Fidelity Qualified Charitable Distribution Form

Fidelity Qualified Charitable Distribution Form - Web 2) complete this form and mail or fax to fidelity charitable. Web fidelity charitable is not able to process irrevocable contribution requests from fidelity ira accounts. Web fa ira one time and periodic distribution request form kit. Qcds can be counted towards your. Web at charles schwab, a qcd needs to be paid directly from the financial institution to the charity at the client’s request. A qualified charitable distribution (qcd) allows individuals who are 70½ years old or older to donate up to $100,000 total. Web qualified charitable donations (qcds), also called qualified charitable distributions, are a way to donate some of your retirement savings to charities while. Web access our most popular forms below, or select all forms to see a complete list. Web a qualified charitable distribution (qcd) is a direct transfer of funds from your ira custodian directly to a qualified charity, like cru. A separate form must be filled out for transfers from separate financial institutions.

Web a qualified charitable distribution (qcd) is a distribution from your individual retirement account (ira) to a qualified charity. Web fa ira one time and periodic distribution request form kit. By donating these funds, you bypass the 50% excise tax penalty for. This form is used to request a one time distribution or a periodic distribution from an ira. Web qualified charitable donations (qcds), also called qualified charitable distributions, are a way to donate some of your retirement savings to charities while. Use this form to request a qcd to be sent to a charity or to multiple charities. Web 2) complete this form and mail or fax to fidelity charitable. You must be age 70½ or older. Most forms can be completed online, or you can download a pdf where it's offered to fill out. Web qualified charitable distribution (qcd) ira.

You must be age 70½ or older. A separate form must be filled out for transfers from separate financial institutions. Use this form to request a qcd to be sent to a charity or to multiple charities. Web qualified charitable distribution (qcd) ira. By donating these funds, you bypass the 50% excise tax penalty for. A qualified charitable distribution (qcd) allows individuals who are 70½ years old or older to donate up to $100,000 total. Morgan securities llc (jpms) roth or traditional. You’ll need a distribution form from the. Web a qualified charitable distribution (qcd) is a direct transfer of funds from your ira custodian directly to a qualified charity, like cru. Web fidelity charitable is not able to process irrevocable contribution requests from fidelity ira accounts.

Qualified Charitable Distributions A Choice for IRA owners to reduce

Web access our most popular forms below, or select all forms to see a complete list. Use this form to request a qcd to be sent to a charity or to multiple charities. A separate form must be filled out for transfers from separate financial institutions. You must file form 5329 to show that. Web qualified charitable distribution (qcd) ira.

