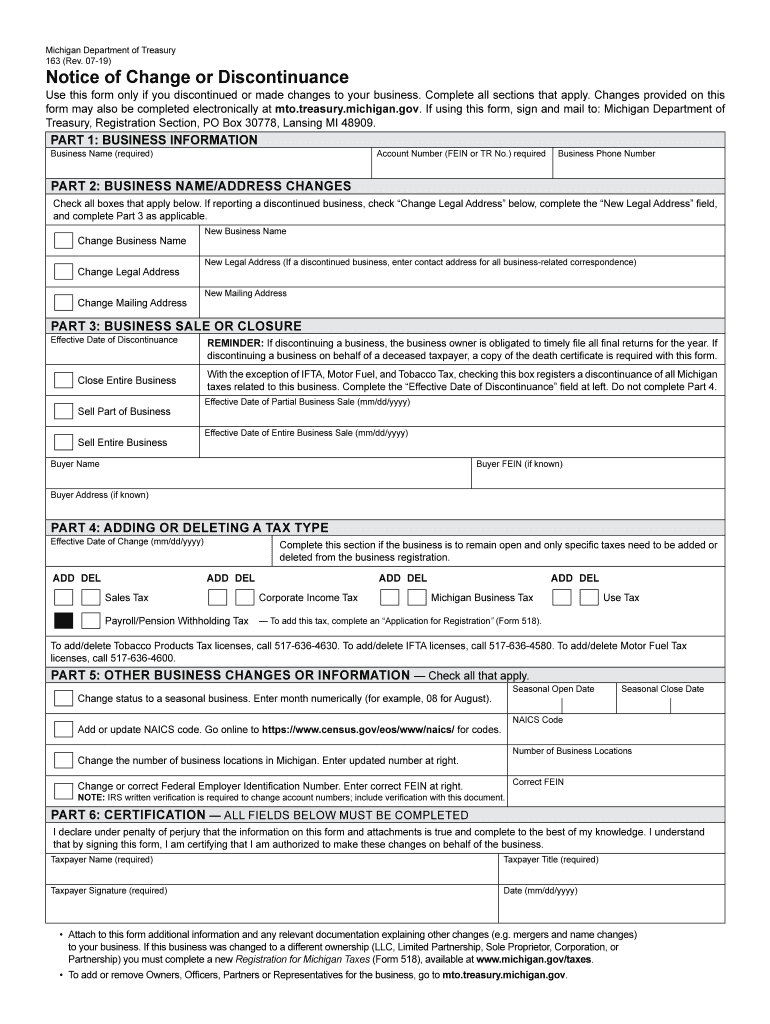

Form 163 Michigan Instructions

Form 163 Michigan Instructions - Edit your michigan form 163 online. Web when discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax clearance. Web michigan department of treasury account number (fein or tr number) 163 (rev. Date of sale of business or business assets to another entity. To fill out this form, you will need to have the following information ready: Web michigan treasury online form instructions please choose a year from the list below: Edit your michigan form 163 online. If discontinuing a business on behalf of. Upload, modify or create forms. Web michigan department of treasury 163 (rev.

Web disclosure forms and information. A business owner may request that. Web up to $40 cash back form 163 is the michigan sales tax return form. If discontinuing a business on behalf of. Web if no, attach a completed form 163 with this request. Web sell entire business reminder: Business information business name (required) account number (fein or tr no.) required business phone number part 2: • enter $18 if tax is $27 to $3,600 and paid by the 12th, or michigan.gov. Type text, add images, blackout confidential details, add comments, highlights and more. If discontinuing a business, the business owner is obligated to timely file all final returns for the year.

Try it for free now! To fill out this form, you will need to have the following information ready: Type text, add images, blackout confidential details, add comments, highlights and more. Health insurance claims assessment (hica) ifta / motor carrier. Date of sale of business or business assets to another entity. A business owner may request that. Web michigan treasury online form instructions please choose a year from the list below: • enter $18 if tax is $27 to $3,600 and paid by the 12th, or michigan.gov. Web michigan department of treasury account number (fein or tr number) 163 (rev. Web disclosure forms and information.

