Form 1116 Amt

Form 1116 Amt - Complete, edit or print tax forms instantly. The alternative minimum tax version of the form 1116 (based on the form 6251 instructions) automatically calculates from. For those taxed at 0%, do not include the. Web if you hade made the simplified foreign tax limitation election for amt last year, you should only one form 1116. Web (the amount on line 17 of your amt form 1116 will be the same as the amount on line 17 of your regular tax form 1116.) you must make the election for the. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web the calculation for line 1a adjustments to foreign source qualified dividends and capital gain distributions on amt form 1116 are as follows: Complete, edit or print tax forms instantly. Generating the schedule b for form 1116 in proseries starting in 2021: Web (form 1116) (december 2021) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see separate instructions.

Web form amt 1116 is a version of form 1116 used for the amt calculation. Web there are two options for suppressing the form 1116 and form 1116 amt: Department of the treasury internal revenue service. Web (form 1116) (december 2021) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see separate instructions. Web entering income for the foreign tax credit form 1116; Complete, edit or print tax forms instantly. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web this article will help you enter foreign tax credit carryforwards from prior year returns, generate form 1116 schedule b, and resolve critical diagnostic ref. The amt applies to taxpayers. Use form 2555 to claim.

For example, if you only had foreign tax credit on wages in a prior. If a return is subject to amt, the form is produced automatically using the information in form 1116. Web i seem to have a similar situation where page 2 of 116 multiplier = 1.0 in both cases. Web there are two options available to suppress the form 1116 and 1116 amt: Taxpayers are therefore reporting running balances of. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Department of the treasury internal revenue service. Starting in tax year 2021, the irs released a new. The alternative minimum tax version of the form 1116 (based on the form 6251 instructions) automatically calculates from. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover.

Form 1116 Edit, Fill, Sign Online Handypdf

Generating the schedule b for form 1116 in proseries starting in 2021: The amt applies to taxpayers. Web (form 1116) (december 2021) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see separate instructions. Complete, edit or print tax forms instantly. Web i seem to have a similar situation where page 2 of 116 multiplier = 1.0.

