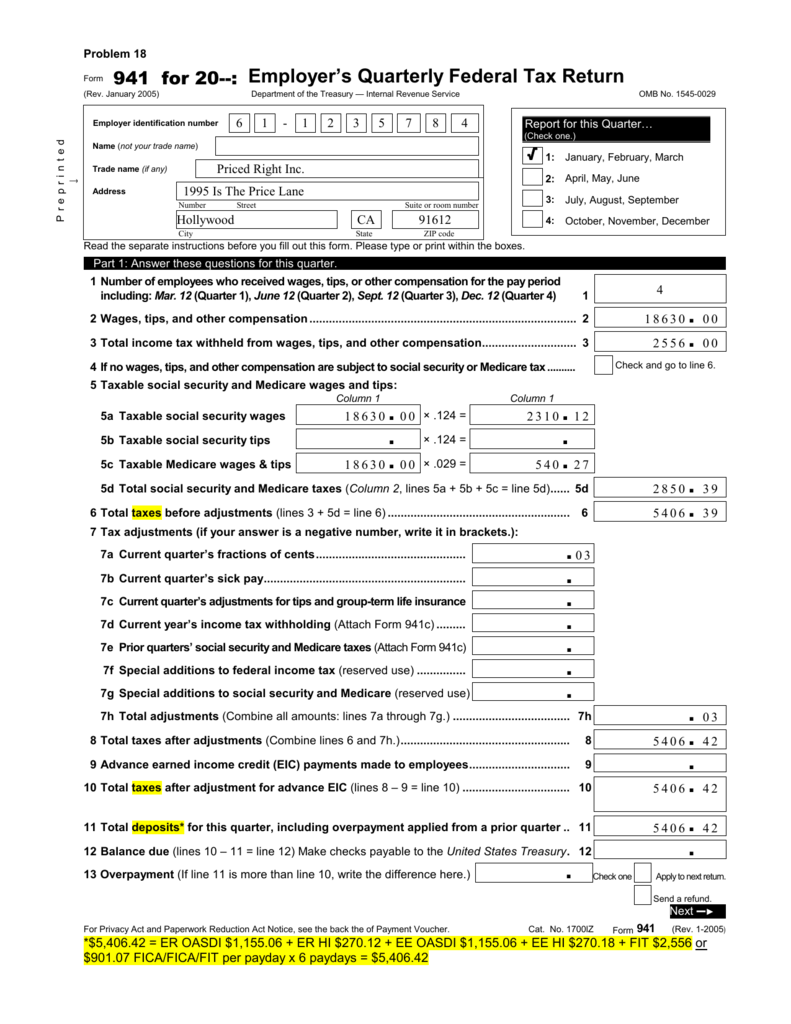

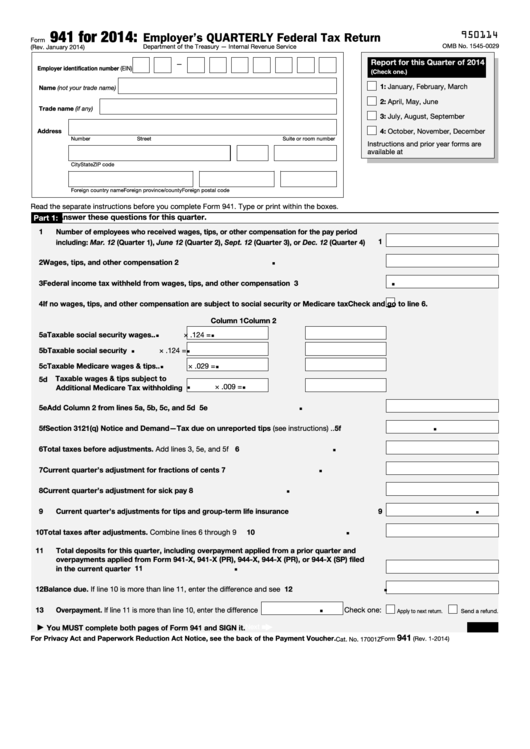

Federal Form 941 For 2014

Federal Form 941 For 2014 - Employers use this form to report income taxes, social security. We ask for the information on form 941 to carry out the internal revenue laws of the united states. This can be accessed through. It is based on wages that were paid from april 1,. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web july 20, 2023. Web form 941 for 2014: Ad access irs tax forms. In general, an employer must electronically transfer to the internal revenue service (irs). Web irs form 941, employer’s quarterly tax return, replaced these forms more than 70 years ago and has been used by businesses to report federal income tax.