Qualified Charitable Distribution (QCD) Donate from your IRA PNC

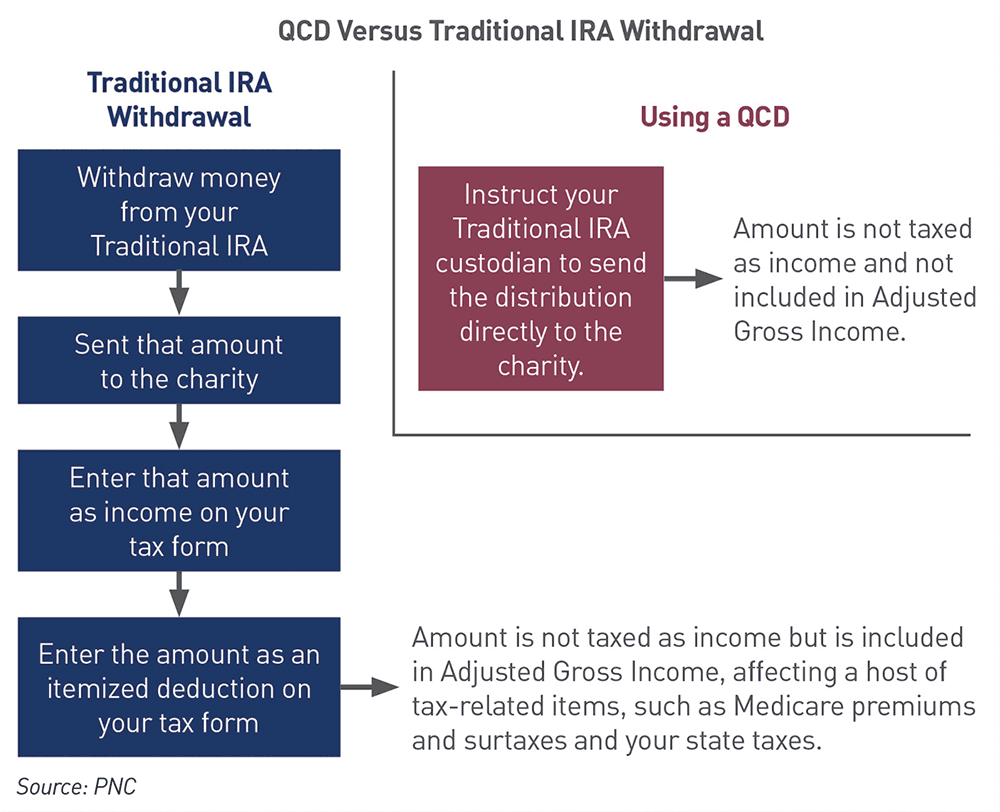

Web the bill contains secure act 2.0 retirement provisions and an expansion of the rules for qualified charitable donations (qcds). Web qualified charitable distributions allow you to distribute ira funds directly to eligible charities. Web if you’re retired and giving to charity this holiday season, experts say qualified charitable distributions, or qcds, may trim your 2022 tax bill. Web fa.

What Are Qualified Charitable Distributions?

Web if you’re retired and giving to charity this holiday season, experts say qualified charitable distributions, or qcds, may trim your 2022 tax bill. A separate form must be filled out for transfers from separate financial institutions. Web qualified charitable distribution (qcd) ira. Web a qualified charitable distribution is a nontaxable charitable contribution made directly from an ira (except for.

Fidelity Charitable Reports 7.3 Billion in Grants From DonorAdvised Funds

ɕ per irs code, you. Web qualified charitable distribution (qcd) ira. Web at charles schwab, a qcd needs to be paid directly from the financial institution to the charity at the client’s request. By donating these funds, you bypass the 50% excise tax penalty for. You’ll need a distribution form from the.

Fidelity's charitable arm prevails in lawsuit alleging negligence

A qualified charitable distribution (qcd) allows individuals who are 70½ years old or older to donate up to $100,000 total. Web 2) complete this form and mail or fax to fidelity charitable. Web a qualified charitable distribution (qcd) is a distribution from your individual retirement account (ira) to a qualified charity. Most forms can be completed online, or you can.

Qualified Charitable Distribution Tax Benefits Snider Advisors

Web qualified charitable donations (qcds), also called qualified charitable distributions, are a way to donate some of your retirement savings to charities while. Web a qualified charitable distribution is a nontaxable charitable contribution made directly from an ira (except for an ongoing sep or simple ira) to a qualified. Web the bill contains secure act 2.0 retirement provisions and an.

PDF Sample Letter of Request for direct qualified charitable

ɕ per irs code, you. By donating these funds, you bypass the 50% excise tax penalty for. Web the bill contains secure act 2.0 retirement provisions and an expansion of the rules for qualified charitable donations (qcds). Most forms can be completed online, or you can download a pdf where it's offered to fill out. Web at charles schwab, a.

Qualified Charitable Distributions Fidelity

Web the bill contains secure act 2.0 retirement provisions and an expansion of the rules for qualified charitable donations (qcds). Before completing this form, please review the. You must be age 70½ or older. Web if you’re retired and giving to charity this holiday season, experts say qualified charitable distributions, or qcds, may trim your 2022 tax bill. By donating.

Benefits and Considerations of Donating to Charity Using IRA Qualified

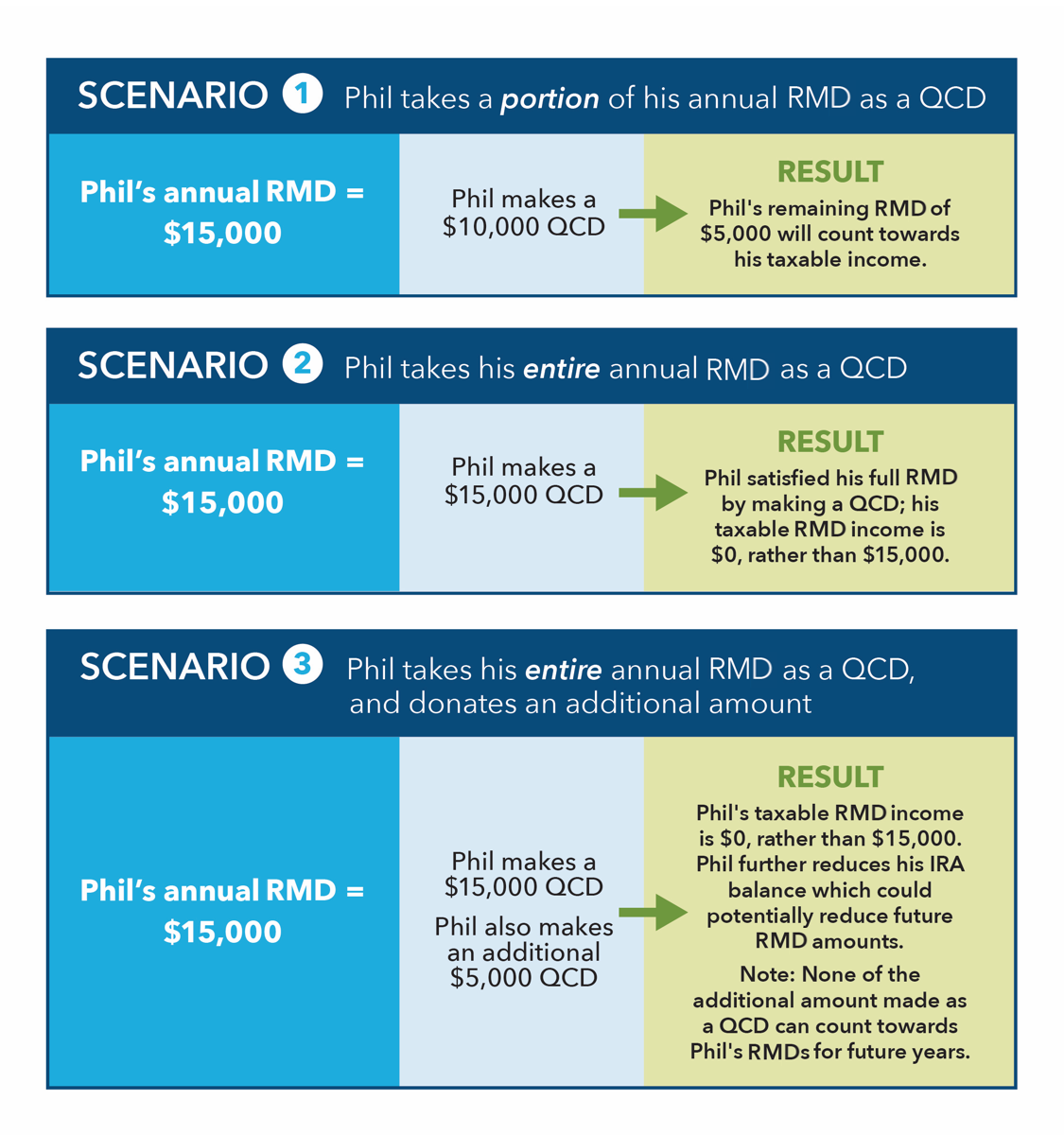

You’ll need a distribution form from the. Qcds can be counted towards your. Web qualified charitable distributions allow you to distribute ira funds directly to eligible charities. Web the bill contains secure act 2.0 retirement provisions and an expansion of the rules for qualified charitable donations (qcds). By donating these funds, you bypass the 50% excise tax penalty for.

Fidelity Investments Charitable Giving Account (Donor Advised Fund

This form is used to request a one time distribution or a periodic distribution from an ira. Web the bill contains secure act 2.0 retirement provisions and an expansion of the rules for qualified charitable donations (qcds). A qcd is a direct transfer of funds from an. By donating these funds, you bypass the 50% excise tax penalty for. Web.

Web Access Our Most Popular Forms Below, Or Select All Forms To See A Complete List.

Web qualified charitable donations (qcds), also called qualified charitable distributions, are a way to donate some of your retirement savings to charities while. You must file form 5329 to show that. Web a qualified charitable distribution is a nontaxable charitable contribution made directly from an ira (except for an ongoing sep or simple ira) to a qualified. A separate form must be filled out for transfers from separate financial institutions.

Web A Qualified Charitable Distribution (Qcd) Is A Direct Transfer Of Funds From Your Ira Custodian Directly To A Qualified Charity, Like Cru.

This form is used to request a one time distribution or a periodic distribution from an ira. Web qualified charitable distribution (qcd) ira. You’ll need a distribution form from the. You must be age 70½ or older.

Use This Form To Request A Qcd To Be Sent To A Charity Or To Multiple Charities.

Web fidelity charitable is not able to process irrevocable contribution requests from fidelity ira accounts. Web qualified charitable distributions allow you to distribute ira funds directly to eligible charities. Qcds can be counted towards your. A qcd is a direct transfer of funds from an.

Before Completing This Form, Please Review The.

Web 2) complete this form and mail or fax to fidelity charitable. A qualified charitable distribution (qcd) allows individuals who are 70½ years old or older to donate up to $100,000 total. Web a qualified charitable distribution (qcd) is a distribution from your individual retirement account (ira) to a qualified charity. ɕ per irs code, you.