Filing Form 7004 Electronically

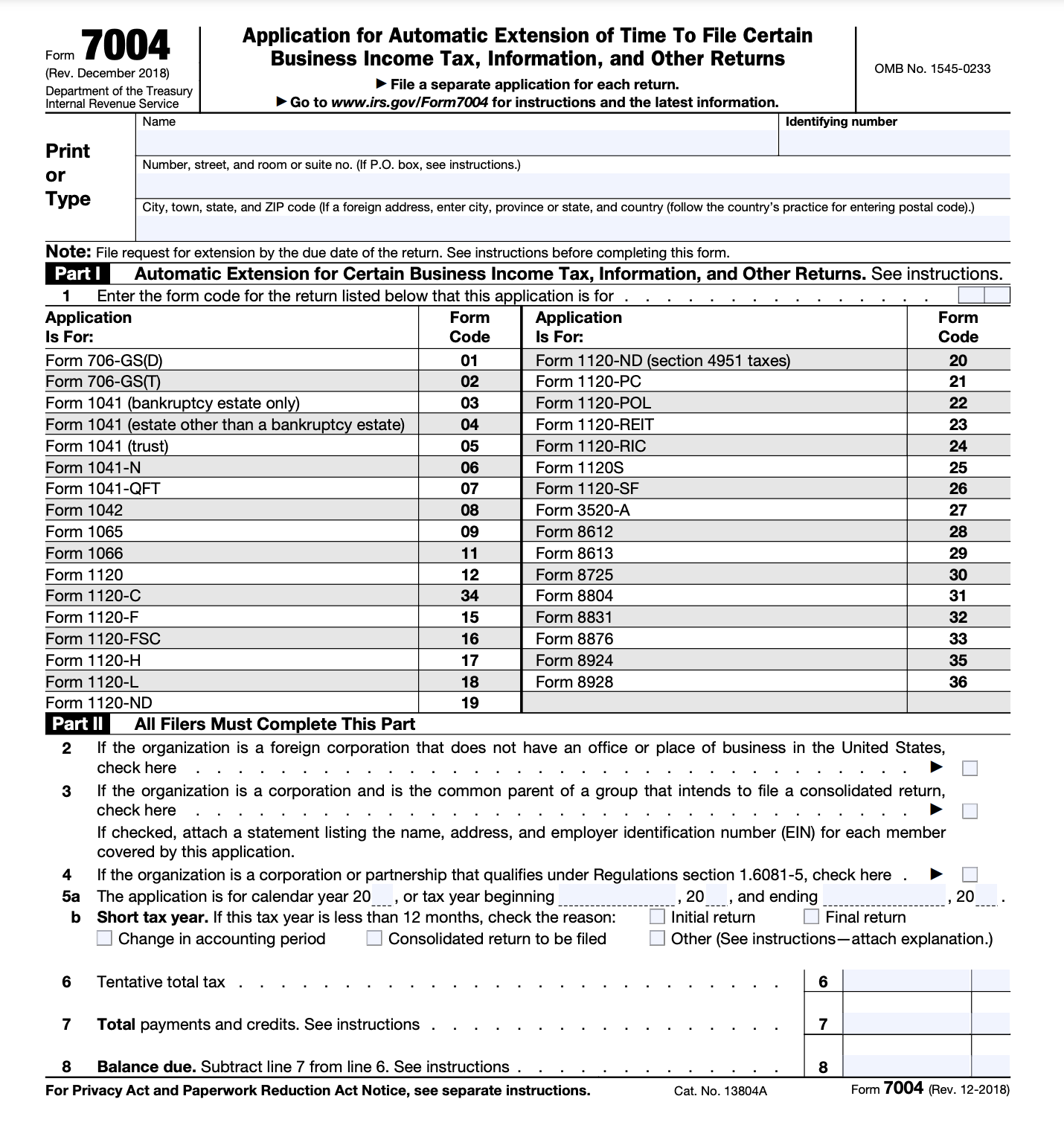

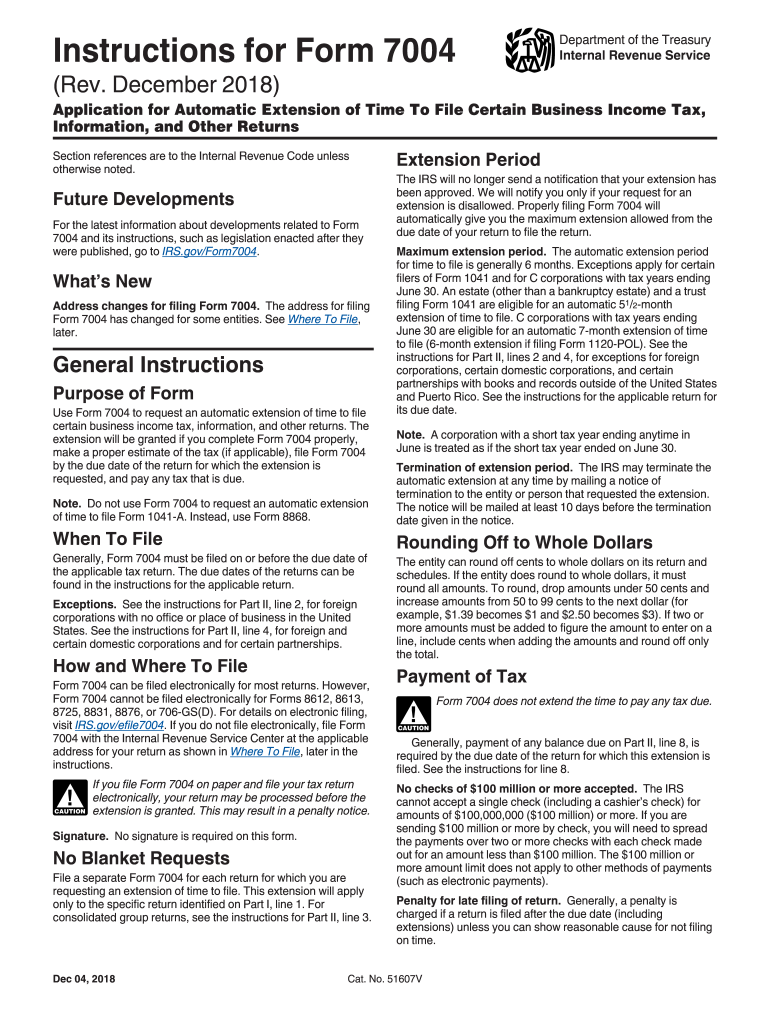

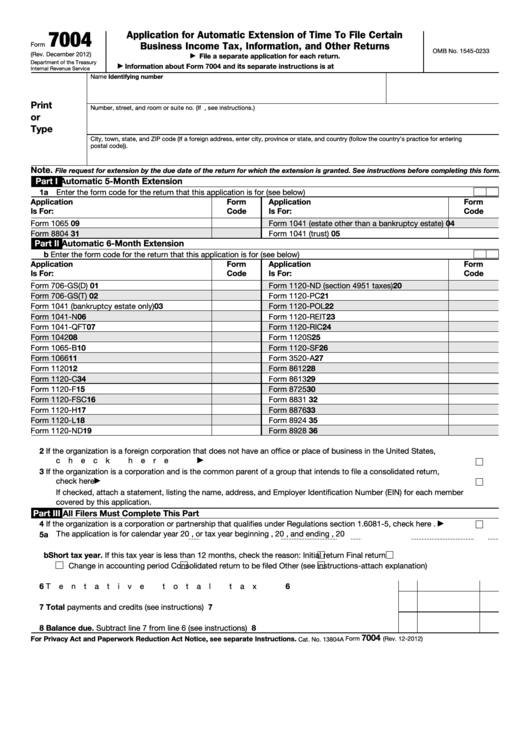

Filing Form 7004 Electronically - Web to electronically file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns: To file form 7004 using taxact. Get irs approved instant schedule 1 copy. Enter business details step 2: Web you can file an irs form 7004 electronically for most returns. Web form 7004 is a document used by taxpayers to request a correction of a tax return. Web how and where to file form 7004 can be filed electronically for most returns. Use form 7004 to request an automatic 6. Select the tax year step 4: Web 13 rows how and where to file.

Select the tax year step 4: Ad get ready for tax season deadlines by completing any required tax forms today. File your form 2290 online & efile with the irs. Complete, edit or print tax forms instantly. Enter demographic information on screen 1, at least the name, address, city, state, zip and ein. It only allowed me to print it. Solved • by intuit • 28 • updated july 13, 2022. Select the appropriate form from the table below to determine where to. Web to file form 7004 extension online, the taxpayers must gather all documents such as: How do i get it to file.

