Form 1042 Due Date

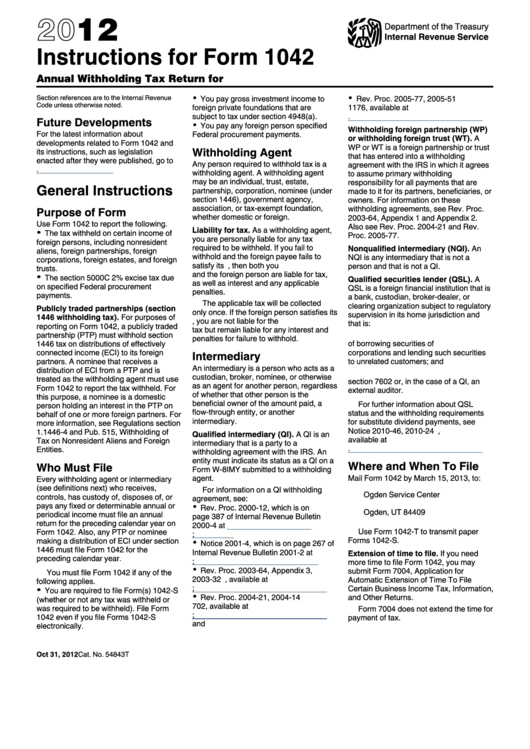

Form 1042 Due Date - Complete, edit or print tax forms instantly. 15 by submitting form 7004, application for automatic. Web use form 1042 to report the following. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Section 1 record of federal tax liability (do not show federal tax deposits here). Web when a partnership withholds on a distribution after march 15 of the year following the year the underlying income was earned by the partnership, the due date for. Computation of tax due or overpayment: Get ready for tax season deadlines by completing any required tax forms today. Deadline for electronic filing of forms 1097, 1098, 1099 (not. Web withholding agents must file form 1042 by march 15, though the filing deadline can be extended to sept.

Web the due date for these forms is quickly approaching. •the tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. If the deadline is a public holiday,. A request for an extension to file must be made before the due date of the return. Web use form 1042 to report the following. Web when are the forms due?

Web the electronic filing of form 1042 is expected to be available in 2023. Web in a case in which a fatca withholding agent withholds after march 15 of the subsequent year, the fatca withholding agent should file a form 1042 (if the dividend. Deadline for electronic filing of forms 1097, 1098, 1099 (not. Web use form 1042 to report the following. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Computation of tax due or overpayment: Web deadlines, extensions and penalties of 1042. Form 1042 must be sent by march 15, for the proceeds of the previous fiscal year. Web when are the forms due?

Forms 1042S & 1042 How to Successfully Complete These Forms for Tax

A request for an extension to file must be made before the due date of the return. Get ready for tax season deadlines by completing any required tax forms today. Web use form 1042 to report the following. Citizen, resident individual, fiduciary partnerships or nonresident partnership all of whose members are citizens or residents, in connection. Computation of tax due.

Form 1042 Annual Withholding Tax Return for U.S. Source of

•the tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. If additional time is required to file the form, an extension may be. 15 by submitting form 7004, application for automatic. Get ready for tax season deadlines by completing any required tax forms today. Deadline for electronic filing of forms.

FORM 1042S 2014 PDF

The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Computation of tax due or overpayment: Web enter date final income paid. Web the electronic filing of form 1042 is expected to be available in 2023. Web deadlines, extensions and penalties of 1042.

Form 1042S Efile Diagnostics Ref. 47040 47039 and 47310 Accountants

Web this form is to be used by a u.s. Complete, edit or print tax forms instantly. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Web deadlines, extensions and penalties of 1042. If additional time is required to file the form, an extension may be.

Instructions for IRS Form 1042S How to Report Your Annual

Web deadlines, extensions and penalties of 1042. Web withholding agents must file form 1042 by march 15, though the filing deadline can be extended to sept. Form 1042 must be sent by march 15, for the proceeds of the previous fiscal year. If additional time is required to file the form, an extension may be. Complete, edit or print tax.

Form 1042 S 2017 Awesome form 1042 S

Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. A request for an extension to file must be made before the due date of the return. Web withholding agents must file form 1042 by march 15, though the filing deadline can be extended.

2018 2019 IRS Form 1042 Fill Out Digital PDF Sample

Deadline for electronic filing of forms 1097, 1098, 1099 (not. Computation of tax due or overpayment: Web use form 1042 to report the following. Web in a case in which a fatca withholding agent withholds after march 15 of the subsequent year, the fatca withholding agent should file a form 1042 (if the dividend. Web when a partnership withholds on.

Instructions For Form 1042 Annual Withholding Tax Return For U.s

Web this form is to be used by a u.s. Web use form 1042 to report the following. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. If additional time is required to file the form, an extension may be. By filing form 8809, you will get an.

Understanding your 1042S » Payroll Boston University

Web use form 1042 to report the following. 15 by submitting form 7004, application for automatic. •the tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Web in a case in which a fatca withholding agent withholds after march 15 of the subsequent year, the fatca withholding agent should file.

Form Instruction 1042S Fill Online, Printable, Fillable Blank form

If additional time is required to file the form, an extension may be. Web deadlines, extensions and penalties of 1042. If the deadline is a public holiday,. Web use form 1042 to report the following. Web when a partnership withholds on a distribution after march 15 of the year following the year the underlying income was earned by the partnership,.

If Additional Time Is Required To File The Form, An Extension May Be.

15 by submitting form 7004, application for automatic. Web the due date for these forms is quickly approaching. Form 1042 must be sent by march 15, for the proceeds of the previous fiscal year. Get ready for tax season deadlines by completing any required tax forms today.

Web Withholding Agents Must File Form 1042 By March 15, Though The Filing Deadline Can Be Extended To Sept.

Complete, edit or print tax forms instantly. Web 3 select the tax form, payment type, period, and amount (and. Complete, edit or print tax forms instantly. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income.

Computation Of Tax Due Or Overpayment:

Web when a partnership withholds on a distribution after march 15 of the year following the year the underlying income was earned by the partnership, the due date for. Section 1 record of federal tax liability (do not show federal tax deposits here). Citizen, resident individual, fiduciary partnerships or nonresident partnership all of whose members are citizens or residents, in connection. Web enter date final income paid.

A Request For An Extension To File Must Be Made Before The Due Date Of The Return.

By filing form 8809, you will get an. Although not required, taxpayers can choose to file form 1042 electronically. Web use form 1042 to report the following. Web when are the forms due?