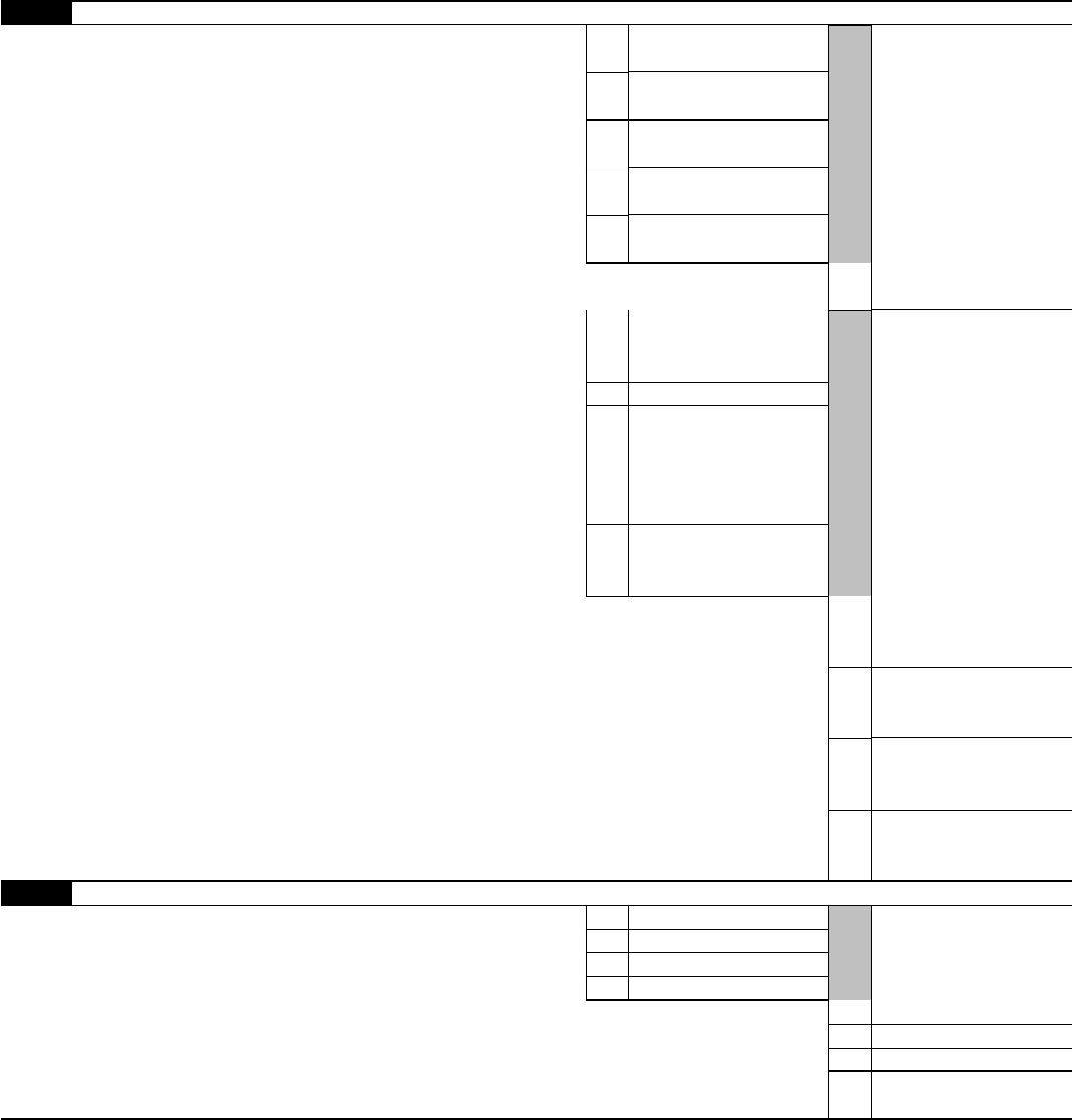

How do I generate Form 1116 Foreign Tax Credit in ProConnect Tax

Complete, edit or print tax forms instantly. Use form 2555 to claim. Web there are two options for suppressing the form 1116 and form 1116 amt: Taxpayers are therefore reporting running balances of. Department of the treasury internal revenue service.

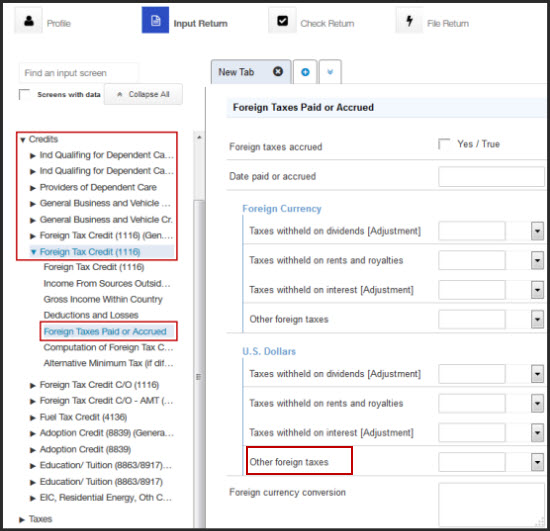

Instructions for Form 1116

If a return is subject to amt, the form is produced automatically using the information in form 1116. Web there are two options available to suppress the form 1116 and 1116 amt: The amt applies to taxpayers. Get ready for tax season deadlines by completing any required tax forms today. Starting in tax year 2021, the irs released a new.

