Form 20 F Instructions

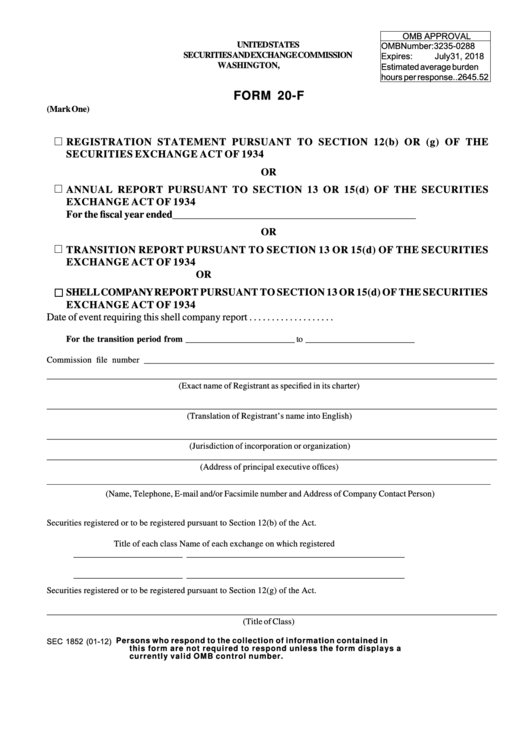

Form 20 F Instructions - Securities and exchange commission (sec). As in previous years, we discuss both disclosure developments and continued areas of focus for the u.s. Web the rules became effective on march 16, 2021. Income tax liability of a foreign corporation. Registration statement / annual report / transition report (pdf) last updated: You file your 2022 tax return and pay the tax due by march 1, 2023. Securities and exchange commission (sec). Securities exchange act of 1934, public companies, international number: Securities and exchange commission (the “sec”). We have discussed the changes in detail in our client update.

You file your 2022 tax return and pay the tax due by march 1, 2023. Securities and exchange commission (sec). We have discussed the changes in detail in our client update. Securities and exchange commission (sec). Web the rules became effective on march 16, 2021. Securities and exchange commission (the “sec”). Registration statement / annual report / transition report (pdf) last updated: Securities and exchange commission that must be filed by all foreign private issuers with listed equity shares on exchanges in the u.s. As in previous years, we discuss both disclosure developments and continued areas of focus for the u.s. Income tax liability of a foreign corporation.

Web the rules became effective on march 16, 2021. Securities exchange act of 1934, public companies, international number: You file your 2022 tax return and pay the tax due by march 1, 2023. As in previous years, we discuss both disclosure developments and continued areas of focus for the u.s. Securities and exchange commission (the “sec”). Registration statement / annual report / transition report (pdf) last updated: We have discussed the changes in detail in our client update. Securities and exchange commission that must be filed by all foreign private issuers with listed equity shares on exchanges in the u.s. Securities and exchange commission (sec). Income tax liability of a foreign corporation.

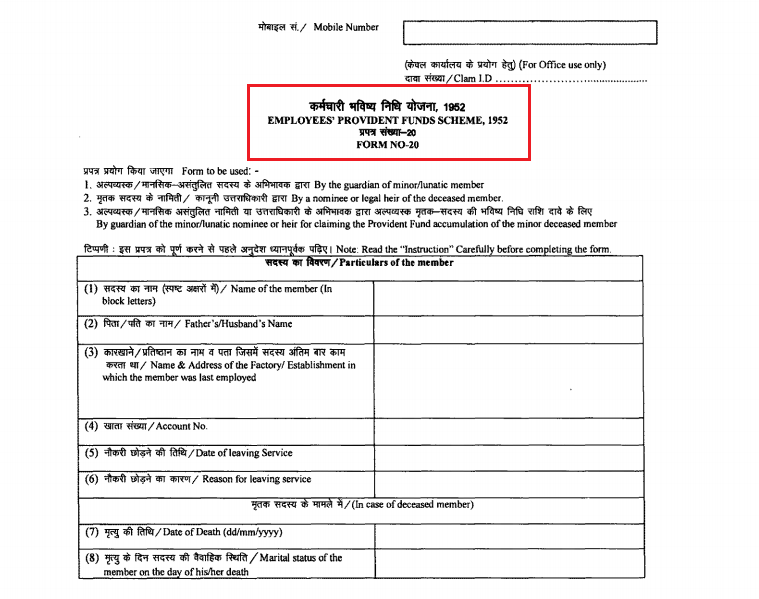

Epf Registration Form For Employee Companies having an employee base

Income tax liability of a foreign corporation. As in previous years, we discuss both disclosure developments and continued areas of focus for the u.s. We have discussed the changes in detail in our client update. Securities and exchange commission (sec). Web the rules became effective on march 16, 2021.

Sec Form 20F Registration Statement/annual Report/transition Report

You file your 2022 tax return and pay the tax due by march 1, 2023. As in previous years, we discuss both disclosure developments and continued areas of focus for the u.s. Income tax liability of a foreign corporation. Web the rules became effective on march 16, 2021. We have discussed the changes in detail in our client update.

2013 Form 20F

Securities and exchange commission (the “sec”). Securities exchange act of 1934, public companies, international number: Web the rules became effective on march 16, 2021. We have discussed the changes in detail in our client update. Securities and exchange commission (sec).

2009_form_20f Dividend Patent Free 30day Trial Scribd

Securities exchange act of 1934, public companies, international number: Securities and exchange commission (the “sec”). Income tax liability of a foreign corporation. Securities and exchange commission (sec). Registration statement / annual report / transition report (pdf) last updated:

2009 Form 20F

Income tax liability of a foreign corporation. Web the rules became effective on march 16, 2021. We have discussed the changes in detail in our client update. Registration statement / annual report / transition report (pdf) last updated: Securities and exchange commission (sec).

Irs Form 433 A Instructions Form Resume Examples 05KA6wD3wP

Registration statement / annual report / transition report (pdf) last updated: Securities exchange act of 1934, public companies, international number: As in previous years, we discuss both disclosure developments and continued areas of focus for the u.s. Web the rules became effective on march 16, 2021. Securities and exchange commission that must be filed by all foreign private issuers with.

2023 Form 990 Schedule F Instructions Fill online, Printable

Income tax liability of a foreign corporation. We have discussed the changes in detail in our client update. You file your 2022 tax return and pay the tax due by march 1, 2023. Web the rules became effective on march 16, 2021. Securities and exchange commission that must be filed by all foreign private issuers with listed equity shares on.

2013 Form 20F

Securities and exchange commission (sec). Securities exchange act of 1934, public companies, international number: Securities and exchange commission (the “sec”). Registration statement / annual report / transition report (pdf) last updated: Web the rules became effective on march 16, 2021.

2009 Form 20F

Income tax liability of a foreign corporation. You file your 2022 tax return and pay the tax due by march 1, 2023. We have discussed the changes in detail in our client update. Securities exchange act of 1934, public companies, international number: Securities and exchange commission (the “sec”).

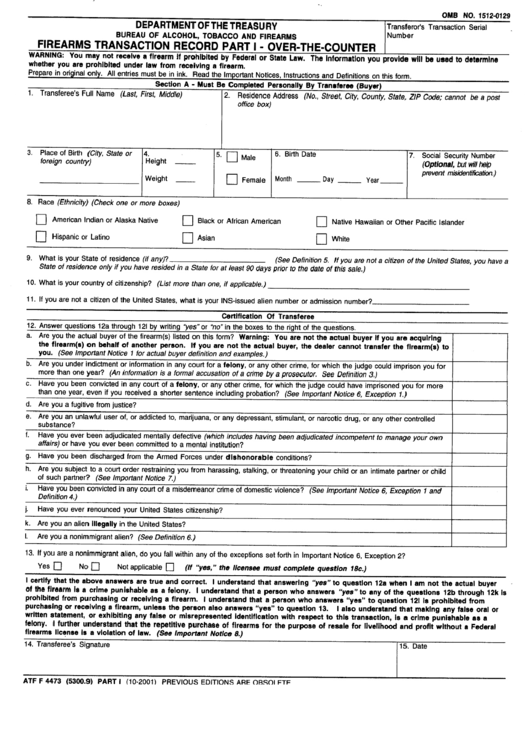

Form Atf F 4473 Firearms Transaction Report printable pdf download

We have discussed the changes in detail in our client update. As in previous years, we discuss both disclosure developments and continued areas of focus for the u.s. Income tax liability of a foreign corporation. You file your 2022 tax return and pay the tax due by march 1, 2023. Securities and exchange commission (sec).

Securities And Exchange Commission (The “Sec”).

Income tax liability of a foreign corporation. Securities and exchange commission (sec). Securities and exchange commission that must be filed by all foreign private issuers with listed equity shares on exchanges in the u.s. Web the rules became effective on march 16, 2021.

Registration Statement / Annual Report / Transition Report (Pdf) Last Updated:

Securities and exchange commission (sec). Securities exchange act of 1934, public companies, international number: As in previous years, we discuss both disclosure developments and continued areas of focus for the u.s. You file your 2022 tax return and pay the tax due by march 1, 2023.