Form 2210 2023

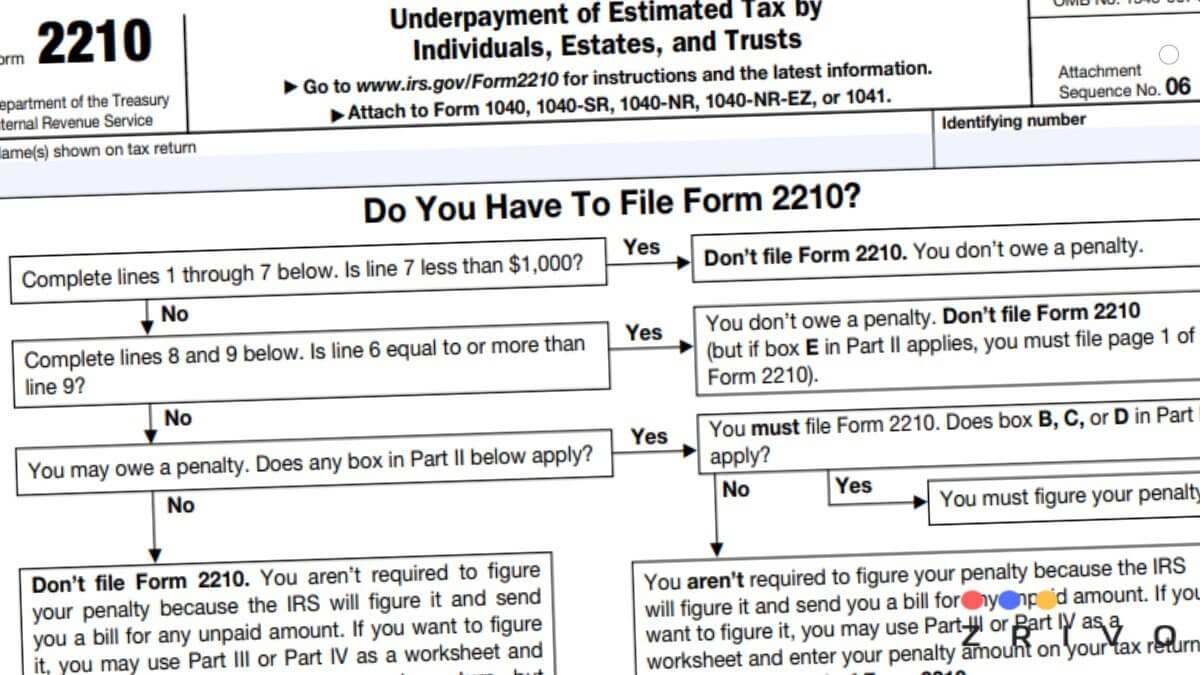

Form 2210 2023 - The irs will generally figure your penalty for you and you should not file form 2210. 06 name(s) shown on tax return Web on this page. Web if your adjusted gross income was $150,000 or more (or $75,000 if you’re married filing separately) then you may not be subject to the penalty if you paid the lower of 90% of the tax shown on the current year return, or 110% of your tax from the prior year. Web the quarter that you underpaid. Interest rate categories and formulas. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the latest information. What is the penalty for underpayment of estimated taxes? 13 minutes watch video get the form step by step instructions if you’re filing an income tax return and haven’t paid enough in income taxes throughout the. You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your return.

Web the quarter that you underpaid. 06 name(s) shown on tax return Your income varies during the year. Web on this page. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the latest information. Web by forrest baumhover march 27, 2023 reading time: What is the penalty for underpayment of estimated taxes? Underpayment of estimated tax by individuals, estates, and trusts. Department of the treasury internal revenue service. You don't make estimated tax payments or paid too little.

