Form 2553 Election

Form 2553 Election - Commissions do not affect our editors' opinions or evaluations. Web why is form 2553 important? If certain requirements for late elections are met, small businesses may file a late small business corporation election past the march 15 deadline. The corporation can fax this form to the irs (see separate instructions). How to fill out form 2553. If you are making more than one qsst election, you may use additional copies of page 4 or use a separate election statement, and attach it to form 2553. Treasury internal revenue service the corporation may either send or fax this form to the irs. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. When a business is registered as a corporation with the irs, it is formed as a c corp by default. Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation rather than a c corporation.

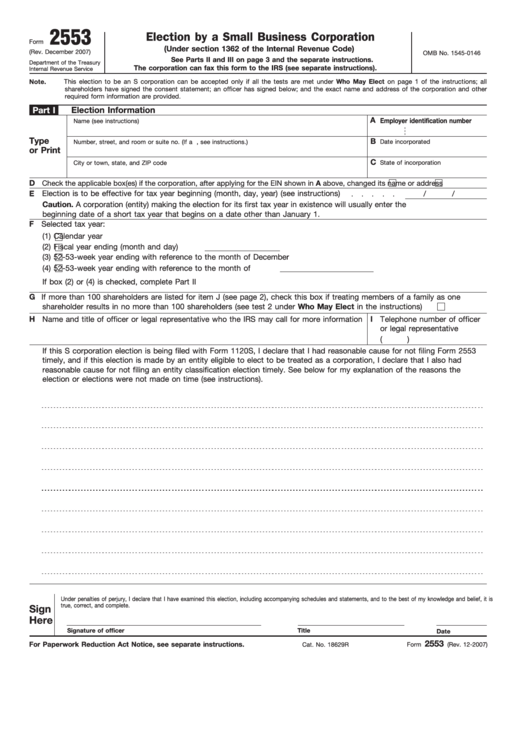

Aug 21, 2022, 10:57pm editorial note: Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Commissions do not affect our editors' opinions or evaluations. Irs form 2553 (election by a small business corporation) is the form that a corporation (or other entity eligible to be treated as a corporation) files to be treated as an s corporation for federal tax purposes. If you miss this original deadline, you may be able to qualify for late election relief. Within 60 days (add 90 days if box q1 is checked) notes: Web up to 40% cash back form: Web for existing entities, most commonly llcs and corporations but can include partnerships, form 2553 must be filed anytime during the prior tax year, or by the 15 th day of the third month of the tax year the election is to apply (generally march 15 th ). If you file form 2553 before the date on line e (the date the election will go into effect), you only need to list the current shareholders. December 2007) department of the treasury internal revenue service election by a small business corporation (under section 1362 of the internal revenue code) omb no.

If you file form 2553 before the date on line e (the date the election will go into effect), you only need to list the current shareholders. Income tax return for an s corporation. The irs will tax you under the default classification rules if you set up an llc. Within 60 days (add 90 days if box q1 is checked) notes: Election by a small business corporation instructions: Treasury internal revenue service the corporation may either send or fax this form to the irs. Commissions do not affect our editors' opinions or evaluations. Enter all the names and addresses of shareholders or former shareholders who are required to consent to the s corp election. Web up to 40% cash back form: An eligible entity is classified for federal tax purposes under the default rules unless it files form 8832 or form 2553, election by a small business corporation.

Video Tips for Filling Out IRS Form 2553, Election by a Small Business

December 2002) (under section 1362 of the internal revenue code) omb no. Businesses must file irs form 2553, election by a small business corporation, to be taxed as an s corporation. How to fill out form 2553. Web the deemed owner of the qsst must also consent to the s corporation election in column k of form 2553. Web form.

Top 10 Form 2553 Templates free to download in PDF format

Web form 2553 can be filed at any time in the tax year before the s corporation is to take effect. Income tax return for an s corporation. Election by a small business corporation (under section 1362 of the internal revenue code) (including a late election filed pursuant to rev. December 2020) (for use with the december 2017 revision of.

Form 2553 Election by a Small Business Corporation (2014) Free Download

Election by a small business corporation (under section 1362 of the internal revenue code) (including a late election filed pursuant to rev. Treasury internal revenue service the corporation may either send or fax this form to the irs. Web up to 40% cash back form: ~16 hours (irs estimate) turnaround: Within 60 days (add 90 days if box q1 is.

IRS Form 2553 Election by a Small Business Corporation Tax Blank Lies

Web up to 40% cash back form: If certain requirements for late elections are met, small businesses may file a late small business corporation election past the march 15 deadline. Businesses must file irs form 2553, election by a small business corporation, to be taxed as an s corporation. Within 60 days (add 90 days if box q1 is checked).

Form 2553 Election by a Small Business Corporation (2014) Free Download

Web the deemed owner of the qsst must also consent to the s corporation election in column k of form 2553. Income tax return for an s corporation. December 2002) (under section 1362 of the internal revenue code) omb no. Web up to 40% cash back form: For a qsub election, cp279 to the parent and cp279a to the subsidiary).

Learn How to Fill the Form 2553 Election by a Small Business

If form 2553 isn’t timely filed, see relief for late elections, later. December 2007) department of the treasury internal revenue service election by a small business corporation (under section 1362 of the internal revenue code) omb no. Web rob watts editor updated: If certain requirements for late elections are met, small businesses may file a late small business corporation election.

Fill Free fillable Election by a Small Business Corporation 2017 Form

Treasury internal revenue service the corporation may either send or fax this form to the irs. If you miss this original deadline, you may be able to qualify for late election relief. When a business is registered as a corporation with the irs, it is formed as a c corp by default. Irs form 2553 (election by a small business.

Quick Tips Filling Out IRS Form 2553 Election by a Small Business

If form 2553 isn’t timely filed, see relief for late elections, later. Name and addresses of shareholders: Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation rather than a c corporation. Most states automatically accept the federal s.

Form 2553 Election by a Small Business Corporation (2014) Free Download

December 2002) (under section 1362 of the internal revenue code) omb no. Web instructions for form 2553 department of the treasury internal revenue service (rev. See page 2 of the instructions. Most states automatically accept the federal s election; File within 75 days of formation for the election to take effect from the date of formation.

Have Your LLC Taxed as an S Corp S Corp Election Form 2553

Web up to 40% cash back form: For a qsub election, cp279 to the parent and cp279a to the subsidiary). If form 2553 isn’t timely filed, see relief for late elections, later. Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as.

December 2017) Department Of The Treasury Internal Revenue Service.

December 2020) (for use with the december 2017 revision of form 2553, election by a small business corporation) section references are to the internal revenue code unless otherwise noted. Web instructions for form 2553 department of the treasury internal revenue service (rev. You can fax this form to the irs. If you miss this original deadline, you may be able to qualify for late election relief.

If Certain Requirements For Late Elections Are Met, Small Businesses May File A Late Small Business Corporation Election Past The March 15 Deadline.

Irs form 2553 (election by a small business corporation) is the form that a corporation (or other entity eligible to be treated as a corporation) files to be treated as an s corporation for federal tax purposes. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Web up to 40% cash back form: For a qsub election, cp279 to the parent and cp279a to the subsidiary).

~16 Hours (Irs Estimate) Turnaround:

The corporation can fax this form to the irs (see separate instructions). Income tax return for an s corporation. Enter all the names and addresses of shareholders or former shareholders who are required to consent to the s corp election. Treasury internal revenue service the corporation may either send or fax this form to the irs.

Web The Deemed Owner Of The Qsst Must Also Consent To The S Corporation Election In Column K Of Form 2553.

If you are making more than one qsst election, you may use additional copies of page 4 or use a separate election statement, and attach it to form 2553. Web what is irs form 2553? So, if you plan to elect for s corp status in 2024, you can file form 2553 at any point in 2023. Within 60 days (add 90 days if box q1 is checked) notes: