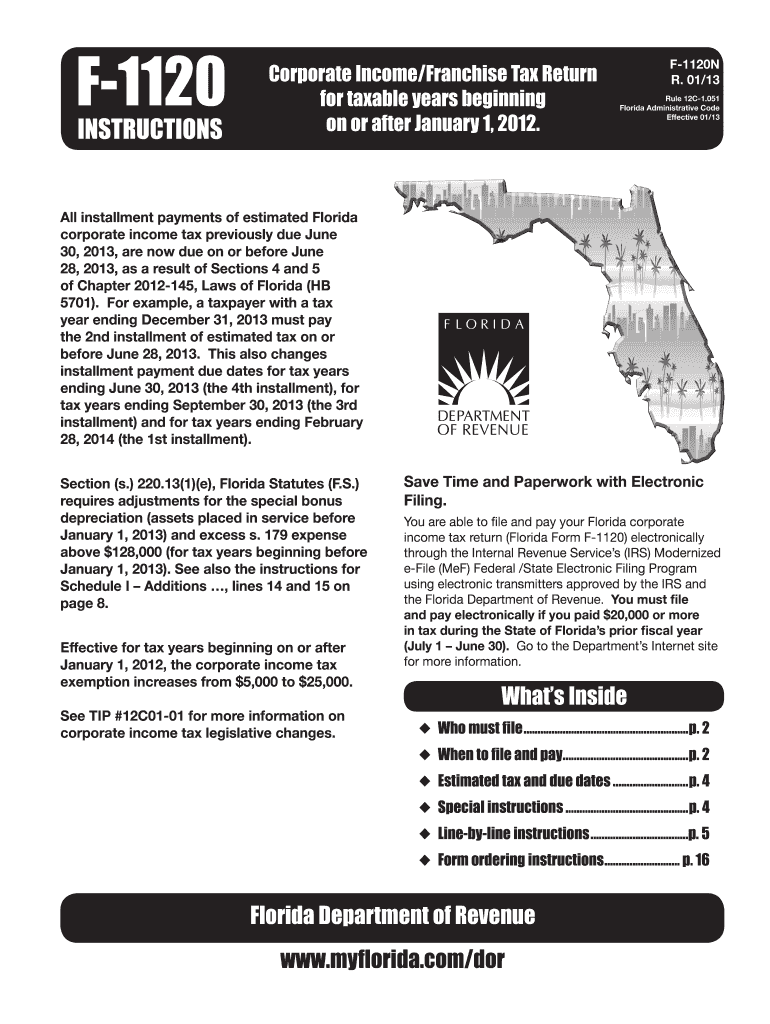

Florida Form F-1120 Instructions 2021

Florida Form F-1120 Instructions 2021 - Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3 stars rate f 1120 as 2 stars rate f 1120 as 1 stars. Web instructions for corporate income/franchise tax return for taxable years beginning on or after january 1, 2021 uwho must file. Web rate the florida form f 1120. Florida net capital loss carryover deduction (see instructions) 4. 2 uwhen to file and pay. For paperwork reduction act notice, see separate instructions. Income tax return of a foreign corporation department of the treasury. How do i submit this additional information? Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Insurance companies (attach copy of.

Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3 stars rate f 1120 as 2 stars rate f 1120 as 1 stars. Income tax return of a foreign corporation department of the treasury. Web we would like to show you a description here but the site won’t allow us. Florida corporate income/franchise tax return for 2020 tax year: Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. How do i submit this additional information? Florida corporate short form income tax return. Complete, edit or print tax forms instantly. Florida net capital loss carryover deduction (see instructions) 4. For paperwork reduction act notice, see separate instructions.

Federal taxable income state income taxes deducted in computing. Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web we would like to show you a description here but the site won’t allow us. Web part i fill in applicable items and use part ii to explain as originally reported or as adjusted any changes. Web instructions for corporate income/franchise tax return for taxable years beginning on or after january 1, 2021 uwho must file. How do i submit this additional information? An extension of time will be void if: Section 220.27, florida statutes, requires an. Florida net capital loss carryover deduction (see instructions) 4. For paperwork reduction act notice, see separate instructions.

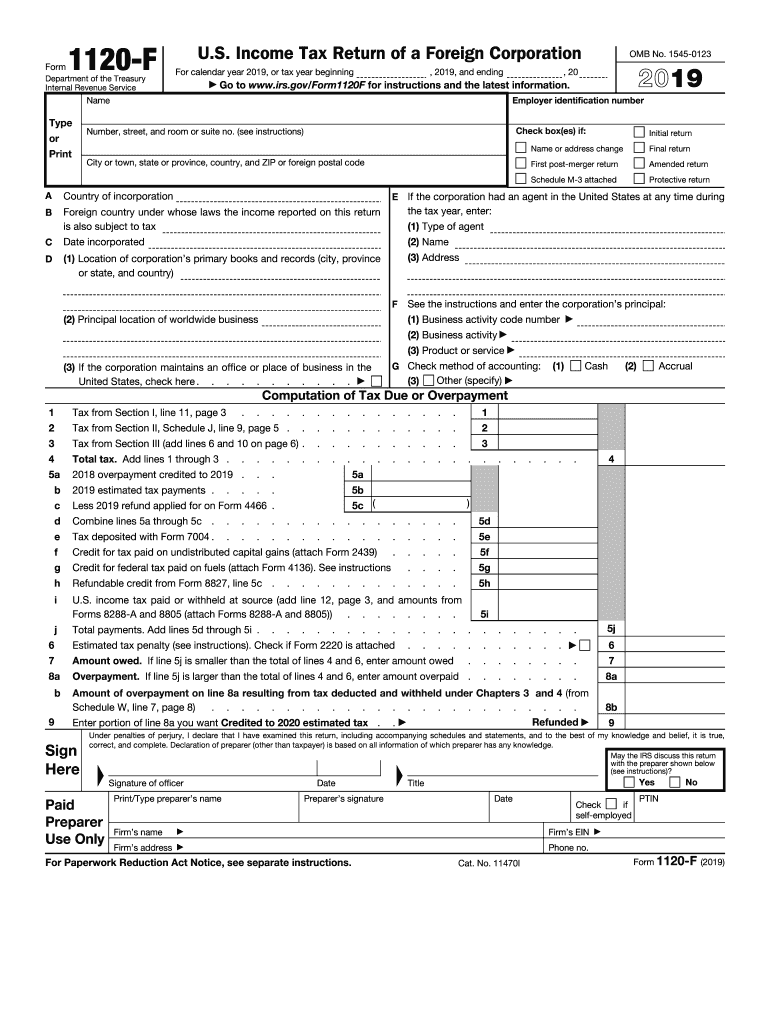

2019 Form IRS 1120F Fill Online, Printable, Fillable, Blank pdfFiller

How do i submit this additional information? Web part i fill in applicable items and use part ii to explain as originally reported or as adjusted any changes. Florida corporate income/franchise tax return for 2020 tax year: Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3 stars rate f 1120 as 2.

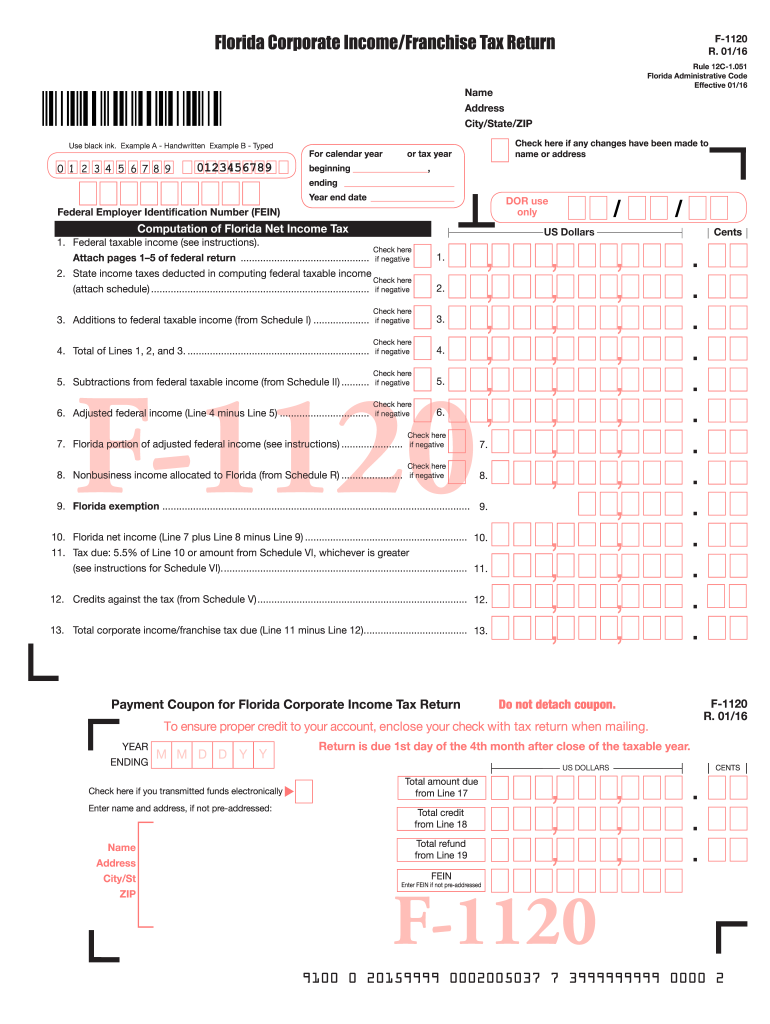

F 1120 2016 form Fill out & sign online DocHub

Web rate the florida form f 1120. An extension of time will be void if: Complete, edit or print tax forms instantly. Section 220.27, florida statutes, requires an. For paperwork reduction act notice, see separate instructions.

Fl F 1120 Instructions Form Fill Out and Sign Printable PDF Template

Web instructions for corporate income/franchise tax return for taxable years beginning on or after january 1, 2021 uwho must file. How do i submit this additional information? Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Florida corporate income/franchise tax return for 2020 tax.

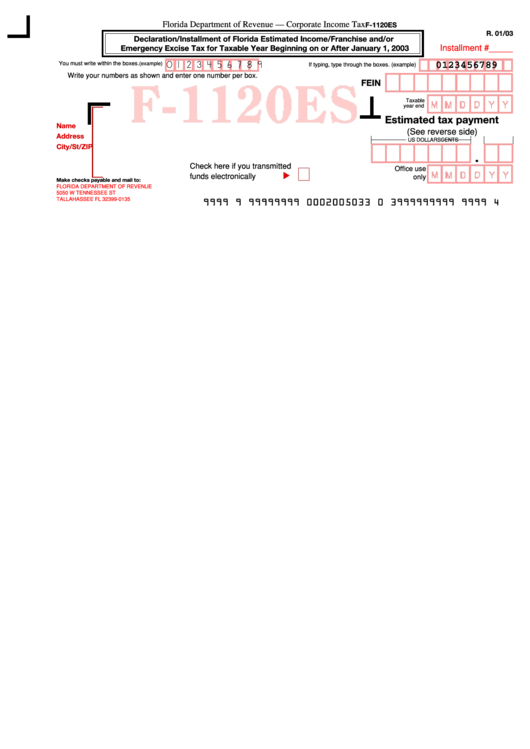

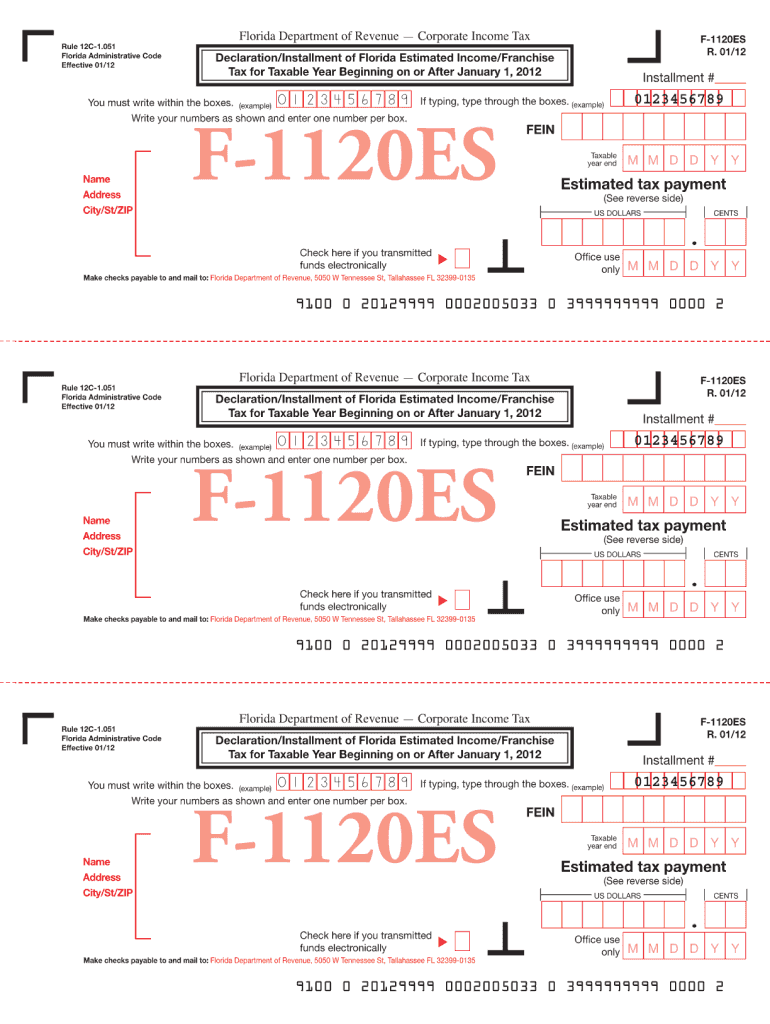

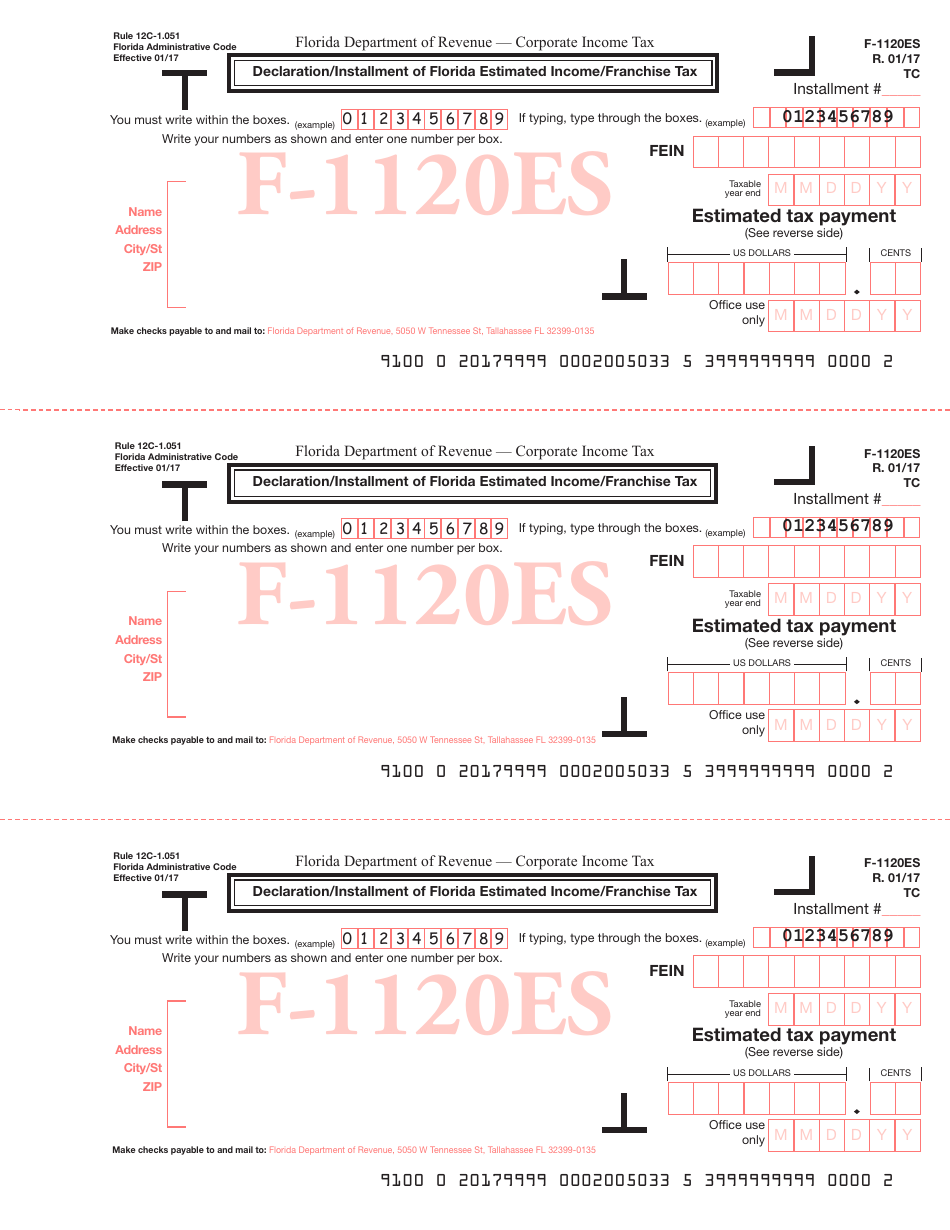

Form F1120es Declaration/installment Of Florida Estimated

Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3 stars rate f 1120 as 2 stars rate f 1120 as 1 stars. How do i submit this additional information? Florida corporate short form income tax return. Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20.

Florida Form F 1120Es Fill Out and Sign Printable PDF Template signNow

For paperwork reduction act notice, see separate instructions. Section 220.27, florida statutes, requires an. Web rate the florida form f 1120. Florida corporate income/franchise tax return for 2020 tax year: Income tax return of a foreign corporation department of the treasury.

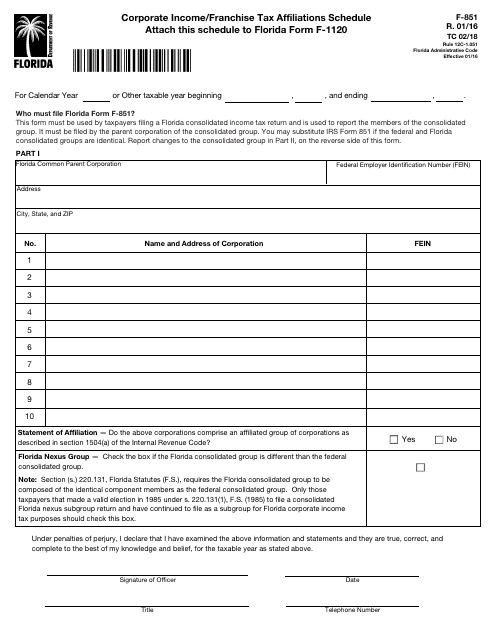

Form F1120 Schedule F851 Download Fillable PDF or Fill Online

Florida corporate income/franchise tax return for 2020 tax year: How do i submit this additional information? For paperwork reduction act notice, see separate instructions. 2 uwhen to file and pay. Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information.

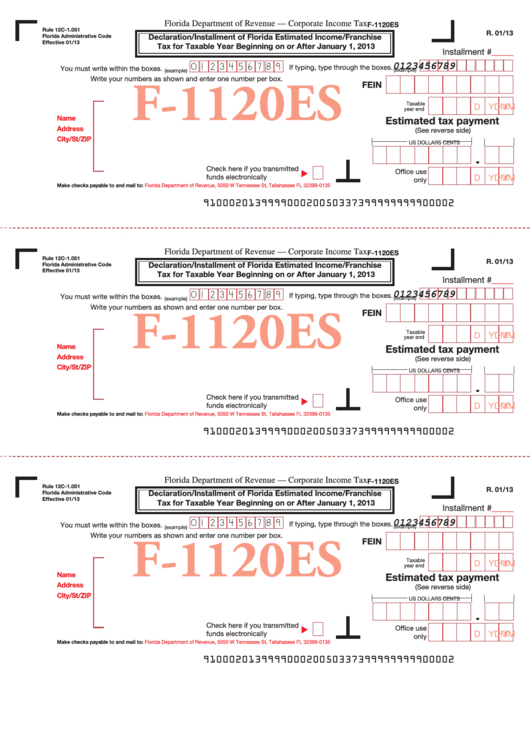

Form F1120es Declaration/installment Of Florida Estimated

How do i submit this additional information? Insurance companies (attach copy of. Income tax return of a foreign corporation department of the treasury. Complete, edit or print tax forms instantly. An extension of time will be void if:

Form F1120es Declaration/installment Of Florida Estimated

How do i submit this additional information? Web rate the florida form f 1120. Insurance companies (attach copy of. Florida corporate income/franchise tax return for 2020 tax year: Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information.

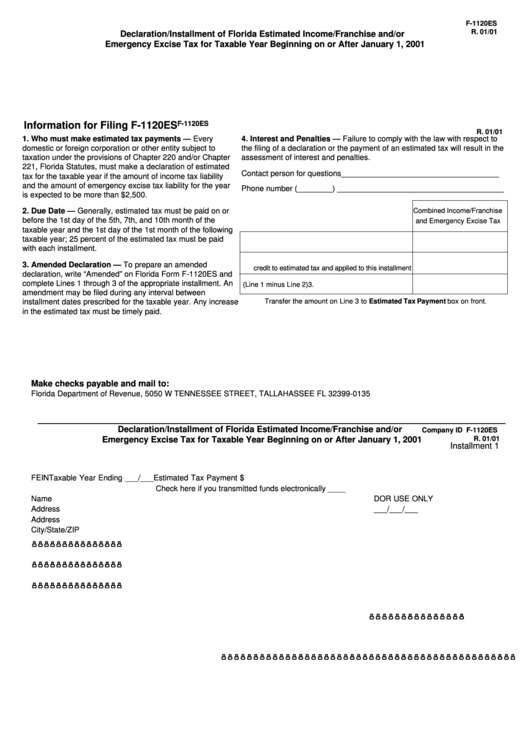

Form F1120ES Download Printable PDF or Fill Online Declaration

Federal taxable income state income taxes deducted in computing. Section 220.27, florida statutes, requires an. Web rate the florida form f 1120. Web part i fill in applicable items and use part ii to explain as originally reported or as adjusted any changes. Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3.

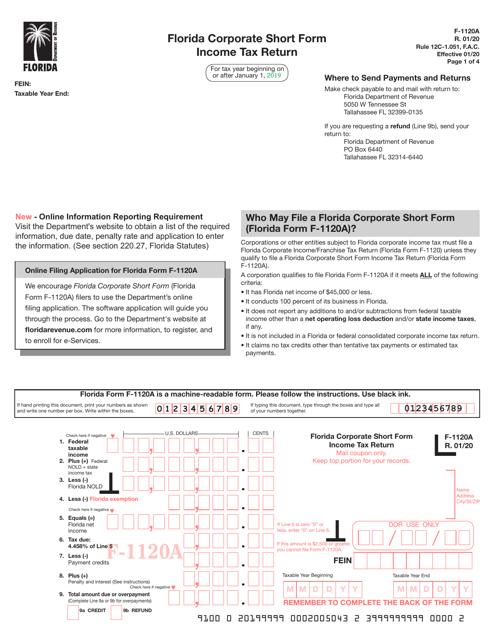

Form F1120A Download Printable PDF or Fill Online Florida Corporate

Web instructions for corporate income/franchise tax return for taxable years beginning on or after january 1, 2021 uwho must file. An extension of time will be void if: Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. For paperwork reduction act notice, see separate.

Income Tax Return Of A Foreign Corporation Department Of The Treasury.

Insurance companies (attach copy of. Florida corporate income/franchise tax return for 2020 tax year: Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3 stars rate f 1120 as 2 stars rate f 1120 as 1 stars. Web we would like to show you a description here but the site won’t allow us.

Web Instructions For Corporate Income/Franchise Tax Return For Taxable Years Beginning On Or After January 1, 2021 Uwho Must File.

Section 220.27, florida statutes, requires an. Web part i fill in applicable items and use part ii to explain as originally reported or as adjusted any changes. 2 uwhen to file and pay. Complete, edit or print tax forms instantly.

Florida Corporate Short Form Income Tax Return.

Web rate the florida form f 1120. How do i submit this additional information? For paperwork reduction act notice, see separate instructions. Florida net capital loss carryover deduction (see instructions) 4.

Federal Taxable Income State Income Taxes Deducted In Computing.

An extension of time will be void if: Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information.