Form 1099 Extension

Form 1099 Extension - Web december 12, 2022 the deadline to file your 1099 is coming up fast! Web there are several ways to submit form 4868. If this is needed, complete form 8809 and check the box on line 5. Only certain taxpayers are eligible. Web a second extension may be requested for an additional 30 days. Web the due date for the many of 1099 tax form's electronic filing is 31st march, 2023 of the 2022 tax year. Before that do you know that there are two types of extensions: Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web in this article, let us check how to request an extension for filing 1099 tax forms with the irs. If you have yet to submit it or need more time to file before the due date, we will help guide you through the.

Web there are several ways to submit form 4868. Web how to request a 1099 int form extension? With tax1099.com, you have an option to schedule your efile. Only certain taxpayers are eligible. If the deadline falls on a weekend or holiday, then it’s moved to the. If you have yet to submit it or need more time to file before the due date, we will help guide you through the. Web on august 1, 2018, the internal revenue service (irs) released treasury decision (td) 9838, extension of time to file certain information returns, which clarified that filing. To download a copy of irs. Web a signature or explanation may be required for the extension. Before that do you know that there are two types of extensions:

Web how to request a 1099 int form extension? Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on how to. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. If this is needed, complete form 8809 and check the box on line 5. Before that do you know that there are two types of extensions: Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. If you have yet to submit it or need more time to file before the due date, we will help guide you through the. Web there are several ways to submit form 4868. If the deadline falls on a weekend or holiday, then it’s moved to the. Web a second extension may be requested for an additional 30 days.

IRS Form 1099 Reporting for Small Business Owners

If this is needed, complete form 8809 and check the box on line 5. Web on august 1, 2018, the internal revenue service (irs) released treasury decision (td) 9838, extension of time to file certain information returns, which clarified that filing. If the deadline falls on a weekend or holiday, then it’s moved to the. With tax1099.com, you have an.

1099misc extension 2019 Fill Online, Printable, Fillable Blank

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Only certain taxpayers are eligible. Web how to request a 1099 int form extension? Web december 12, 2022 the deadline to file your 1099 is coming up fast! Web a signature or.