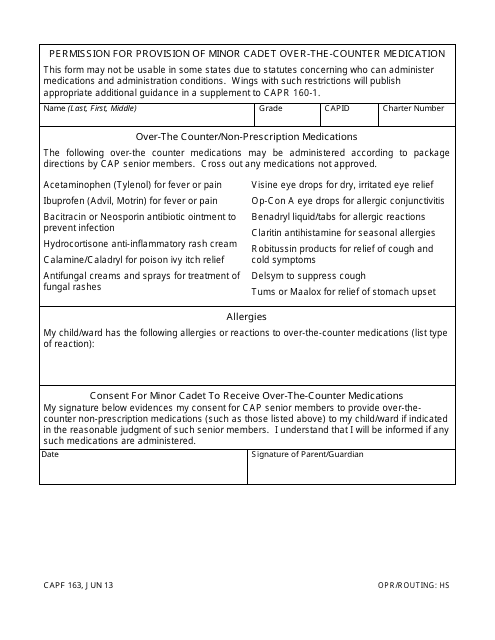

Cap form 163 Fill out & sign online DocHub

Is money being held in escrow. Edit your michigan form 163 online. Ad download or email mi 163 & more fillable forms, register and subscribe now! Web michigan department of treasury account number (fein or tr number) 163 (rev. If discontinuing a business, the business owner is obligated to timely file all final returns for the year.

Form 163 michigan Fill out & sign online DocHub

Web michigan treasury online form instructions please choose a year from the list below: Web michigan department of treasury 163 (rev. Web when discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax clearance. Web disclosure forms and information. Web sell entire business reminder:

Www.michigan.govtaxes Form 5080 Form Resume Examples 9x8rakgd3d

Sign it in a few clicks. Sign it in a few clicks. Sign it in a few clicks draw your signature, type. Web if no, attach a completed form 163 with this request. Edit your michigan form 163 online.

Instructions for Form 8990 (12/2021) Internal Revenue Service

Ad download or email mi 163 & more fillable forms, register and subscribe now! Sign it in a few clicks. To fill out this form, you will need to have the following information ready: Upload, modify or create forms. 2023 mto form instructions 2022 mto form instructions 2021 mto form.

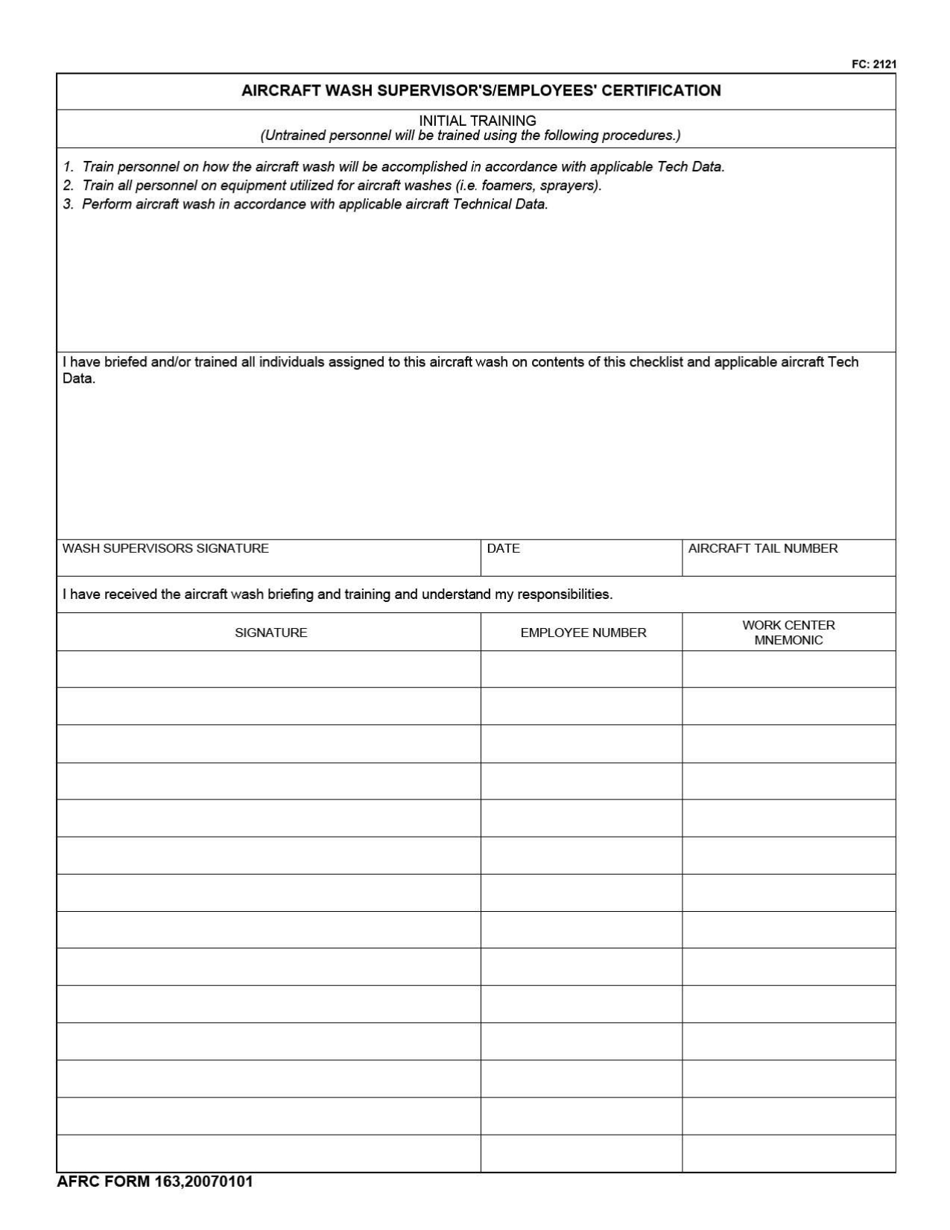

AFRC Form 163 Download Fillable PDF or Fill Online Aircraft Wash

Web you must notify the registration section of the michigan department of treasury by completing a form 163 notice of change or discontinuance. Edit your michigan form 163 online. Try it for free now! Type text, add images, blackout confidential details, add comments, highlights and more. If discontinuing a business, the business owner is obligated to timely file all final.

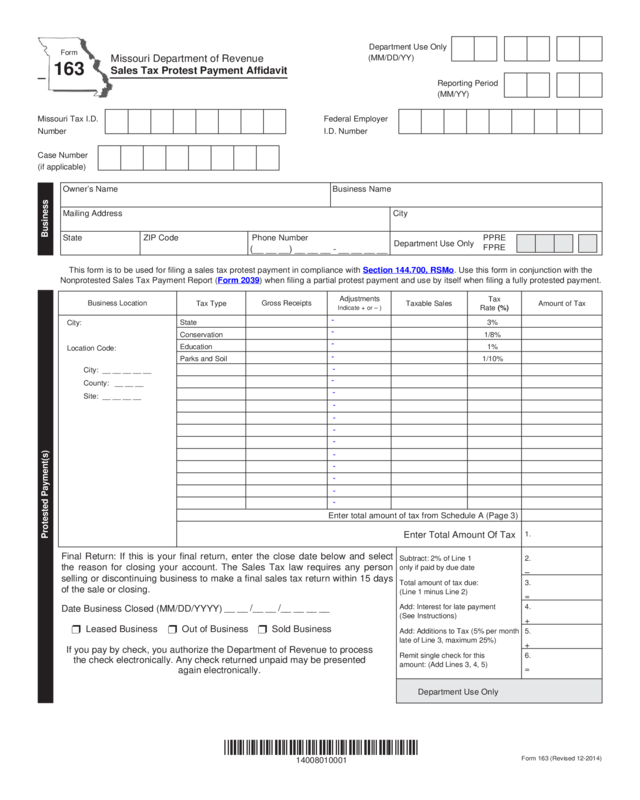

Form 163 Sales Tax Protest Payment Affidavit Edit, Fill, Sign Online

If discontinuing a business on behalf of. Your michigan sales tax number 2. Ad download or email mi 163 & more fillable forms, register and subscribe now! Type text, add images, blackout confidential details, add comments, highlights and more. Upload, modify or create forms.

Fill Free fillable Form 163 Notice of Change or Discontinuance

Web disclosure forms and information. Edit your michigan form 163 online type text, add images, blackout confidential details, add comments, highlights and more. Web michigan department of treasury account number (fein or tr number) 163 (rev. Try it for free now! Type text, add images, blackout confidential details, add comments, highlights and more.

CAP Form 163 Download Fillable PDF or Fill Online Permission for

Upload, modify or create forms. Edit your michigan form 163 online. Type text, add images, blackout confidential details, add comments, highlights and more. A business owner may request that. Edit your michigan form 163 online type text, add images, blackout confidential details, add comments, highlights and more.

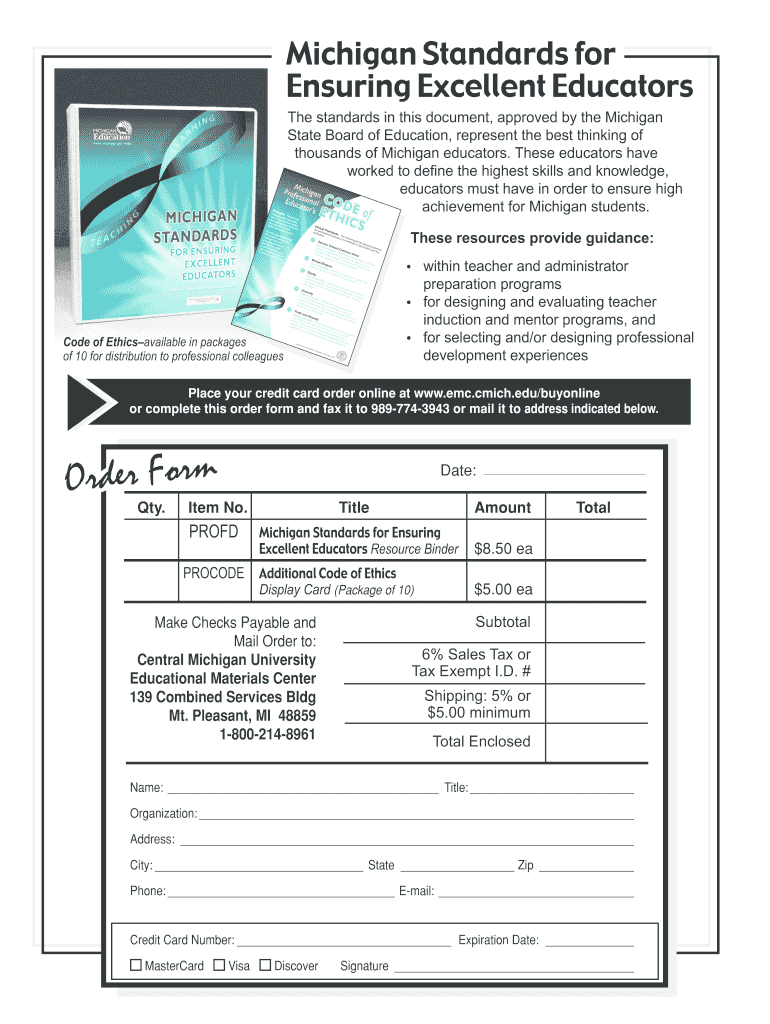

MI Standards Order Form State of Michigan Michigan Fill Out and Sign

Upload, modify or create forms. Your michigan sales tax number 2. Date of sale of business or business assets to another entity. Browse 693 michigan department of treasury forms and templates collected. Sign it in a few clicks draw your signature, type.

Michigan Form 1099 G Form Resume Examples 7NYA0gLR9p

To fill out this form, you will need to have the following information ready: 2023 mto form instructions 2022 mto form instructions 2021 mto form. Business information business name (required) account number (fein or tr no.) required business phone number part 2: Web michigan department of treasury 163 (rev. Web disclosure forms and information.

6/05) Notice Of Change Or Discontinuance Check This Box If You Have Not Received A Current Set Of Suw Forms.

To fill out this form, you will need to have the following information ready: Business information business name (required) account number (fein or tr no.) required business phone number part 2: Web michigan treasury online form instructions please choose a year from the list below: Upload, modify or create forms.

2023 Mto Form Instructions 2022 Mto Form Instructions 2021 Mto Form.

A business owner may request that. Edit your michigan form 163 online. Type text, add images, blackout confidential details, add comments, highlights and more. Web sell entire business reminder:

Web If No, Attach A Completed Form 163 With This Request.

• enter $18 if tax is $27 to $3,600 and paid by the 12th, or michigan.gov. If discontinuing a business, the business owner is obligated to timely file all final returns for the year. Web you must notify the registration section of the michigan department of treasury by completing a form 163 notice of change or discontinuance. Web disclosure forms and information.

Web Up To $40 Cash Back Form 163 Is The Michigan Sales Tax Return Form.

Your michigan sales tax number 2. Web when discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax clearance. Date of sale of business or business assets to another entity. Try it for free now!