Form 1065 Schedule M-2 Instructions

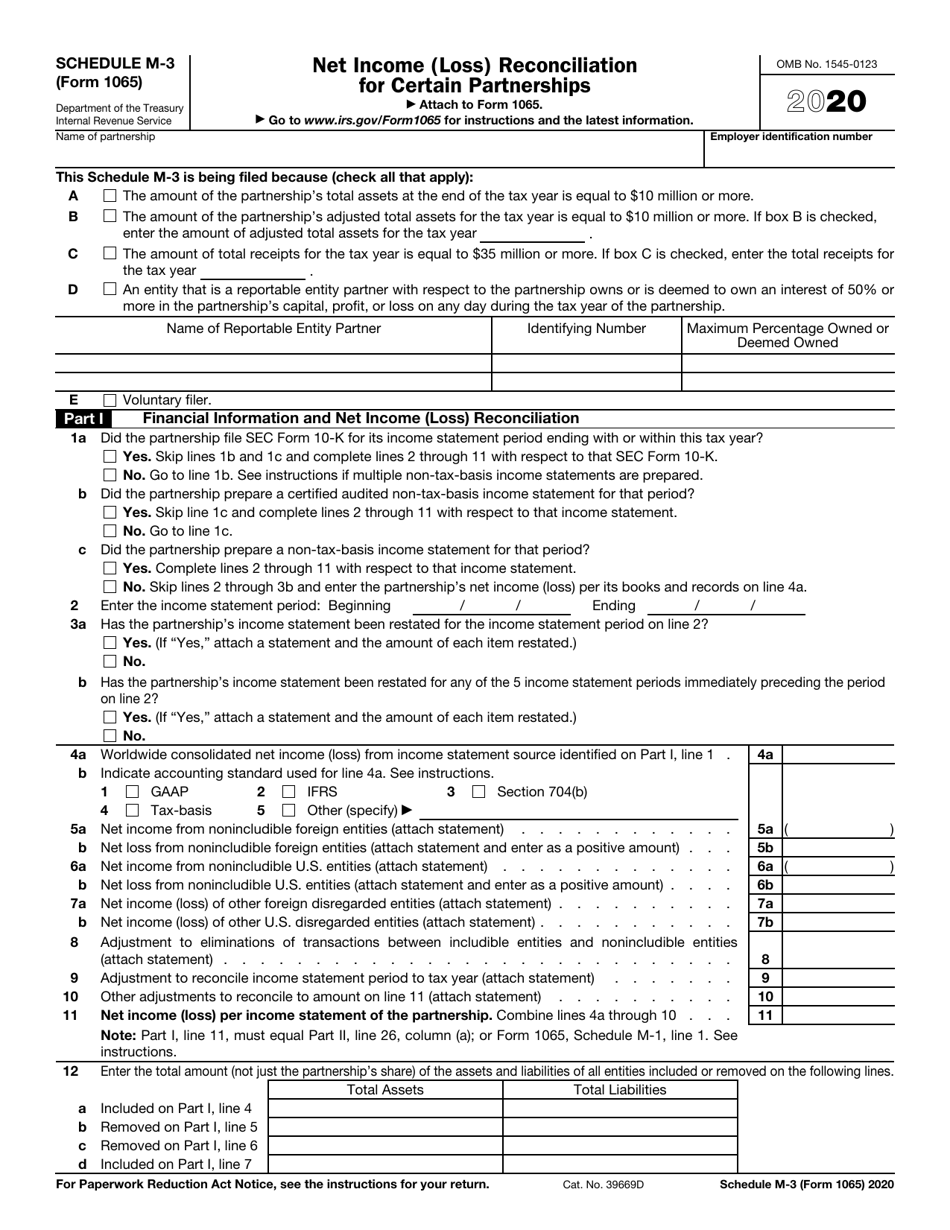

Form 1065 Schedule M-2 Instructions - December 2021) net income (loss) reconciliation. And the total assets at the end of the. Beginning with tax years ending on or after. Analysis of partners' capital accounts.54 codes for. Part i, line 11, must equal part ii, line 26, column (a); This line has gone through a few changes in the past years, including; Web go to www.irs.gov/form1065 for instructions and the latest information. If the partnership's principal business, office, or agency is located in: They go on to state if net. Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner capital account reporting requirements.

