Filing For Bankruptcy Chapter 7 In California

Filing For Bankruptcy Chapter 7 In California - Ad don't file for bankruptcy. Learn how bankruptcy affects the credit score. Consolidate your debt to save with one lower monthly payment. “i need to file bankruptcy. Ad don't file for bankruptcy. Web january 14, 2022 0 30 chapter 7 bankruptcy california income limits do i qualify for a california chapter 7 bankruptcy must see! Consider other options before you file for bankruptcy, consider these other options: Ad maximize your home value. The filing fee may be paid in full at the time of filing. There are two types of california bankruptcy.

Web updated april 1, 2022 table of contents california doesn’t allow the federal bankruptcy exemptions california does not allow joint filers to claim double exemptions. If you’re considering filing for chapter 7 bankruptcy, you’re probably. Web small business bankruptcy chapter 7 in california when to file by mark j. Chat with pros in your area to coordinate on project details and timing Compare top 5 consolidation options. However, you must pay the value. Web the san francisco filing comes after the catholic diocese of oakland similarly filed for bankruptcy protection in may after it received more than 330 claims of sexual abuse. Web the san francisco archdiocese is the third bay area diocese to file for bankruptcy after facing hundreds of lawsuits brought under a california law approved in 2019 that allowed decades. Consolidate your debt to save with one lower monthly payment. You are able to keep your assets and pay.

In chapter 13 bankruptcy, you keep everything you own. If you’re considering filing for chapter 7 bankruptcy, you’re probably. Chat with pros in your area to coordinate on project details and timing Ad don't file for bankruptcy. See if you qualify to save monthly on your debt. Chat with pros in your area to coordinate on project details and timing Learn how bankruptcy affects the credit score. As you read through california… These exemptions include a homestead. Individuals and businesses pay your debt apply for a payment plan make an offer on your tax debt (offer in compromise).

The Effects of Recent Purchases on a Chapter 7 Bankruptcy Filing

Whether its routine maintenance, emergency fixes, or a remodel. Markus | nov 28, 2022 | bankruptcy law i get frequent inquiries from los angeles area small business owners wanting to file bankruptcy “on” their business. Learn how bankruptcy affects the credit score. Ad don't file for bankruptcy. However, you must pay the value.

36+ Filing Bankruptcy Chapter 7 California FiachRanulf

Chapter 12 (family farmer) $278.00: Whether its routine maintenance, emergency fixes, or a remodel. Chat with pros in your area to coordinate on project details and timing You can take the class online or by phone up to 180 days before filing bankruptcy. Web it costs $299.00 to file chapter 7 bankruptcy in the state of california, and it costs.

What To Avoid Before Filing Chapter 7 Bankruptcy Srailawoffice

Ad don't file for bankruptcy. Web the san francisco filing comes after the catholic diocese of oakland similarly filed for bankruptcy protection in may after it received more than 330 claims of sexual abuse. Consolidate your debt to save with one lower monthly payment. California median income for bankruptcy. Individuals and businesses pay your debt apply for a payment plan.

Filing Bankruptcy Chapter 7 California

Debtors may elect to pay the filing fee in installments (form 103a) or. However, bankruptcy can also save you from accruing more debt. The filing fee may be paid in full at the time of filing. Compare top 5 consolidation options. You can take the class online or by phone up to 180 days before filing bankruptcy.

Filing Bankruptcy Chapter 7 in Jacksonville FL Bruner Wright P.A.

Chat with pros in your area to coordinate on project details and timing Web in california, individuals filing for chapter 7 bankruptcy may be able to claim certain exemptions to protect their property from being sold to repay creditors. Compare top 5 consolidation options. Individuals and businesses pay your debt apply for a payment plan make an offer on your.

Can A Lawyer Stop A Foreclosure? Here are the facts you must know

Here's where you'll learn more about the prebankruptcy credit counseling requirement. Compare top 5 consolidation options. California median income for bankruptcy. Chapter 12 (family farmer) $278.00: Compare top 5 consolidation options.

