Form 1310 Pdf

Form 1310 Pdf - Green died on january 4 before filing his tax return. Street address of decedent city/town state zip name of claimant relationship to decedent. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Download your fillable irs form 1310 in pdf. I am a creditor of the decedent or a person who has paid or incurred the decedent's funeral expense, and 30 Web 1310 of the surrogate's court procedure act, by all debtors of the decedent known to me after diligent inquiry, do note: If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: If you are claiming a refund on behalf of a deceased taxpayer, you must. Statement of person claiming refund due a deceased taxpayer. You can get the irs form 1310 from the official website of the department of the treasury, internal revenue service.

Statement of person claiming refund due a deceased taxpayer. I am a creditor of the decedent or a person who has paid or incurred the decedent's funeral expense, and 30 — statement of person claiming refund due a deceased taxpayer. The statement is prepared and served as an attachment to the original tax report and filed with the irs, following the basic tax report recommendations. If you are claiming a refund on behalf of a deceased taxpayer, you must. Irs form 1310 is executed to support the application for the deceased’s refund for the tax year at issue. On april 3 of the same year, you were appointed Name of decedent social security number date of death. Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. Use form 1310 to claim a refund on behalf of a deceased taxpayer.

Irs form 1310 is executed to support the application for the deceased’s refund for the tax year at issue. — statement of person claiming refund due a deceased taxpayer. It appears you don't have a pdf plugin for this browser. For section b a table of heirs form must be completed and made part of this affidavit. Use form 1310 to claim a refund on behalf of a deceased taxpayer. The statement is prepared and served as an attachment to the original tax report and filed with the irs, following the basic tax report recommendations. The irs form 1310 is titled as statement of person claiming refund due a deceased taxpayer. Statement of person claiming refund due a deceased taxpayer. Statement of person claiming refund due a deceased taxpayer. Download your fillable irs form 1310 in pdf.

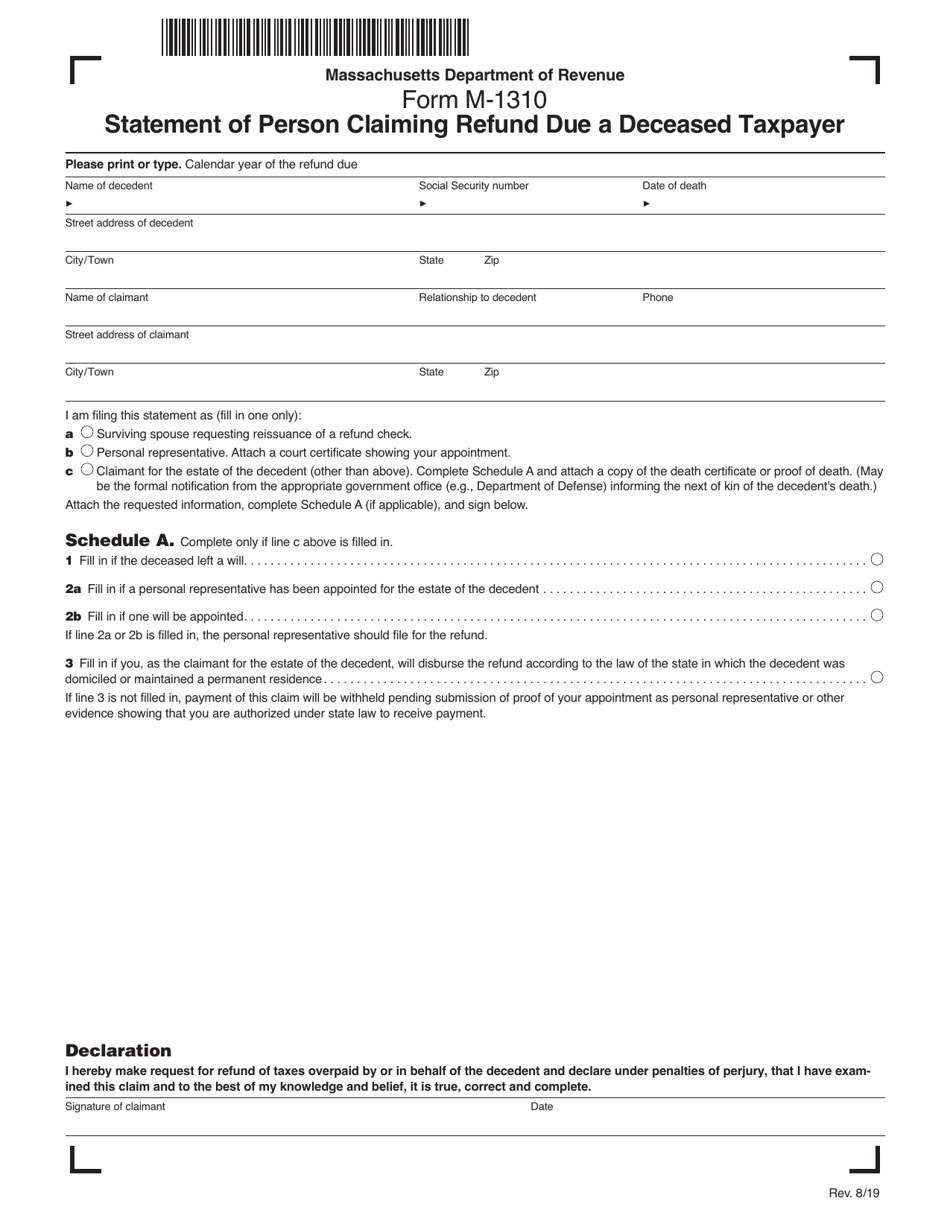

Form M1310 Download Printable PDF or Fill Online Statement of Person

Statement of person claiming refund due a deceased taxpayer. You can get the irs form 1310 from the official website of the department of the treasury, internal revenue service. It appears you don't have a pdf plugin for this browser. Web form 1310 is an irs form used to claim a federal tax refund for the beneficiary of a recently.

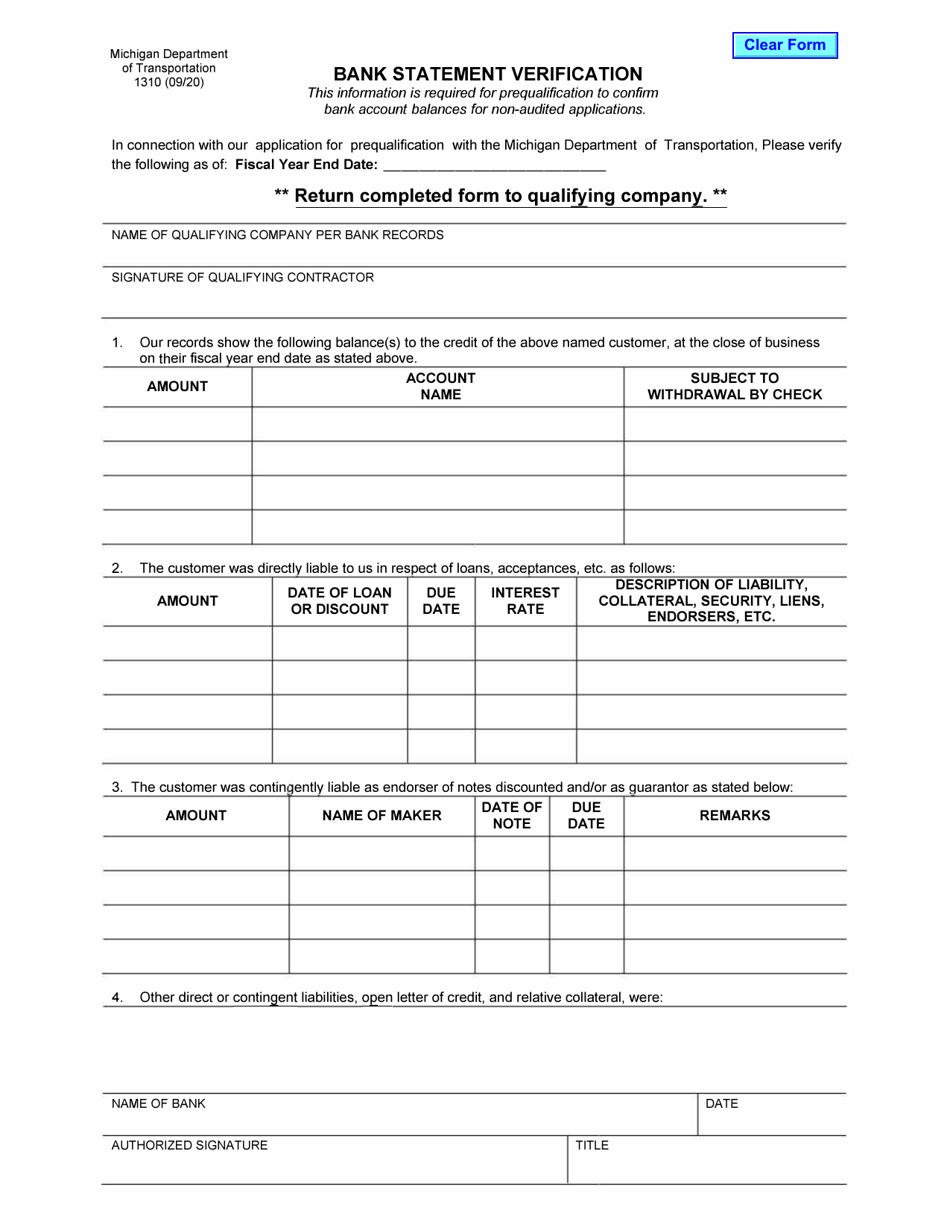

Mi 1310 Instructions Pdf Fill Out and Sign Printable PDF Template

Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. Web 1310 of the surrogate's court procedure act, by all debtors of the decedent known to me after diligent inquiry, do note: Calendar year of the refund due. Download your fillable irs form 1310 in pdf. Street address of decedent city/town.

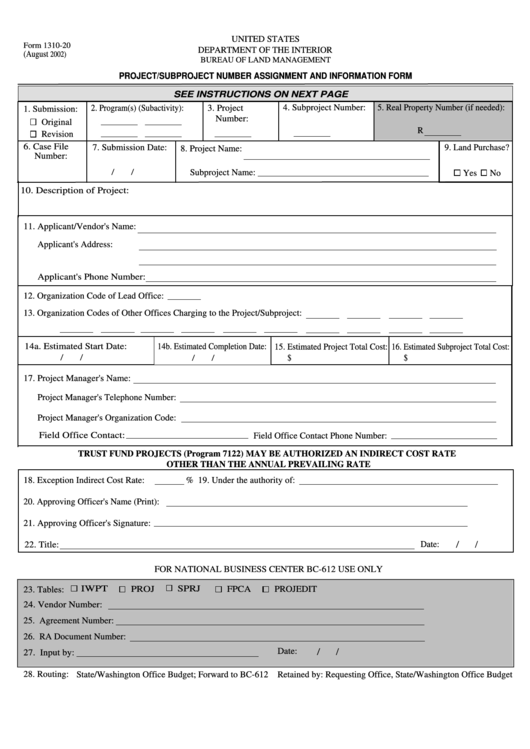

Fillable Form 131020 Project/subproject Number Assignment And

Calendar year of the refund due. You can get the irs form 1310 from the official website of the department of the treasury, internal revenue service. Use form 1310 to claim a refund on behalf of a deceased taxpayer. For section b a table of heirs form must be completed and made part of this affidavit. The statement is prepared.

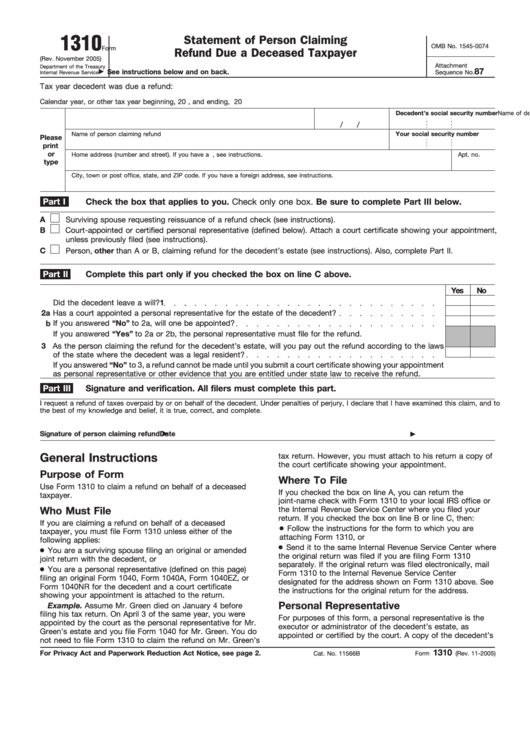

2021 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Calendar year of the refund due. — statement of person claiming refund due a deceased taxpayer. Statement of person claiming refund due a deceased taxpayer. Green died on january 4 before filing his tax return.

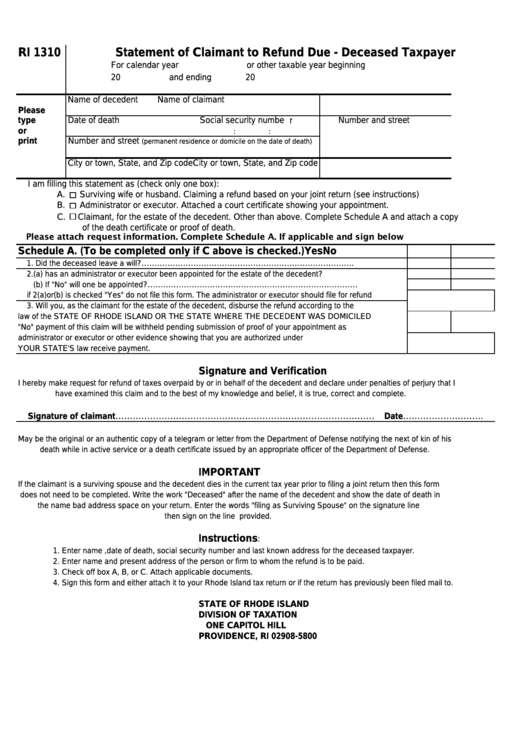

Form Ri 1310 Statement Of Claimant To Refund DueDeceased Taxpayer

Statement of person claiming refund due a deceased taxpayer. Statement of person claiming refund due a deceased taxpayer. The statement is prepared and served as an attachment to the original tax report and filed with the irs, following the basic tax report recommendations. Web massachusetts department of revenue. For section b a table of heirs form must be completed and.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Download the form and open it on pdfelement to start the process of form filling. Web 1310 of the surrogate's court procedure act, by all debtors of the decedent known to me after diligent inquiry, do note: If you are claiming a refund on behalf of a deceased taxpayer, you must. — statement of person claiming refund due a deceased.

Form 1310 2014 2019 Blank Sample to Fill out Online in PDF

Street address of decedent city/town state zip name of claimant relationship to decedent. Download your fillable irs form 1310 in pdf. Calendar year of the refund due. Download the form and open it on pdfelement to start the process of form filling. If you are claiming a refund on behalf of a deceased taxpayer, you must.

Form 1310 Download Fillable PDF or Fill Online Bank Statement

The irs form 1310 is titled as statement of person claiming refund due a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Green died on january 4 before filing his tax return. — statement of person claiming refund due a deceased taxpayer. You.

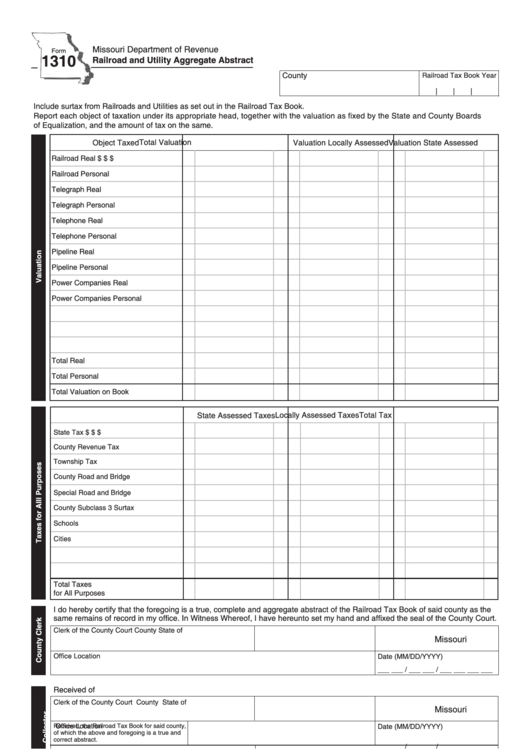

Fillable Form 1310 Railroad And Utility Aggregate Abstract printable

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Use form 1310 to claim a refund on behalf of a deceased taxpayer. On april 3 of the same year, you.

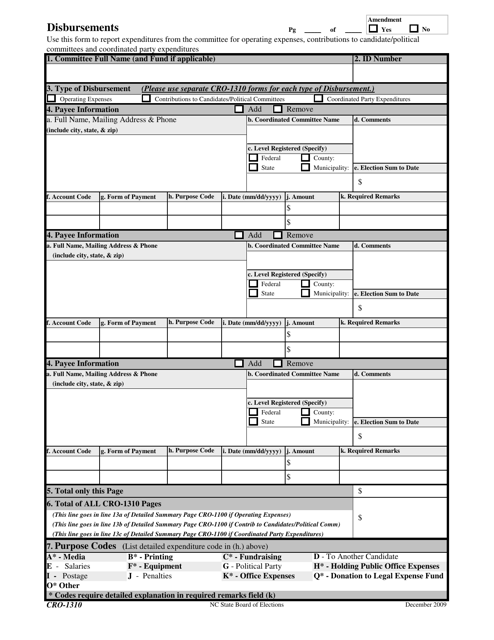

Form CRO1310 Download Printable PDF or Fill Online Disbursements North

For section b a table of heirs form must be completed and made part of this affidavit. Irs form 1310 is executed to support the application for the deceased’s refund for the tax year at issue. Use form 1310 to claim a refund on behalf of a deceased taxpayer. On april 3 of the same year, you were appointed Calendar.

Web 1310 Of The Surrogate's Court Procedure Act, By All Debtors Of The Decedent Known To Me After Diligent Inquiry, Do Note:

Name of decedent social security number date of death. Statement of person claiming refund due a deceased taxpayer. Download your fillable irs form 1310 in pdf. On april 3 of the same year, you were appointed

The Statement Is Prepared And Served As An Attachment To The Original Tax Report And Filed With The Irs, Following The Basic Tax Report Recommendations.

The irs form 1310 is titled as statement of person claiming refund due a deceased taxpayer. Calendar year of the refund due. Download the form and open it on pdfelement to start the process of form filling. Green died on january 4 before filing his tax return.

— Statement Of Person Claiming Refund Due A Deceased Taxpayer.

If you are claiming a refund on behalf of a deceased taxpayer, you must. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Irs form 1310 is executed to support the application for the deceased’s refund for the tax year at issue. Web massachusetts department of revenue.

For Section B A Table Of Heirs Form Must Be Completed And Made Part Of This Affidavit.

If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: I am a creditor of the decedent or a person who has paid or incurred the decedent's funeral expense, and 30 Web use form 1310 to claim a refund on behalf of a deceased taxpayer. You can get the irs form 1310 from the official website of the department of the treasury, internal revenue service.