This line has gone through a few changes in the past years, including; This line has gone through a few changes in the past years, including; Web go to www.irs.gov/form1065 for instructions and the latest information. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate partner. If the partnership's principal business, office, or agency is located in: December 2021) net income (loss) reconciliation. They go on to state if net. Analysis of partners' capital accounts. And the total assets at the end of the. Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner capital account reporting requirements.

Web go to www.irs.gov/form1065 for instructions and the latest information. They go on to state if net. And the total assets at the end of the. Web since tax year 2021, federal form 1065 instructions for line 3 have been modified. This line has gone through a few changes in the past years, including; Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate partner. December 2021) net income (loss) reconciliation. This line has gone through a few changes in the past years, including; If the partnership's principal business, office, or agency is located in: Part i, line 11, must equal part ii, line 26, column (a);

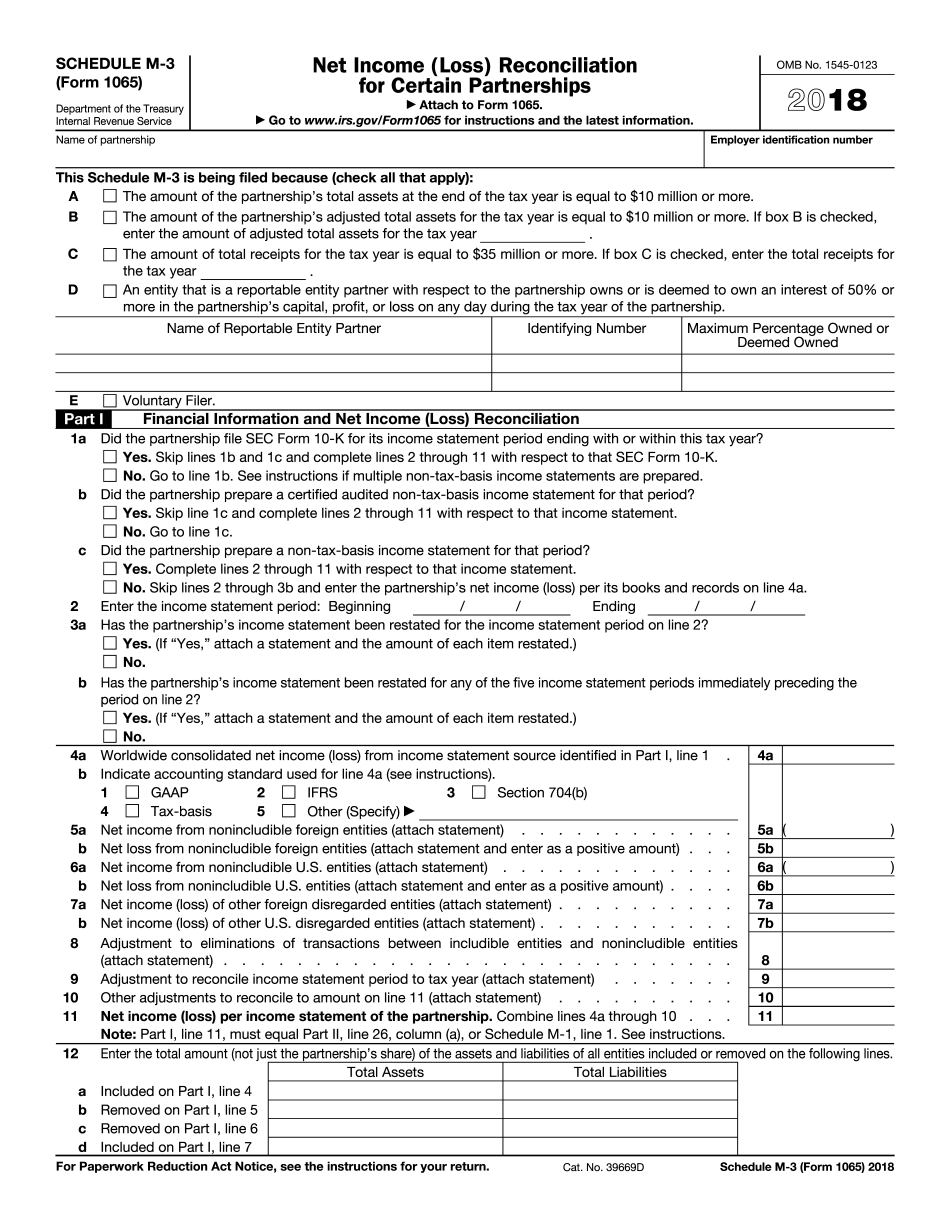

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

Analysis of partners' capital accounts.54 codes for. If the partnership's principal business, office, or agency is located in: Web for tax year 2021, federal form 1065 instructions for line 3 have been modified. They go on to state if net. Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner capital account reporting.

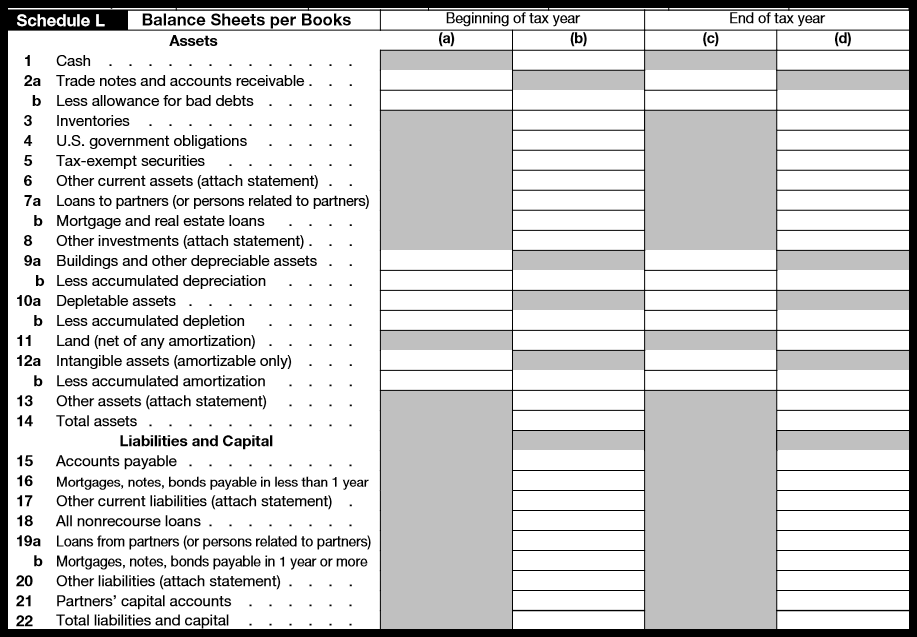

Form 7 Analysis Of Net Five Secrets About Form 7 Analysis Of Net

Reconciliation of income \⠀䰀漀猀猀尩 per books with income \⠀䰀漀猀猀尩 per return. Web for tax year 2021, federal form 1065 instructions for line 3 have been modified. Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner capital account reporting requirements. This line has gone through a few changes in the past years, including;.

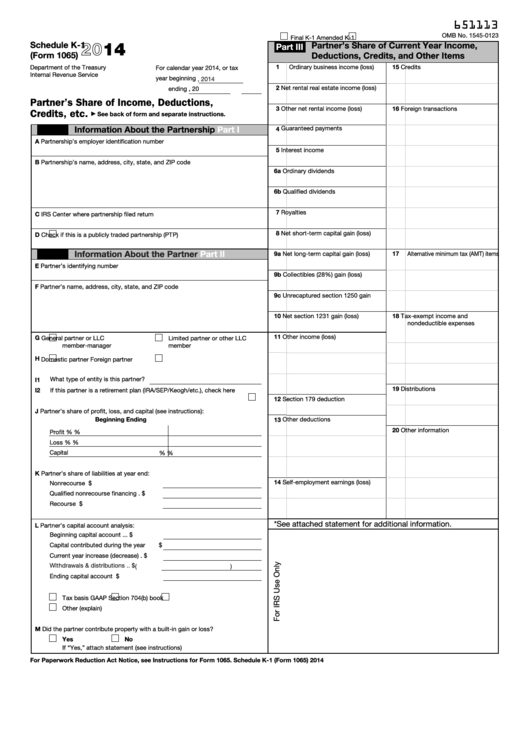

Fillable Schedule K1 (Form 1065) Partner'S Share Of

Beginning with tax years ending on or after. Web find irs mailing addresses by state to file form 1065. Analysis of partners' capital accounts. Analysis of partners' capital accounts.54 codes for. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate partner.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

And the total assets at the end of the. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate partner. Analysis of partners' capital accounts.54 codes for. Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to.