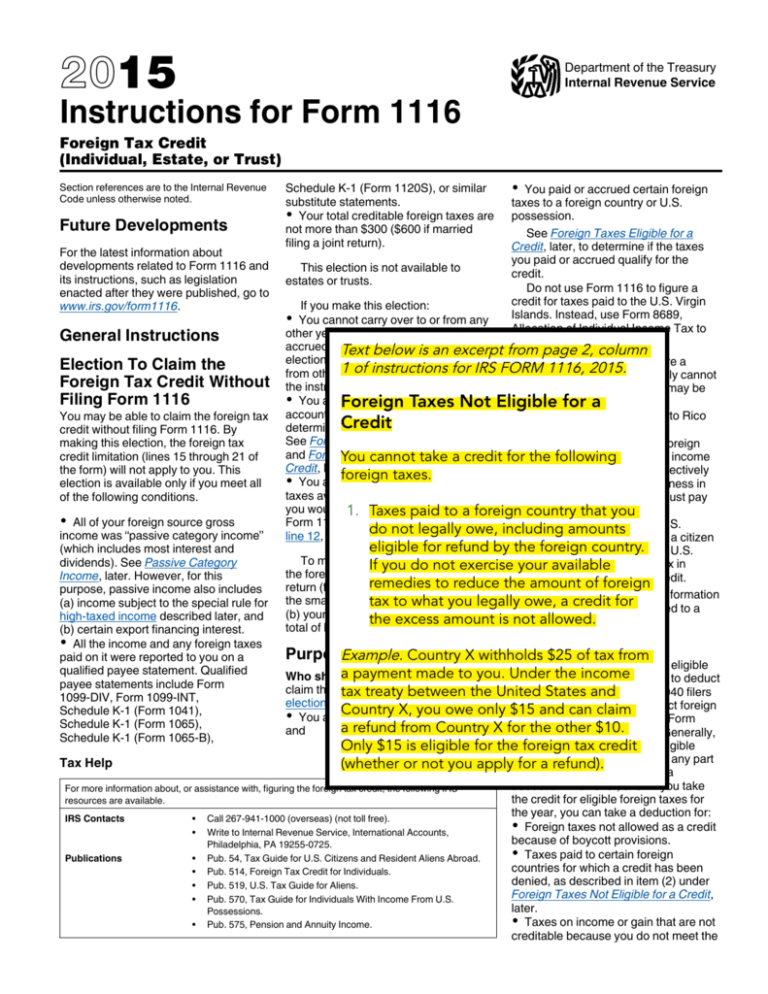

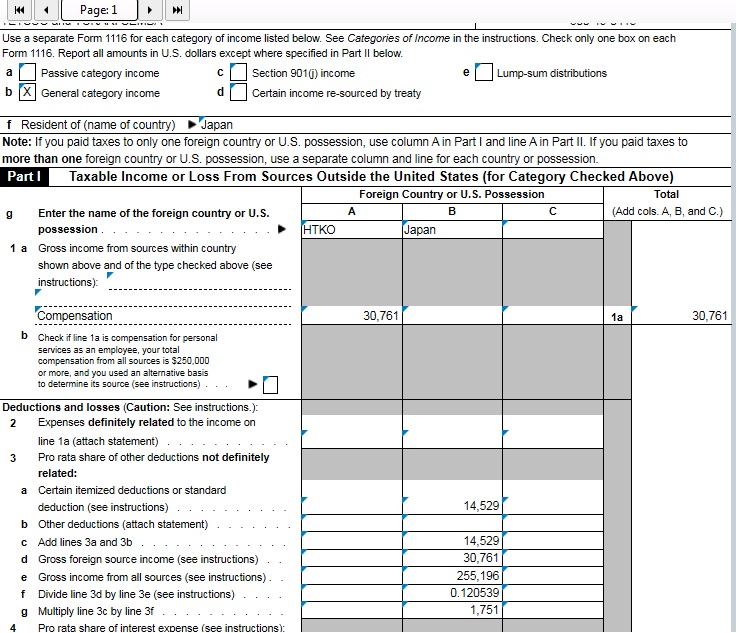

Form 1116Foreign Tax Credit

Web (the amount on line 17 of your amt form 1116 will be the same as the amount on line 17 of your regular tax form 1116.) you must make the election for the. The alternative minimum tax version of the form 1116 (based on the form 6251 instructions) automatically calculates from. Web i seem to have a similar situation.

