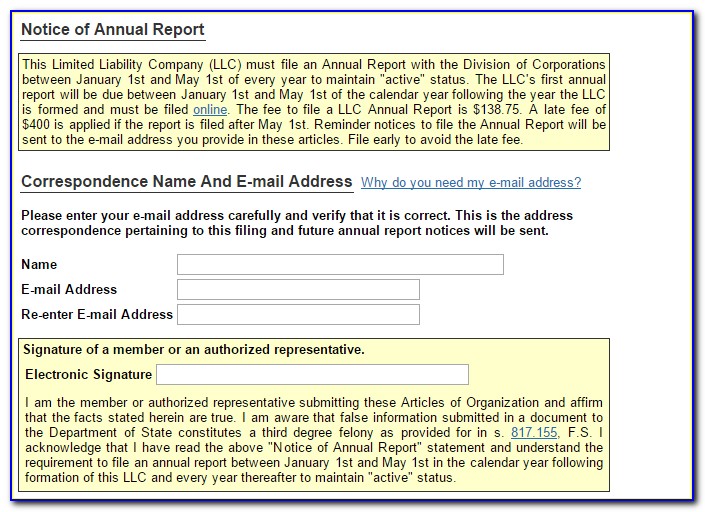

Florida Annual Report Form

Florida Annual Report Form - Web the fee for the annual report is $150. Some businesses, such as insurance companies, don't have any official forms for use and instead communicate with bcm by filings made on company letterhead. Web the forms below are used to establish account information, submit reports, or engage in collateral transactions with the bureau of collateral management (bcm). Processed in the order received. To file any time after january 1st, go to our website at www.sunbiz.org. Those business entities formed or effective after january 1 st of this year are not due an annual report and must select and file the appropriate amendment form by mail. If your entity was formed prior to january 1 of this year, file your annual report or an amended annual report using a credit card. Physician's certification of total and permanent disability: Tangible personal property tax return: Web the official/legal name of your business on our records.

Web the purpose of an annual report or amended annual report is to update or verify your entity’s information on our records. To file any time after january 1st, go to our website at www.sunbiz.org. Processed in the order received. Tangible personal property tax return: It is not a financial statement. Web llp annual report form creation; To change the name, download and complete the appropriate amendment form. Updates will post within minutes of filing! Submitting your annual report on time avoids a late fee. Web what is an annual report?

The department of state encourages business owners to file early. After may 1st a $400 late fee is added to the annual report filing fee. Physician's certification of total and permanent disability: Certificate of merger for florida partnership (pdf) (s. Tangible personal property tax return: Some businesses, such as insurance companies, don't have any official forms for use and instead communicate with bcm by filings made on company letterhead. Florida corporations forms need to update sunbiz asap? Web what is an annual report? Updates will post within minutes of filing! It is required, whether or not you need to make changes.

FLORIDA Annual Report filing deadline extended until June 30

If your entity was formed prior to january 1 of this year, file your annual report or an amended annual report using a credit card. Web what is an annual report? The annual report does not allow you to change the name of your business. Cancellation of partnership statement (pdf) conversion forms. The department of state encourages business owners to.

Florida LLC Annual Report Step by Step Guide on How to File

To file any time after january 1st, go to our website at www.sunbiz.org. Review the instructions for filing an annual. It is not a financial statement. Cancellation of partnership statement (pdf) conversion forms. If your entity was formed prior to january 1 of this year, file your annual report or an amended annual report using a credit card.

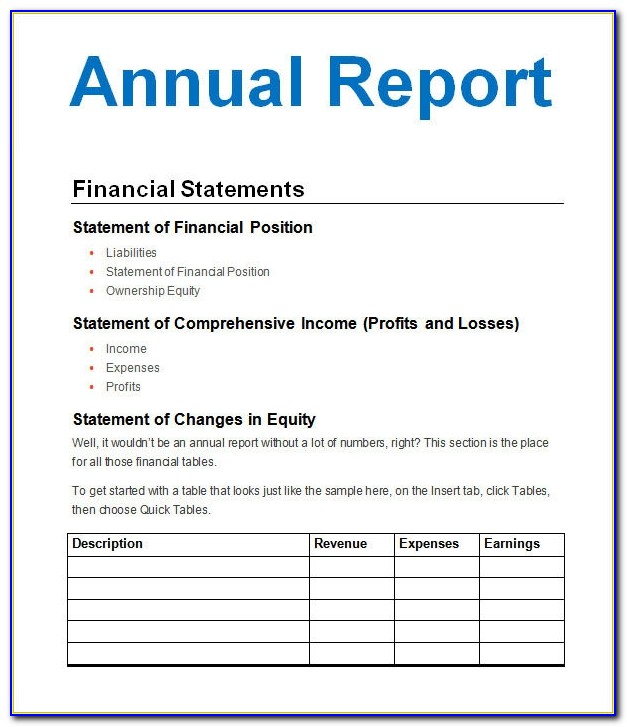

Llc Annual Report Florida Template

An annual report must be filed each year for your business entity to maintain an active status with the department of state. Physician's certification of total and permanent disability: If your entity was formed prior to january 1 of this year, file your annual report or an amended annual report using a credit card. Florida partnership into “other organization” (pdf).

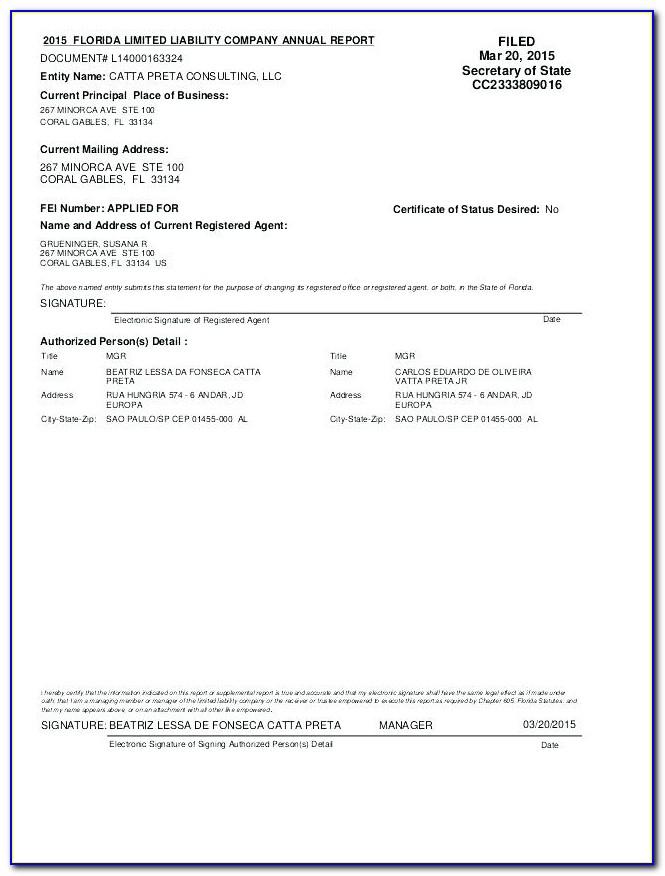

Florida Llc Annual Report Sample

Web the official/legal name of your business on our records. An annual report must be filed each year for your business entity to maintain an active status with the department of state. Submitting your annual report on time avoids a late fee. The form updates or confirms the florida department of state, division of corporations' records. Web private car and.

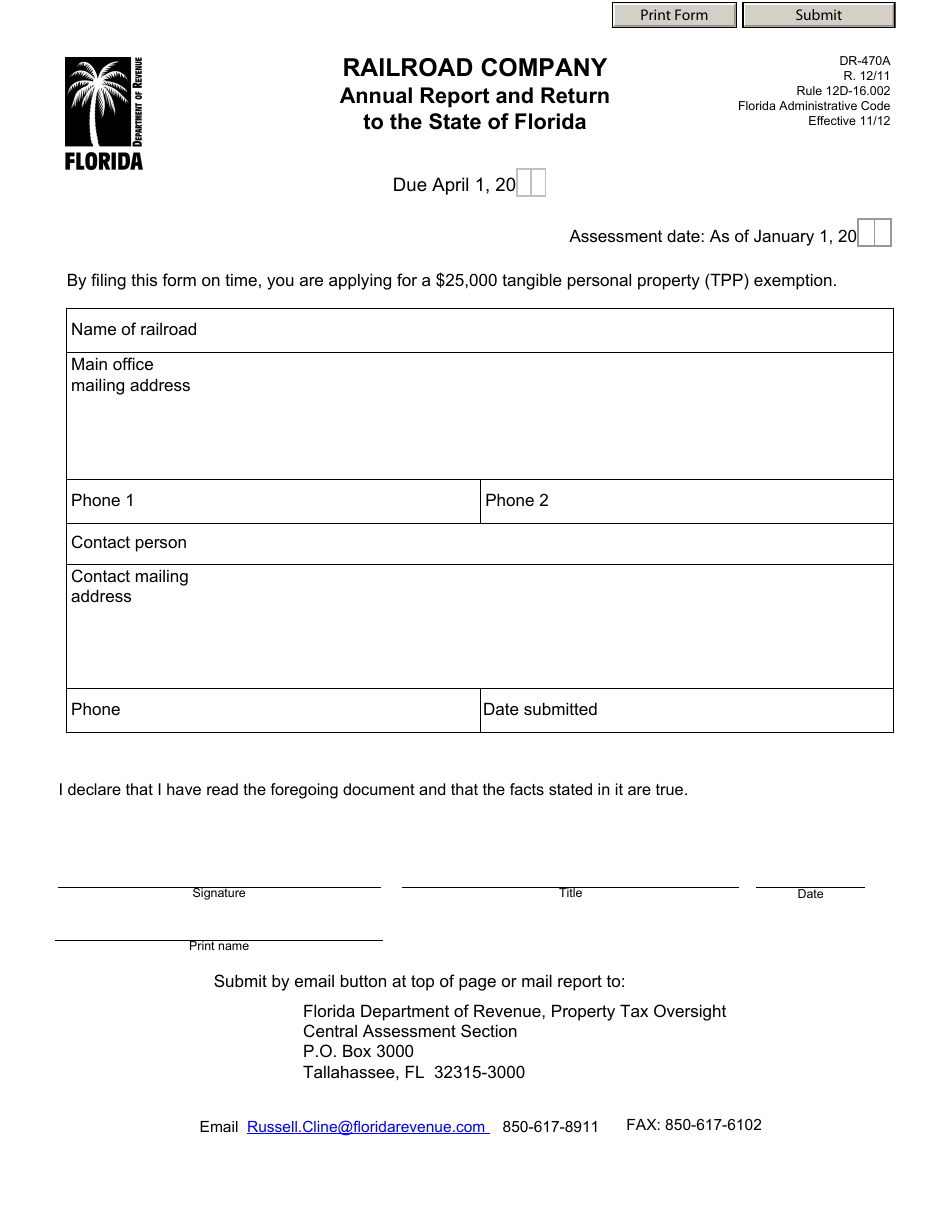

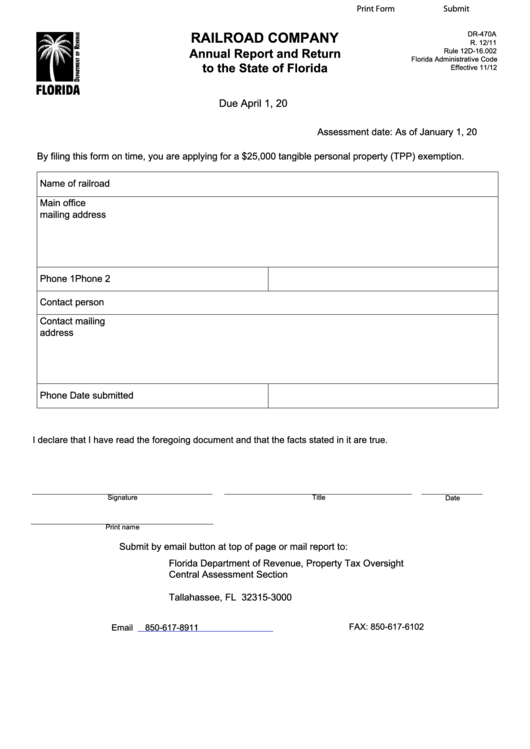

Form DR470A Download Fillable PDF or Fill Online Railroad Company

Web private car and freight line equipment companies annual report and return to state of florida: Review the instructions for filing an annual. Certificate of merger for florida partnership (pdf) (s. If your entity was formed prior to january 1 of this year, file your annual report or an amended annual report using a credit card. It is required, whether.

Preparing and Filing Your Company’s Florida Annual Report

Processed in the order received. Certificate of merger for florida partnership (pdf) (s. To change the name, download and complete the appropriate amendment form. Some businesses, such as insurance companies, don't have any official forms for use and instead communicate with bcm by filings made on company letterhead. After may 1st a $400 late fee is added to the annual.

Florida Llc Annual Report Example

Florida corporations forms need to update sunbiz asap? Web the purpose of an annual report or amended annual report is to update or verify your entity’s information on our records. Web private car and freight line equipment companies annual report and return to state of florida: Those business entities formed or effective after january 1 st of this year are.

Fillable Form Dr470a Railroad Company Annual Report And Return To

Declaration of mobile home as real property: Processed in the order received. Some businesses, such as insurance companies, don't have any official forms for use and instead communicate with bcm by filings made on company letterhead. Certificate of merger for florida partnership (pdf) (s. It is required, whether or not you need to make changes.

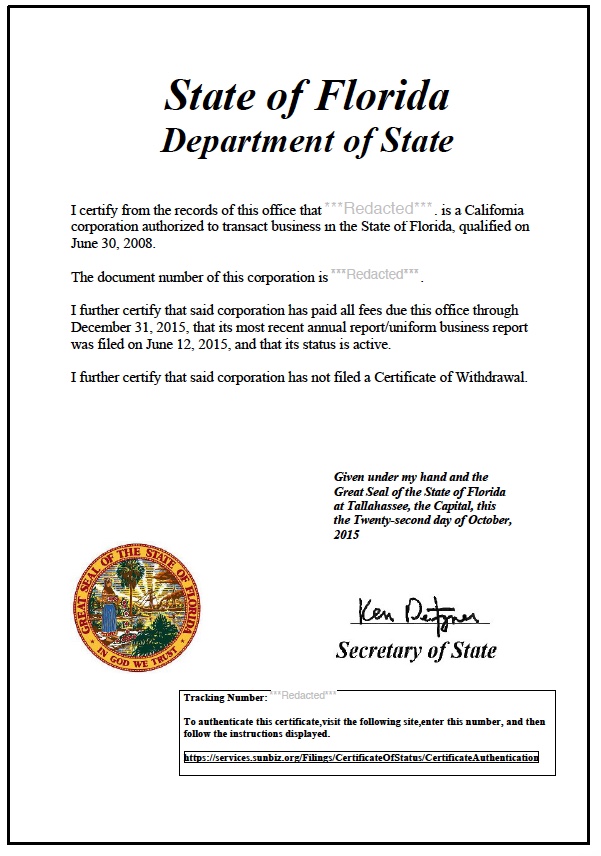

Florida Certificate of Organization LLC Bible

It is required, whether or not you need to make changes. Processed in the order received. Web llp annual report form creation; Some businesses, such as insurance companies, don't have any official forms for use and instead communicate with bcm by filings made on company letterhead. Tangible personal property tax return:

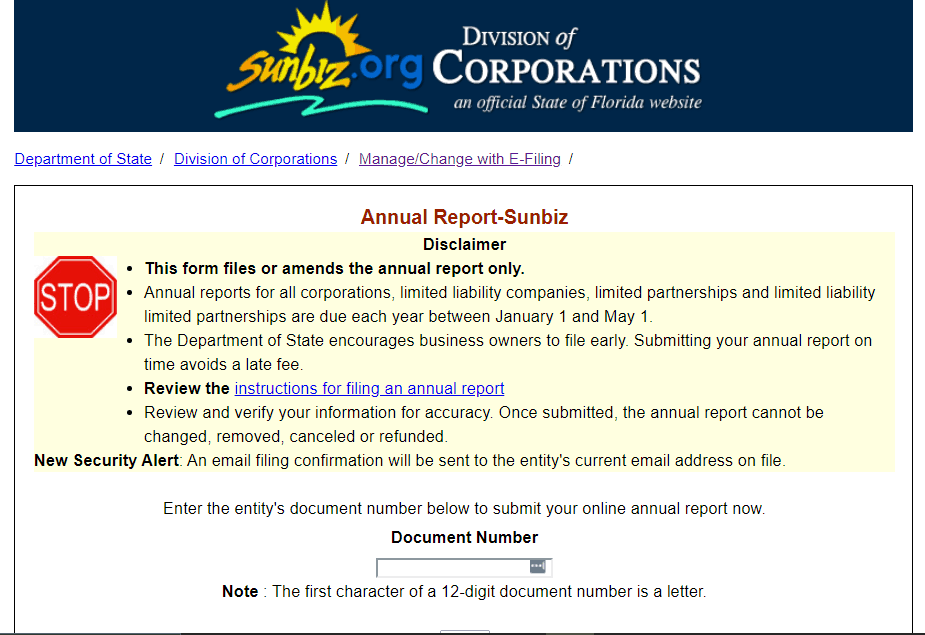

Florida LLC Annual Report Step by Step Guide on How to File

Processed in the order received. Processed in the order received. Web what is an annual report? Cancellation of partnership statement (pdf) conversion forms. An annual report must be filed each year for your business entity to maintain an active status with the department of state.

Web The Purpose Of An Annual Report Or Amended Annual Report Is To Update Or Verify Your Entity’s Information On Our Records.

Processed in the order received. Web private car and freight line equipment companies annual report and return to state of florida: To file any time after january 1st, go to our website at www.sunbiz.org. Review the instructions for filing an annual.

Web Annual Reports For All Corporations, Limited Liability Companies, Limited Partnerships And Limited Liability Limited Partnerships Are Due Each Year Between January 1 And May 1.

Certificate of merger for florida partnership (pdf) (s. Tangible personal property tax return: Declaration of mobile home as real property: Florida corporations forms need to update sunbiz asap?

Web The Official/Legal Name Of Your Business On Our Records.

Physician's certification of total and permanent disability: Florida partnership into “other organization” (pdf) (s.620.8914, f.s.) “other organization” into florida partnership (pdf) (s.620.8914, f.s.) merger form. Web what is an annual report? Cancellation of partnership statement (pdf) conversion forms.

Web Llp Annual Report Form Creation;

Processed in the order received. After may 1st a $400 late fee is added to the annual report filing fee. The form updates or confirms the florida department of state, division of corporations' records. An annual report must be filed each year for your business entity to maintain an active status with the department of state.