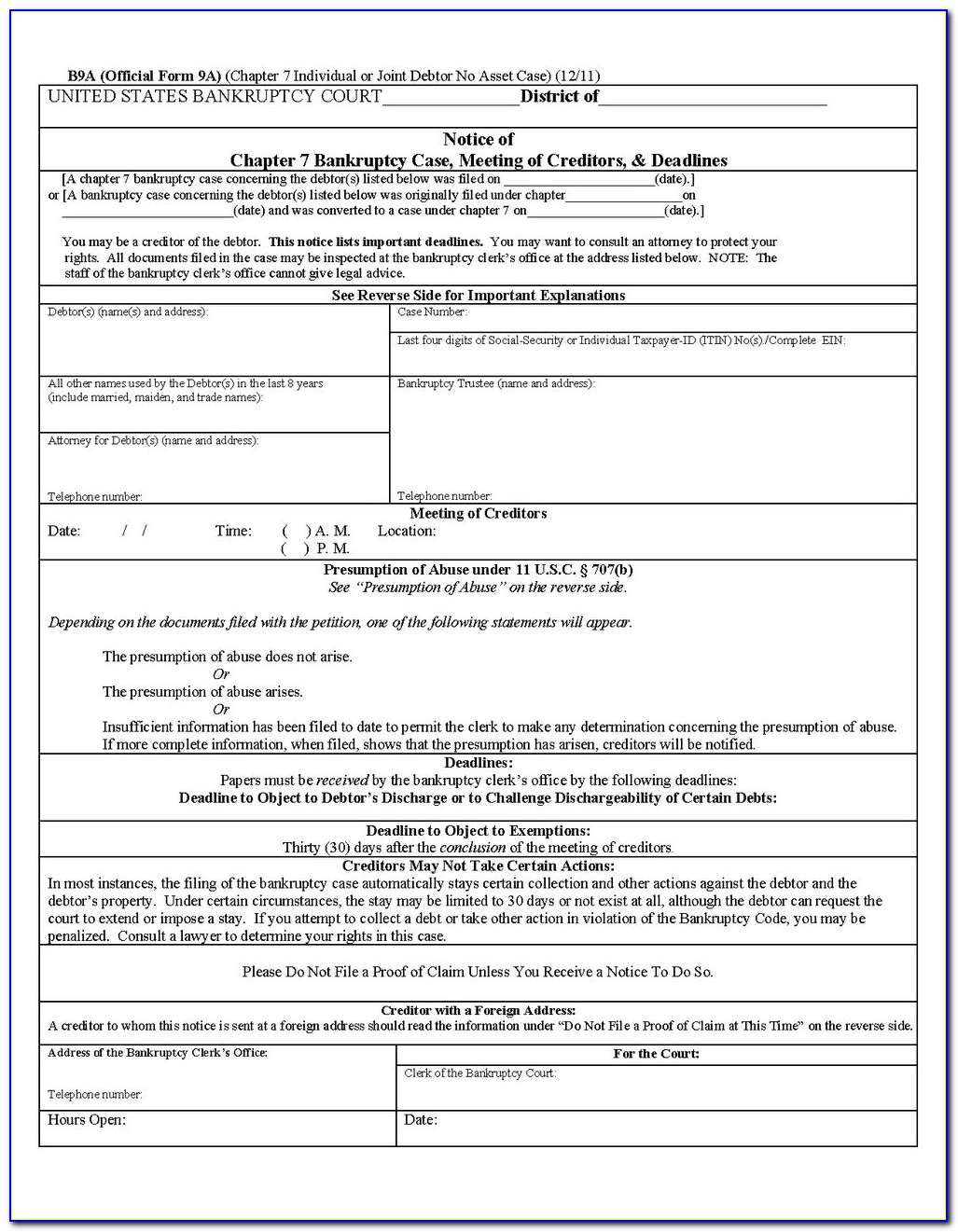

What is a ‘No Asset’ Chapter 7 Bankruptcy Case? Kingcade & Garcia, P.A.

Web the archdiocese said the filing is necessary to manage and resolve the more than 500 lawsuits alleging child sexual abuse brought against rcasf under california assembly bill 218, which. Whether its routine maintenance, emergency fixes, or a remodel. The current fees for filing documents with the bankruptcy court are as follows: Consolidate your debt to save with one lower.

36+ How Does Bankruptcy Chapter 7 Work BillieJamie

You are able to keep your assets and pay. Web in chapter 7 bankruptcy, the bankruptcy trustee sells nonexempt property and distributes the proceeds to creditors. California median income for bankruptcy. Web the archdiocese said the filing is necessary to manage and resolve the more than 500 lawsuits alleging child sexual abuse brought against rcasf under california assembly bill 218,.

Filing Chapter 7 Bankruptcy In NC Bankruptcy Attorney

There are two types of california bankruptcy. Here's where you'll learn more about the prebankruptcy credit counseling requirement. Web the san francisco filing comes after the catholic diocese of oakland similarly filed for bankruptcy protection in may after it received more than 330 claims of sexual abuse. Whether its routine maintenance, emergency fixes, or a remodel. The california median income.

Concrete Countertop Precast Forms Form Resume Examples jNDA72eO6x

You are able to keep your assets and pay. Web a chapter 7 bankruptcy will stay on your credit report for 10 years, while a chapter 13 bankruptcy will fall off after seven years. Web $1,650 attorneys' fees in ca for chapter 7 bankruptcy typically range from $1,000 to $2,500. Compensation per victim varied widely, from $1.3 million in san.

Ad Don't File For Bankruptcy.

In chapter 13 bankruptcy, you keep everything you own. Web january 14, 2022 0 30 chapter 7 bankruptcy california income limits do i qualify for a california chapter 7 bankruptcy must see! Web the san francisco archdiocese is the third bay area diocese to file for bankruptcy after facing hundreds of lawsuits brought under a california law approved in 2019 that allowed decades. You are able to keep your assets and pay.

Web In Chapter 7 Bankruptcy, The Bankruptcy Trustee Sells Nonexempt Property And Distributes The Proceeds To Creditors.

Ad maximize your home value. May apply to waive the filing fee (form 103b). See if you qualify to save monthly on your debt. The california median income figures for the means test are adjusted periodically, based on irs and census bureau data.

Fill Out And File The Chapter 7 Bankruptcy.

Web if you’ve lived in california for two years or more, you’ll need to decide between the exemptions outlined in sections 703 and section 704 of the california code of civil procedure. File bankruptcy petition, certificate of credit counseling, and other required documents with court and pay filing fees. Chat with pros in your area to coordinate on project details and timing California median income for bankruptcy.

However, Bankruptcy Can Also Save You From Accruing More Debt.

Whether its routine maintenance, emergency fixes, or a remodel. Individuals and businesses pay your debt apply for a payment plan make an offer on your tax debt (offer in compromise). You can take the class online or by phone up to 180 days before filing bankruptcy. Compare top 5 consolidation options.