Form 1098 Due Date 2022

Form 1098 Due Date 2022 - Web due date for certain statements sent to recipients. Here are a few dates. Web when is the deadline to file form 1098 for the 2022 tax year? If you file electronically, the due date is march 31, 2022. The deadline to file form 1098 with the irs is the end of february. Web it has to be sent to the recipient by 31 st january. Several properties securing the mortgage. If it is filed on paper, then the. Web your mortgage interest statement (form 1098) is available within digital banking during the month of january and we'll notify you when it's ready. Web deadline for tax form 1098:

Web interest received on december 20, of the current year, that accrues by december 31, of the current year, but is not due until january 31, of the following year, is reportable on the. Learn more about how to simplify your businesses 1098/1099 reporting. Web your mortgage interest statement (form 1098) is available within digital banking during the month of january and we'll notify you when it's ready. Web due date for certain statements sent to recipients. Web when is the deadline to file form 1098 for the 2022 tax year? Web refund of the overpaid interest. Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! Also referred to as mortgage interest tax form, it reports the mortgage interest payments. For taxpayers filing electronically, the due date to file form 1098. Web the due date for paper filing form 1099 is january 31st, 2022.

To file electronically, you must have software that generates a file according to the specifications in pub. If filing the form electronically, the due date. January 31, 2023 is the due date to distribute copies of form 1098 to a recipient. Address and description of the property. Instructions, including due dates, and to request. Web when is the deadline to file form 1098 for the 2022 tax year? Web due date for certain statements sent to recipients. If you file electronically, the due date is march 31, 2022. Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! Web deadline for tax form 1098:

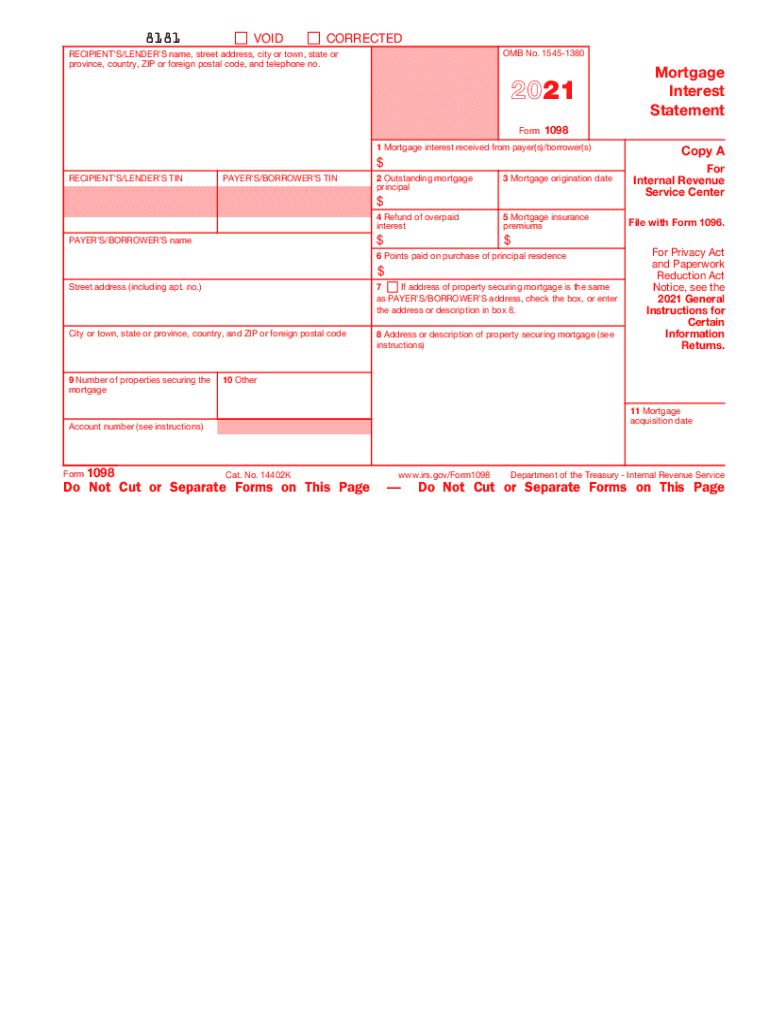

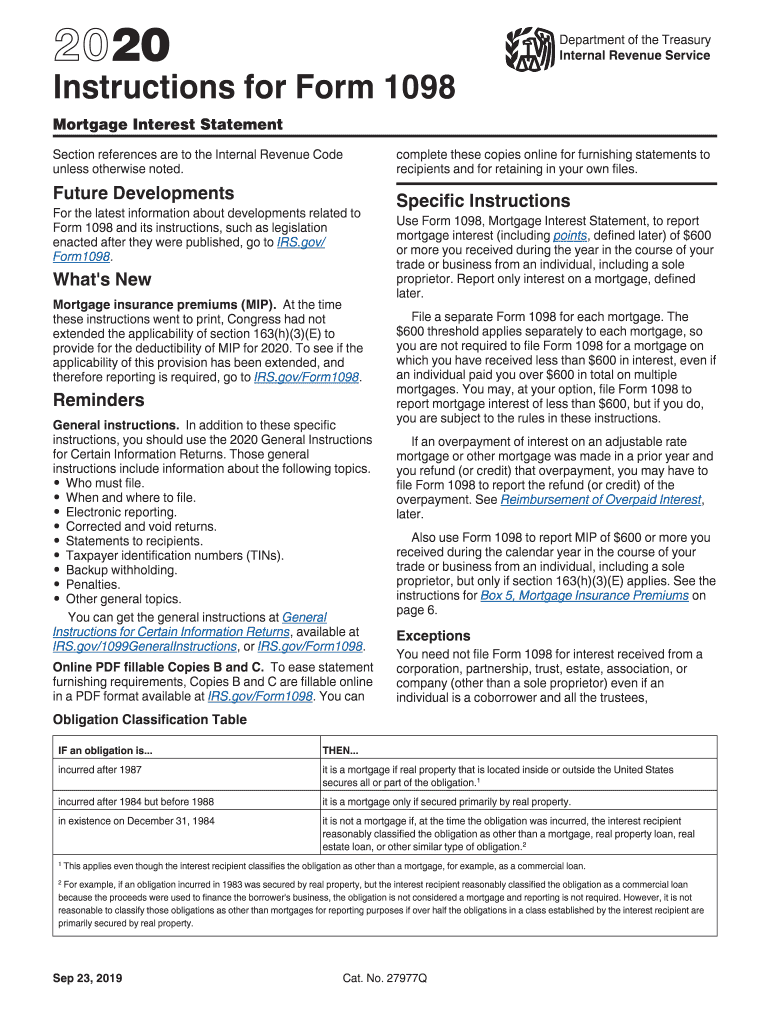

2020 Form IRS 1098 Instructions Fill Online, Printable, Fillable, Blank

Also referred to as mortgage interest tax form, it reports the mortgage interest payments. Web the due date for paper filing form 1099 is january 31st, 2022. Web it has to be sent to the recipient by 31 st january. Recipient copy 30 days from the date of the sale or contribution. Web don’t miss any 2022 tax deadlines!

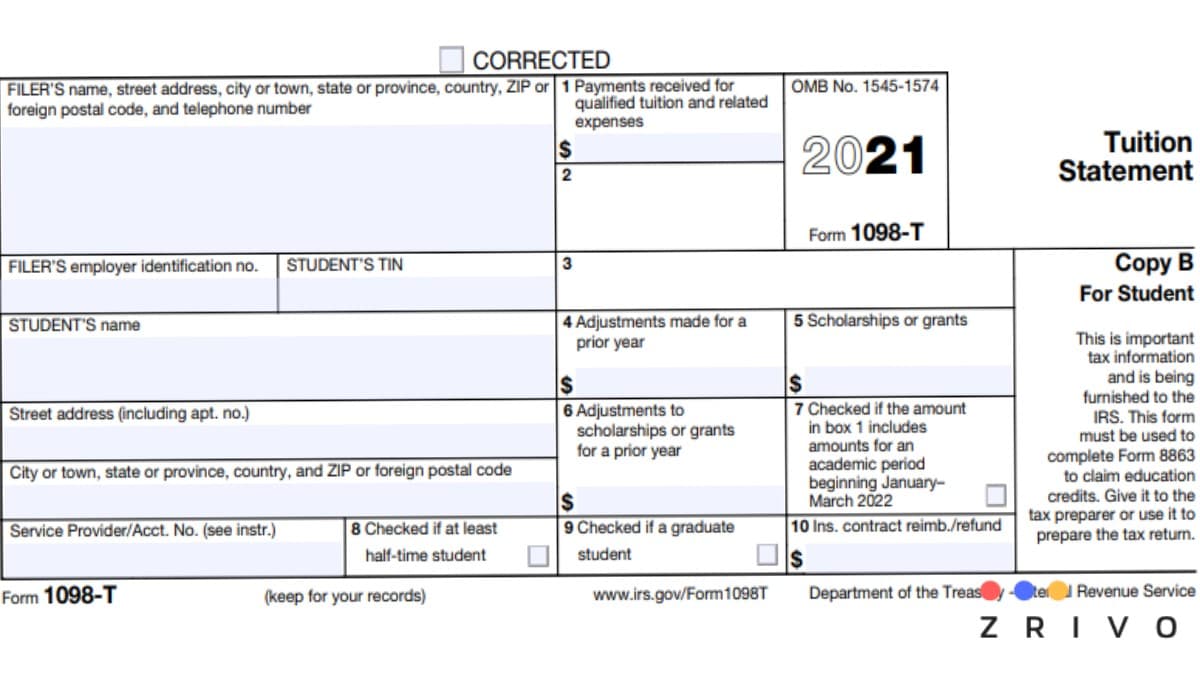

Form 1098T Community Tax

Web don’t miss any 2022 tax deadlines! Web when is the deadline to file form 1098 for the 2022 tax year? Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! The irs’ copy, other than for 1099. Paper file to government by:

1098 T Form 2021

Here are a few dates. Web due date for certain statements sent to recipients. Web when is the deadline to file form 1098 for the 2022 tax year? If it is filed on paper, then the. Instructions, including due dates, and to request.

Documents to Bring To Tax Preparer Tax Documents Checklist

Instructions, including due dates, and to request. Address and description of the property. Web don’t miss any 2022 tax deadlines! Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! If filing the form electronically, the due date.

Form 1098 Mortgage Interest Statement and How to File

Web deadline for tax form 1098: Web it has to be sent to the recipient by 31 st january. The irs’ copy, other than for 1099. Web due date for certain statements sent to recipients. These due dates for information.

2020 Form IRS 1098E Fill Online, Printable, Fillable, Blank pdfFiller

January 31, 2023 is the due date to distribute copies of form 1098 to a recipient. Paper file to government by: Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! Also referred to as mortgage interest tax form, it reports the mortgage interest payments. If filing the form electronically, the due date.

Form 1098T Information Student Portal

Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! Also referred to as mortgage interest tax form, it reports the mortgage interest payments. The irs’ copy, other than for 1099. If you file electronically, the due date is march 31, 2022. Web the due date for paper filing form 1099 is january 31st, 2022.

2848 Form 2021 IRS Forms Zrivo

Here are a few dates. If it is filed on paper, then the. Web it has to be sent to the recipient by 31 st january. If you file electronically, the due date is march 31, 2022. For taxpayers filing electronically, the due date to file form 1098.

2021 Form 1098. Mortgage Interest Statement Fill and Sign Printable

To file electronically, you must have software that generates a file according to the specifications in pub. Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! Paper file to government by: Web refund of the overpaid interest. If you file electronically, the due date is march 31, 2022.

1098C Software to Print and Efile Form 1098C

Recipient copy 30 days from the date of the sale or contribution. Web deadline for tax form 1098: Web when is the deadline to file form 1098 for the 2022 tax year? January 31, 2023 is the due date to distribute copies of form 1098 to a recipient. Web it has to be sent to the recipient by 31 st.

Web Refund Of The Overpaid Interest.

Learn more about how to simplify your businesses 1098/1099 reporting. Web form 1098 is an irs form used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amount totals. Web it has to be sent to the recipient by 31 st january. Recipient copy 30 days from the date of the sale or contribution.

Here Are A Few Dates.

The irs’ copy, other than for 1099. Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! The deadline to file form 1098 with the irs is the end of february. Web when is the deadline to file form 1098 for the 2022 tax year?

Web The Due Date For Paper Filing Form 1099 Is January 31St, 2022.

Web deadline for tax form 1098: These due dates for information. If you file electronically, the due date is march 31, 2022. If filing the form electronically, the due date.

For Taxpayers Filing Electronically, The Due Date To File Form 1098.

Web due date for certain statements sent to recipients. January 31, 2023 is the due date to distribute copies of form 1098 to a recipient. Also referred to as mortgage interest tax form, it reports the mortgage interest payments. Several properties securing the mortgage.

/Form1098-5c57730f46e0fb00013a2bee.jpg)