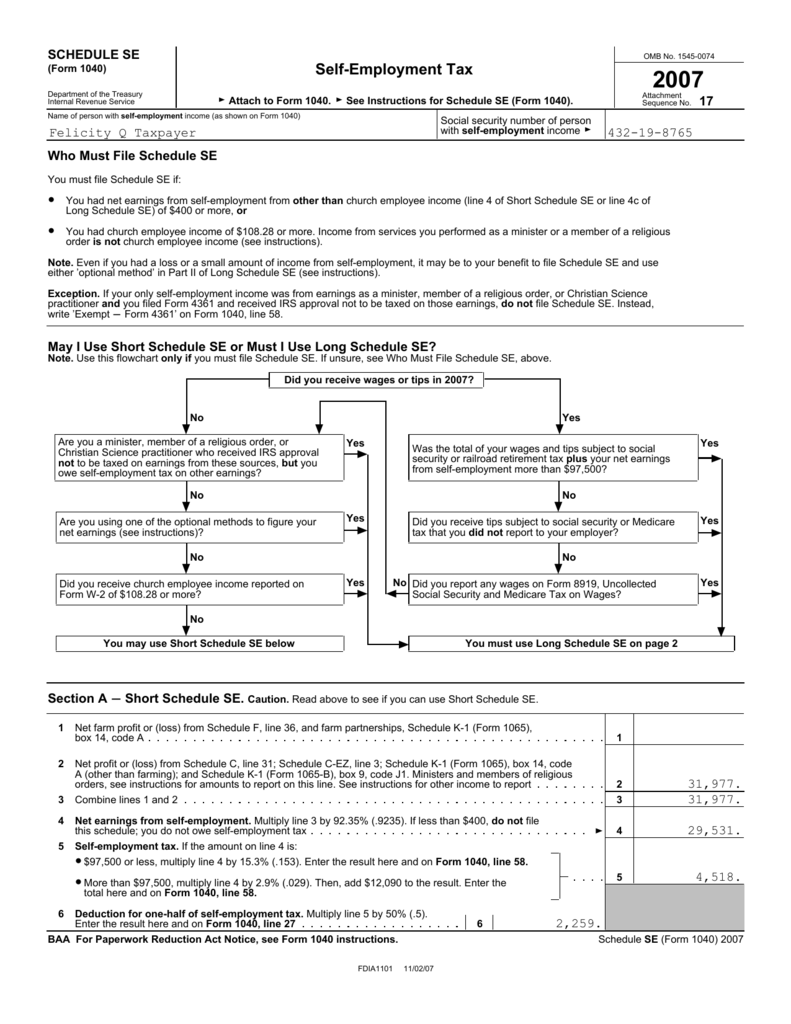

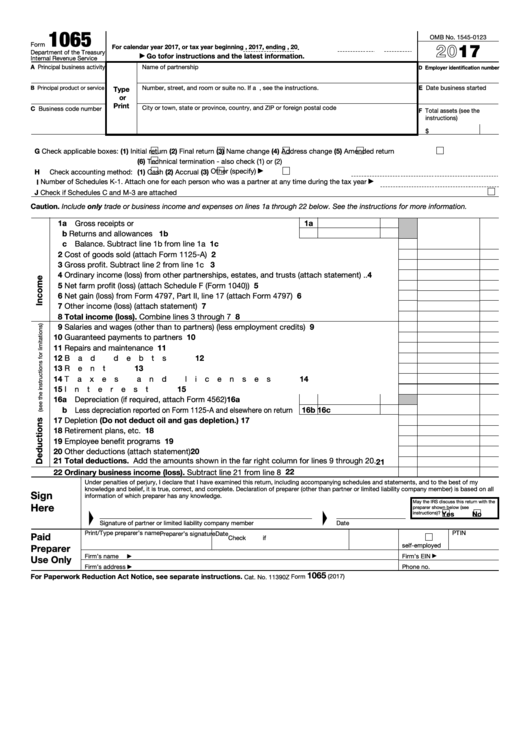

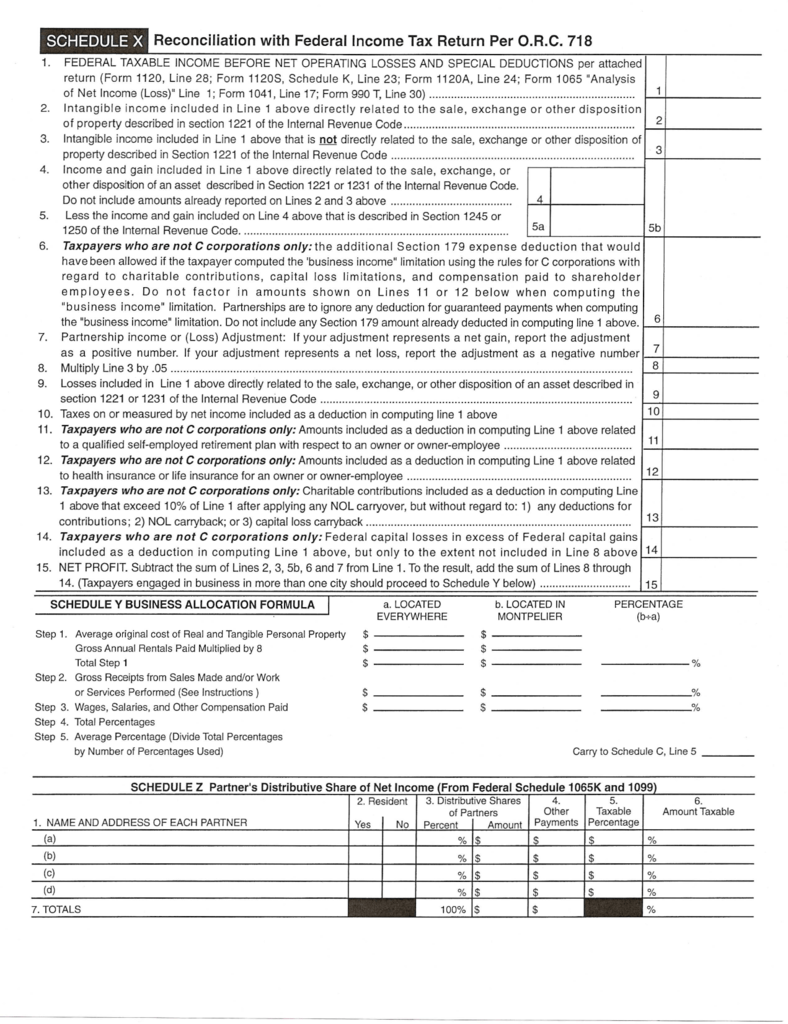

Form 1065 Line 14

Form 1065 Line 14 - Web this would be for taxes and licenses of the partnership, not payroll tax withholding, etc. The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Here's how irs defines line 14: Gross income from line 3a is going to line 14c on the k and then to. Taxes paid or accrued in connection with the acquisition of business property states local and foreign. And the total assets at the end of the tax year. Web where to file your taxes for form 1065. Web form 1065, u.s. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Web use schedule d (form 1065) to report the following.

And the total assets at the end of the tax year. Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. Taxes paid or accrued in connection with the acquisition of business property states local and foreign. Web the partnership will report any information you need to figure the interest due under section 453(l)(3) with respect to the disposition of certain timeshares and. Web the amount of total assets at the end of the tax year reported on schedule l, line 14, column (d), is equal to $10 million or more. Web this would be for taxes and licenses of the partnership, not payroll tax withholding, etc. Web where to file your taxes for form 1065. Web form 1065, u.s. Enter the amount from the “overpayment” line of the original return, even if the elp or remic chose to credit all or part of this amount to the next year's. If the partnership's principal business, office, or agency is located in:

Web where to file your taxes for form 1065. Web this would be for taxes and licenses of the partnership, not payroll tax withholding, etc. Web the amount of total assets at the end of the tax year reported on schedule l, line 14, column (d), is equal to $10 million or more. Web the partnership will report any information you need to figure the interest due under section 453(l)(3) with respect to the disposition of certain timeshares and. Web use schedule d (form 1065) to report the following. The amount of adjusted total assets for the. Web which of the following taxes are deductibles on line 14 of form 1065? Enter the amount from the “overpayment” line of the original return, even if the elp or remic chose to credit all or part of this amount to the next year's. Taxes paid or accrued in connection with the acquisition of business property states local and foreign. If the partnership's principal business, office, or agency is located in:

How to Fill Out Form 1065 for Partnership Tax Return YouTube

Taxes paid or accrued in connection with the acquisition of business property states local and foreign. Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. Web the partnership will report any information you need to figure the interest due under section 453(l)(3) with respect to the disposition of certain timeshares.

Form K1 1065 Instructions Ethel Hernandez's Templates

Web the partnership will report any information you need to figure the interest due under section 453(l)(3) with respect to the disposition of certain timeshares and. The amount of adjusted total assets for the. Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. If the partnership's principal business, office, or.

Sample 1065 tax return ropotqlucky

Web form 1065, u.s. The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Web the partnership will report any information you need to figure the interest due under section 453(l)(3) with respect to the disposition of certain timeshares and. Line 21 replaces line 16p for foreign taxes paid or accrued.

Form 10 Line 10 Why You Must Experience Form 10 Line 10 At Least Once

Gross income from line 3a is going to line 14c on the k and then to. Web the partnership will report any information you need to figure the interest due under section 453(l)(3) with respect to the disposition of certain timeshares and. Web this would be for taxes and licenses of the partnership, not payroll tax withholding, etc. Taxes paid.

Form 1065 U.S. Return of Partnership (2014) Free Download

If the partnership's principal business, office, or agency is located in: And the total assets at the end of the tax year. Web where to file your taxes for form 1065. Web this would be for taxes and licenses of the partnership, not payroll tax withholding, etc. Web the partnership will report any information you need to figure the interest.

Fillable IRS Form 1065 Return of Partnership Printable

Web form 1065, u.s. Web where to file your taxes for form 1065. Here's how irs defines line 14: Taxes paid or accrued in connection with the acquisition of business property states local and foreign. Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation.

Form 13 Line 13 13 Things Nobody Told You About Form 1365 Line 13 AH

Web which of the following taxes are deductibles on line 14 of form 1065? Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. The amount of adjusted total assets for the. Web the amount of total assets at the end of the tax year reported.

IRS Form 1065 Schedule K1 (2020)

The amount of adjusted total assets for the. Enter the amount from the “overpayment” line of the original return, even if the elp or remic chose to credit all or part of this amount to the next year's. Web where to file your taxes for form 1065. Web the amount of total assets at the end of the tax year.

Form 1065 U.S. Return of Partnership (2014) Free Download

And the total assets at the end of the tax year. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Web use schedule d (form 1065) to report the following. The amount of adjusted total assets for the. Taxes paid or accrued in connection with.

Form 13 Line 13 13 Things Nobody Told You About Form 1365 Line 13 AH

And the total assets at the end of the tax year. If the partnership's principal business, office, or agency is located in: Web form 1065, u.s. Web use schedule d (form 1065) to report the following. The amount of adjusted total assets for the.

If The Partnership's Principal Business, Office, Or Agency Is Located In:

Web the partnership will report any information you need to figure the interest due under section 453(l)(3) with respect to the disposition of certain timeshares and. Web the amount of total assets at the end of the tax year reported on schedule l, line 14, column (d), is equal to $10 million or more. Enter the amount from the “overpayment” line of the original return, even if the elp or remic chose to credit all or part of this amount to the next year's. Web use schedule d (form 1065) to report the following.

And The Total Assets At The End Of The Tax Year.

Web this would be for taxes and licenses of the partnership, not payroll tax withholding, etc. The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. The amount of adjusted total assets for the.

Taxes Paid Or Accrued In Connection With The Acquisition Of Business Property States Local And Foreign.

Web where to file your taxes for form 1065. Here's how irs defines line 14: Web which of the following taxes are deductibles on line 14 of form 1065? Gross income from line 3a is going to line 14c on the k and then to.

Line 21 Replaces Line 16P For Foreign Taxes Paid Or Accrued With Respect To Basis Adjustments And Income Reconciliation.

Web form 1065, u.s.