Filing Form 8938

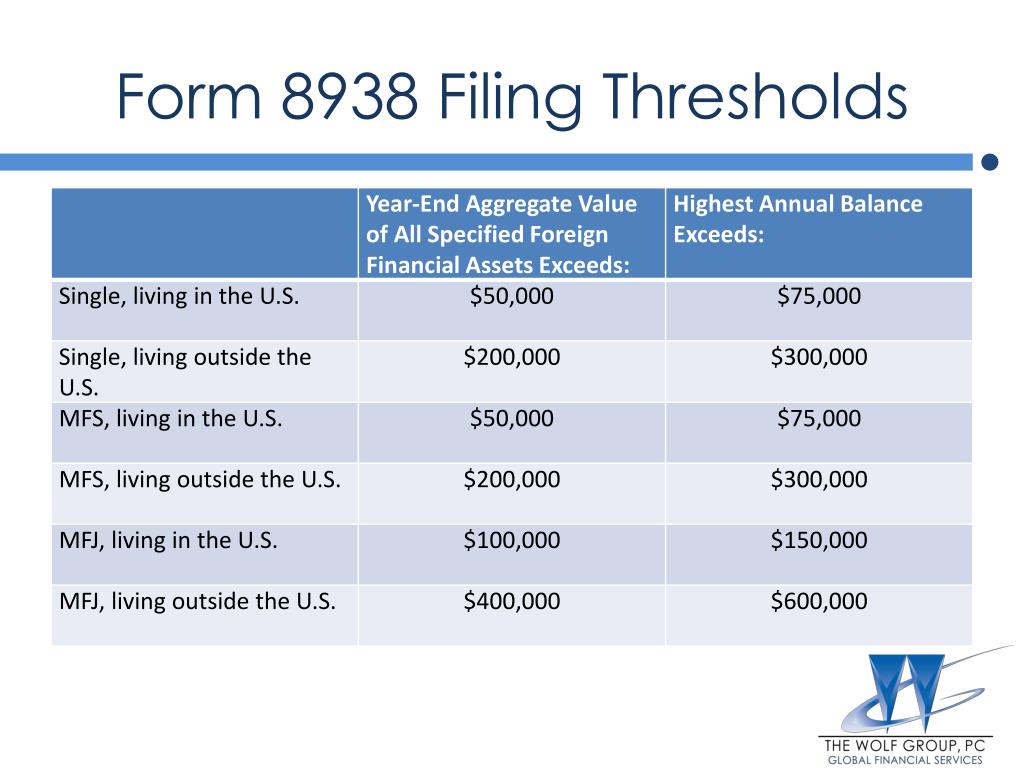

Filing Form 8938 - Web filing form 8938 is only available to those using turbotax deluxe or higher. Web the reporting thresholds for form 8938 are much higher than the fbar reporting threshold. Web must file form 8938 if you are a specified person (see specified person, later) that has an interest in specified foreign financial assets and the value of those assets is. Web in general, form 8938 penalties will be $10,000 per year. Complete, edit or print tax forms instantly. Unlike the fbar penalties, there has been no indication that the internal revenue service plans on seeking penalties. If you underpay your tax due to fraud,. Web form 8938 thresholds for 20232. Web form 8938 is used to report your foreign financial assets if the total value exceeds a certain threshold based on your filing status and the types of assets. Web form 8938 is issued by the irs rather than fincen.

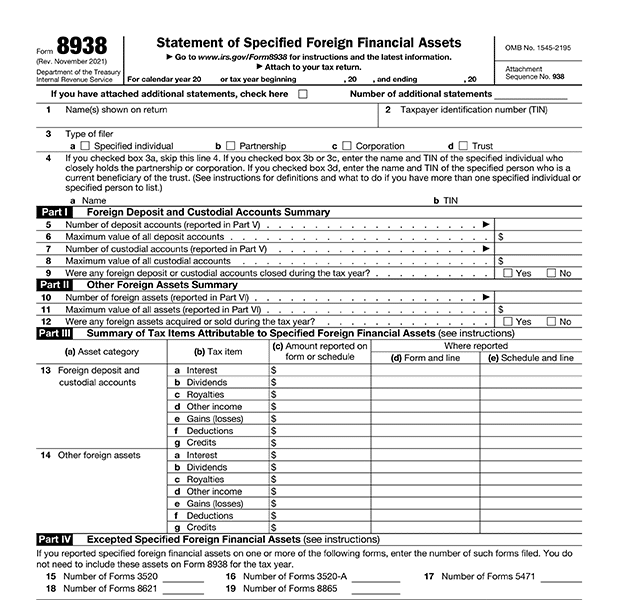

Web statement of specified foreign financial assets 3 type of filer specified individual b partnership c corporation d trust 4 if you checked box 3a, skip this line 4. To get to the 8938 section in turbotax, refer to the following instructions: What's the most annoying us expat tax form? Ad access irs tax forms. Taxpayers, corporations, partnerships, and trusts that hold foreign assets beyond a certain threshold. Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets. Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial assets, and to the. Web in general, form 8938 penalties will be $10,000 per year. Web do i need to file form 8938, statement of specified foreign financial assets? Web form 8938 is one of the newest additions to the internal revenue service’s international information reporting requirements for us taxpayers who have foreign accounts, assets,.