Checkmark=cross employer’s quarterly federal tax return. Web there are two options for filing form 941: Employer's quarterly federal tax return? At this time, the irs. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web about form 941, employer's quarterly federal tax return. Web irs form 941, employer’s quarterly tax return, replaced these forms more than 70 years ago and has been used by businesses to report federal income tax. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web form 941 for 2023: Don't use an earlier revision to report taxes for 2023.

October, november, december go to www.irs.gov/form941 for instructions and the latest. It is based on wages that were paid from april 1,. Ad access irs tax forms. However, if you pay an amount with. In general, an employer must electronically transfer to the internal revenue service (irs). Web form 941 is a quarterly form, meaning employers are required to file it on a quarterly basis. At this time, the irs. Complete irs tax forms online or print government tax documents. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web form 941 for 2023:

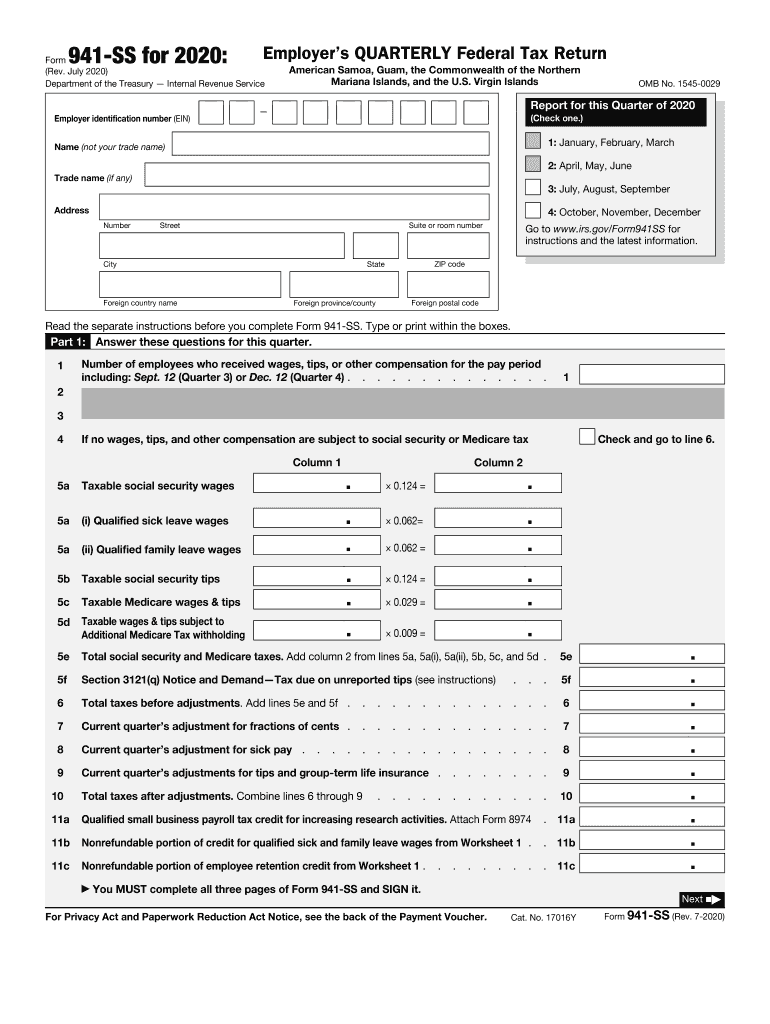

Printable 941 Form For 2020 Printable World Holiday

Employers use this form to report income taxes, social security. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web there are two options for filing form 941: Web form 941 is a quarterly form, meaning employers are required to file it on a quarterly basis. You must file form 941 by the following due dates for.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

This can be accessed through. Web about form 941, employer's quarterly federal tax return. We ask for the information on form 941 to carry out the internal revenue laws of the united states. Web july 20, 2023. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states.

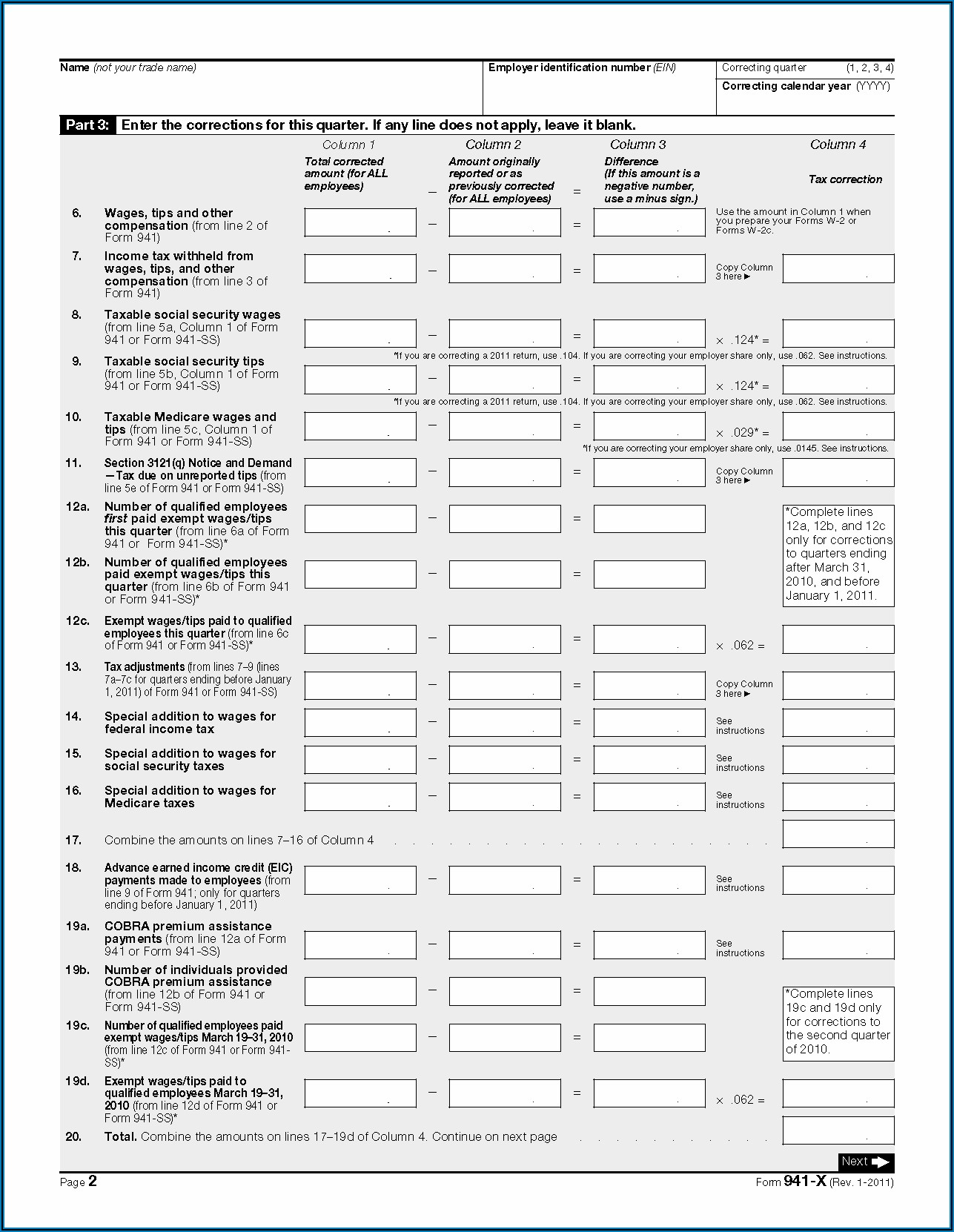

Federal Tax Form 941944 Form Resume Examples MoYoAG6W2Z

Web irs form 941, employer’s quarterly tax return, replaced these forms more than 70 years ago and has been used by businesses to report federal income tax. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Snohomish county tax preparer pleads guilty to assisting in the. We need it to figure.

