File Form 843 Online

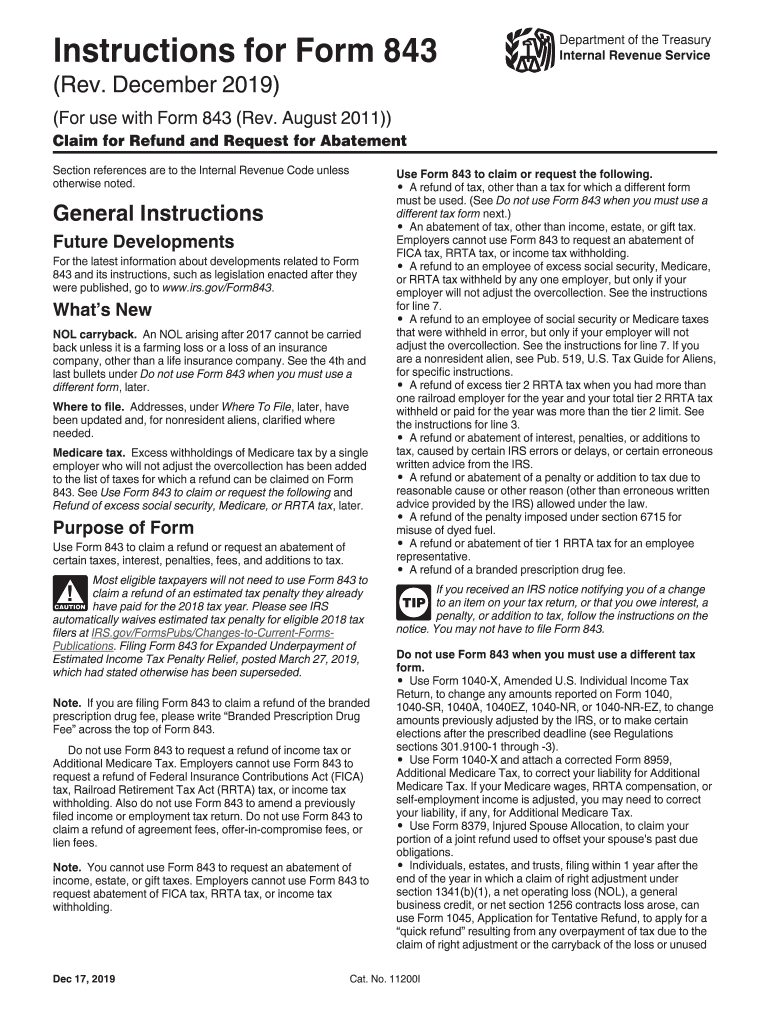

File Form 843 Online - Ad irs form 843 & more, subscribe now. Web form 843 is used to request a reduction in interest or penalties that the irs has incorrectly assessed or to demand a refund of some assessed taxes. Income, estate, gift, employment and excise. Web this form can be used to request abatement for penalties associated with the following types of taxes: Upload, modify or create forms. Web form 843 can be submitted to the irs via telephone, in writing via regular mail, or online through the irs website. Web to generate form 843: Web to generate form 843 go to the input return tab. Go to screen 61, claim of refund (843). This form is for income earned in tax year.

Web taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain types of tax related charges. In response to an irs notice regarding a tax or fee related to certain taxes. If you are filing form 843. Web to generate form 843 go to the input return tab. Edit your form 843 online type text, add images, blackout confidential details, add comments, highlights and more. Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. We last updated federal form 843 in february 2023 from the federal internal revenue service. Web more about the federal form 843. Sign it in a few clicks draw your signature, type it,. Check the box, print form 843 with complete return.

Upload, modify or create forms. Complete irs tax forms online or print government tax documents. Use fill to complete blank online irs pdf forms for free. Web taxpayers can complete form 843: If you are filing form 843 to claim a refund of. Web taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain types of tax related charges. Web form 843 can be submitted to the irs via telephone, in writing via regular mail, or online through the irs website. Click on claim for refund (843). Ad irs form 843 & more, subscribe now. Web form 843 is used to request a reduction in interest or penalties that the irs has incorrectly assessed or to demand a refund of some assessed taxes.

Form 843 Penalty Abatement Request & Reasonable Cause

Jackson hewitt’s tax debt specialists are. Web to generate form 843 go to the input return tab. Edit your form 843 online type text, add images, blackout confidential details, add comments, highlights and more. Check the box print form 843. Check the box, print form 843 with complete return.

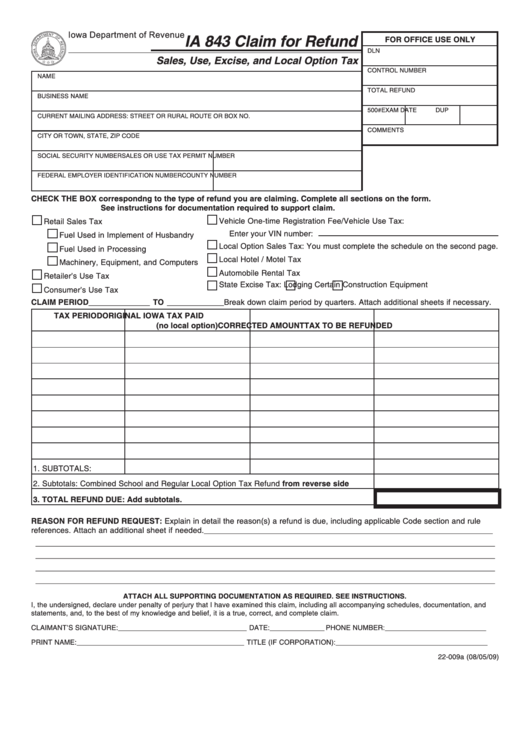

Form Ia 843 Claim For Refund printable pdf download

Scroll down to the claim/request information. Find a local tax pro Jackson hewitt’s tax debt specialists are. Upload, modify or create forms. Income, estate, gift, employment and excise.

Form 843 Claim for Refund and Request for Abatement Definition

Find a local tax pro Ad get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Web fill online, printable, fillable, blank form 843:

Form 843 Penalty Abatement Request & Reasonable Cause

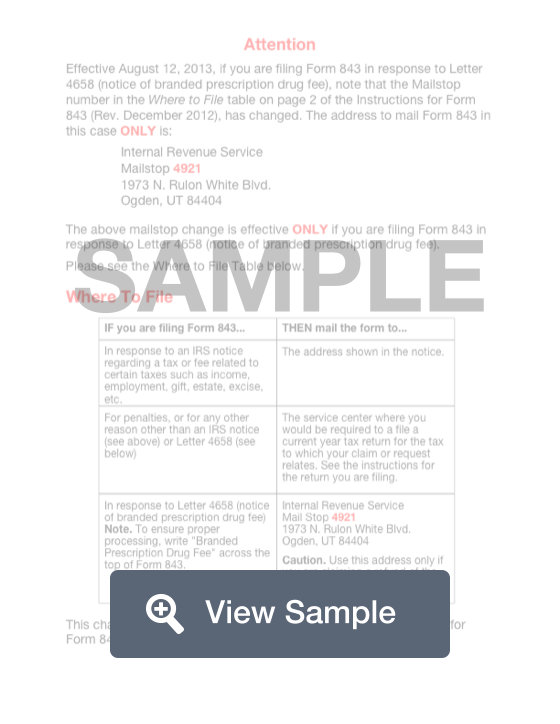

Web mailing addresses for form 843. In response to an irs notice regarding a tax or fee related to certain taxes. Use fill to complete blank online irs pdf forms for free. Web form 843 is used to request a reduction in interest or penalties that the irs has incorrectly assessed or to demand a refund of some assessed taxes..

Where To File Form 843?

Scroll down to the claim/request information. For instance, if you want to request abatement on penalties incurred on two previously filed. Ad get ready for tax season deadlines by completing any required tax forms today. Check the instructions for form 843 for where to mail. Upload, modify or create forms.

Form 843 Claim for Refund and Request for Abatement (2011) Free Download

Web you must file a separate form 843 for every type of tax or fee and for every time period. Web more about the federal form 843. Web form 843 is available in the 1040, 1120, 1120s, 990, 706 and 709 packages. Income, estate, gift, employment and excise. Web to generate form 843 go to the input return tab.

Form 843 Edit, Fill, Sign Online Handypdf

Web mailing addresses for form 843. Web you must file a separate form 843 for every type of tax or fee and for every time period. Ad irs form 843 & more, subscribe now. Check the box, print form 843 with complete return. Claim for refund and request for abatement (irs) form.

Form 843 Refund & Abatement Request Fill Out Online PDF FormSwift

If you believe that you are entitled to. Web taxpayers can use irs form 843 to claim a refund or ask for an abatement of certain types of tax related charges. If you are filing form 843 to claim a refund of. Web this form can be used to request abatement for penalties associated with the following types of taxes:.

Iowa Refund Request Form Ia 843 Edit, Fill, Sign Online Handypdf

Web fill online, printable, fillable, blank form 843: Go to screen 61, claim of refund (843). Try it for free now! Details & instructions on using this form. Web more about the federal form 843.

2019 Form IRS Instruction 843 Fill Online, Printable, Fillable, Blank

Web taxpayers can complete form 843: If you believe that you are entitled to. Web form 843 is used to request a reduction in interest or penalties that the irs has incorrectly assessed or to demand a refund of some assessed taxes. If you are filing form 843. Ad get ready for tax season deadlines by completing any required tax.

Web To Generate Form 843 Go To The Input Return Tab.

Web fill out irs form 843 if you've already paid a penalty and now realize you might be able to get your money back, you’ll want to file irs form 843. Upload, modify or create forms. Use fill to complete blank online irs pdf forms for free. If you believe that you are entitled to.

Web You Must File A Separate Form 843 For Every Type Of Tax Or Fee And For Every Time Period.

Find a local tax pro Web taxpayers can complete form 843: Check the box, print form 843 with complete return. In response to an irs notice regarding a tax or fee related to certain taxes.

Click On Claim For Refund (843).

Web fill online, printable, fillable, blank form 843: Upload, modify or create forms. Ad irs form 843 & more, subscribe now. Claim for refund and request for abatement (irs) form.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web this form can be used to request abatement for penalties associated with the following types of taxes: Web this form can be used to request an abatement (an end or reduction) of certain types of taxes, fees, penalties, and interest. Jackson hewitt’s tax debt specialists are. Sign it in a few clicks draw your signature, type it,.

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)