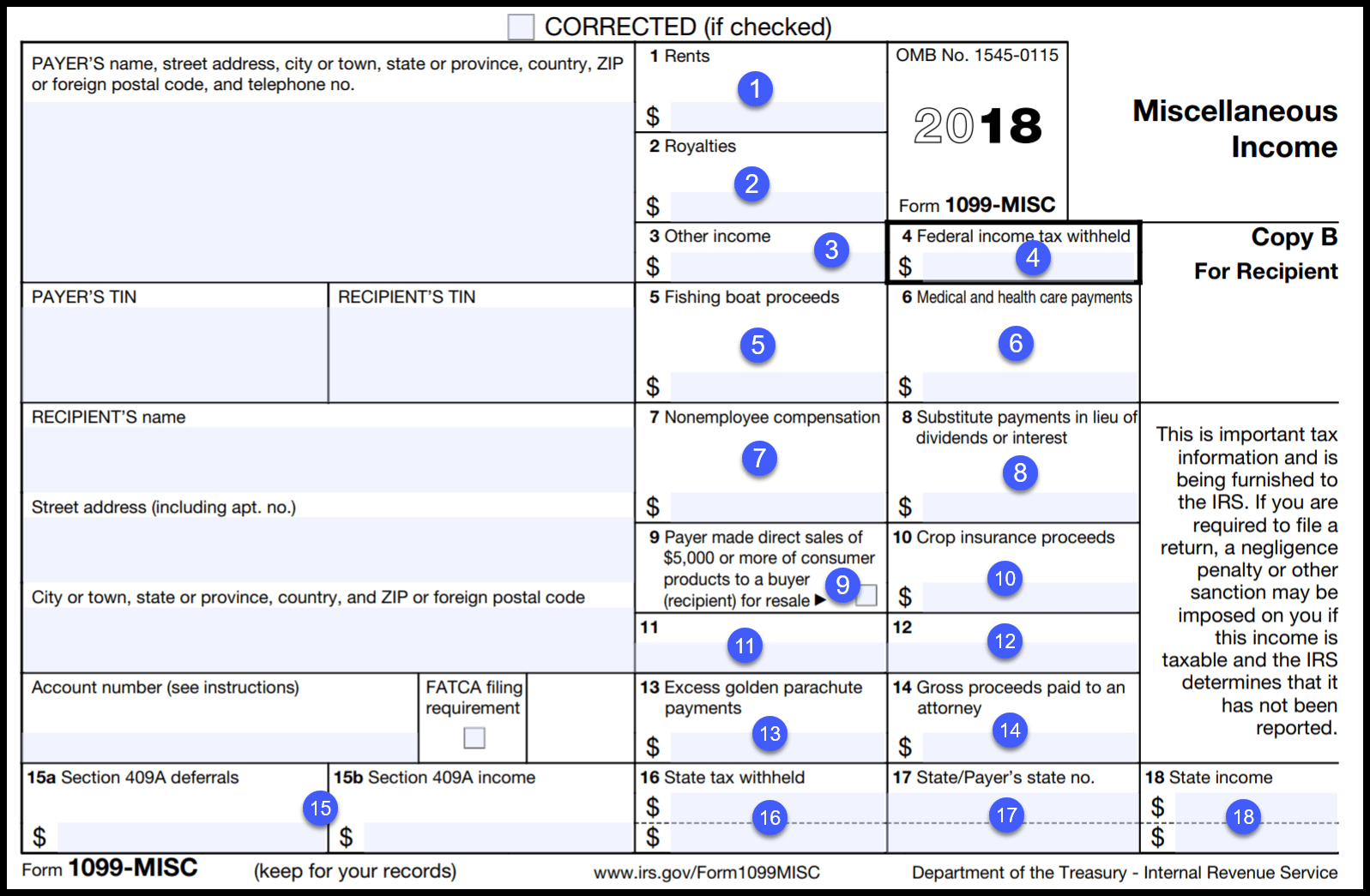

What is a 1099Misc Form? Financial Strategy Center

If this is needed, complete form 8809 and check the box on line 5. With tax1099.com, you have an option to schedule your efile. Only certain taxpayers are eligible. If you have yet to submit it or need more time to file before the due date, we will help guide you through the. Web december 12, 2022 the deadline to.

IRS Form 1099R How to Fill it Right and Easily

Web form 1099 extension process with the form 1099 reporting deadline quickly approaching, we are providing a refresh of the extension process below: Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on how to. If the deadline falls on a weekend or holiday, then it’s moved to.

What to Do with the IRS 1099C Form for Cancellation of Debt

Web there are several ways to submit form 4868. Web on august 1, 2018, the internal revenue service (irs) released treasury decision (td) 9838, extension of time to file certain information returns, which clarified that filing. Only certain taxpayers are eligible. Web a signature or explanation may be required for the extension. If the deadline falls on a weekend or.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Web there are several ways to submit form 4868. Web december 12, 2022 the deadline to file your 1099 is coming up fast! Web the due date for the many of 1099 tax form's electronic filing is 31st march, 2023 of the 2022 tax year. Web a signature or explanation may be required for the extension. If this is needed,.

How to Calculate Taxable Amount on a 1099R for Life Insurance

Web when you do not have time to file your returns, you can request an extension for your 1099 taxes from the irs in order to avoid the late filing fees and penalty charges. If you have yet to submit it or need more time to file before the due date, we will help guide you through the. Web there.

Extension To File Form 1099 Misc Universal Network

Web a signature or explanation may be required for the extension. Web on august 1, 2018, the internal revenue service (irs) released treasury decision (td) 9838, extension of time to file certain information returns, which clarified that filing. Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on.

Requesting Extensions for 1099's ASAP Help Center

Only certain taxpayers are eligible. Web the due date for the many of 1099 tax form's electronic filing is 31st march, 2023 of the 2022 tax year. Before that do you know that there are two types of extensions: Web form 1099 extension process with the form 1099 reporting deadline quickly approaching, we are providing a refresh of the extension.

Form 1099 Misc Fillable Universal Network

Web form 1099 extension process with the form 1099 reporting deadline quickly approaching, we are providing a refresh of the extension process below: Before that do you know that there are two types of extensions: Web a second extension may be requested for an additional 30 days. Only certain taxpayers are eligible. Web the due date for the many of.

Web In This Article, Let Us Check How To Request An Extension For Filing 1099 Tax Forms With The Irs.

To download a copy of irs. With tax1099.com, you have an option to schedule your efile. Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on how to. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due.

If You Cannot File 1099 Int Tax With The Irs By “March 31 St, 2021“, You Need To File For An Extension.

If this is needed, complete form 8809 and check the box on line 5. Before that do you know that there are two types of extensions: Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web on august 1, 2018, the internal revenue service (irs) released treasury decision (td) 9838, extension of time to file certain information returns, which clarified that filing.

Only Certain Taxpayers Are Eligible.

Web a signature or explanation may be required for the extension. If you have yet to submit it or need more time to file before the due date, we will help guide you through the. Web the due date for the many of 1099 tax form's electronic filing is 31st march, 2023 of the 2022 tax year. Web when you do not have time to file your returns, you can request an extension for your 1099 taxes from the irs in order to avoid the late filing fees and penalty charges.

If The Deadline Falls On A Weekend Or Holiday, Then It’s Moved To The.

Web how to request a 1099 int form extension? Web a second extension may be requested for an additional 30 days. Web december 12, 2022 the deadline to file your 1099 is coming up fast! Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.