form 941 DriverLayer Search Engine

Web about form 941, employer's quarterly federal tax return. Web form 941 is a quarterly form, meaning employers are required to file it on a quarterly basis. Complete irs tax forms online or print government tax documents. Employer's quarterly federal tax return? Web there are two options for filing form 941:

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

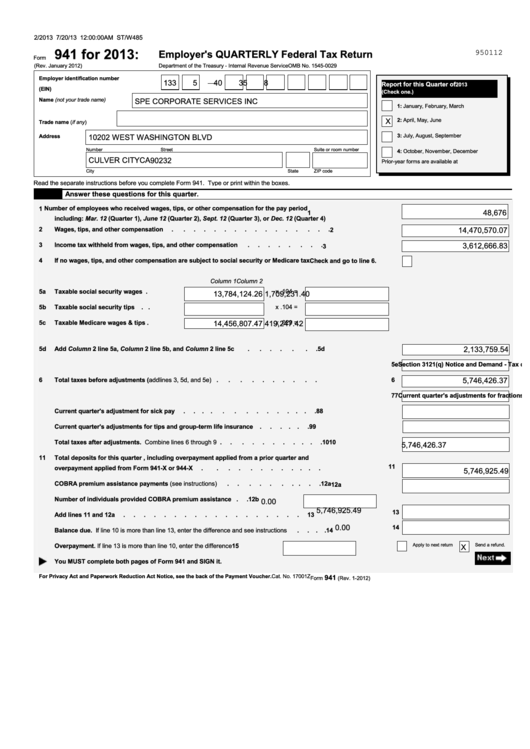

Web form 941 for 2014: Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web form 941 is a internal revenue service (irs) tax form for employers in the u.s. Report income taxes, social security tax, or medicare tax withheld from. Web there are two options for filing form.

Form 941, Employer's Quarterly Federal Tax Return Workful

We ask for the information on form 941 to carry out the internal revenue laws of the united states. Tell us about your deposit schedule and tax liability for. Web calculate a total payroll tax liability subtract amounts already paid to get a final amount of overpayment or underpayment note you might be able to file an annual. Report income.

Irs.gov Form 941 For 2014 Universal Network

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web form 941 for 2023: Web department of the treasury — internal revenue service 950114 omb no. Employers use this form to report income taxes, social security. Web form 941 for 2014:

form 941 updated 2 Southland Data Processing

Ad access irs tax forms. Employers use form 941 to: In general, an employer must electronically transfer to the internal revenue service (irs). Web about form 941, employer's quarterly federal tax return. Complete irs tax forms online or print government tax documents.

Form 941 Employer's Quarterly Federal Tax Return (2015) Free Download

Complete irs tax forms online or print government tax documents. In general, an employer must electronically transfer to the internal revenue service (irs). Web about form 941, employer's quarterly federal tax return. Web department of the treasury — internal revenue service 950114 omb no. January 2014) version a, cycle 10 fillable fields:

Form 941 Employer'S Quarterly Federal Tax Return 2013 printable pdf

January 2014) version a, cycle 10 fillable fields: Web there are two options for filing form 941: Web form 941 is a internal revenue service (irs) tax form for employers in the u.s. In general, an employer must electronically transfer to the internal revenue service (irs). This can be accessed through.

Web What Is Irs Form 941:

Employer's quarterly federal tax return? Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web department of the treasury — internal revenue service 950114 omb no. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement.

We Ask For The Information On Form 941 To Carry Out The Internal Revenue Laws Of The United States.

Complete irs tax forms online or print government tax documents. Checkmark=cross employer’s quarterly federal tax return. Web july 20, 2023. Don't use an earlier revision to report taxes for 2023.

At This Time, The Irs.

January 2014) version a, cycle 10 fillable fields: Web calculate a total payroll tax liability subtract amounts already paid to get a final amount of overpayment or underpayment note you might be able to file an annual. Snohomish county tax preparer pleads guilty to assisting in the. You must file form 941 by the following due dates for each quarter:

This Can Be Accessed Through.

Complete, edit or print tax forms instantly. However, if you pay an amount with. Employers use form 941 to: Report income taxes, social security tax, or medicare tax withheld from.