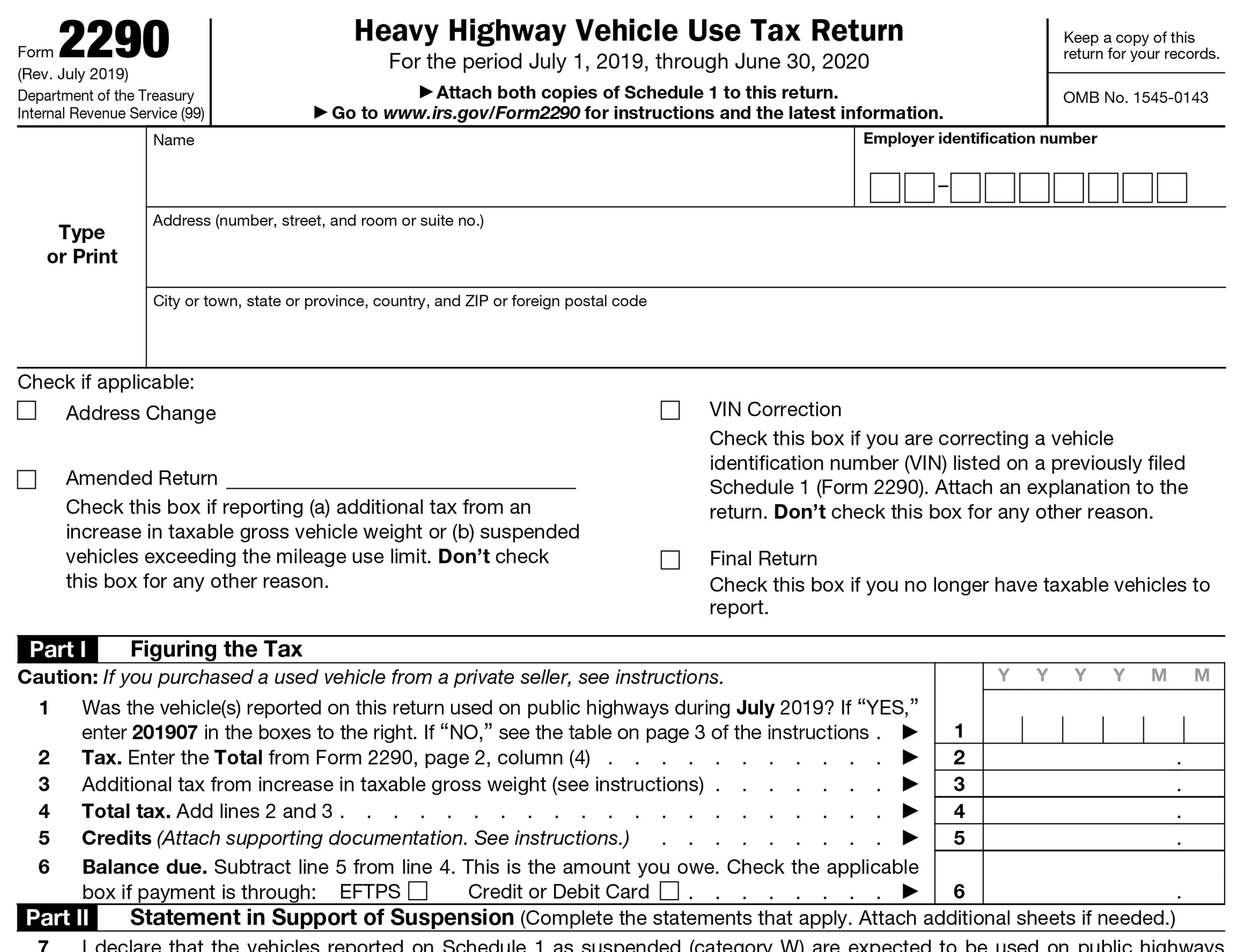

Form 2290 2022

Form 2290 2022 - July 2023) department of the treasury internal revenue service heavy highway vehicle use tax return for the period july 1,. July 2023 to june 2024: Web it is due in june each year, and it is payable by the end of august of the same year. Web form tax year tax period actions; Do your truck tax online & have it efiled to the irs! Try it for free now! Get ready for tax season deadlines by completing any required tax forms today. Use the table below to determine your. Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. Web you can visit the official irs website to download and print out the blank 2290 form for 2022.

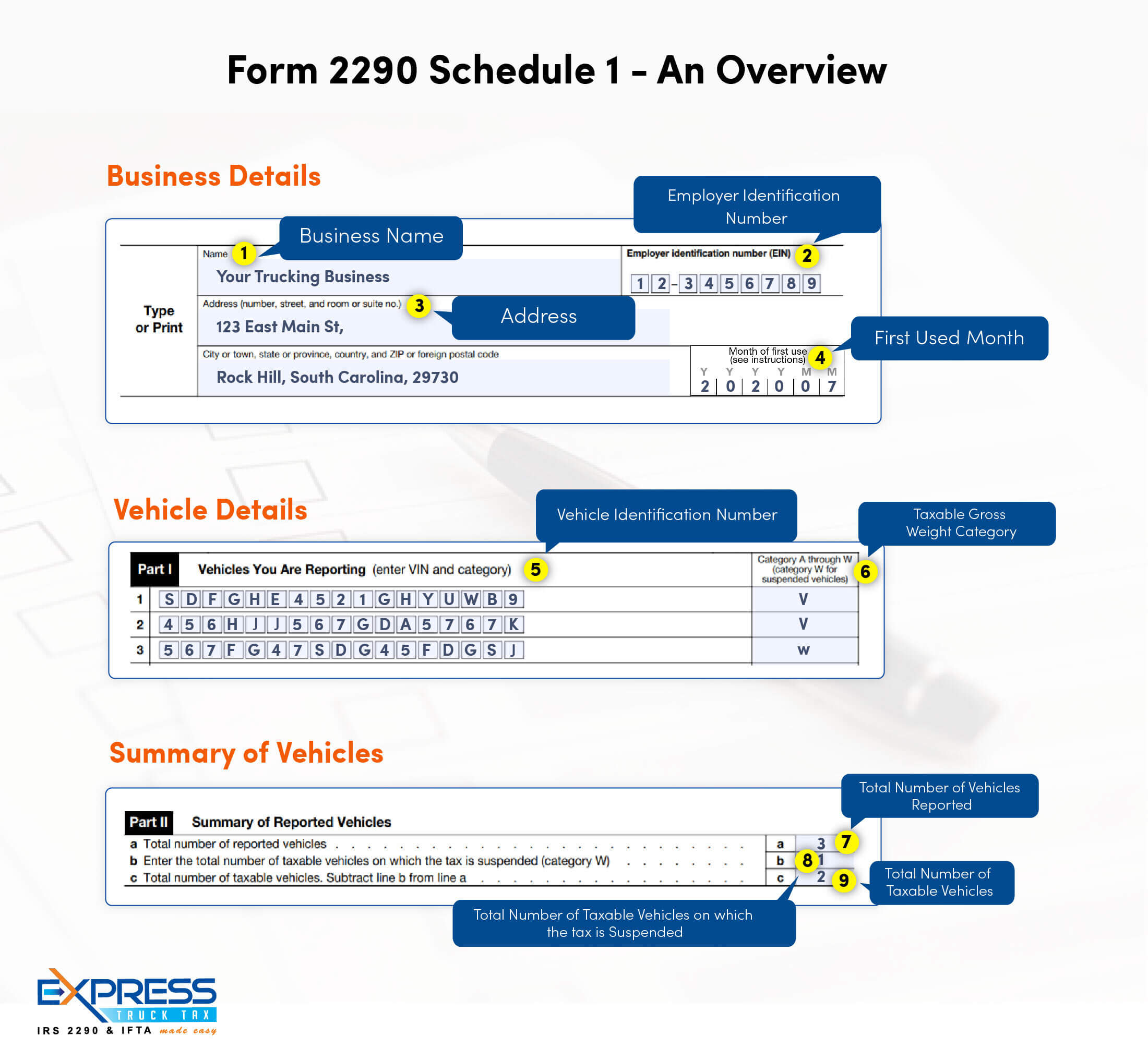

Web form tax year tax period actions; You'll need a pdf reader to open and print it. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. July 2022 to june 2023: This tax is assessed on vehicles that weigh 55,000 pounds or more and is used to hel. Web you can visit the official irs website to download and print out the blank 2290 form for 2022. The sample is available in pdf format; Web it is due in june each year, and it is payable by the end of august of the same year.

The current period begins july 1, 2023, and ends june 30,. July 2022 to june 2023: You'll need a pdf reader to open and print it. Web december 6, 2022 draft as of form 2290 (rev. Web form 2290 deadline generally applies to file form 2290 and paying tax payments along with the form 2290 tax return for the tax year that begins july 1, 2022, and ends june 30,. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. Therefore, the form 2290 tax should be made in advance for the current tax year, from. Web it is due in june each year, and it is payable by the end of august of the same year. Do your truck tax online & have it efiled to the irs! Get ready for tax season deadlines by completing any required tax forms today.