IRS Form 1065 Schedule M3 Download Fillable PDF or Fill Online Net

Web find irs mailing addresses by state to file form 1065. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate partner. Reconciliation of income \⠀䰀漀猀猀尩 per books with income \⠀䰀漀猀猀尩 per return. This line has gone through a few changes in the.

IRS Form 1065 (Schedule M3) 2018 2019 Fill out and Edit Online PDF

December 2021) net income (loss) reconciliation. Web find irs mailing addresses by state to file form 1065. They go on to state if net. Analysis of partners' capital accounts.54 codes for. This line has gone through a few changes in the past years, including;

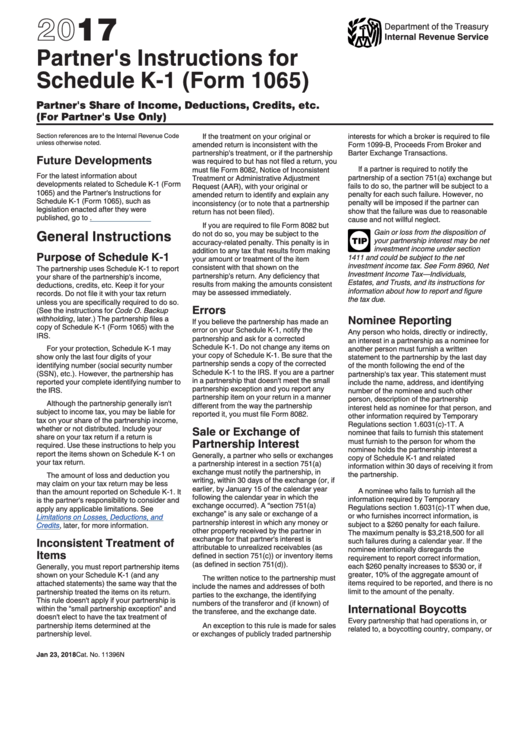

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

Web for tax year 2021, federal form 1065 instructions for line 3 have been modified. Part i, line 11, must equal part ii, line 26, column (a); And the total assets at the end of the. Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner capital account reporting requirements. Web go to.

Llc Tax Form 1065 Universal Network

They go on to state if net. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate partner. Analysis of partners' capital accounts. This line has gone through a few changes in the past years, including; Web find irs mailing addresses by state.

1120 EF Message 0042 Schedule M2 is out of Balance (M1, M2, ScheduleL)

If the partnership's principal business, office, or agency is located in: Web for tax year 2021, federal form 1065 instructions for line 3 have been modified. Web go to www.irs.gov/form1065 for instructions and the latest information. Web find irs mailing addresses by state to file form 1065. And the total assets at the end of the.

Form 1065 (Schedule K1) Partner's Share of Deductions and

Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner capital account reporting requirements. December 2021) net income (loss) reconciliation. They go on to state if net. This line has gone through a few changes in the past years, including; Beginning with tax years ending on or after.

And The Total Assets At The End Of The.

Part i, line 11, must equal part ii, line 26, column (a); Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate partner. Analysis of partners' capital accounts.54 codes for. Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner capital account reporting requirements.

Web For Tax Year 2021, Federal Form 1065 Instructions For Line 3 Have Been Modified.

This line has gone through a few changes in the past years, including; Analysis of partners' capital accounts. December 2021) net income (loss) reconciliation. This line has gone through a few changes in the past years, including;

Web Find Irs Mailing Addresses By State To File Form 1065.

Web since tax year 2021, federal form 1065 instructions for line 3 have been modified. They go on to state if net. Web go to www.irs.gov/form1065 for instructions and the latest information. Reconciliation of income \⠀䰀漀猀猀尩 per books with income \⠀䰀漀猀猀尩 per return.

Beginning With Tax Years Ending On Or After.

If the partnership's principal business, office, or agency is located in: