Form 2290 Online Jj Keller

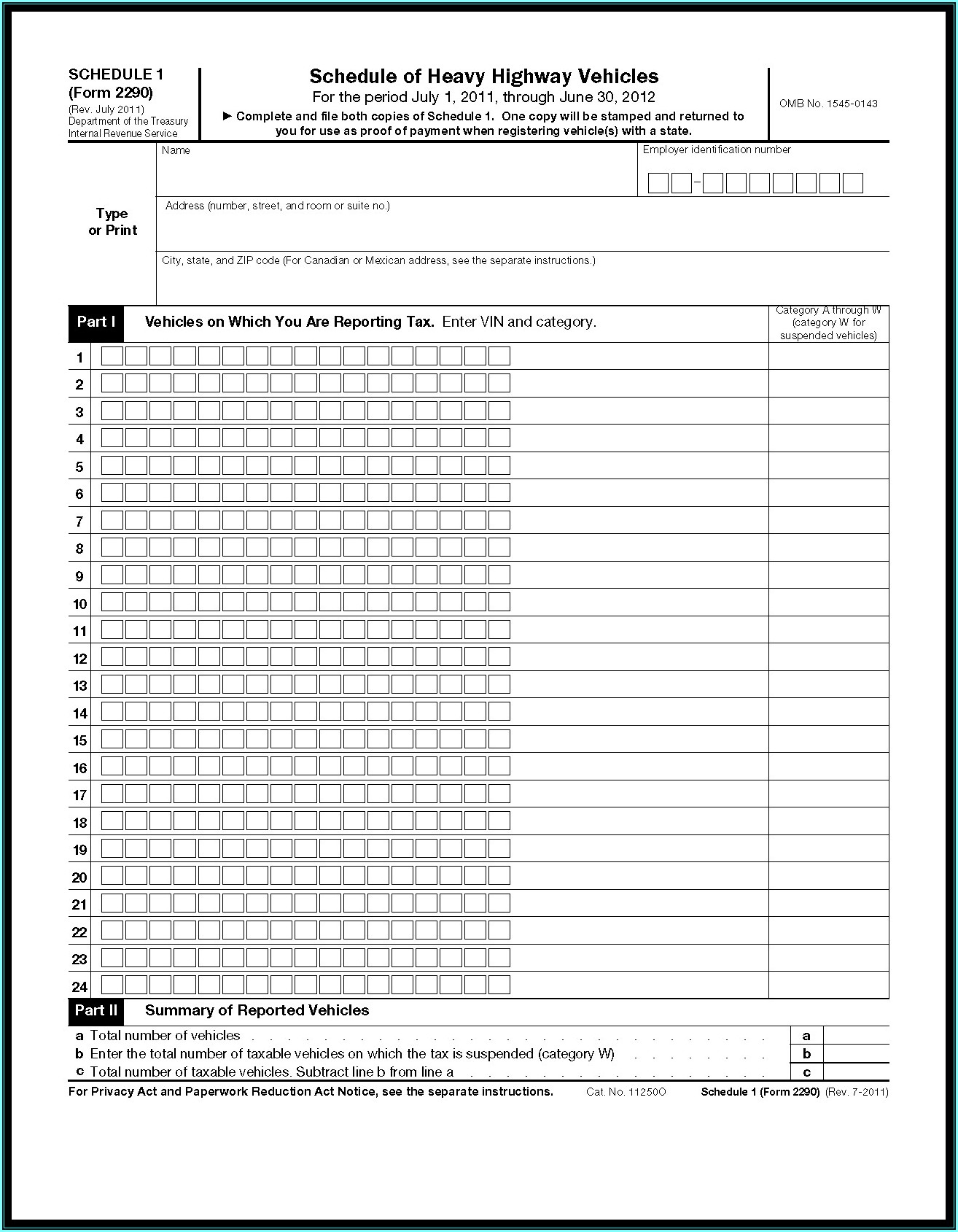

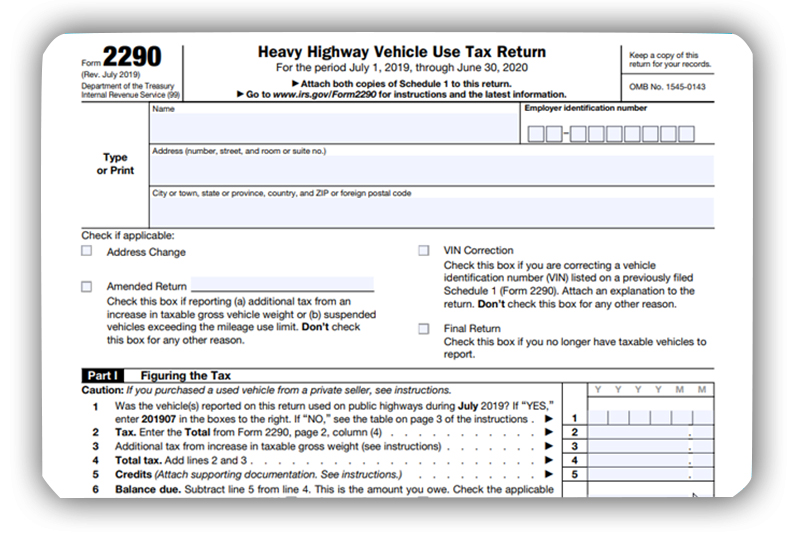

Form 2290 Online Jj Keller - Once you are logged in, click on the vehicles tab in the top left corner. File your 2290 tax & pay with your credit card in seconds. Web sign in to jjkeller.com or an advantage membership to access your account information. All online services offer a. Annual filing the tax period begins on july 1 and ends the. Keller's 2290online.com is the fastest way to e‑file irs form 2290 (heavy vehicle use tax) and get your stamped schedule 1. Manually enter vehicle data by. Web the internal revenue service regulations require the electronic filing of form 2290 for companies with 25 or more vehicles with a taxable gross weight of 55,000. Keller has been the trusted partner for transportation. Web schedule 1 of the form 2290 is used to list all reportable vehicles by category and vehicle identification number (vin).

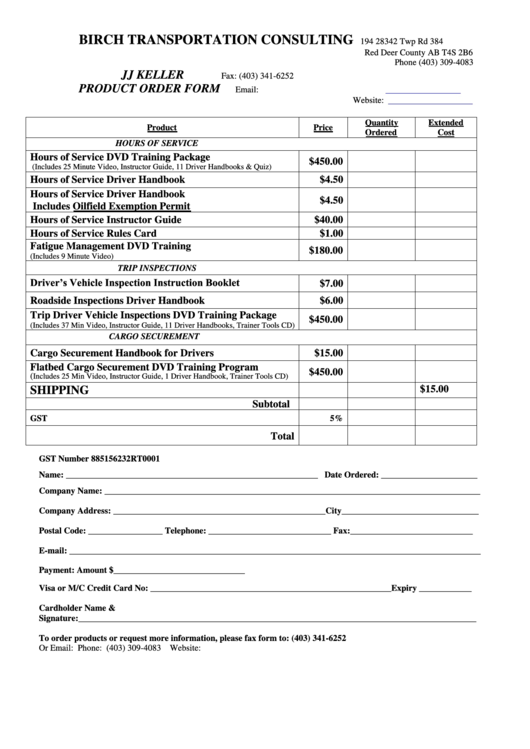

Keller has been the trusted partner for transportation. You should complete and file both copies of schedule 1. Certified by the irs , we are an authorized electronic filing partner. All online services offer a. You'll be given two options: Keller's 2290online.com is the fastest way to e‑file irs form 2290 (heavy vehicle use tax) and get your stamped schedule 1. Get expert assistance with simple 2290 @ $6.95. Ad online 2290 tax filing in minutes. With 2290online.com, you can file your irs. Keller's pricing is set up to accommodate any size fleet or filing frequency.

Offers its online tax filing service, 2290online.com. File your 2290 tax & pay with your credit card in seconds. The second copy will be stamped and returned to you for use as proof of payment. Get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Manually enter vehicle data by. *email address *password keep me signed in forgot your password? Ad efile form 2290 (hvut) tax return directly to the irs and get your stamped schedule 1 fast. Web schedule 1 of the form 2290 is used to list all reportable vehicles by category and vehicle identification number (vin). Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Get expert assistance with simple 2290 @ $6.95.

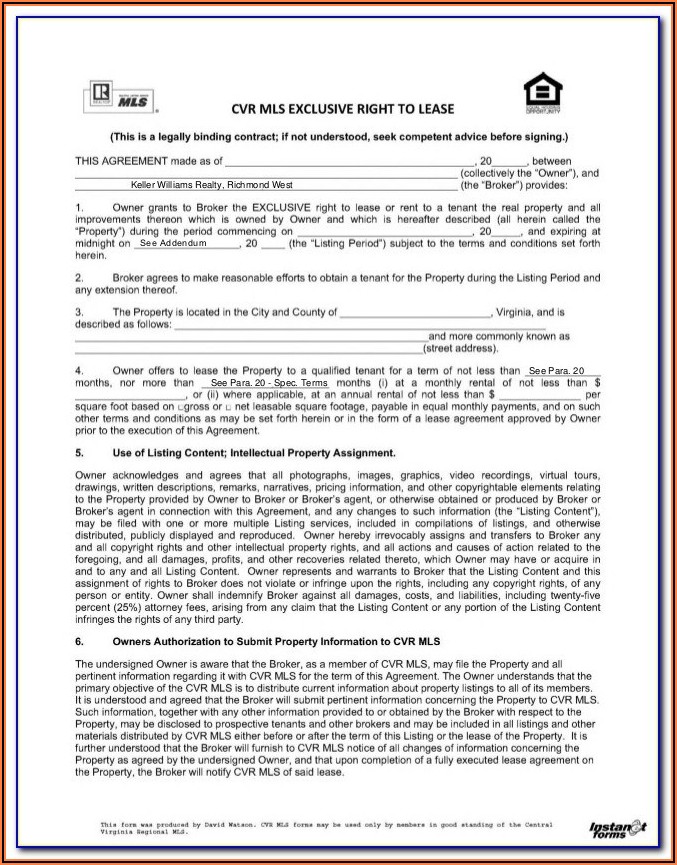

Jj Keller Crane Inspection Form Form Resume Examples l6YNkMoV3z

Manually enter vehicle data by. Get expert assistance with simple 2290 @ $6.95. Keller's 2290online.com is the fastest way to e‑file irs form 2290 (heavy vehicle use tax) and get your stamped schedule 1. Web steps to file form 2290. Keller's pricing is set up to accommodate any size fleet or filing frequency.

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Web if you have any vehicles 55,000 pounds or more, j. Keller's 2290online.com is the fastest way to e‑file irs form 2290 (heavy vehicle use tax) and get your stamped schedule 1. File your 2290 tax & pay with your credit card in seconds. Ad online 2290 tax filing in minutes. Web information about form 2290, heavy highway vehicle use.

E File Form 2290 Irs Form Resume Examples Wk9yzrvY3D

Offers its online tax filing service, 2290online.com. Get expert assistance with simple 2290 @ $6.95. Web schedule 1 of the form 2290 is used to list all reportable vehicles by category and vehicle identification number (vin). *email address *password keep me signed in forgot your password? Choose to pay per filing with low individual filing fees, or choose one of.

File IRS 2290 Form Online for 20222023 Tax Period

Web schedule 1 of the form 2290 is used to list all reportable vehicles by category and vehicle identification number (vin). Is prepared to help motor carriers comply. Common reasons a carrier may file more than once a year. Electronic filing for faster processing of your tax returns. Web sign in to jjkeller.com or an advantage membership to access your.

File Form 2290 Online & Get IRS Stamped Schedule 1 in Minutes

Web 13 rows form 2290 due dates for vehicles placed into service during reporting period. Avoid late fees and penalties. File your 2290 tax & pay with your credit card in seconds. Web sign in to jjkeller.com or an advantage membership to access your account information. Once you are logged in, click on the vehicles tab in the top left.

Top Jj Keller Forms And Templates free to download in PDF format

Is prepared to help motor carriers comply. Offers its online tax filing service,. Get expert assistance with simple 2290 @ $6.95. *email address *password keep me signed in forgot your password? Annual filing the tax period begins on july 1 and ends the.

Electronic IRS Form 2290 2018 2019 Printable PDF Sample

Keller has been the trusted partner for transportation. Web the internal revenue service regulations require the electronic filing of form 2290 for companies with 25 or more vehicles with a taxable gross weight of 55,000. *email address *password keep me signed in forgot your password? Get expert assistance with simple 2290 @ $6.95. Certified by the irs , we are.

Efile Form 2290 with J. J. Keller at YouTube

With 2290online.com, you can file your irs. Ad online 2290 tax filing in minutes. Is prepared to help motor carriers comply. Electronic filing for faster processing of your tax returns. Annual filing the tax period begins on july 1 and ends the.

Jj Keller and associates form 2290 Brilliant Dna Adenine

Ad online 2290 tax filing in minutes. Manually enter vehicle data by. Ad need help with irs form 2290 tax filing? File your 2290 tax & pay with your credit card in seconds. Offers its online tax filing service, 2290online.com.

With 2290Online.com, You Can File Your Irs.

Ad efile form 2290 (hvut) tax return directly to the irs and get your stamped schedule 1 fast. Keller ® applications designed specifically for the commercial motor vehicle market. Keller's pricing is set up to accommodate any size fleet or filing frequency. Avoid late fees and penalties.

Get Expert Assistance With Simple 2290 @ $6.95.

You should complete and file both copies of schedule 1. Choose to pay per filing with low individual filing fees, or choose one of our annual filing plans, in. Ad need help with irs form 2290 tax filing? Web the internal revenue service regulations require the electronic filing of form 2290 for companies with 25 or more vehicles with a taxable gross weight of 55,000.

Annual Filing The Tax Period Begins On July 1 And Ends The.

Ad online 2290 tax filing in minutes. Electronic filing for faster processing of your tax returns. File your 2290 tax & pay with your credit card in seconds. Keller has been the trusted partner for transportation.

Web Sign In To Jjkeller.com Or An Advantage Membership To Access Your Account Information.

Offers its online tax filing service, 2290online.com. Is prepared to help motor carriers comply. *email address *password keep me signed in forgot your password? You'll be given two options: