Foreign Income Exclusion Form

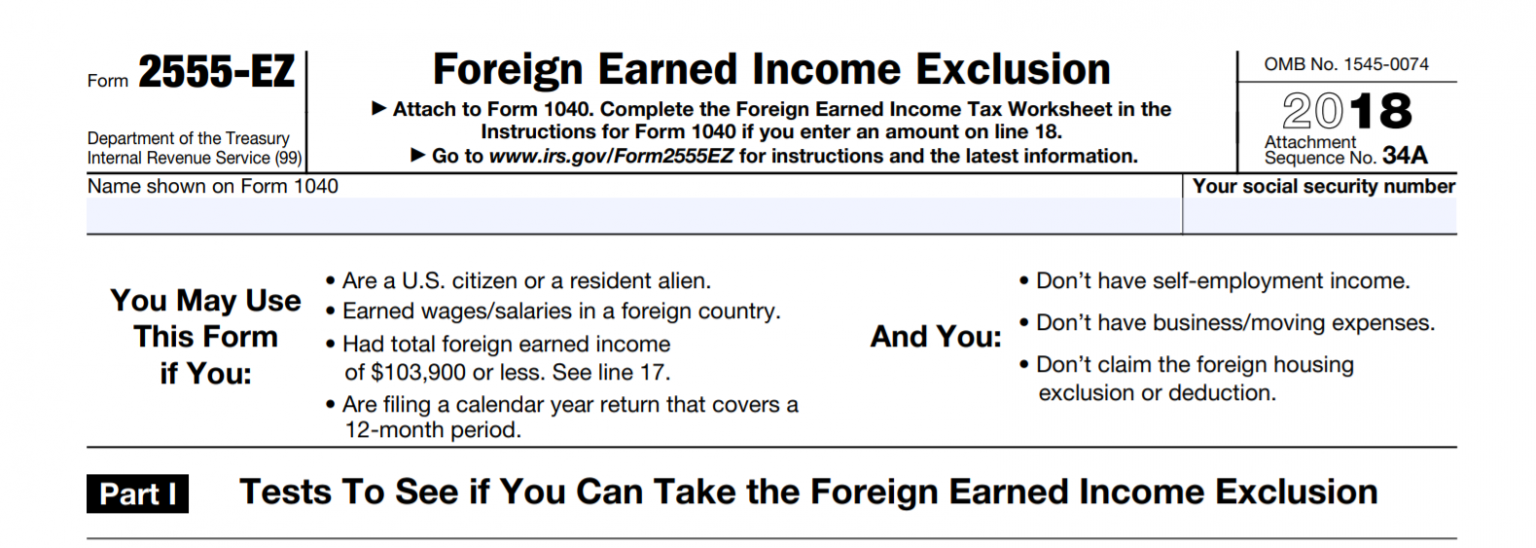

Foreign Income Exclusion Form - For tax year 2022, the maximum foreign earned income exclusion is the lesser of the. Ad our international tax services can be customized to fit your specific business needs. Top frequently asked questions for u.s. Uslegalforms allows users to edit, sign, fill & share all type of documents online. You still have to file your u.s. Web however, you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation ($107,600 for 2020, $108,700 for 2021,. Your initial choice of the. Web where income relates to services both in the u.s. Web one tax break for expatriates is the foreign earned income exclusion. Web the maximum foreign earned income exclusion amount is adjusted annually for inflation.

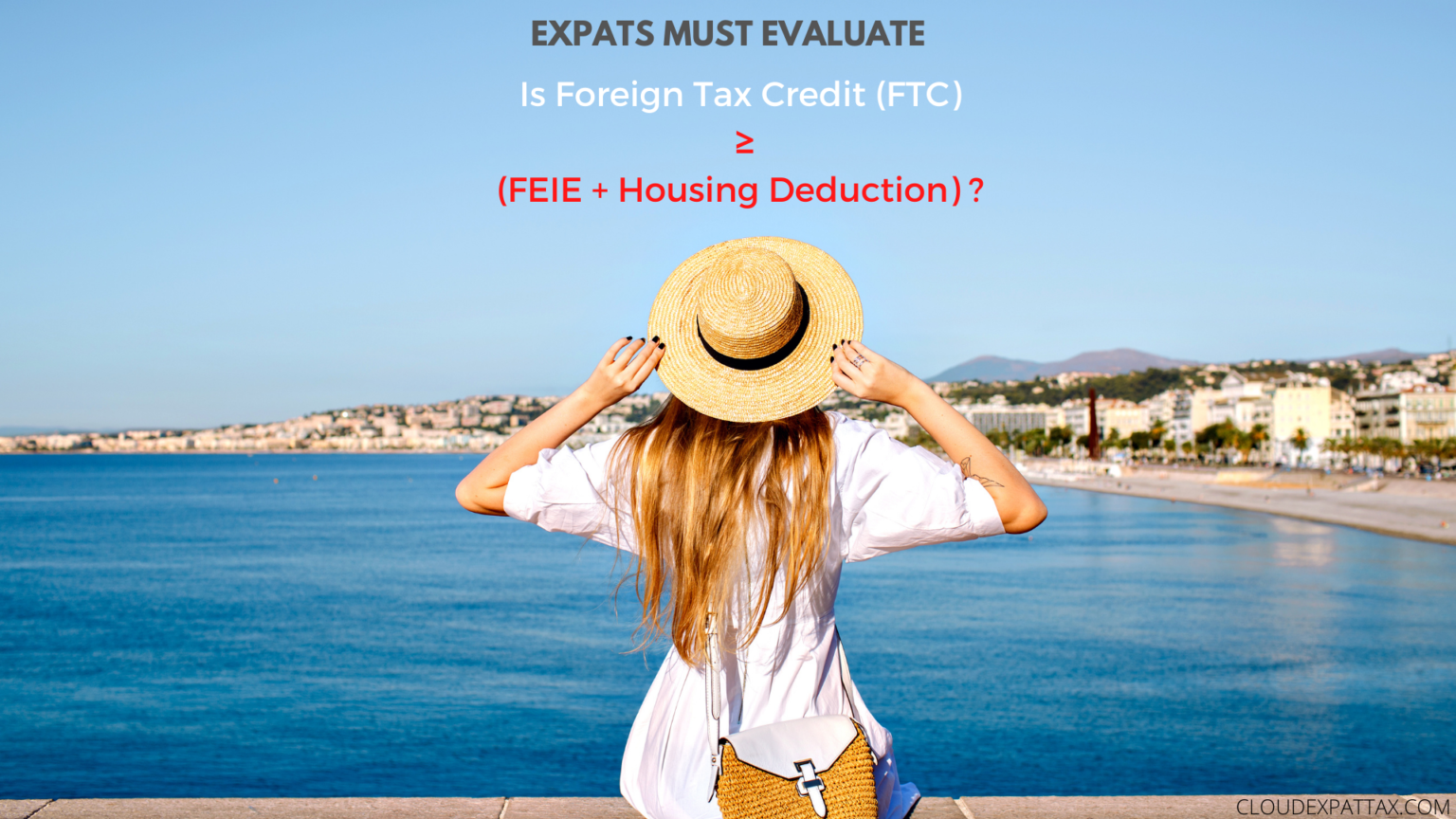

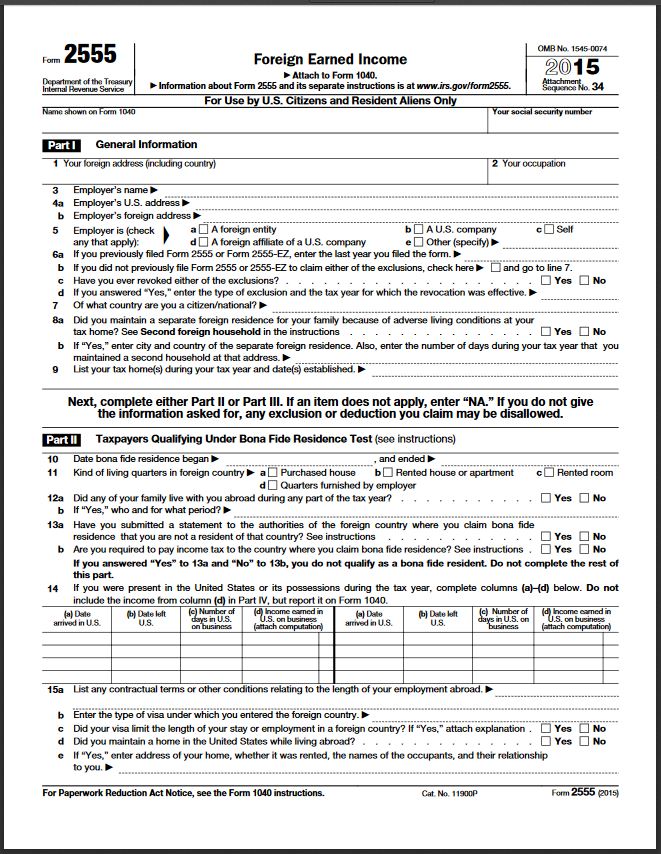

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages. Special rules apply to foreign service and military personnel. Web 235 rows if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. You still have to file your u.s. Web foreign earned income exclusion (form 2555) u.s. Web mp should take a $37,000 nonrefundable foreign tax credit against the $36,000 u.s. Aliens and citizens living abroad. This form allows an exclusion of up to $107,600 of your foreign earned income if you are a u.s. And outside the u.s., the income must be apportioned.

Web the foreign earned income exclusion, the foreign housing exclusion, and the foreign housing deduction are based on foreign earned income. Top frequently asked questions for u.s. Aliens and citizens living abroad. If you qualify, you can use form. And outside the u.s., the income must be apportioned. Web to obtain the tax benefit of the foreign earned income exclusion, expats must file irs form 2555 along with their federal tax return. You cannot exclude or deduct more. This form allows an exclusion of up to $107,600 of your foreign earned income if you are a u.s. Ad our international tax services can be customized to fit your specific business needs. Web one tax break for expatriates is the foreign earned income exclusion.