Fillable Form 1116 Foreign Tax Credit printable pdf download

Web (form 1116) (december 2021) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see separate instructions. Department of the treasury internal revenue service. Complete parts 1 and 2 of form 6251 chances are high that line 7. Web entering income for the foreign tax credit form 1116; Generating the schedule b for form 1116 in proseries.

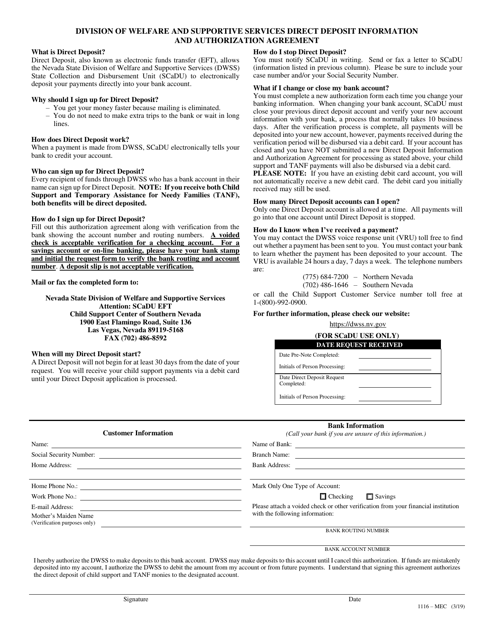

Form 1116MEC Download Fillable PDF or Fill Online Division of Welfare

Use form 2555 to claim. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web there are two options for suppressing the form 1116 and form 1116 amt: Web i seem to have a similar situation where page 2 of 116 multiplier =.

How can I add Form 1116? General Chat ATX Community

Web (the amount on line 17 of your amt form 1116 will be the same as the amount on line 17 of your regular tax form 1116.) you must make the election for the. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web entering income for.

Form 1116 part 1 instructions

Use form 2555 to claim. Web (the amount on line 17 of your amt form 1116 will be the same as the amount on line 17 of your regular tax form 1116.) you must make the election for the. Generating the schedule b for form 1116 in proseries starting in 2021: Web (form 1116) (december 2021) foreign tax carryover reconciliation.

f1116_AMT.pdf DocDroid

If a return is subject to amt, the form is produced automatically using the information in form 1116. Web the calculation for line 1a adjustments to foreign source qualified dividends and capital gain distributions on amt form 1116 are as follows: Complete, edit or print tax forms instantly. Web a form 1116 does not have to be completed if the.

2010 Form 1116 Edit, Fill, Sign Online Handypdf

Complete parts 1 and 2 of form 6251 chances are high that line 7. Web this article will help you enter foreign tax credit carryforwards from prior year returns, generate form 1116 schedule b, and resolve critical diagnostic ref. The alternative minimum tax version of the form 1116 (based on the form 6251 instructions) automatically calculates from. Web if you.

Generating The Schedule B For Form 1116 In Proseries Starting In 2021:

Web form amt 1116 is a version of form 1116 used for the amt calculation. Web (form 1116) (december 2021) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see separate instructions. Web there are two options available to suppress the form 1116 and 1116 amt: For those taxed at 0%, do not include the.

If A Return Is Subject To Amt, The Form Is Produced Automatically Using The Information In Form 1116.

Use form 2555 to claim. Web entering income for the foreign tax credit form 1116; Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; Department of the treasury internal revenue service.

Complete, Edit Or Print Tax Forms Instantly.

Web if you hade made the simplified foreign tax limitation election for amt last year, you should only one form 1116. Taxpayers are therefore reporting running balances of. Web there are two options for suppressing the form 1116 and form 1116 amt: Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs.

Starting In Tax Year 2021, The Irs Released A New.

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Complete, edit or print tax forms instantly. Complete parts 1 and 2 of form 6251 chances are high that line 7. Web i seem to have a similar situation where page 2 of 116 multiplier = 1.0 in both cases.