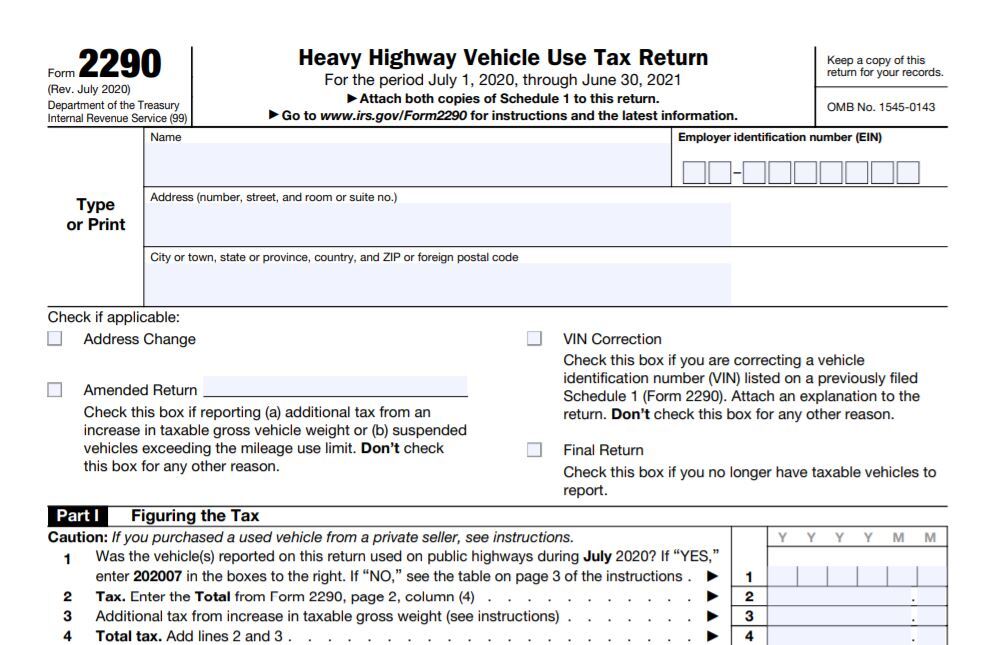

File IRS 2290 Form Online for 20222023 Tax Period

Therefore, the form 2290 tax should be made in advance for the current tax year, from. July 2023) department of the treasury internal revenue service heavy highway vehicle use tax return for the period july 1,. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used.

Free Printable Form 2290 Printable Templates

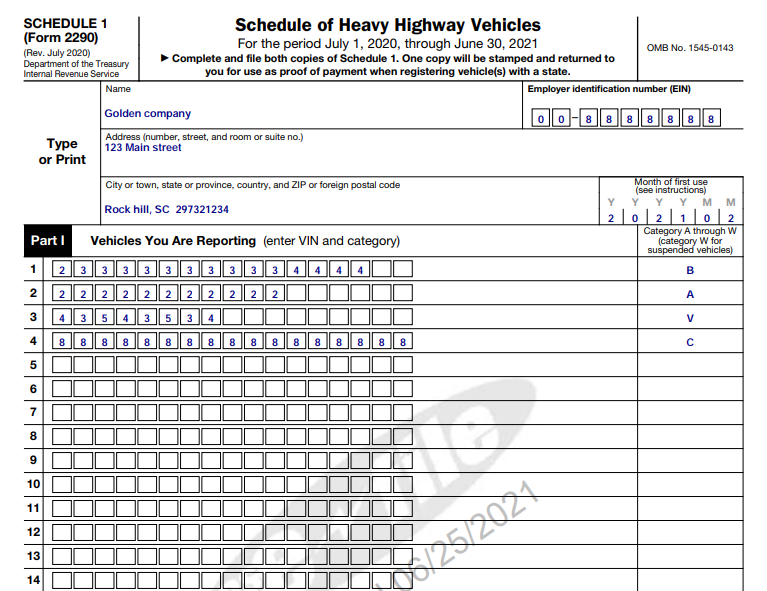

Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. Web last updated on july 19, 2022 by eformblogadmin the purpose of filing irs form 2290 is to report the proof of the heavy vehicle use tax.

IRS Form 2290 Instructions for 20222023

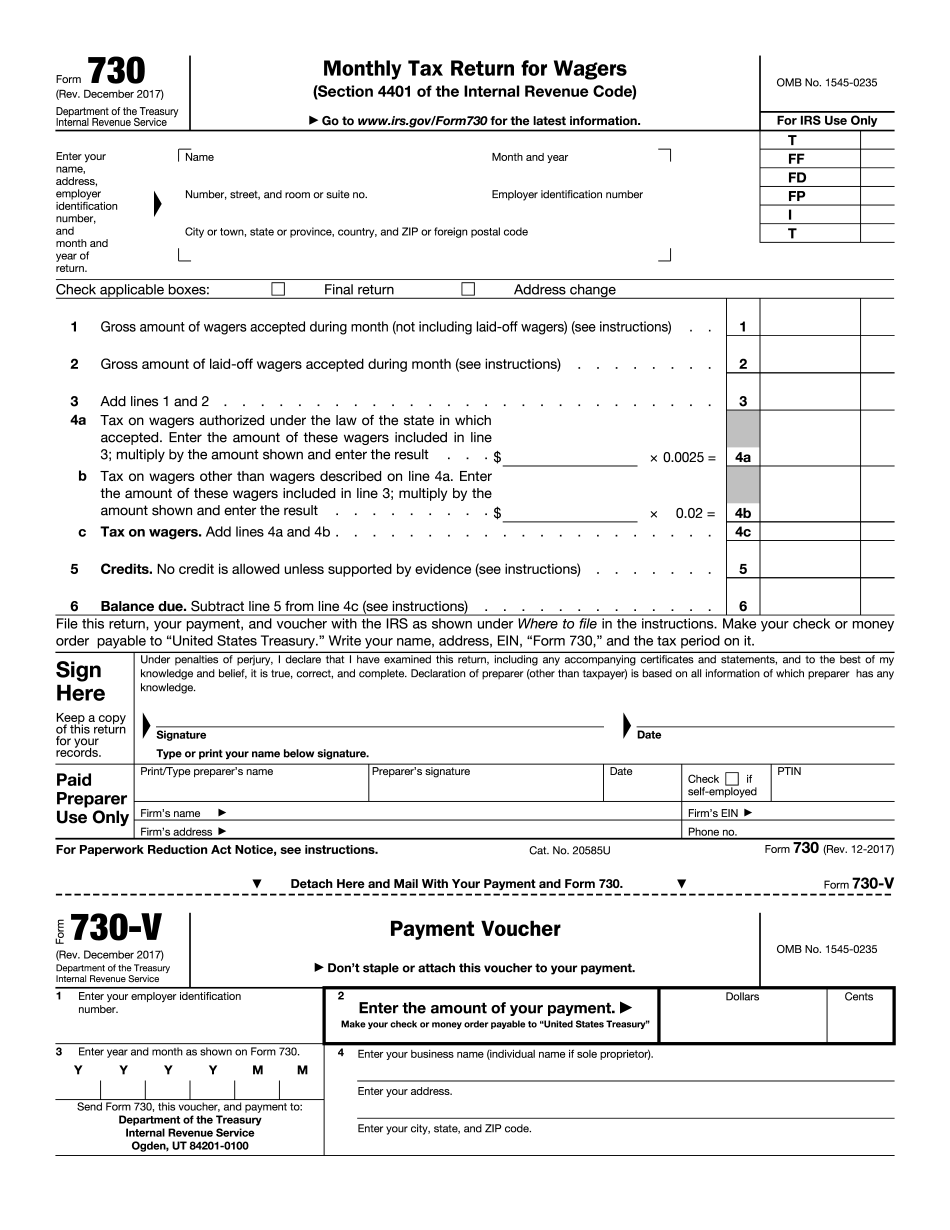

Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. July 2022 to june 2023: Easy, fast, secure & free to try. 2022 the 2290 form is used to report the annual heavy vehicle use tax. July 2023 to june 2024:

Ez Form Taxes 2017 Universal Network

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web it is due in june each year, and it is payable by the end of august of the same year. This tax is assessed on vehicles that weigh 55,000 pounds or more and is used to hel..

File 20222023 Form 2290 Electronically 2290 Schedule 1

Web form tax year tax period actions; Get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Web 13 rows month form 2290 must be filed; Do your truck tax online & have it efiled to the irs!

Tax Credit 2023 2023

Web december 6, 2022 draft as of form 2290 (rev. Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. Web last updated on july 19, 2022 by eformblogadmin the purpose of filing irs form 2290 is to report the proof of the heavy vehicle use tax paid.

IRS 2290 20202022 Fill and Sign Printable Template Online US Legal

The sample is available in pdf format; Therefore, the form 2290 tax should be made in advance for the current tax year, from. Web the 2290 form is due annually between july 1 and august 31. You'll need a pdf reader to open and print it. Web 13 rows month form 2290 must be filed;

Printable IRS Form 2290 for 2020 Download 2290 Form

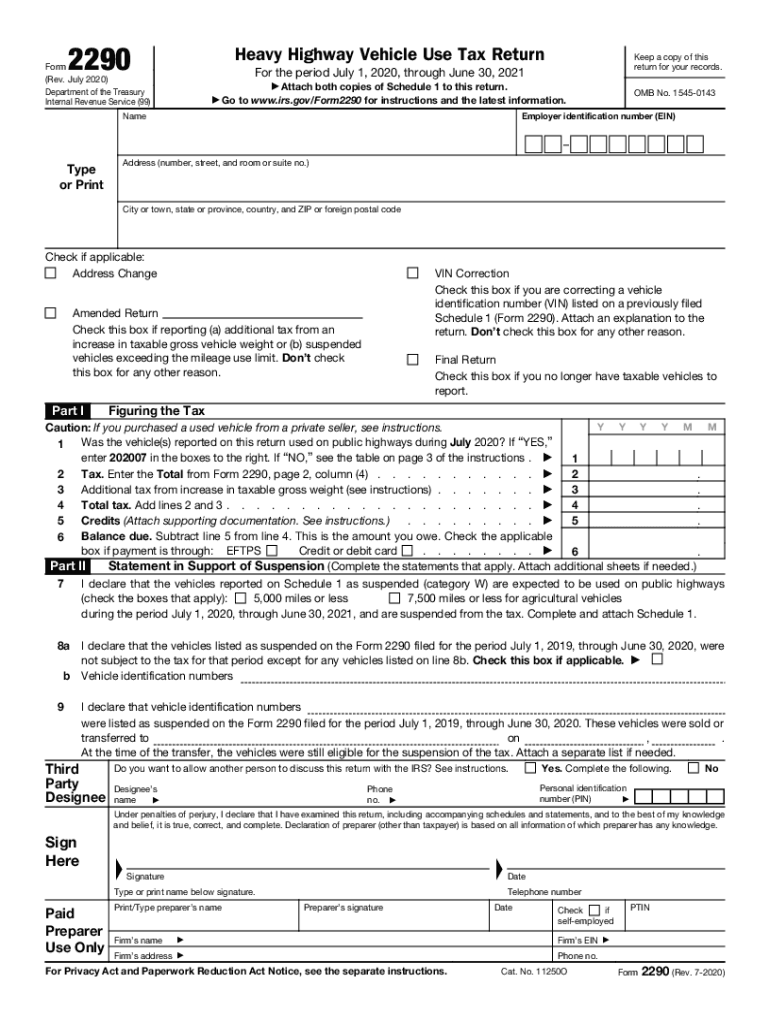

Web december 6, 2022 draft as of form 2290 (rev. Ad upload, modify or create forms. Try it for free now! Do your truck tax online & have it efiled to the irs! Web the irs 2290 form is a “ federal heavy vehicle use tax return form ” used to report heavy vehicle information to the internal revenue service.

form 2290 20182022 Fill Online, Printable, Fillable Blank

July 2022 to june 2023: Web form tax year tax period actions; In general, the irs requires every. Therefore, the form 2290 tax should be made in advance for the current tax year, from. 2022 the 2290 form is used to report the annual heavy vehicle use tax.

Understanding Form 2290 StepbyStep Instructions for 20222023

You'll need a pdf reader to open and print it. Therefore, the form 2290 tax should be made in advance for the current tax year, from. Web you can visit the official irs website to download and print out the blank 2290 form for 2022. Easy, fast, secure & free to try. Web december 6, 2022 draft as of form.

You'll Need A Pdf Reader To Open And Print It.

Try it for free now! Web the 2290 form is due annually between july 1 and august 31. July 2023 to june 2024: July 2022 to june 2023:

Web You Must File Form 2290 For These Trucks By The Last Day Of The Month Following The Month The Vehicle Was First Used On Public Highways.

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. 2022 the 2290 form is used to report the annual heavy vehicle use tax. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Ad upload, modify or create forms.

Do Your Truck Tax Online & Have It Efiled To The Irs!

The annual due date to file and pay the heavy vehicle use tax form 2290 is. Web 13 rows month form 2290 must be filed; Every year, millions of trucking companies file their 2290. July 2023) department of the treasury internal revenue service heavy highway vehicle use tax return for the period july 1,.

Web Form 2290 Deadline Generally Applies To File Form 2290 And Paying Tax Payments Along With The Form 2290 Tax Return For The Tax Year That Begins July 1, 2022, And Ends June 30,.

Easy, fast, secure & free to try. Use the table below to determine your. The current period begins july 1, 2023, and ends june 30,. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is.