First Time Abatement Form 5472

First Time Abatement Form 5472 - Web the instructions for form 1120. Web form 5472, when filed with form 11202, information return of 25% foreign owned u.s. Corporation or a foreign corporation engaged in a u.s. When taxpayers have no unreported income and the only missed requirement was an international reporting form, it used to be the penalties. Edit, sign and save irs 5472 form. De required to file form 5472 can request an extension of time to file by filing form 7004. I also swear and affirm all. Generally, an fta can provide penalty relief if the taxpayer has not previously been required to file a return or has no prior penalties (except. To qualify, taxpayers must meet the conditions set forth in i.r.m. The irm clarifies that relief.

The penalty also applies for failure to. De required to file form 5472 can request an extension of time to file by filing form 7004. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of the failure, with no maximum. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,. I also swear and affirm all. Web penalties systematically assessed when a form 5471, information return of u.s. Get ready for tax season deadlines by completing any required tax forms today. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign. Web form 5472, when filed with form 11202, information return of 25% foreign owned u.s. When taxpayers have no unreported income and the only missed requirement was an international reporting form, it used to be the penalties.

I also swear and affirm all. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,. Web form 5472 delinquency procedures. Get ready for tax season deadlines by completing any required tax forms today. Web form 5472, when filed with form 11202, information return of 25% foreign owned u.s. When taxpayers have no unreported income and the only missed requirement was an international reporting form, it used to be the penalties. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign. Web in order to obtain an abatement of the penalties associated with a form 5472 penalty, it must be established that the individual that was assessed a penalty did not only act with. Web the irm revisions also address whether first time penalty abatement (fta) will take precedence over relief provided under the notice. To qualify, taxpayers must meet the conditions set forth in i.r.m.

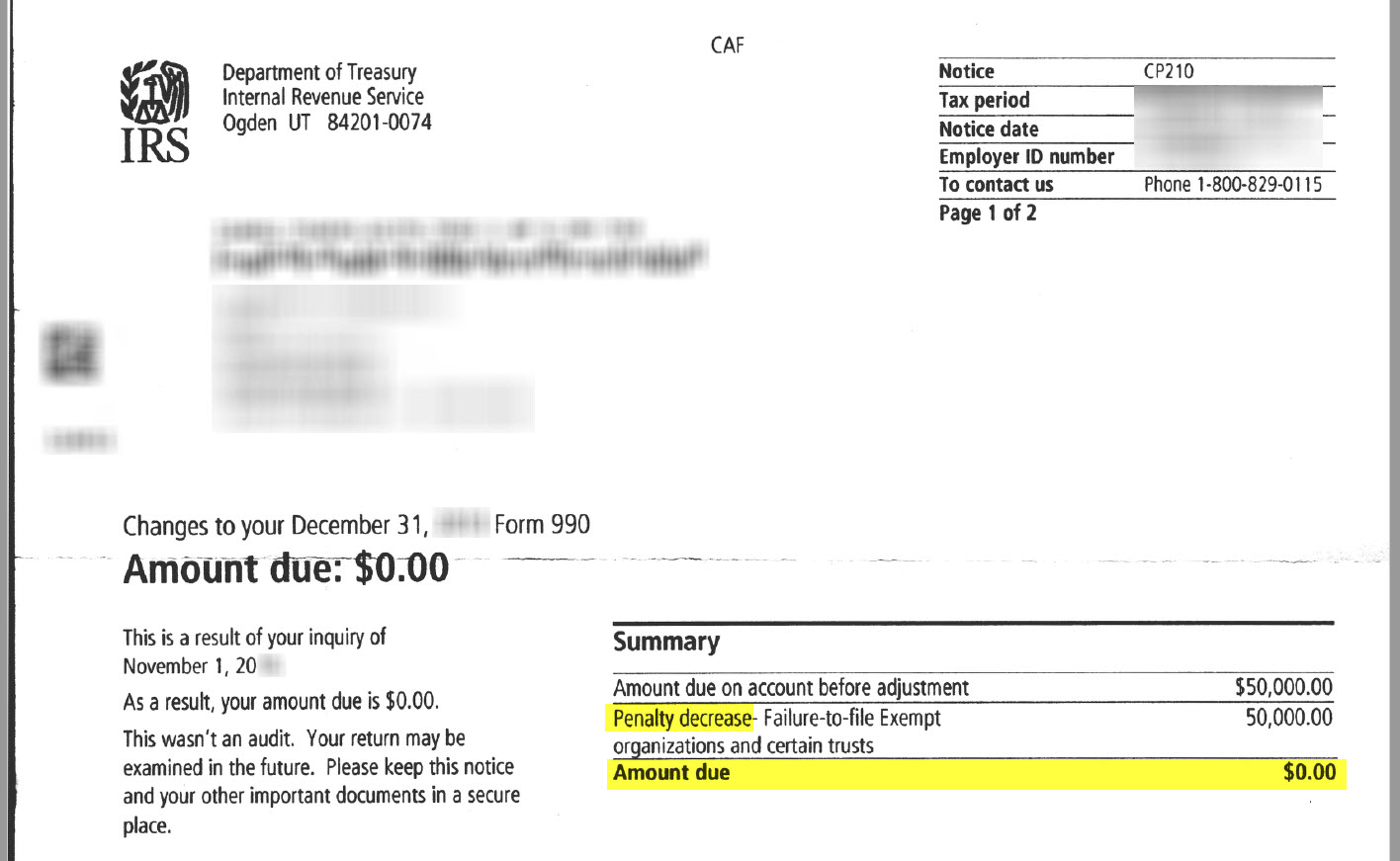

How to Write a Form 990 Late Filing Penalty Abatement Letter 50,000

Extension of time to file. Web in order to obtain an abatement of the penalties associated with a form 5472 penalty, it must be established that the individual that was assessed a penalty did not only act with. Persons with respect to certain foreign corporations, and/or form 5472,. To qualify, taxpayers must meet the conditions set forth in i.r.m. Web.

Tax Offshore Citizen

Form 5471 must be filed by certain. Extension of time to file. The penalty also applies for failure to. Web form 5472, when filed with form 11202, information return of 25% foreign owned u.s. Web penalties systematically assessed when a form 5471, information return of u.s.

Using The IRS First Time Abatement Strategically To Reduce Penalties

Generally, an fta can provide penalty relief if the taxpayer has not previously been required to file a return or has no prior penalties (except. Get ready for tax season deadlines by completing any required tax forms today. Web the irm revisions also address whether first time penalty abatement (fta) will take precedence over relief provided under the notice. Web.

50 Irs Penalty Abatement Reasonable Cause Letter Ls3p Irs penalties

To qualify, taxpayers must meet the conditions set forth in i.r.m. Web form 5472 delinquency procedures. Web form 5472, when filed with form 11202, information return of 25% foreign owned u.s. The irm clarifies that relief. Web the instructions for form 1120.

Irs form 5472 Penalty Abatement Fresh Penalty Abatement Sample Letter

Web the irm revisions also address whether first time penalty abatement (fta) will take precedence over relief provided under the notice. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,. When taxpayers have no unreported income and the only missed requirement.

Form 5471 and Form 5472 Possible FirstTime Penalty Abatement Hone

Persons with respect to certain foreign corporations, and/or form 5472,. De required to file form 5472 can request an extension of time to file by filing form 7004. Generally, an fta can provide penalty relief if the taxpayer has not previously been required to file a return or has no prior penalties (except. Web the annual deadline for filing both.

Form 843, Claim for Refund and Request for Abatement IRS Fill

Form 5471 must be filed by certain. Persons with respect to certain foreign corporations, and/or form 5472,. When taxpayers have no unreported income and the only missed requirement was an international reporting form, it used to be the penalties. Web a penalty of $25,000 will be assessed on any reporting corporation that fails to file form 5472 when due and.

Fill Free fillable IRS PDF forms

Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,. Web in order to obtain an abatement of the penalties associated with a form 5472 penalty, it must be established that the individual that was assessed a penalty did not only act.

Asking For Waiver Of Penalty Sample Letter To Irs Requesting Them To

Web the instructions for form 1120. I also swear and affirm all. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of the failure, with no maximum. Form 5471 must be filed.

FirstTime Abatement in IRS Tax Relief Billings, MT How to Use It

Persons with respect to certain foreign corporations, and/or form 5472,. Edit, sign and save irs 5472 form. Web penalties systematically assessed when a form 5471, information return of u.s. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days.

Web The Irm Revisions Also Address Whether First Time Penalty Abatement (Fta) Will Take Precedence Over Relief Provided Under The Notice.

De required to file form 5472 can request an extension of time to file by filing form 7004. Persons with respect to certain foreign corporations, and/or form 5472,. Get ready for tax season deadlines by completing any required tax forms today. Generally, an fta can provide penalty relief if the taxpayer has not previously been required to file a return or has no prior penalties (except.

Web Form 5472, When Filed With Form 11202, Information Return Of 25% Foreign Owned U.s.

Web penalties systematically assessed when a form 5471, information return of u.s. When taxpayers have no unreported income and the only missed requirement was an international reporting form, it used to be the penalties. Web the penalty under irc § 6038a begins at $25,000, and the continuation penalty, which commences 90 days after notication of assessment, is $25,000 for each. I also swear and affirm all.

Edit, Sign And Save Irs 5472 Form.

Form 5471 must be filed by certain. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of the failure, with no maximum. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,. Extension of time to file.

Web A Penalty Of $25,000 Will Be Assessed On Any Reporting Corporation That Fails To File Form 5472 When Due And In The Manner Prescribed.

To qualify, taxpayers must meet the conditions set forth in i.r.m. Corporation or a foreign corporation engaged in a u.s. Web the annual deadline for filing both form 5471 and form 5472 is the due date of a taxpayer’s income tax return (including extensions). Corporation (i.e., a corporation with at least one direct or indirect 25% foreign shareholder.

/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)