Ad access irs tax forms. Web for additional information, also refer to about form 8938, statement of specified foreign financial assets. Single, head of household, married filing separately. Web form 8938 is one of the newest additions to the internal revenue service’s international information reporting requirements for us taxpayers who have foreign accounts, assets,. Web under prior law, the reporting of sffas on form 8938 solely applied to individuals, provided that the value of the reportable foreign assets exceeded the. Web must file form 8938 if you are a specified person (see specified person, later) that has an interest in specified foreign financial assets and the value of those assets is. Complete irs tax forms online or print government tax documents. Select your tax module below for steps: If you do not have to file an income tax return for the tax year, you do not need to file form 8938, even. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

PPT 1818 Society Form 8938 and Other I mportant R eporting I ssues

Web filing form 8938 is only available to those using turbotax deluxe or higher. Complete, edit or print tax forms instantly. Web form 8938 is issued by the irs rather than fincen. $200,000 on the last day of the tax year or more than. Unlike the fbar penalties, there has been no indication that the internal revenue service plans on.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Specified domestic entity (1) partnership (2) corporation (3) trust (4) estate check this box if this is an original, amended, or. Complete, edit or print tax forms instantly. Web form 8938 is used to report your foreign financial assets if the total value exceeds a certain threshold based on your filing status and the types of assets. Web filing form.

US Expat Taxes Explained Filing Form 8938

To get to the 8938 section in turbotax, refer to the following instructions: Web filing form 8938 is only available to those using turbotax deluxe or higher. What's the most annoying us expat tax form? Single, head of household, married filing separately. Web form 8938 thresholds for 20232.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Form 8938 threshold & requirements u.s. Web do i need to file form 8938, statement of specified foreign financial assets? Web filing form 8938 is only available to those using turbotax deluxe or higher. Web form 8938 thresholds for 20232. Select your tax module below for steps:

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

If you are required to file form 8938 but do not file a complete and correct form 8938 by the. Web form 8938 is issued by the irs rather than fincen. Unlike the fbar penalties, there has been no indication that the internal revenue service plans on seeking penalties. Taxpayers can file form 4868 by mail, but remember to get.

Review a chart comparing the foreign asset types and filing

Web form 8938 is issued by the irs rather than fincen. Web form 8938 is used to report your foreign financial assets if the total value exceeds a certain threshold based on your filing status and the types of assets. Internal revenue service form 8938 refers to statement of specified foreign financial assets filed by us persons with fatca. To.

FATCA Reporting Filing Form 8938 Gordon Law Group

Complete, edit or print tax forms instantly. If you are required to file form 8938 but do not file a complete and correct form 8938 by the. Web in general, form 8938 penalties will be $10,000 per year. Ad access irs tax forms. What's the most annoying us expat tax form?

The FORM 8938 Here is what you need to know if you are filing it

Web we have prepared a summary explaining the basics of form 8938, who has to file, and when. Form 8938 threshold & requirements u.s. Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets. To get to the 8938 section in turbotax, refer to the.

Form 8938 Who Has to Report Foreign Assets & How to File

If you do not have to file an income tax return for the tax year, you do not need to file form 8938, even. Form 8938 and the fbar are both due by the april 15 tax deadline, but have different. Web form 8938 is one of the newest additions to the internal revenue service’s international information reporting requirements for.

IRS Reporting Requirements for Foreign Account Ownership and Trust

Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial assets, and to the. Web form 8938 reporting & filing requirements: Web in general, form 8938 penalties will be $10,000 per year. Web must file form 8938 if you are a specified person (see specified person, later).

Web Married Filing A Joint Return (2) Other Individual.

What's the most annoying us expat tax form? Web in general, form 8938 penalties will be $10,000 per year. Web irs form 8938 is a tax form used by some u.s. If you are required to file form 8938 but do not file a complete and correct form 8938 by the.

Web For Additional Information, Also Refer To About Form 8938, Statement Of Specified Foreign Financial Assets.

Web we have prepared a summary explaining the basics of form 8938, who has to file, and when. Form 8938 threshold & requirements u.s. Complete irs tax forms online or print government tax documents. Web under prior law, the reporting of sffas on form 8938 solely applied to individuals, provided that the value of the reportable foreign assets exceeded the.

Complete, Edit Or Print Tax Forms Instantly.

Ad access irs tax forms. Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial assets, and to the. Single, head of household, married filing separately. Complete, edit or print tax forms instantly.

$200,000 On The Last Day Of The Tax Year Or More Than.

Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets. Unlike the fbar penalties, there has been no indication that the internal revenue service plans on seeking penalties. Web form 8938 reporting & filing requirements: Select your tax module below for steps: