Florida Form Rt 6

Florida Form Rt 6 - Any employer who employs ten (10) or more employees in any quarter during the preceding fiscal year (july 1 st thru june 30 th) for. 6.if you have questions, please contact your state. Complete, edit or print tax forms instantly. Try it for free now! Try it for free now! When filing online, a formatted flat file may be imported containing the tax and wage information for. Employer's quarterly report with payment coupon if you cannot print this form in color, please order it to be mailed to you. Online filing via the florida dor website for a single employer. 5.using the enclosed envelope, return your completed form to the central processing facility. To register online, go to our website at www.myflorida.com/dor.

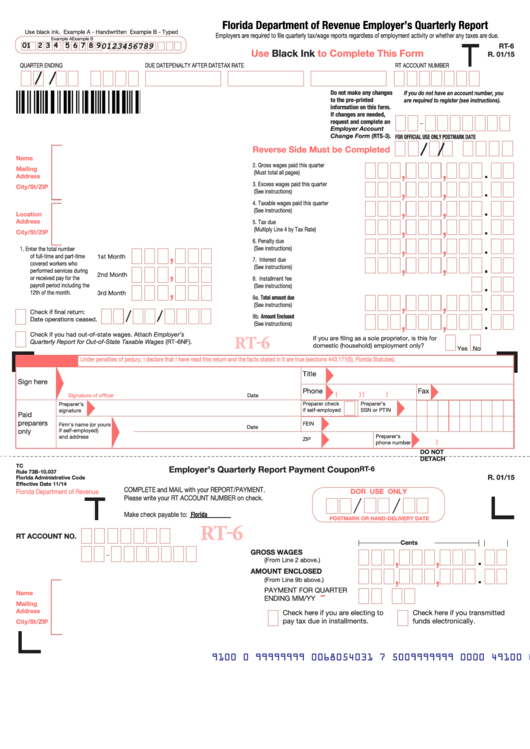

Web the tips below will help you fill in florida rt 6 fillable form easily and quickly: To register online, go to our website at www.myflorida.com/dor. Employer's quarterly report with payment coupon if you cannot print this form in color, please order it to be mailed to you. 5.using the enclosed envelope, return your completed form to the central processing facility. 6.if you have questions, please contact your state. Complete, edit or print tax forms instantly. Try it for free now! Online filing via the florida dor website for a single employer. Any employer who employs ten (10) or more employees in any quarter during the preceding fiscal year (july 1 st thru june 30 th) for. Web florida department of revenue employer’s quarterly report employers are required to file quarterly tax/wage reports regardless of employment activity or whether any taxes are.

Upload, modify or create forms. 6.if you have questions, please contact your state. Employer's quarterly report with payment coupon if you cannot print this form in color, please order it to be mailed to you. Complete, edit or print tax forms instantly. Web the tips below will help you fill in florida rt 6 fillable form easily and quickly: Any employer who employs ten (10) or more employees in any quarter during the preceding fiscal year (july 1 st thru june 30 th) for. Try it for free now! To register online, go to our website at www.myflorida.com/dor. 5.using the enclosed envelope, return your completed form to the central processing facility. Web florida department of revenue employer’s quarterly report employers are required to file quarterly tax/wage reports regardless of employment activity or whether any taxes are.

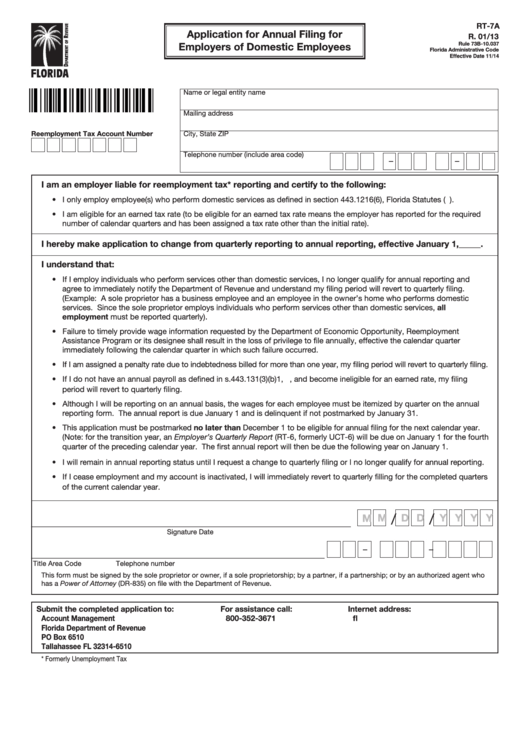

Form Rt7a Florida Application For Annual Filing For Employers Of

To register online, go to our website at www.myflorida.com/dor. When filing online, a formatted flat file may be imported containing the tax and wage information for. Ad upload, modify or create forms. Any employer who employs ten (10) or more employees in any quarter during the preceding fiscal year (july 1 st thru june 30 th) for. Upload, modify or.

Rt 6 Form 2020 Fill Out and Sign Printable PDF Template signNow

Any employer who employs ten (10) or more employees in any quarter during the preceding fiscal year (july 1 st thru june 30 th) for. To register online, go to our website at www.myflorida.com/dor. 5.using the enclosed envelope, return your completed form to the central processing facility. Web florida department of revenue employer’s quarterly report employers are required to file.

Form Rt6 Florida Department Of Revenue Employer'S Quarterly Report

Ad upload, modify or create forms. Any employer who employs ten (10) or more employees in any quarter during the preceding fiscal year (july 1 st thru june 30 th) for. Employer's quarterly report with payment coupon if you cannot print this form in color, please order it to be mailed to you. When filing online, a formatted flat file.

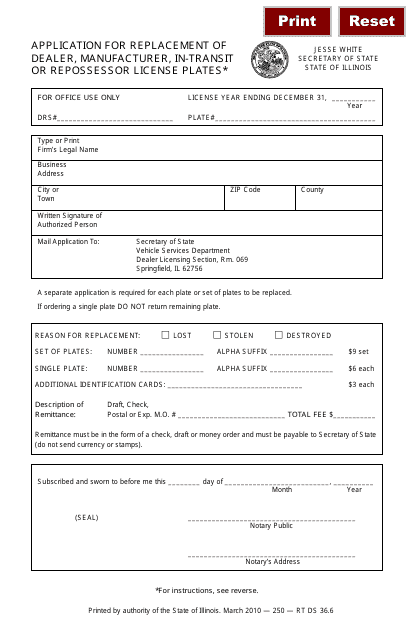

Form RT DS36.6 Download Fillable PDF or Fill Online Application for

To register online, go to our website at www.myflorida.com/dor. Online filing via the florida dor website for a single employer. Web the tips below will help you fill in florida rt 6 fillable form easily and quickly: Any employer who employs ten (10) or more employees in any quarter during the preceding fiscal year (july 1 st thru june 30.

Florida Rt 6 Form amulette

Any employer who employs ten (10) or more employees in any quarter during the preceding fiscal year (july 1 st thru june 30 th) for. Employer's quarterly report with payment coupon if you cannot print this form in color, please order it to be mailed to you. Ad upload, modify or create forms. 5.using the enclosed envelope, return your completed.

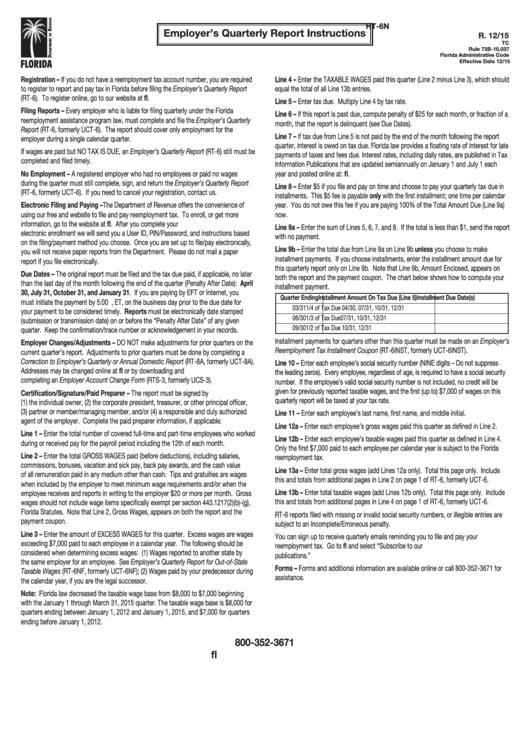

Instructions For Form Rt6n Florida Employer'S Quarterly Report

Any employer who employs ten (10) or more employees in any quarter during the preceding fiscal year (july 1 st thru june 30 th) for. Employer's quarterly report with payment coupon if you cannot print this form in color, please order it to be mailed to you. Upload, modify or create forms. Web florida department of revenue employer’s quarterly report.

Fill Free fillable forms for the state of Florida

6.if you have questions, please contact your state. Ad upload, modify or create forms. Try it for free now! Complete, edit or print tax forms instantly. When filing online, a formatted flat file may be imported containing the tax and wage information for.

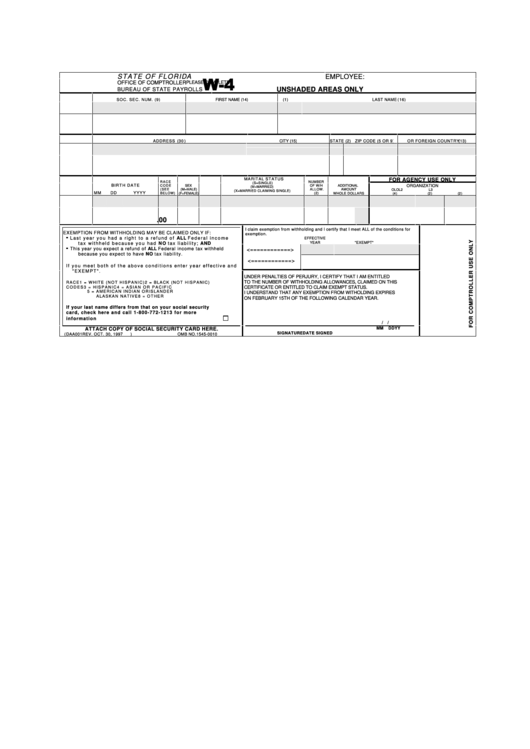

Fillable Florida Form W4 Employee'S Withholding Allowance

6.if you have questions, please contact your state. Upload, modify or create forms. Online filing via the florida dor website for a single employer. Web the tips below will help you fill in florida rt 6 fillable form easily and quickly: Employer's quarterly report with payment coupon if you cannot print this form in color, please order it to be.

Florida Dmv Form 82042 Printable Blank PDF Online

5.using the enclosed envelope, return your completed form to the central processing facility. Try it for free now! Try it for free now! Web the tips below will help you fill in florida rt 6 fillable form easily and quickly: Online filing via the florida dor website for a single employer.

Florida Concealed Weapons Permit Application Form Form Resume

Web the tips below will help you fill in florida rt 6 fillable form easily and quickly: 5.using the enclosed envelope, return your completed form to the central processing facility. Employer's quarterly report with payment coupon if you cannot print this form in color, please order it to be mailed to you. Try it for free now! Ad upload, modify.

Try It For Free Now!

5.using the enclosed envelope, return your completed form to the central processing facility. Any employer who employs ten (10) or more employees in any quarter during the preceding fiscal year (july 1 st thru june 30 th) for. Complete, edit or print tax forms instantly. Web the tips below will help you fill in florida rt 6 fillable form easily and quickly:

Upload, Modify Or Create Forms.

Online filing via the florida dor website for a single employer. Try it for free now! When filing online, a formatted flat file may be imported containing the tax and wage information for. Ad upload, modify or create forms.

6.If You Have Questions, Please Contact Your State.

Employer's quarterly report with payment coupon if you cannot print this form in color, please order it to be mailed to you. Web florida department of revenue employer’s quarterly report employers are required to file quarterly tax/wage reports regardless of employment activity or whether any taxes are. To register online, go to our website at www.myflorida.com/dor.