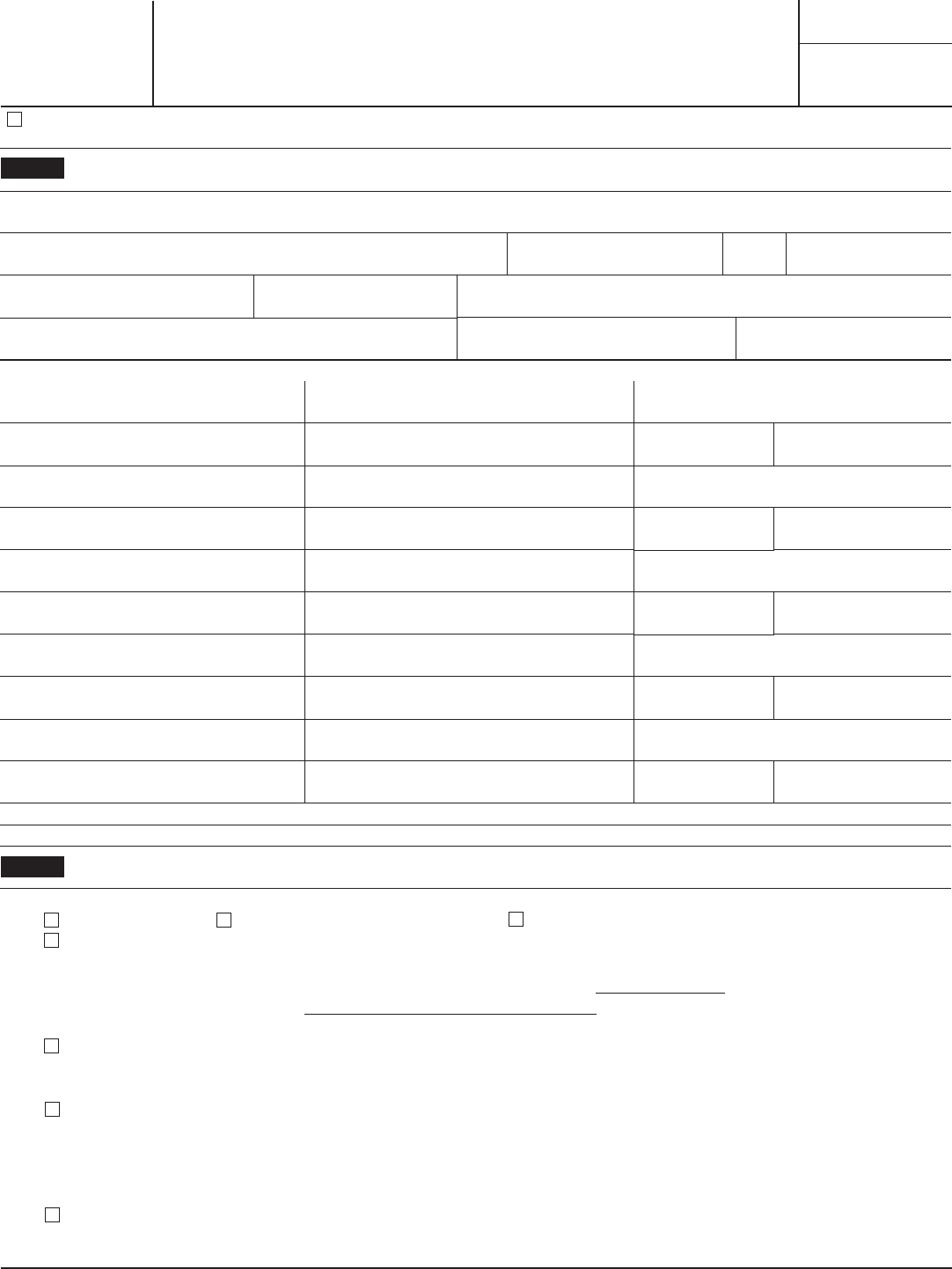

Form 1023-Ez Instructions

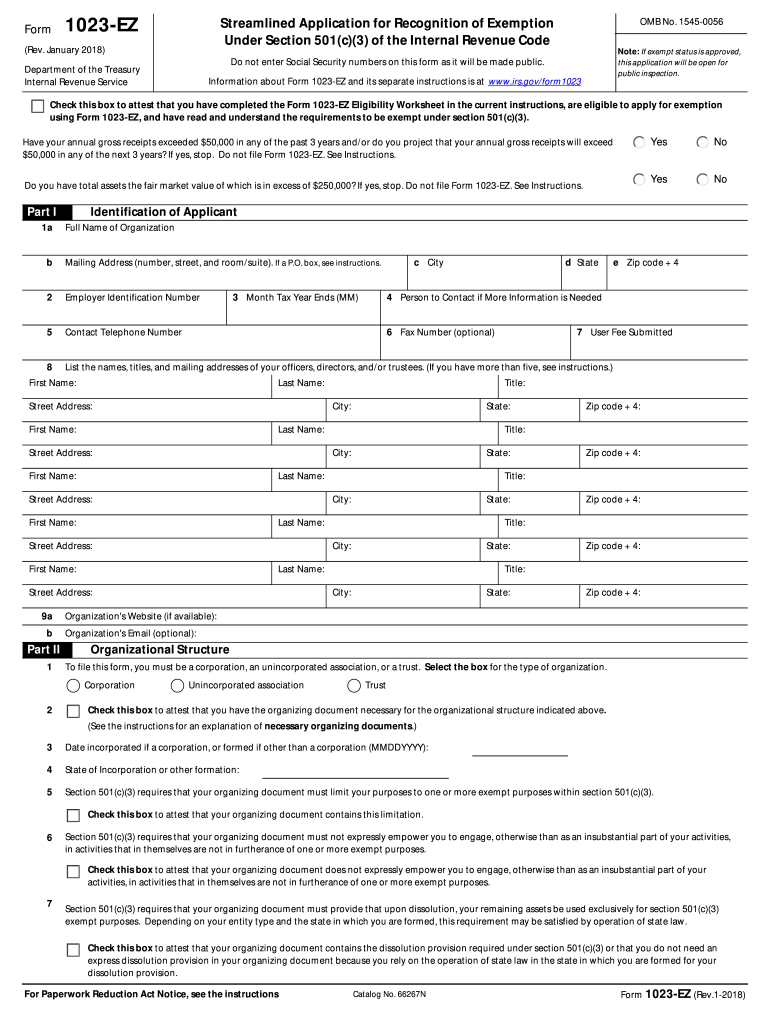

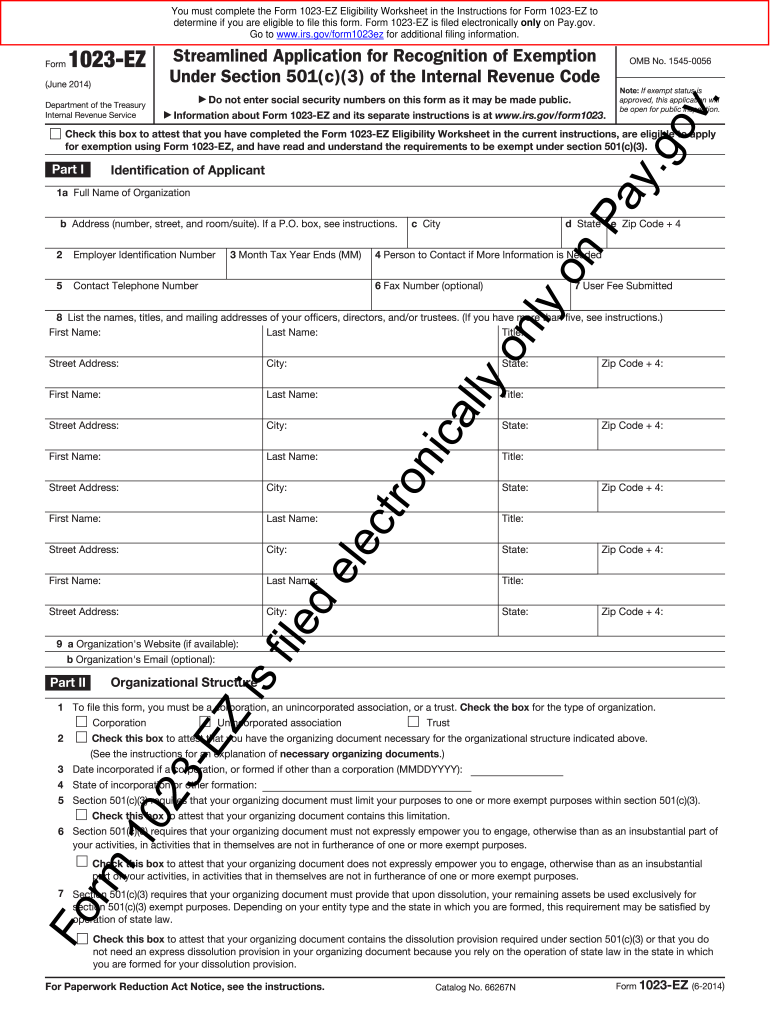

Form 1023-Ez Instructions - Here’s a summary of the revisions we made to the form 1023. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3). Only certain organizations are eligible to file. Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501 (c) (3). Learn what you need to know before the form completion and check what you can do with our pdf template online. Web purpose of form. You must apply on form 1023.

Learn what you need to know before the form completion and check what you can do with our pdf template online. Web purpose of form. Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501 (c) (3). Here’s a summary of the revisions we made to the form 1023. Only certain organizations are eligible to file. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3). You must apply on form 1023.

Here’s a summary of the revisions we made to the form 1023. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3). You must apply on form 1023. Web purpose of form. Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501 (c) (3). Only certain organizations are eligible to file. Learn what you need to know before the form completion and check what you can do with our pdf template online.

1023 ez form Fill out & sign online DocHub

Here’s a summary of the revisions we made to the form 1023. Learn what you need to know before the form completion and check what you can do with our pdf template online. Web purpose of form. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3). You must.

Sample Completed 1023 Ez Form Fill Out and Sign Printable PDF

Learn what you need to know before the form completion and check what you can do with our pdf template online. Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501 (c) (3). Any organization may file form 1023 to apply for recognition of exemption from federal income tax.

2022 IRS Form 1023EZ Reinstatement Instructions Editable Online

Web purpose of form. Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501 (c) (3). Here’s a summary of the revisions we made to the form 1023. You must apply on form 1023. Learn what you need to know before the form completion and check what you can.

Irs Form 1023 Sample Narrative Universal Network

Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3). You must apply on form 1023. Web purpose of form. Only certain organizations are eligible to file. Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501 (c).

Should Your Charity Submit IRS Form 1023EZ?

Web purpose of form. Only certain organizations are eligible to file. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3). You must apply on form 1023. Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501 (c).

irs form 1023ez Fill Online, Printable, Fillable Blank

Here’s a summary of the revisions we made to the form 1023. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3). Web purpose of form. Only certain organizations are eligible to file. Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal.

501c3 Form 1023 Instructions Universal Network

Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3). Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501 (c) (3). Here’s a summary of the revisions we made to the form 1023. Only certain organizations are.

How to Fill Out Form 1023 & Form 1023EZ for Nonprofits Step by Step

Web purpose of form. Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501 (c) (3). Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501 (c) (3). Here’s a summary of the revisions we made to the form 1023..

Structure examples Form 1023 instructions

Here’s a summary of the revisions we made to the form 1023. Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501 (c) (3). You must apply on form 1023. Web purpose of form. Any organization may file form 1023 to apply for recognition of exemption from federal income.

Form 1023EZ Edit, Fill, Sign Online Handypdf

Here’s a summary of the revisions we made to the form 1023. Web purpose of form. Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501 (c) (3). Only certain organizations are eligible to file. You must apply on form 1023.

Any Organization May File Form 1023 To Apply For Recognition Of Exemption From Federal Income Tax Under Section 501 (C) (3).

Learn what you need to know before the form completion and check what you can do with our pdf template online. You must apply on form 1023. Use form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501 (c) (3). Here’s a summary of the revisions we made to the form 1023.

Only Certain Organizations Are Eligible To File.

Web purpose of form.