Form 1041-A

Form 1041-A - Income tax return for estates and trusts. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. Name of estate or trust (if a grantor type trust, see the. For instructions and the latest information. Web form 1041 department of the treasury—internal revenue service. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. For calendar year 2022 or fiscal year beginning , 2022, and ending , 20. Use this form to report the charitable information required by section 6034 and the related regulations. Create custom documents by adding smart fillable fields. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file.

Create custom documents by adding smart fillable fields. Source income of foreign persons; Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Web information about form 1041, u.s. Information return trust accumulation of charitable amounts. Use this form to report the charitable information required by section 6034 and the related regulations. Income tax return for estates and trusts. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. For example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year.

Information return trust accumulation of charitable amounts. Form 1042, annual withholding tax return for u.s. Web information about form 1041, u.s. Source income subject to withholding. Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. For example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year. Name of estate or trust (if a grantor type trust, see the.

Form 1041A U.S. Information Return Trust Accumulation of Charitable

For calendar year 2022 or fiscal year beginning , 2022, and ending , 20. Source income subject to withholding. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Web form 1041 department of the treasury—internal revenue service. Estates or trusts must file form 1041 by the fifteenth day of the fourth.

Form 1041A U.S. Information Return Trust Accumulation of Charitable

For example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file..

Form 1041A U.S. Information Return Trust Accumulation of Charitable

Form 1042, annual withholding tax return for u.s. Source income of foreign persons; Create custom documents by adding smart fillable fields. Income tax return for estates and trusts. Web information about form 1041, u.s.

Form 1041 filing instructions

Create custom documents by adding smart fillable fields. Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries. Income tax return for estates and trusts. For example, for a trust or estate with a tax year ending december 31, the due.

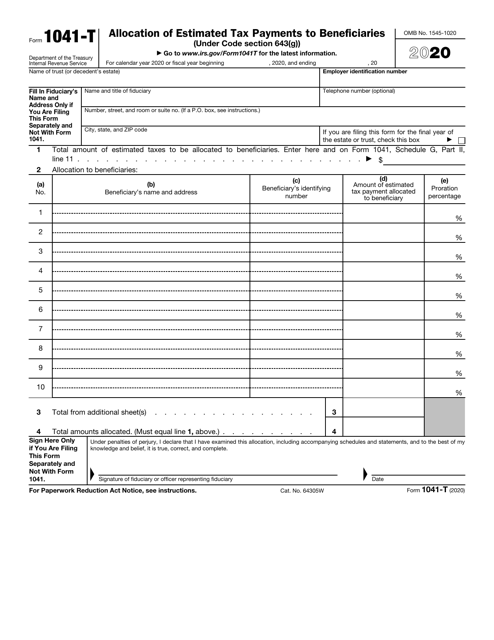

IRS Form 1041T Download Fillable PDF or Fill Online Allocation of

Source income subject to withholding. Name of estate or trust (if a grantor type trust, see the. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Create custom documents by adding smart fillable fields. Use this form to report the charitable information required by section 6034 and the related regulations.

form 1041 sch b instructions Fill Online, Printable, Fillable Blank

Form 1042, annual withholding tax return for u.s. For example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year. For instructions and the latest information. For calendar year 2022 or fiscal year beginning , 2022, and ending , 20. Income tax return for estates and trusts.

1041 A Printable PDF Sample

Web information about form 1041, u.s. Create custom documents by adding smart fillable fields. Use this form to report the charitable information required by section 6034 and the related regulations. Source income of foreign persons; Form 1042, annual withholding tax return for u.s.

Form 1041T Allocation of Estimated Tax Payments to Beneficiaries

Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. For calendar year 2022 or fiscal year beginning , 2022, and ending , 20. Web form 1041 department of the treasury—internal revenue service. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Create.

Form 1041A U.S. Information Return Trust Accumulation of Charitable

Web information about form 1041, u.s. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. For example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year. For instructions and the latest.

form 1041 withholding Fill Online, Printable, Fillable Blank form

For example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year. Web form 1041 department of the treasury—internal revenue service. For instructions and the latest information. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's.

Income Tax Return For Estates And Trusts.

Use this form to report the charitable information required by section 6034 and the related regulations. Create custom documents by adding smart fillable fields. Web form 1041 department of the treasury—internal revenue service. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or.

For Example, For A Trust Or Estate With A Tax Year Ending December 31, The Due Date Is April 15 Of The Following Year.

For instructions and the latest information. Web information about form 1041, u.s. Name of estate or trust (if a grantor type trust, see the. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year.

Form 1042, Annual Withholding Tax Return For U.s.

Source income of foreign persons; Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Information return trust accumulation of charitable amounts. For calendar year 2022 or fiscal year beginning , 2022, and ending , 20.

Web Form 1041 Is A Tax Return Filed By Estates Or Trusts That Generated Income After The Decedent Passed Away And Before The Designated Assets Were Transferred To Beneficiaries.

Source income subject to withholding.