Foreign Earned Exclusion Explained Expat US Tax

Web the foreign earned income exclusion, the foreign housing exclusion, and the foreign housing deduction are based on foreign earned income. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. And outside the u.s., the income must be apportioned. Web foreign earned income exclusion (form 2555) u.s. Top frequently asked.

Everything You Need to Know About the Foreign Earned Exclusion

Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web however, you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation ($107,600 for 2020, $108,700 for 2021,. Web the foreign earned income exclusion, the foreign housing exclusion, and the foreign.

Foreign Earned Exclusion US for Expats Tax Guide

Ad our international tax services can be customized to fit your specific business needs. Web foreign earned income exclusion (form 2555) expatriation: As long as they timely file form 2555 to elect the foreign. Resident alien living and working in a foreign country. Web what is the foreign earned income exclusion (form 2555)?

2000 Form 2555EZ. Foreign Earned Exclusion irs Fill out

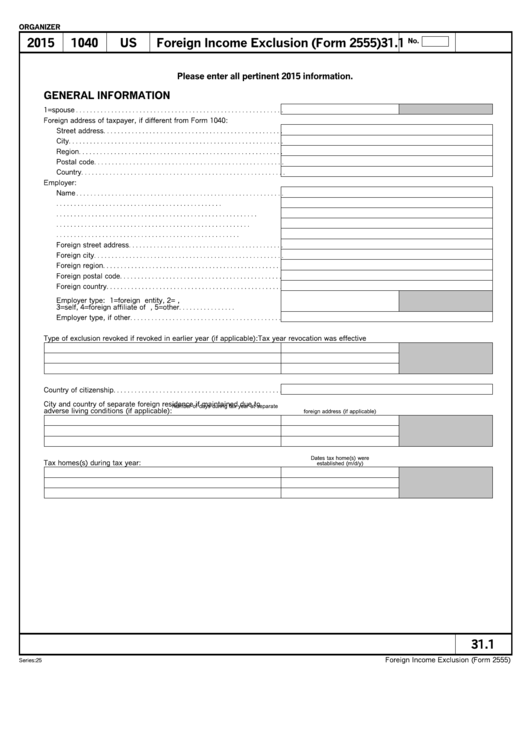

The form has nine sections:. We have decades of experience with holistic international tax strategies and planning. Web foreign earned income exclusion (form 2555) expatriation: Reporting of foreign financial accounts; Web 235 rows if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

2015 Foreign Exclusion (Form 2555) printable pdf download

Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Resident alien living and working in a foreign country. If you qualify, you can use form. Web what is the foreign earned income exclusion (form 2555)? Web however, you may qualify to exclude your foreign earnings from income up to an.

Filing Form 2555 for the Foreign Earned Exclusion

Web foreign earned income exclusion (form 2555) u.s. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web the maximum foreign earned income exclusion amount is adjusted annually for inflation. Web to obtain the tax benefit of the foreign earned income exclusion, expats must file irs form 2555 along with.

Foreign Exclusion International Accounting & Tax Consultants

You cannot exclude or deduct more. Ad our international tax services can be customized to fit your specific business needs. Edit, sign and save foreign earning exempt form. If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income. Resident alien living and working in a foreign country.

Foreign Earned Exclusion Form 2555 Verni Tax Law

As long as they timely file form 2555 to elect the foreign. Web however, you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation ($107,600 for 2020, $108,700 for 2021,. If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign.

What to claim, foreign tax credit (Form 1116) or foreign earned

Web the foreign earned income exclusion, the foreign housing exclusion, and the foreign housing deduction are based on foreign earned income. Ad our international tax services can be customized to fit your specific business needs. We have decades of experience with holistic international tax strategies and planning. You still have to file your u.s. Web mp should take a $37,000.

Foreign Exclusion Form 2555

Web foreign earned income exclusion (form 2555) u.s. We have decades of experience with holistic international tax strategies and planning. Top frequently asked questions for u.s. Web 235 rows if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. If you qualify, you can use form.

For Tax Year 2022, The Maximum Foreign Earned Income Exclusion Is The Lesser Of The.

Top frequently asked questions for u.s. If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income. Ad our international tax services can be customized to fit your specific business needs. This form allows an exclusion of up to $107,600 of your foreign earned income if you are a u.s.

Web You Can Choose The Foreign Earned Income Exclusion And/Or The Foreign Housing Exclusion By Completing The Appropriate Parts Of Form 2555.

Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. The form has nine sections:. Web the maximum foreign earned income exclusion amount is adjusted annually for inflation. We have decades of experience with holistic international tax strategies and planning.

Web Mp Should Take A $37,000 Nonrefundable Foreign Tax Credit Against The $36,000 U.s.

Web the foreign earned income exclusion, the foreign housing exclusion, and the foreign housing deduction are based on foreign earned income. Your initial choice of the. Withholding on income from u.s. Reporting of foreign financial accounts;

Special Rules Apply To Foreign Service And Military Personnel.

Web foreign earned income exclusion (form 2555) expatriation: You still have to file your u.s. Web 235 rows if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web foreign earned income exclusion (form 2555) u.s.