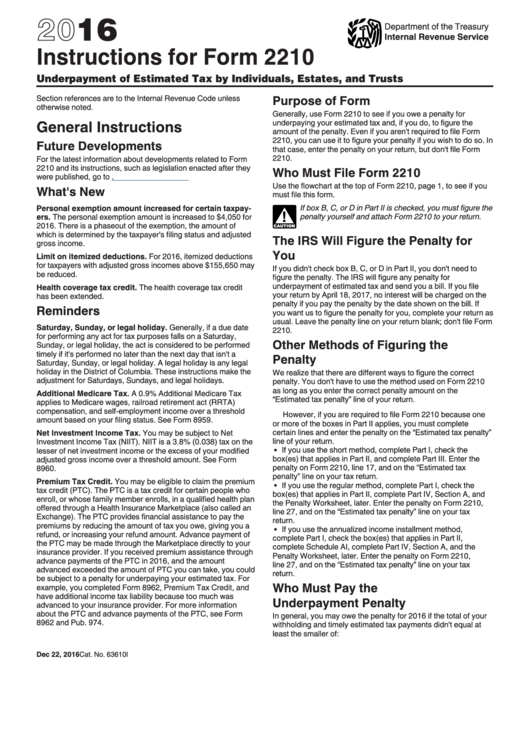

You don't make estimated tax payments or paid too little. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. The irs will generally figure your penalty for you and you should not file form 2210. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web if your adjusted gross income was $150,000 or more (or $75,000 if you’re married filing separately) then you may not be subject to the penalty if you paid the lower of 90% of the tax shown on the current year return, or 110% of your tax from the prior year. Prior years quarterly interest rates. Web by forrest baumhover march 27, 2023 reading time: You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your return. Your income varies during the year. Current year 2023 quarterly interest rates.

2210 Form 2021 IRS Forms Zrivo

Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Web if your adjusted gross income was $150,000 or more (or $75,000 if you’re married filing separately) then you may not be subject to the penalty if you paid the lower of 90% of the tax shown on the current year return, or 110% of your.

2210 Form 2022 2023

Interest rate categories and formulas. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web the quarter that you underpaid. For instructions and the latest information. How we calculate interest rates.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Prior years quarterly interest rates. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. You can use form 2210, underpayment of estimated tax by individuals, estates, and. How we calculate interest rates. Web by forrest baumhover march 27, 2023 reading time:

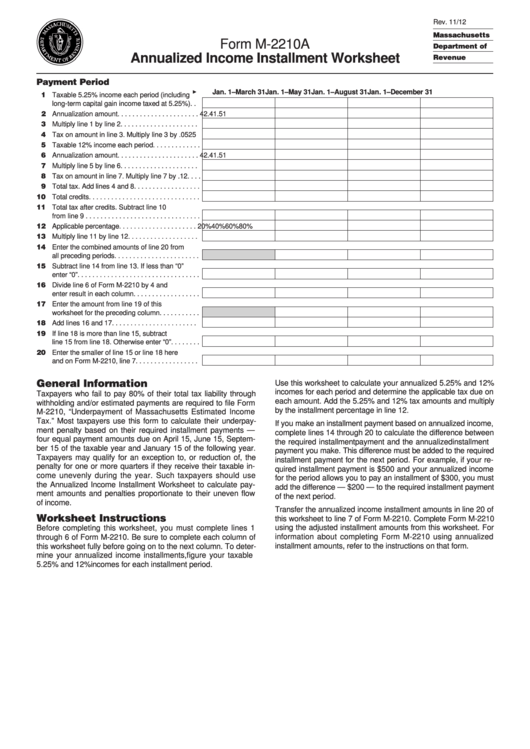

Fillable Form M2210a Annualized Installment Worksheet

The interest rate for underpayments, which is updated by the irs each quarter. Interest rate categories and formulas. Web the quarter that you underpaid. Web if your adjusted gross income was $150,000 or more (or $75,000 if you’re married filing separately) then you may not be subject to the penalty if you paid the lower of 90% of the tax.

Instructions For Form 2210 Underpayment Of Estimated Tax By

You can use form 2210, underpayment of estimated tax by individuals, estates, and. Web on this page. Department of the treasury internal revenue service. The interest rate for underpayments, which is updated by the irs each quarter. How we calculate interest rates.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Interest rate categories and formulas. 13 minutes watch video get the form step by step instructions if you’re filing an income tax return and haven’t paid enough in income taxes throughout the. What is the penalty for underpayment of estimated taxes? For instructions and the latest information. Current year 2023 quarterly interest rates.

Form 2210 Edit, Fill, Sign Online Handypdf

How we calculate interest rates. Web if your adjusted gross income was $150,000 or more (or $75,000 if you’re married filing separately) then you may not be subject to the penalty if you paid the lower of 90% of the tax shown on the current year return, or 110% of your tax from the prior year. Current year 2023 quarterly.

Ssurvivor Form 2210 Instructions 2018

Prior years quarterly interest rates. You may need this form if: Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your return. Web form 2210 is used.

Ssurvivor Form 2210 Instructions 2020

You may need this form if: You can use form 2210, underpayment of estimated tax by individuals, estates, and. Complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web by forrest baumhover march 27, 2023 reading time: The interest rate for underpayments, which is updated by the irs each quarter.

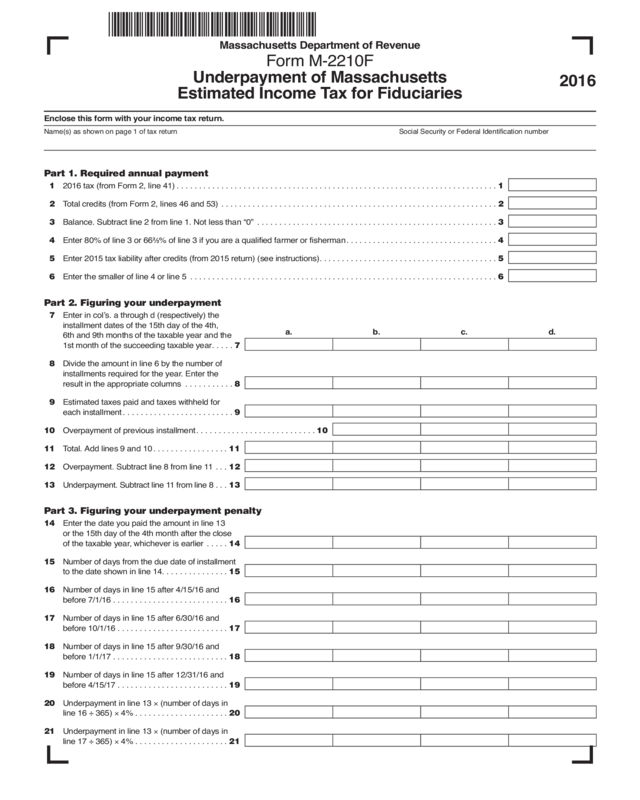

Form M2210F Edit, Fill, Sign Online Handypdf

You may need this form if: Web on this page. The irs will generally figure your penalty for you and you should not file form 2210. Department of the treasury internal revenue service. Complete form 2210, schedule ai, annualized income installment method pdf (found within the form).

What Is The Penalty For Underpayment Of Estimated Taxes?

Complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web the quarter that you underpaid. Current year 2023 quarterly interest rates. For instructions and the latest information.

You May Need This Form If:

Web by forrest baumhover march 27, 2023 reading time: You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your return. Underpayment of estimated tax by individuals, estates, and trusts. Prior years quarterly interest rates.

Use Form 2210 To Determine The Amount Of Underpaid Estimated Tax And Resulting Penalties As Well As For Requesting A Waiver Of The Penalties.

The irs will generally figure your penalty for you and you should not file form 2210. 13 minutes watch video get the form step by step instructions if you’re filing an income tax return and haven’t paid enough in income taxes throughout the. Department of the treasury internal revenue service. 06 name(s) shown on tax return

Web Use Form 2210 To See If You Owe A Penalty For Underpaying Your Estimated Tax.

Web on this page. You can use form 2210, underpayment of estimated tax by individuals, estates, and. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Your income varies during the year.