Form 1120 2022

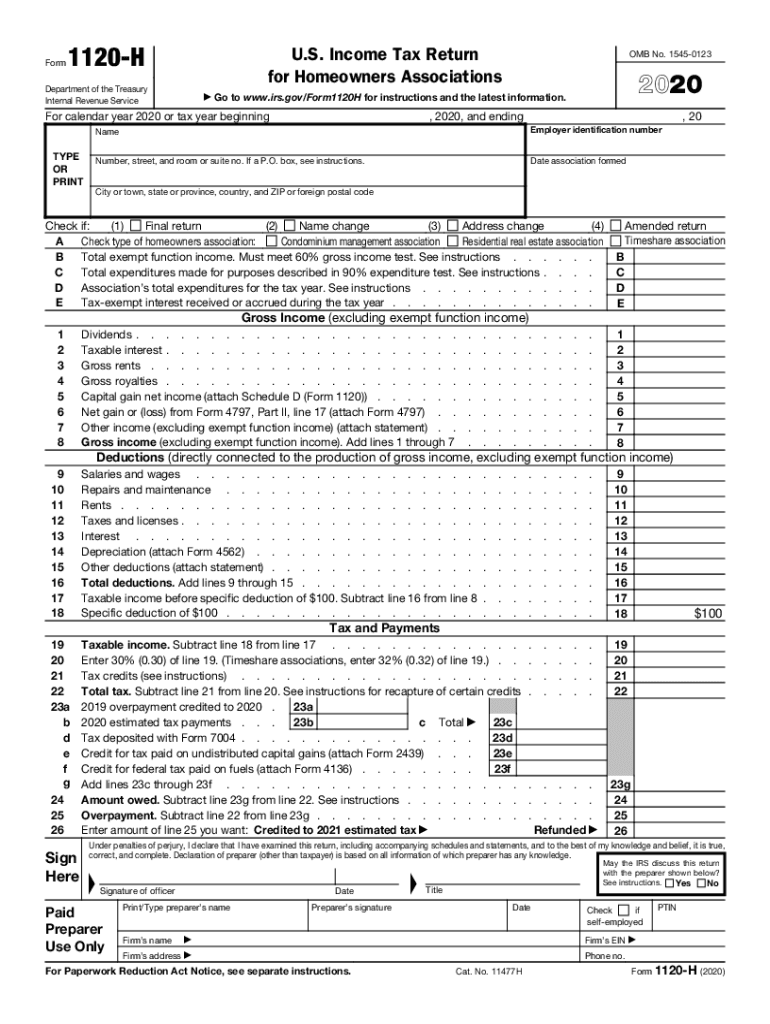

Form 1120 2022 - Corporation income tax return, including recent updates, related forms and instructions on how to file. In general, the final tax return for a c corporation is due on the 15th day of the 4th month after the end of its. Web march 20, 2022: These forms are due by the 15th day of the third month following the close of the tax year, which for most taxpayers is march 15. See faq #17 for a link to the instructions. Web the 2022 form 1120 can also be used if: Income tax return for an s corporation for calendar year 2022 or tax year beginning , 2022, ending , 20 s election effective date name d employer identification number business activity code number (see instructions) type or print number, street, and room or suite no. The corporation has a tax year of less than 12 months that begins and ends in 2023, and the 2023 form 1120 is not available at the time the corporation is required to file its return. Income tax return for homeowners associations for calendar year 2022 or tax year beginning , 2022, and ending , 20 gross income (excluding exempt function income) deductions (directly connected to the production of gross income, excluding exempt function income) tax and payments 19 taxable income. Note that there is no final date for the transmission of electronic 1120 returns.

Web irs begins accepting 1120 electronic tax returns. Corporation income tax return, including recent updates, related forms and instructions on how to file. Income tax return for homeowners associations for calendar year 2022 or tax year beginning , 2022, and ending , 20 gross income (excluding exempt function income) deductions (directly connected to the production of gross income, excluding exempt function income) tax and payments 19 taxable income. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web march 20, 2022: Note that there is no final date for the transmission of electronic 1120 returns. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. See faq #17 for a link to the instructions. Web the 2022 form 1120 can also be used if: Web information about form 1120, u.s.

The corporation has a tax year of less than 12 months that begins and ends in 2023, and the 2023 form 1120 is not available at the time the corporation is required to file its return. In general, the final tax return for a c corporation is due on the 15th day of the 4th month after the end of its. Web information about form 1120, u.s. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web march 20, 2022: See faq #17 for a link to the instructions. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Note that there is no final date for the transmission of electronic 1120 returns. Web irs begins accepting 1120 electronic tax returns. Income tax return for an s corporation for calendar year 2022 or tax year beginning , 2022, ending , 20 s election effective date name d employer identification number business activity code number (see instructions) type or print number, street, and room or suite no.

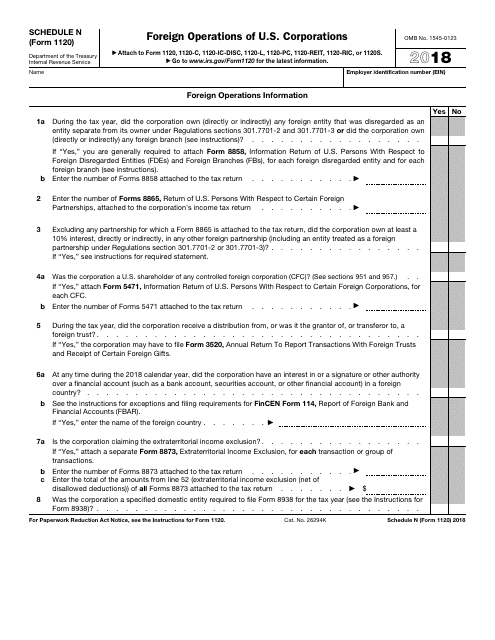

IRS Form 1120 Schedule N Download Fillable PDF or Fill Online Foreign

Web irs begins accepting 1120 electronic tax returns. Note that there is no final date for the transmission of electronic 1120 returns. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web information about form 1120, u.s. Income tax return for an s corporation.

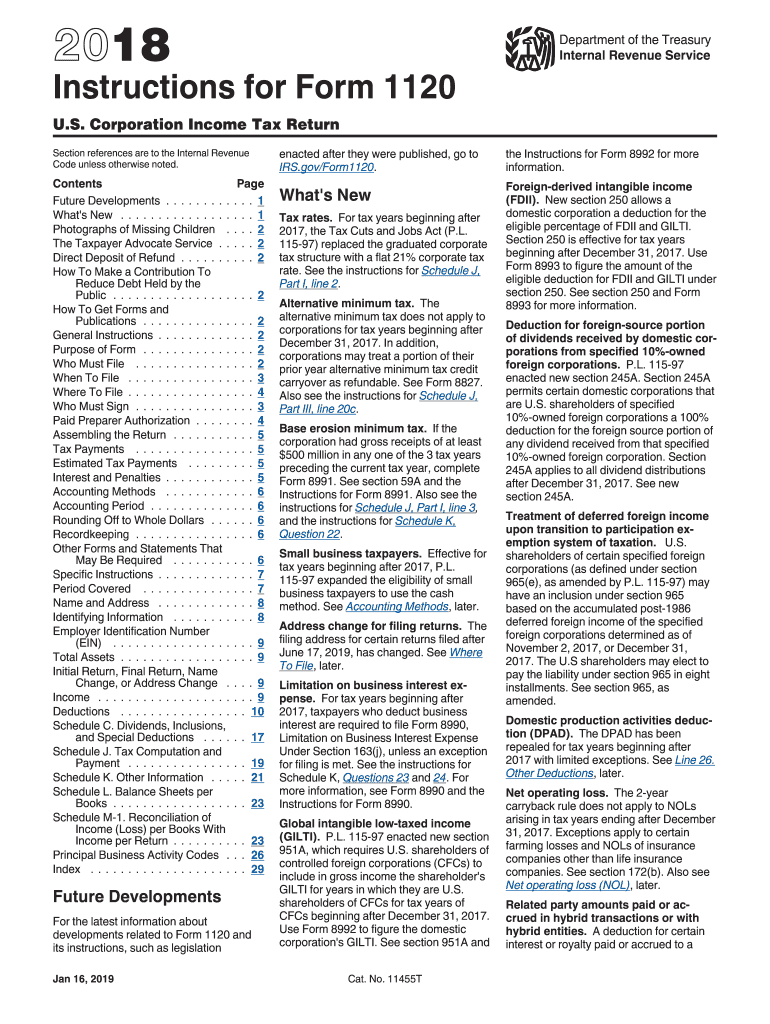

2018 1120 Fill Out and Sign Printable PDF Template signNow

In general, the final tax return for a c corporation is due on the 15th day of the 4th month after the end of its. Income tax return for homeowners associations for calendar year 2022 or tax year beginning , 2022, and ending , 20 gross income (excluding exempt function income) deductions (directly connected to the production of gross income,.

IRS 1120 2022 Form Printable Blank PDF Online

Web march 20, 2022: These forms are due by the 15th day of the third month following the close of the tax year, which for most taxpayers is march 15. Web irs begins accepting 1120 electronic tax returns. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Web.

Form 1120 Fill out & sign online DocHub

See faq #17 for a link to the instructions. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web information about form 1120, u.s. Income tax return for an s corporation for calendar year 2022 or tax year beginning , 2022, ending , 20.

1120s schedule d instructions

See faq #17 for a link to the instructions. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. The corporation has a tax year of less than 12 months that begins and ends in 2023, and the 2023 form 1120 is not available at the time the corporation.

IRS Form 1120S LinebyLine Instructions 2022 S Corporation U.S

Web the 2022 form 1120 can also be used if: Income tax return for an s corporation for calendar year 2022 or tax year beginning , 2022, ending , 20 s election effective date name d employer identification number business activity code number (see instructions) type or print number, street, and room or suite no. In general, the final tax.

IRS Form 1120S (2020)

See faq #17 for a link to the instructions. Web march 20, 2022: Income tax return for homeowners associations for calendar year 2022 or tax year beginning , 2022, and ending , 20 gross income (excluding exempt function income) deductions (directly connected to the production of gross income, excluding exempt function income) tax and payments 19 taxable income. The corporation.

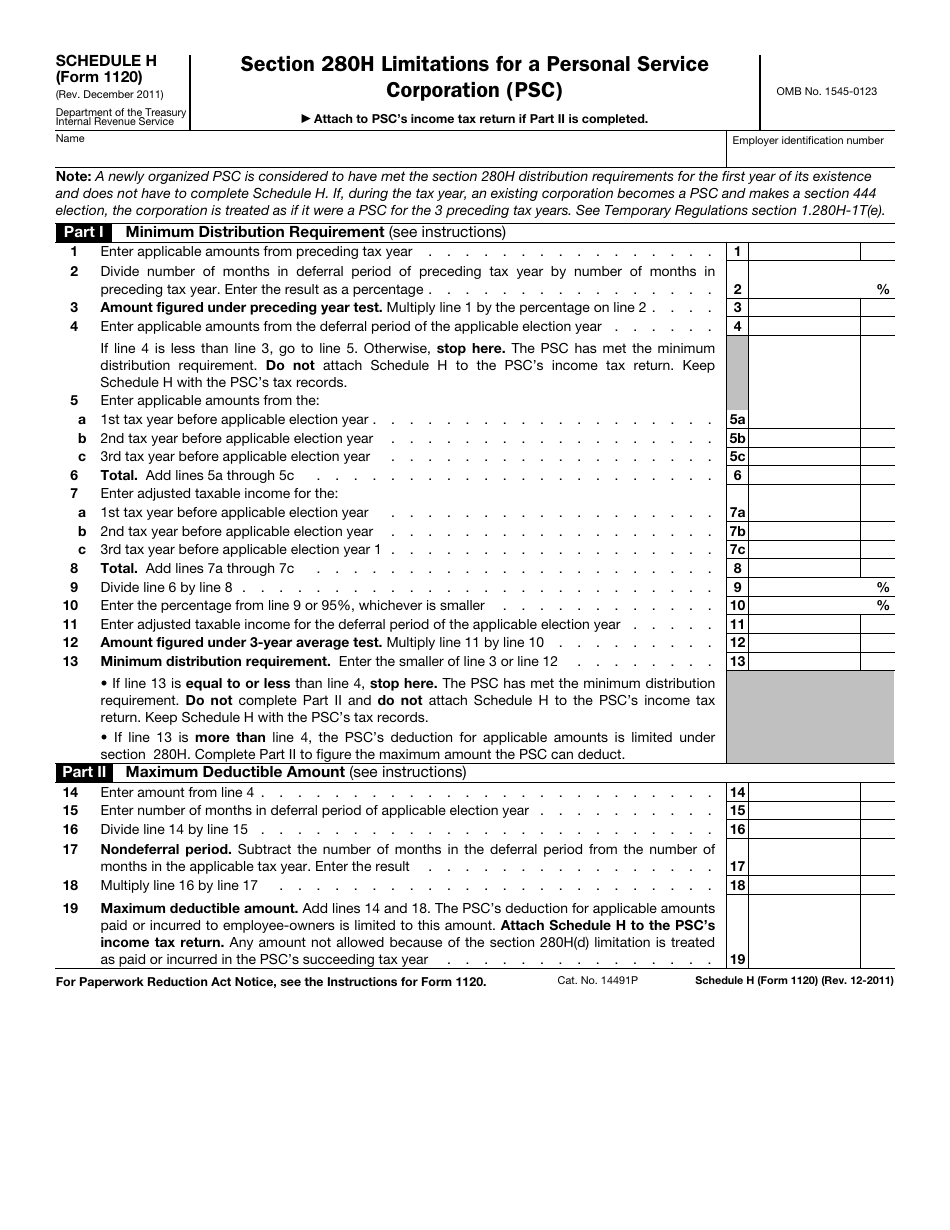

IRS Form 1120 Schedule H Download Fillable PDF or Fill Online Section

Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. These forms are due by the 15th day of the third month following the close of the tax year, which for most taxpayers is march 15. Note that there is no final date for the transmission of electronic 1120.

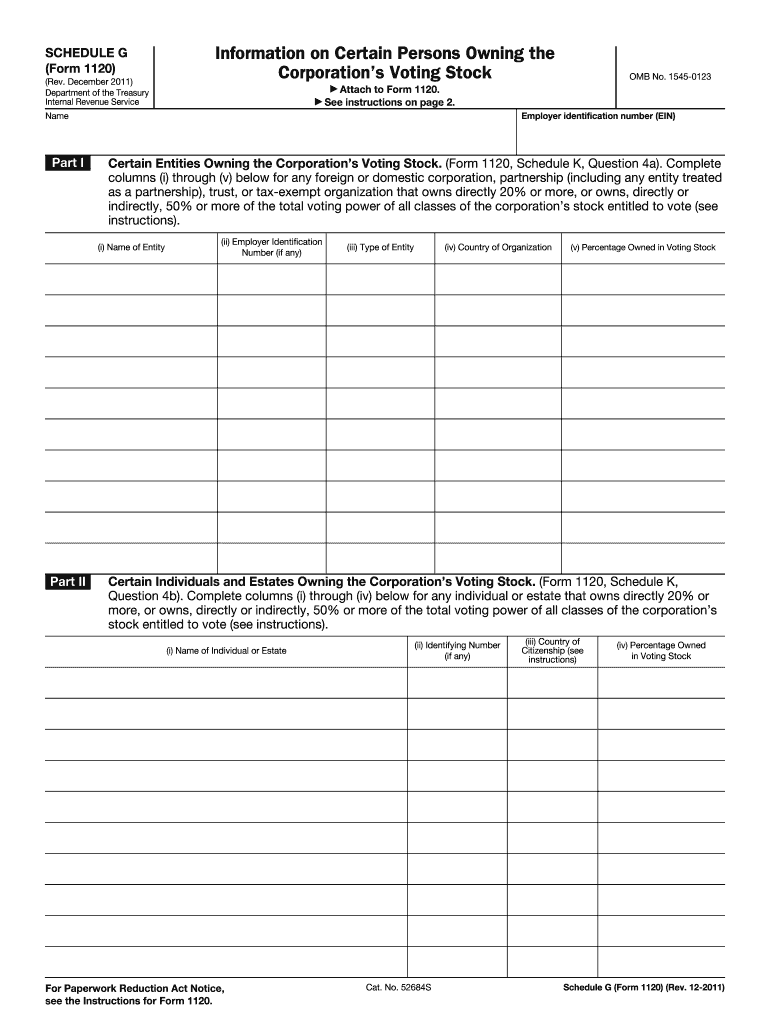

Schedule G Fill Out and Sign Printable PDF Template signNow

Corporation income tax return, including recent updates, related forms and instructions on how to file. The corporation has a tax year of less than 12 months that begins and ends in 2023, and the 2023 form 1120 is not available at the time the corporation is required to file its return. In general, the final tax return for a c.

Farm Service Agency Adjusted Gross Calculation Could Influence

Web march 20, 2022: Web the 2022 form 1120 can also be used if: Income tax return for an s corporation for calendar year 2022 or tax year beginning , 2022, ending , 20 s election effective date name d employer identification number business activity code number (see instructions) type or print number, street, and room or suite no. Note.

In General, The Final Tax Return For A C Corporation Is Due On The 15Th Day Of The 4Th Month After The End Of Its.

Web irs begins accepting 1120 electronic tax returns. Income tax return for an s corporation for calendar year 2022 or tax year beginning , 2022, ending , 20 s election effective date name d employer identification number business activity code number (see instructions) type or print number, street, and room or suite no. These forms are due by the 15th day of the third month following the close of the tax year, which for most taxpayers is march 15. Corporation income tax return, including recent updates, related forms and instructions on how to file.

Use This Form To Report The Income, Gains, Losses, Deductions, Credits, And To Figure The Income Tax Liability Of A Corporation.

Web information about form 1120, u.s. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Income tax return for homeowners associations for calendar year 2022 or tax year beginning , 2022, and ending , 20 gross income (excluding exempt function income) deductions (directly connected to the production of gross income, excluding exempt function income) tax and payments 19 taxable income. Web march 20, 2022:

The Corporation Has A Tax Year Of Less Than 12 Months That Begins And Ends In 2023, And The 2023 Form 1120 Is Not Available At The Time The Corporation Is Required To File Its Return.

Note that there is no final date for the transmission of electronic 1120 returns. Web the 2022 form 1120 can also be used if: See faq #17 for a link to the instructions.