File your form 2290 today avoid the rush. Complete, edit or print tax forms instantly. Web you can file an irs form 7004 electronically for most returns. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Solved • by intuit • 28 • updated july 13, 2022. To file form 7004 using taxact. Web federal tax extension form 7004, the “application for automatic extension of time to file certain business income tax, information, and other returns” ( pdf ), is a. Select business entity & form step 3: When filing an extension request form 7004 signatures may be required. Form 7004 can be filed electronically for most returns.

Tax Filing Extension 2022 Latest News Update

To file form 7004 using taxact. Enter code 25 in the box on form 7004, line 1. Complete, edit or print tax forms instantly. Get irs approved instant schedule 1 copy. Web you can file an irs form 7004 electronically for most returns.

What is Form 7004 and How to Fill it Out Bench Accounting

Enter business details step 2: Use form 7004 to request an automatic 6. Web use the chart to determine where to file form 7004 based on the tax form you complete. Select the tax year step 4: File your form 2290 online & efile with the irs.

Form 7004 Where To Sign Fill Out and Sign Printable PDF Template

Web use the chart to determine where to file form 7004 based on the tax form you complete. File your form 2290 online & efile with the irs. Web level 1 i filed for an extension within the software but i can't figure out how to electronically submit it. Web irs form 7004 is an application for the automatic extension.

How to file extension for business tax return arlokasin

Solved • by intuit • 28 • updated july 13, 2022. Web form 7004 is a document used by taxpayers to request a correction of a tax return. Enter demographic information on screen 1, at least the name, address, city, state, zip and ein. Web 13 rows how and where to file. File your form 2290 today avoid the rush.

Tax filing mistakes to avoid when filing IRS extension Forms 4868 and

Web use the chart to determine where to file form 7004 based on the tax form you complete. Web form 7004 is a document used by taxpayers to request a correction of a tax return. Ad don't leave it to the last minute. Complete, edit or print tax forms instantly. Web how and where to file form 7004 can be.

filing form 1041 Blog ExpressExtension Extensions Made Easy

The following links provide information on the companies that have passed the internal revenue service (irs). Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. Web to file form 7004 extension online, the taxpayers must gather all documents such as: How do.

Turbotax 1065 Extension Best Reviews

Web 0:00 / 1:50 how to file form 7004 electronically expressextension 174 subscribers subscribe 19 share 15k views 1 year ago visit. It is completed during a taxpayer’s preparation of a federal return and sent to the irs. Web form 7004 is a document used by taxpayers to request a correction of a tax return. Use form 7004 to request.

This Is Where You Need To Mail Your Form 7004 This Year Blog

File your form 2290 today avoid the rush. See the form 7004 instructions for a list of the exceptions. Complete, edit or print tax forms instantly. File your form 2290 online & efile with the irs. Web level 1 i filed for an extension within the software but i can't figure out how to electronically submit it.

A Simple Guide to Filing the 2020 Form 7004 for Businesses Blog

The following links provide information on the companies that have passed the internal revenue service (irs). Select business entity & form step 3: Web irs form 7004 is an application for the automatic extension of time to file certain business income tax, information, and other returns. Complete, edit or print tax forms instantly. Web you can file an irs form.

Can I Electronically File Form 7004 Paul Johnson's Templates

Complete, edit or print tax forms instantly. However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or. Web to file form 7004 extension online, the taxpayers must gather all documents such as: Solved • by intuit • 28 • updated july 13, 2022. Ad get ready for tax season deadlines by completing any required tax.

Web Generally, Form 7004 Must Be Filed On Or Before The Regular Due Date Of The Applicable Tax Return And Can Be Filed Electronically For Most Returns.

Web to electronically file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns: Business information (name, ein, address) type of business (exp. Enter business details step 2: File your form 2290 online & efile with the irs.

Web 1 Min Read You Can Extend Filing Form 1120S When You File Form 7004.

Web level 1 i filed for an extension within the software but i can't figure out how to electronically submit it. Complete, edit or print tax forms instantly. Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? Web to file form 7004 extension online, the taxpayers must gather all documents such as:

Web Use The Chart To Determine Where To File Form 7004 Based On The Tax Form You Complete.

Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. How do i get it to file. Web 0:00 / 1:50 how to file form 7004 electronically expressextension 174 subscribers subscribe 19 share 15k views 1 year ago visit. Select the tax year step 4:

Select Business Entity & Form Step 3:

It is completed during a taxpayer’s preparation of a federal return and sent to the irs. Web signature requirements for form 7004. Get irs approved instant schedule 1 copy. However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or.